PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848168

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848168

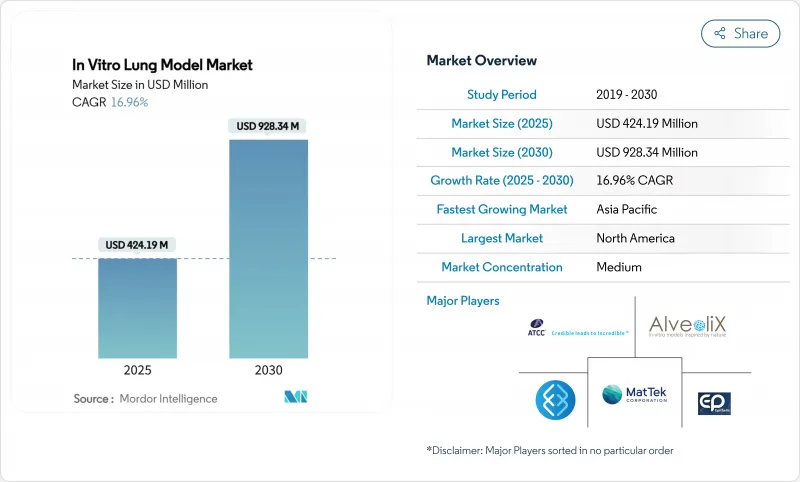

In Vitro Lung Model - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The In Vitro Lung Model Market size is estimated at USD 424.19 million in 2025, and is expected to reach USD 928.34 million by 2030, at a CAGR of 16.96% during the forecast period (2025-2030).

Regulatory agencies are openly endorsing in-vitro alternatives most notably the FDA's 2024 guidance on New Alternative Methods thereby accelerating corporate investment in organ-on-chip and organoid platforms. Rapid post-pandemic growth in inhaled therapeutics, sustained Horizon Europe grants, and continuing advances in stretchable microfluidic systems are reinforcing demand from both drug developers and academic laboratories. At the same time, validation bottlenecks and capital-intensive hardware temper adoption rates, obliging suppliers to pair technical innovation with rigorous regulatory engagement.

Global In Vitro Lung Model Market Trends and Insights

Global phase-out of animal testing enhancing demand for lung alternatives

Legislatures on three continents are mandating systematic reductions in vertebrate testing, prompting drug developers to align pipeline workflows with validated in-vitro lung constructs. FDA guidance now lists organ-on-chip data among acceptable toxicity endpoints, a position echoed by the European Parliament's roadmap, creating a policy-driven tailwind that reclassifies lung models as compliance necessities rather than exploratory tools. Pharmaceutical firms are reallocating preclinical budgets toward microfluidic chips that better anticipate human pharmacokinetics, thereby boosting order volumes for full-integrated breathing systems. Vendors capable of generating Good Laboratory Practice data packages see an immediate competitive lift as regulatory filings increasingly reference chip-based toxicity read-outs. Over the medium term, multi-agency alignment is expected to cut validation cycles, widening the customer base to cost-sensitive generics manufacturers.

Surge in inhaled therapeutics post-pandemic boosting respiratory R&D

The COVID-19 crisis reframed respiratory drug delivery as a universal strategic priority, expanding inhaled modality pipelines across antivirals, fibrosis agents, and COPD biologics. Sophisticated 3D airway constructs now enable granular tracking of aerosol deposition profiles under variable breathing regimes, giving formulation scientists actionable metrics before animal or clinical stages. This real-time insight shortens lead optimisation loops and lowers attrition linked to poor pulmonary targeting. The clear linkage between airway-specific pharmacology and pandemic resilience continues to attract venture capital, keeping start-up suppliers well-funded for translational improvements. Short-term gains materialise mainly in North America and Europe; Asia-Pacific uptake accelerates as local pharma pivots toward respiratory franchises.

Lack of standardised OECD validation for lung constructs

OECD guidelines covering skin, eye, and hepatic in-vitro assays are yet to be matched by a lung-specific test battery, leaving sponsors to negotiate bespoke validation packages for every assay run. The absence heightens regulatory risk and forces duplicative inter-lab ring trials that slow commercial roll-outs. Meanwhile, divergent national acceptance criteria create patchwork compliance hurdles, particularly for global multi-centre studies. Ongoing cross-agency working groups promise harmonised protocols, but consensus timelines still run multiple years, leading many mid-tier CROs to defer investment in complex chips.

Other drivers and restraints analyzed in the detailed report include:

- EU-funded Horizon projects advancing scalable lung micro-physiology

- Commercialisation of stretchable microfluidic lung systems

- Capital intensity of dynamic lung-on-chip platforms for CROs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The in vitro lung model market size for 2D Static Monolayer systems remains the largest market share of 53.63% in 2024, yet the category's CAGR lags markedly behind dynamic microfluidic platforms. organ-on-chip systems integrate breathing motions and fluid shear, yielding data that more accurately forecasts human exposure outcomes, a feature driving their 18.05% growth trajectory. ALI Transwell inserts function as a pragmatic bridge for high-throughput toxicology screens, sustaining volume demand from consumer-product safety labs. Meanwhile, 3D cell aggregates fill a crucial niche in oncology research where spheroid geometry better reflects tumour oxygen gradients.

Automated 3D printing has begun to erode historical cost barriers: BMF Biotechnology's nano-resolution printers fabricate chip housings within hours, cutting per-unit expenditure by double-digit percentages. Research institutions exploit mucus-enriched bioinks to recreate airway viscosity, enhancing cilia beat synchrony and pathogen entry modelling. The iterative feedback between biomedical engineers and toxicologists is set to accelerate innovation, positioning organ-on-chip suppliers for above-trend revenue realisation.

The in Vitro Lung Model Report is Segmented by Model Type (2D Static Monolayer Models, Air-Liquid Interface Transwell Models, and More), Application (Drug Discovery & Lead Optimisation, and More), End User (Pharmaceutical & Biotechnology Companies, and More), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America leads the in vitro lung model market with 42.05% revenue in 2024, anchored by FDA regulatory clarity and a dense cluster of biotech start-ups that have normalised chip-based assays in IND submissions. Federal grants and venture capital co-fund translational projects, ensuring steady product upgrades and robust domestic demand.

Asia-Pacific, however, posts the steepest 26.32% CAGR, propelled by Chinese and South Korean funding schemes that subsidise academic-corporate consortia building local chip manufacturing lines. CN Bio's new Seoul-based distribution pact exemplifies how foreign suppliers leverage regional enthusiasm for human-relevant testing to secure first-mover gains.

Europe maintains mid-teens growth underwritten by Horizon grants and a region-wide roadmap to retire animal studies, stimulating recurring orders for OECD-aligned validation studies. The presence of precision-engineering firms in Germany and the Netherlands supports the localisation of microfluidic component supply, reducing lead times for European buyers.

Latin America and the Middle East & Africa remain nascent but opportunity-rich. Local CROs predominantly deploy monolayer or ALI inserts, yet pilot Horizon-linked training programs aim to seed organ-on-chip know-how. Policy convergence around chemical-safety reform could fast-track uptake once infrastructure grants are unlocked.

- Emulate

- Mimetas BV

- CN Bio Innovations Ltd.

- AlveoliX

- TissUse

- InSphero

- Epithelix Sarl

- MatTek Corporation

- ATCC Global

- Lonza Group

- Thermo Fisher Scientific

- SynVivo Inc.

- BEOnChip SL

- React4Life Srl

- AxoSim Technologies LLC

- Kirkstall Ltd.

- Advanced BioMatrix Inc.

- Charles River Laboratories Intl.

- StemBioSys Inc.

- Hesperos

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Global Phase-out of Animal Testing Enhancing Demand for Lung Alternatives

- 4.2.2 Surge in Inhaled Therapeutics Post-Pandemic Boosting Respiratory R&D

- 4.2.3 EU-Funded Horizon Projects Advancing Scalable Lung Micro-Physiology

- 4.2.4 Commercialization of Stretchable Microfluidic Lung Systems

- 4.2.5 Shift to iPSC-Derived, Patient-Specific Lung Models for Precision Trials

- 4.2.6 Increasing Respiratory Disease Burden Driving Inhalation Toxicology Platforms

- 4.3 Market Restraints

- 4.3.1 Lack of Standardized OECD Validation for Lung Constructs

- 4.3.2 Capital Intensity of Dynamic Lung-on-Chip Platforms for CROs

- 4.3.3 Supply Chain Variability of Primary Human Airway Cells

- 4.3.4 Interoperability Challenges with Legacy High-Throughput Screening Systems

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Model Type

- 5.1.1 2D Static Monolayer Models

- 5.1.2 Air-Liquid Interface (ALI) Transwell Models

- 5.1.3 3D Cell Aggregates & Spheroids

- 5.1.4 Organ-on-Chip Microfluidic Models

- 5.1.5 3D Bioprinted Lung Tissues

- 5.2 By Application

- 5.2.1 Drug Discovery & Lead Optimisation

- 5.2.2 Inhalation Toxicology & Safety Assessment

- 5.2.3 Disease Modelling

- 5.2.4 Personalised Medicine & Biomarker Discovery

- 5.3 By End User

- 5.3.1 Pharmaceutical & Biotechnology Companies

- 5.3.2 Contract Research Organisations

- 5.3.3 Academic & Research Institutes

- 5.3.4 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Emulate Inc.

- 6.3.2 Mimetas BV

- 6.3.3 CN Bio Innovations Ltd.

- 6.3.4 AlveoliX AG

- 6.3.5 TissUse GmbH

- 6.3.6 InSphero AG

- 6.3.7 Epithelix Sarl

- 6.3.8 MatTek Corporation

- 6.3.9 ATCC Global

- 6.3.10 Lonza Group AG

- 6.3.11 Thermo Fisher Scientific Inc.

- 6.3.12 SynVivo Inc.

- 6.3.13 BEOnChip SL

- 6.3.14 React4Life Srl

- 6.3.15 AxoSim Technologies LLC

- 6.3.16 Kirkstall Ltd.

- 6.3.17 Advanced BioMatrix Inc.

- 6.3.18 Charles River Laboratories Intl.

- 6.3.19 StemBioSys Inc.

- 6.3.20 Hesperos Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment