PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848166

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848166

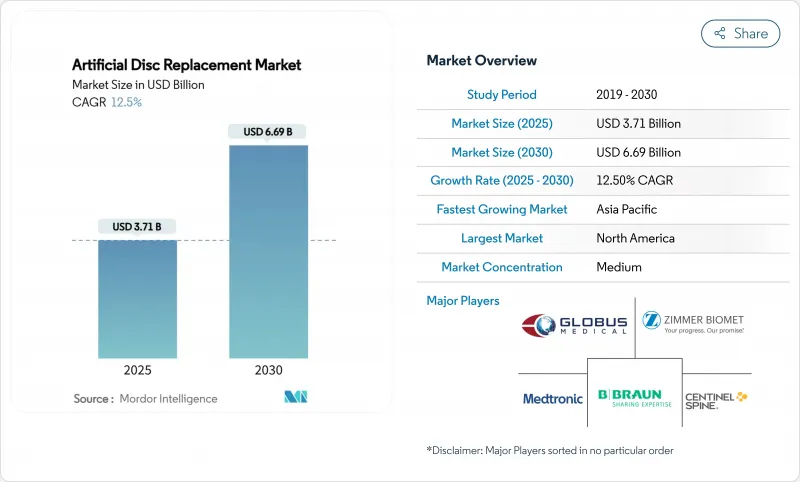

Artificial Disc Replacement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Artificial Disc Replacement market size is USD 3.71 billion in 2025 and is forecast to reach USD 6.69 billion by 2030, expanding at a 12.5% CAGR.

A sustained surge in degenerative disc disease, the validation of motion-preservation outcomes, and swift advances in biomimetic implant design collectively underpin this double-digit trajectory. North America retains early-mover advantage thanks to broad private-payer coverage, while Asia-Pacific accelerates on the back of hospital build-outs and aging demographics. Metal-on-polymer systems remain the workhorse, yet ceramic-on-polymer platforms are outpacing the field, benefitting from lower wear profiles and enhanced imaging compatibility. Outpatient migration is another pivotal trend; artificial disc arthroplasty conducted in ambulatory surgical centers (ASCs) now routinely delivers 60% cost savings relative to inpatient care. Competitive intensity is sharpening as incumbents consolidate portfolios and smaller specialists commercialize viscoelastic and AI-guided offerings.

Global Artificial Disc Replacement Market Trends and Insights

Rising Global Prevalence of Degenerative Disc Disease

Global low-back and neck pain cases exceed 600 million and are projected to rise markedly by 2050 as populations age. Higher life expectancy and sedentary work patterns exacerbate disc degeneration, compelling payers to seek durable, motion-preserving solutions. The economic burden spans lost productivity and disability payments, making artificial discs attractive for stakeholders looking beyond short-term surgical costs. Traditional fusion often fails to restore biomechanics, positioning disc arthroplasty as a credible alternative that maintains mobility and quality of life. Public health agencies increasingly frame musculoskeletal wellness as a productivity imperative, reinforcing demand for next-generation implants.

Rapid Technological Advances in Motion-Preservation Implants

Viscoelastic cervical discs, 3D-printed patient-specific endplates, and ceramic-on-polymer bearings illustrate a design paradigm shift toward more biomimetic constructs. These innovations cut wear debris, permit physiologic motion in six degrees of freedom, and simplify imaging follow-up by reducing artifact. The incorporation of additive manufacturing enables optimized lattice structures that distribute load evenly, potentially prolonging implant survivorship. Such advancements widen indications, including multi-level disease, and feed surgeon confidence in newer systems. AI-enhanced planning software further fine-tunes sizing and positioning, trimming OR time and revision risk.

High Implant & Procedure Costs Versus Fusion Alternatives

Artificial disc systems command premium pricing versus fusion cages, challenging adoption where budgets are tight. Although lifetime economic models favor motion preservation, upfront costs remain a hurdle for public payers; Medicare still restricts lumbar coverage to patients under 60 years. Emerging economies grapple with capital constraints and variable private insurance penetration, slowing penetration despite rising disease burden. Volume-based procurement and local manufacturing incentives are gradually narrowing the gap, yet cost containment will continue to temper near-term growth.

Other drivers and restraints analyzed in the detailed report include:

- Growing Surgeon & Patient Preference for Minimally Invasive Disc Arthroplasty

- Expanding Long-Term Clinical Evidence Supporting Safety and Superior Outcomes

- Limited Surgeon Training & Learning Curve for Complex Disc Arthroplasty

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The lumbar segment supplied 52% of the artificial disc replacement market size in 2024, reflecting the prevalence of low-back disorders. Still, cervical volumes are scaling faster, projected at a 15.4% CAGR thanks to demonstrated 82.3% clinical success and more straightforward anatomy. Multi-level regulatory clearances and viscoelastic designs such as the M6-C strengthen the cervical value proposition. Lumbar devices retain traction through long-term durability data, with prodisc L exhibiting just 0.67% revision across two decades. Together these patterns illustrate how the artificial disc replacement market is diversifying across spinal levels rather than concentrating solely on lumbar pathology.

Enhanced cervical uptake also reshapes surgical workflow: shorter operative times, reduced blood loss, and faster ambulatory qualification encourage ASC migration. Reimbursement parity between cervical fusion and arthroplasty in many U.S. plans neutralizes cost objections, letting surgeons emphasize functional benefits. Disc height maintenance and segmental lordosis restoration further differentiate cervical arthroplasty, influencing guidelines and referral flows.

Metal-on-polymer constructs delivered 60% of the artificial disc replacement market share in 2024, yet ceramic-based systems now post a 16.2% CAGR-the segment's fastest rate. Zirconia-toughened alumina reduces wear debris and eliminates metal ion hypersensitivity risks that affect 10-15% of patients. Improved sintering methods have mitigated earlier brittleness concerns, while radiolucency aids postoperative imaging. As MRI follow-up becomes routine, the advantage intensifies. Price differentials are narrowing as ceramic supply chains scale, enabling broader payer acceptance. Manufacturers continue to combine titanium endplates with ceramic-polymer cores to balance osseointegration with articulation performance.

The move toward ceramic also dovetails with patient marketing: allergy-free, low-noise implants resonate with health-conscious demographics. Europe, with stringent metal-ion monitoring, leads in adoption and provides a template for other regions. Concurrently, R&D into gradient materials and hybrid constructs signals an innovation pipeline geared to further erode metal's historical lead.

The Artificial Disc Replacement Market Report is Segmented by Disc Type (Cervical Artificial Disc and Lumbar Artificial Disc), Material (Metal-On-Metal, Metal-On-Polymer, and Ceramic-On-Polymer), Design (Constrained (Fixed-Core), and More), Core Mobility (Fixed Core and Mobile Core), End-User (Hospitals, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 38% of the artificial disc replacement market share in 2024 on the strength of favorable reimbursement, dense spine-center networks, and rapid uptake of AI-guided planning tools. Two-level cervical approvals expanded the eligible cohort, intensifying procedure counts. The region confronts reimbursement headwinds-Medicare's age-limit on lumbar disc arthroplasty persists-yet private insurers increasingly authorize motion preservation based on cost-effectiveness evidence.

Europe ranks second, buoyed by public systems that acknowledge long-term economic gains from reduced adjacent segment disease. Germany and France are early adopters of ceramic-dominated platforms, leveraging local biomaterials expertise. Harmonized CE-Mark updates in 2025 clarified post-market surveillance requirements, smoothing market entry for next-generation discs. Aging demographics and wellness-oriented cultural norms sustain procedure growth across the continent.

Asia-Pacific is the fastest-growing region, projected at a 15% CAGR through 2030. Japan's super-aged society and government-backed robotics programs funnel investment into spine technologies. China, via its volume-based procurement reforms, supports domestic manufacturing and accelerates time-to-market for locally developed discs. India's Production Linked Incentive (PLI) scheme nurtures indigenous MedTech capacity, narrowing import dependency and lowering costs. Varied regulatory pathways create complexity, yet the overarching trajectory remains upward as healthcare access widens.

- Medtronic

- Zimmer Biomet

- Johnson & Johnson

- Centinel Spine

- NuVasive

- Globus Medical

- Stryker

- Orthofix

- Alphatec Spine Inc

- AxioMed

- B. Braun Melsungen AG (Aesculap)

- Synergy Spine Solutions Inc

- Spineart

- Prodorth Spine

- Vertebral Technologies Inc

- Paradigm Spine

- Spineway

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Prevalence of Degenerative Disc Disease and Chronic Low-Back Pain

- 4.2.2 Rapid Technological Advances in Motion-Preservation Implants (Mobile-Core & Biomimetic Materials)

- 4.2.3 Growing Surgeon & Patient Preference for Minimally Invasive Disc Arthroplasty over Spinal Fusion

- 4.2.4 Expanding Long-Term Clinical Evidence Supporting Safety and Superior Functional Outcomes

- 4.2.5 Increasing Healthcare Expenditure and Access to Advanced Spinal Care in Emerging Economies

- 4.3 Market Restraints

- 4.3.1 High Implant & Procedure Costs Versus Fusion Alternatives in Cost-Constrained Health Systems

- 4.3.2 Stringent Regulatory Approval Pathways and Lengthy Clinical Trial Requirements

- 4.3.3 Limited Surgeon Training & Learning Curve for Complex Disc Arthroplasty Techniques

- 4.3.4 Uncertainty Over Long-Term Implant Survivability and Revision Surgery Complexity

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Disc Type

- 5.1.1 Cervical Artificial Disc

- 5.1.2 Lumbar Artificial Disc

- 5.2 By Material

- 5.2.1 Metal-on-Metal

- 5.2.2 Metal-on-Polymer

- 5.2.3 Ceramic-on-Polymer

- 5.3 By Design

- 5.3.1 Constrained (Fixed-Core)

- 5.3.2 Semi-Constrained (Mobile-Core)

- 5.3.3 Non-Constrained (Elastic-Core)

- 5.4 By Core Mobility

- 5.4.1 Fixed Core

- 5.4.2 Mobile Core

- 5.5 By End-User

- 5.5.1 Hospitals

- 5.5.2 Orthopedic & Spine Specialty Clinics

- 5.5.3 Ambulatory Surgical Centers (ASCs)

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Medtronic PLC

- 6.3.2 Zimmer Biomet

- 6.3.3 Johnson & Johnson (DePuy Synthes)

- 6.3.4 Centinel Spine LLC

- 6.3.5 NuVasive Inc

- 6.3.6 Globus Medical

- 6.3.7 Stryker Corporation

- 6.3.8 Orthofix Medical Inc

- 6.3.9 Alphatec Spine Inc

- 6.3.10 AxioMed LLC

- 6.3.11 B. Braun Melsungen AG (Aesculap)

- 6.3.12 Synergy Spine Solutions Inc

- 6.3.13 Spineart SA

- 6.3.14 Prodorth Spine

- 6.3.15 Vertebral Technologies Inc

- 6.3.16 Paradigm Spine

- 6.3.17 Spineway

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment