PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910660

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910660

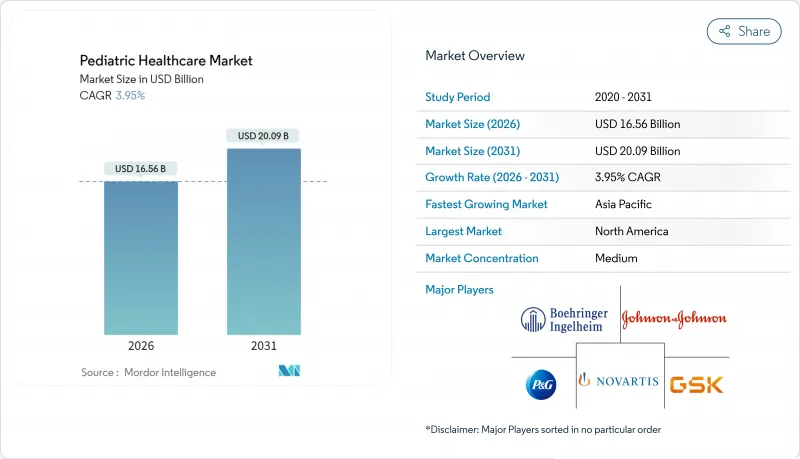

Pediatric Healthcare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The pediatric healthcare market size in 2026 is estimated at USD 16.56 billion, growing from 2025 value of USD 15.93 billion with 2031 projections showing USD 20.09 billion, growing at 3.95% CAGR over 2026-2031.

Strong demand for routine immunizations, rapid gene-therapy approvals, and the rising use of artificial intelligence in diagnostic imaging anchor the current growth trajectory of the pediatric healthcare market. Market participants add digital tools to their portfolios, pursue hospital consolidation, and partner with schools to expand telehealth, all of which shape competitive strategies. Newborn-critical-care equipment priced up to 70% below imported alternatives improves access in developing regions and drives localized manufacturing. At the same time, the resurgence of respiratory syncytial virus (RSV) outbreaks, a USD 25 billion annual burden across age groups, fuels demand for vaccines and antivirals.

Global Pediatric Healthcare Market Trends and Insights

Rapid Uptick in Routine Pediatric Immunization Funding

Expanded public-health budgets add new vaccine lines and strengthen supply chains, particularly in Asia-Pacific where child mortality remains high. National programs now integrate digital registries that track doses and flag missed schedules, improving coverage rates. Pharmaceutical firms benefit from larger procurement volumes that stabilize manufacturing forecasts and raise barriers to entry. Cold-chain specialists, data-analytics vendors, and logistics providers also capture value. Multiplier effects span training, storage, and mobile-clinic deployment, reinforcing the pediatric healthcare market as a resilient growth platform.

Expansion of Rare-Disease Gene-Therapy Approvals

U.S. and European regulators authorized curative treatments for metachromatic leukodystrophy, Duchenne muscular dystrophy, and aromatic L-amino acid decarboxylase deficiency, setting new clinical benchmarks. Casgevy and Lyfgenia became the first CRISPR-based therapies for sickle-cell disease, delivering crisis-free outcomes in most adolescents. Although price tags exceed USD 2 million, payers trial milestone-based contracts to offset budget impact. Patent-term extensions under the pediatric exclusivity program further attract biopharma investment. Over the forecast horizon, new submissions in Asia-Pacific will widen access and lift the pediatric healthcare market.

Rising Antimicrobial Resistance in Children

Multidrug-resistant sepsis adds USD 38 billion to U.S. costs each year and lengthens pediatric hospital stays. Children consume higher antibiotic volumes, accelerating resistance cycles. Stewardship programs improve prescribing in tertiary centers yet remain patchy in rural clinics. Pipeline scarcity for child-specific antibiotics heightens clinical risks. Without policy incentives or pooled procurement, resistance will temper revenue expansion across anti-infective portfolios within the pediatric healthcare market.

Other drivers and restraints analyzed in the detailed report include:

- AI-Assisted Pediatric Radiology Adoption

- Re-Emergence of RSV & Other Respiratory Outbreaks

- Gap in Pediatric-Specific Device Reimbursement

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The pharmaceuticals segment captured 46.21% of pediatric healthcare market share in 2025 on the back of essential vaccines and chronic-disease therapies. Branded formulations benefit from patent extensions, while generics sustain volume demand in public programs. Digital health solutions are forecast to outpace other categories at 4.17% CAGR. Remote-monitoring apps, symptom checkers, and medication-adherence bots cut emergency visits by 42% in pilot cohorts.

Growing venture funding supports pediatric-centric platforms that integrate behavioral-health modules, nutrition coaching, and immunization reminders, making them stickier for families. The pediatric healthcare market size for digital tools is projected to expand further as reimbursement codes widen. Medical devices follow pharmaceuticals in revenue but struggle with limited pediatric labeling, prompting clinicians to repurpose adult hardware, a practice that attracts regulatory scrutiny. Pediatric healthcare industry advocates push for harmonized standards to accelerate device approvals.

Infectious diseases remained the largest revenue pool at 27.94% of pediatric healthcare market size during 2025, underlining persistent RSV, influenza, and gastrointestinal burdens. Comprehensive vaccine schedules and antimicrobial combinations sustain baseline demand. Oncology exhibits the fastest CAGR at 4.45%, fueled by targeted therapies and gene-editing breakthroughs.

Precision-medicine trials match tumor genetics with small-molecule inhibitors, lifting survival rates and supporting premium pricing. Neurological disorders attract AI-driven imaging tools that refine lesion mapping, while cardiovascular applications test dissolvable stents calibrated for pediatric vasculature. The diversified pipeline strengthens the pediatric healthcare market and mitigates reliance on any single therapy class.

The Report Covers Global Pediatric Healthcare Market Share & Analysis. The Market is Segmented by Type (Chronic Illness and Acute Illness), Treatment (Vaccines, Drugs, Others), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Report Offers the Value (in USD Million) for the Above Segments.

Geography Analysis

North America contributed 33.88% to global revenue in 2025 as advanced insurance coverage, specialist density, and early technology adoption underpin spending. Nevertheless, 2 million children reside more than 80 miles from vital subspecialists, prompting telehealth grants and mobile-clinic programs. Gene-therapy accelerations and hospital mergers drive strategic realignment, while AI adoption in radiology spreads from academic centers to community imaging sites. Public-private partnerships invest in rural broadband and diagnostic hubs, extending the pediatric healthcare market footprint.

Asia-Pacific is projected to log 6.05% CAGR through 2031. Rapid urbanization raises income and insurance penetration, while governments budget USD 138 billion for hospital construction and equipment upgrades by 2027. China leads clinical-trial volume for pediatric drugs, upscaling manufacturing to serve regional demand. Indian start-ups develop cost-effective neonatal equipment adopted by public hospitals. Regional harmonization of regulatory review times shortens launch cycles, accelerating revenue capture within the pediatric healthcare market.

Europe maintains steady mid-single-digit growth backed by universal coverage and coordinated rare-disease frameworks. Joint procurement lowers vaccine prices, yet declining birth rates moderate volume growth. Emerging ecosystems in South America and Middle East & Africa record double-digit growth off smaller bases. Governments there partner with NGOs to deploy mobile clinics and maternal-child health campaigns, enlarging access to the pediatric healthcare market.

- Pfizer

- Johnson & Johnson

- GlaxoSmithKline

- Merck

- Sanofi

- Novartis

- Roche

- AstraZeneca

- Abbott Laboratories

- Medtronic

- Boston Children's Hospital

- Koninklijke Philips

- GE HealthCare Technologies Inc.

- Oracle

- Teladoc Health

- Fresenius

- Cardinal Health

- Siemens Healthineers

- Takeda Pharmaceuticals

- Dr. Reddy's Laboratories Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid uptick in routine pediatric immunization funding

- 4.2.2 Expansion of rare-disease gene-therapy approvals

- 4.2.3 AI-assisted pediatric radiology adoption

- 4.2.4 Re-emergence of RSV & other respiratory outbreaks

- 4.2.5 School-based tele-health roll-outs (under-the-radar)

- 4.2.6 Micro-hospital formats targeting children (under-the-radar)

- 4.3 Market Restraints

- 4.3.1 Rising antimicrobial-resistance in children

- 4.3.2 Gap in pediatric-specific device reimbursement

- 4.3.3 Dearth of long-term safety data for mRNA vaccines (under-the-radar)

- 4.3.4 Shortage of pediatric subspecialists in low-income regions (under-the-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type (Value)

- 5.1.1 Pharmaceuticals

- 5.1.2 Medical Devices

- 5.1.3 Digital Health Solutions

- 5.1.4 Pediatric Services

- 5.2 By Therapeutic Area

- 5.2.1 Infectious Diseases

- 5.2.2 Respiratory Disorders

- 5.2.3 Neurological Disorders

- 5.2.4 Cardiovascular Disorders

- 5.2.5 Oncology

- 5.2.6 Others

- 5.3 By Age Group

- 5.3.1 Neonates (0-28 days)

- 5.3.2 Infants (1-23 months)

- 5.3.3 Children (2-11 years)

- 5.3.4 Adolescents (12-18 years)

- 5.4 By Care Setting

- 5.4.1 Hospitals

- 5.4.2 Clinics

- 5.4.3 Homecare

- 5.4.4 Telehealth

- 5.5 By End User

- 5.5.1 Public Healthcare Providers

- 5.5.2 Private Healthcare Providers

- 5.6 By Geography (Value)

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 GCC

- 5.6.5.2 South Africa

- 5.6.5.3 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.3.1 Pfizer Inc.

- 6.3.2 Johnson & Johnson

- 6.3.3 GlaxoSmithKline plc

- 6.3.4 Merck & Co., Inc.

- 6.3.5 Sanofi S.A.

- 6.3.6 Novartis AG

- 6.3.7 F. Hoffmann-La Roche Ltd

- 6.3.8 AstraZeneca plc

- 6.3.9 Abbott Laboratories

- 6.3.10 Medtronic plc

- 6.3.11 Boston Children's Hospital

- 6.3.12 Koninklijke Philips N.V.

- 6.3.13 GE HealthCare Technologies Inc.

- 6.3.14 Oracle Corporation

- 6.3.15 Teladoc Health, Inc.

- 6.3.16 Fresenius Medical Care AG & Co. KGaA

- 6.3.17 Cardinal Health, Inc.

- 6.3.18 Siemens Healthineers AG

- 6.3.19 Takeda Pharmaceutical Company Ltd.

- 6.3.20 Dr. Reddy's Laboratories Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment