PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848170

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848170

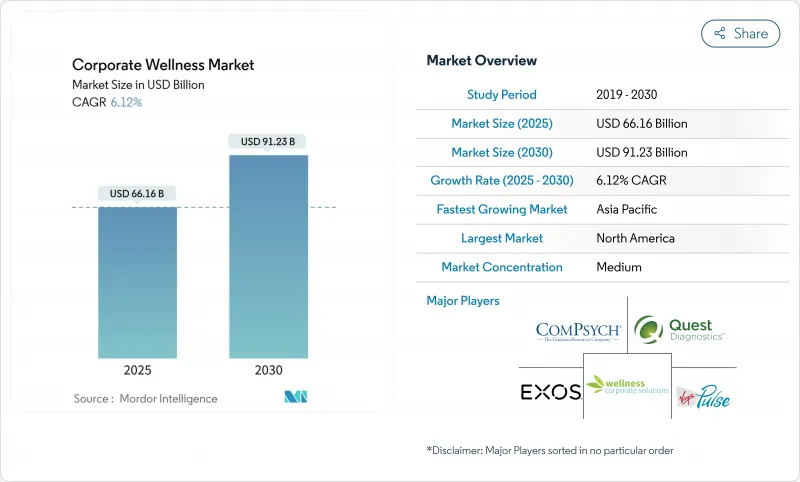

Corporate Wellness - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The corporate wellness market size stands at USD 66.16 billion in 2025 and is projected to reach USD 91.23 billion by 2030, reflecting a forecast CAGR of 6.12% from 2025 to 2030.

Rising employer healthcare outlays, an escalating burden of lifestyle-linked diseases, and increased C-suite focus on holistic employee wellbeing are the principal forces propelling demand. Preventive wellness initiatives have moved from discretionary perks to core cost-containment tools as longitudinal studies continue to validate returns on investment. Hybrid work patterns are reshaping service delivery toward integrated onsite-virtual models that sustain engagement without compromising flexibility. Meanwhile, North America retains leadership, but accelerated uptake in Asia Pacific signals an impending realignment of regional growth momentum. Vendor strategies are evolving toward end-to-end, analytics-enabled ecosystems that quantify both tangible savings and intangible cultural benefits, thereby strengthening procurement cases among large and mid-sized buyers.

Global Corporate Wellness Market Trends and Insights

Escalating Employer Healthcare Costs Prompting Preventive Wellness Investments

Employers are channeling larger portions of benefits budgets into preventive initiatives as medical claims inflation outpaces wage growth. Biometric screenings combined with personalized coaching allow firms to identify metabolic risks early, thereby avoiding high-cost episodes later in the care continuum. Finance leaders increasingly treat preventive wellness as a hedge against unpredictable self-insurance liabilities rather than an optional perk. Integration of wellness metrics into financial dashboards elevates visibility at board level, and this alignment between CFOs and CHROs accelerates program scale-up. As eligibility thresholds widen, smaller employee cohorts gain access to expanded services, further cementing wellness as an enterprise-wide cost control mechanism.

Rising Global Burden of Lifestyle-Related Chronic Diseases Among Working-Age Adults

Diabetes, cardiovascular conditions, and obesity have emerged as leading causes of lost productivity, driving employers to embed nutrition coaching, movement challenges, and mental health modules into program design. Health Risk Assessments provide baseline data that inform targeted outreach to high-risk clusters. Advanced analytics enable real-time program refinements that slow disease progression and reduce claims intensity. Employer awareness that disease mitigation sustains productivity reinforces the link between wellness spending and operational performance. In turn, iterative program design nurtures a culture of continuous improvement, setting a feedback loop that strengthens engagement over time.

Persistently Low Long-Term Employee Engagement Levels in Wellness Initiatives

Participation typically peaks shortly after program launch then fades as novelty wears off, limiting ROI if left unaddressed. Employers are layering social challenges, leadership role modeling, and micro-break prompts into daily routines to normalize healthy behaviors. Concierge-style coaching services that contextualize data from wearables help sustain relevance by offering personalized insights. Embedding wellness objectives into performance management can further entrench desired behaviors by aligning them with career progression. Ultimately, convenience and cultural reinforcement-not one-time incentives-prove most effective at shifting long-term habits.

Other drivers and restraints analyzed in the detailed report include:

- Proven ROI/VOI from Wellness Programs in Reducing Absenteeism and Talent Turnover

- Rapid Digital Health Innovation Expanding Access to Virtual & Hybrid Wellness Solutions

- Heightened Data-Privacy and Cyber-Security Risks for Sensitive Health Information

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Health Risk Assessment captured 26.0% of corporate wellness market share in 2024, reflecting its role as the diagnostic bedrock that shapes downstream interventions. Repeat assessments generate longitudinal datasets that underpin predictive analytics, allowing employers to stratify risk and allocate resources more effectively. The corporate wellness market increasingly demands integrated dashboards that consolidate screening results, claims information, and wearable data into a single view. Vendors respond by enhancing interoperability, ensuring that screening data can trigger automated care pathways such as weight-management coaching or diabetic counseling. Large employers highlight faster time-to-value when screenings seamlessly integrate with broader wellbeing ecosystems rather than functioning as stand-alone events.

Stress Management is forecast to post a 7.2% CAGR through 2030, the fastest rate within service lines. The corporate wellness market views mental wellbeing as the next frontier of productivity, spurred by mounting evidence linking unmanaged stress to turnover and burnout. Emerging solutions combine cognitive-behavioral content, real-time heart-rate variability feedback, and mindfulness sessions, offering a multifaceted toolkit that resonates with diverse employee segments. Gamified challenges that reward consistent meditation practice or journaling have proven more engaging than didactic e-learning modules. Employers report that weaving stress interventions into leadership development programs normalizes mental health conversations, breaking cultural stigmas and amplifying program reach.

Onsite delivery commanded 55.0% of corporate wellness market share in 2024, attributable to embedded clinics, fitness centers, and live coaching sessions that visibly demonstrate employer commitment. Face-to-face interactions foster rapport and trust, especially during biometric screenings where immediate feedback can prompt behavior shifts. However, the surge in hybrid working is tilting future growth toward virtual modalities, forecast at an 8% CAGR through 2030, as employees demand always-on access regardless of work location. Digital platforms extend program reach without adding real-estate costs, a critical advantage for global enterprises with distributed footprints.

Hybrid configurations that merge occasional onsite events with continuous digital engagement are becoming the default architecture for the corporate wellness market. Tele-coaching follows up on in-person screenings, ensuring continuity of care and closing feedback loops. Wearable integration provides real-time data that coaches use to refine goals, making interventions dynamic rather than static. Employers deploying hybrid models report more consistent participation curves because services are accessible during commutes, travels, and remote days. Additionally, cross-channel data aggregation supports more granular ROI reporting, which strengthens the business case when budgets come up for renewal.

The Corporate Wellness Market Report is Segmented by Service Type (Health Risk Assessment, Fitness & Nutrition Programs, and More), Deployment Model (On-Site, and More), End User (Large Organizations, and More), Ownership (In-House Managed Programs and Outsourced Vendor-Managed Programs), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 39.4% of corporate wellness market share in 2024, underpinned by steep employer healthcare costs and benefit mandates that embed wellness into total rewards strategies. U.S. companies channel significant budgets into multi-modal programs that bundle onsite clinics with app-based coaching, leveraging data analytics to track ROI. Canadian employers emphasize mental health and flexible scheduling, reflecting the interplay with public healthcare coverage. Mexican subsidiaries of multinationals adopt wellness to align with global risk-management frameworks, encouraged by fiscal incentives that target non-communicable diseases. Across the continent, the convergence of value-based care and analytics is solidifying wellness as a strategic lever rather than a voluntary perk.

Asia Pacific is the fastest-growing region, forecast at a 7.6% CAGR from 2025 to 2030, driven by rapid urbanization, a technology-literate workforce, and rising chronic disease prevalence. Chinese firms integrate traditional practices such as tai chi with wearable-enabled step challenges, while Indian employers pilot tele-nutrition consults that blend Ayurvedic principles with modern dietetics. Japanese corporations, facing demographic aging, emphasize resilience training to preserve productivity. Regional regulators are codifying wellness guidelines, providing clarity that accelerates adoption. The expanding digital health ecosystem, including super-apps and telemedicine, offers fertile ground for vendors to localize offerings and scale rapidly.

Europe's corporate wellness market is mature and shaped by strict labor statutes and entrenched social welfare systems. Programs often highlight psychosocial wellbeing, flexible scheduling, and ergonomic design, reflecting cultural emphasis on work-life harmony. Scandinavian firms set benchmarks with integrated strategies that weave wellness into corporate purpose statements and governance charters. In the Middle East and Africa, Gulf Cooperation Council economies target high diabetes and cardiovascular rates through on-demand fitness subscriptions and nutritional counseling. South America, led by Brazil, is expanding gradually as domestic firms partner with global vendors to introduce evidence-based programs adapted to local cultural contexts. Although maturity and regulatory landscapes vary, the common theme across regions is a shift toward preventive, data-driven wellness that aligns with economic and societal priorities.

- ComPsych

- Virgin Pulse

- EXOS

- Optum

- Quest Diagnostics Health & Wellness

- Wellness Corporate Solutions (LabCorp)

- Privia Health

- Marino Wellness

- Vitality Group International

- Wellsource

- TotalWellness

- Fitbit Health Solutions

- Curtis Health

- Bridges Health

- Medcan

- Truworth Wellness

- Central Corporate Wellness

- Anthem Inc.

- Cigna Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Employer Healthcare Costs Prompting Preventive Wellness Investments

- 4.2.2 Rising Global Burden of Lifestyle-Related Chronic Diseases Among Working-Age Adults

- 4.2.3 Proven ROI/VOI from Wellness Programs in Reducing Absenteeism and Talent Turnover

- 4.2.4 Rapid Digital Health Innovation Expanding Access to Virtual & Hybrid Wellness Solutions

- 4.2.5 Strengthening Occupational Health & Safety Regulations Mandating Employee Well-Being Measures

- 4.2.6 Integration of Wearables and Real-Time Analytics Enabling Personalized, Data-Driven Interventions

- 4.3 Market Restraints

- 4.3.1 Persistently Low Long-Term Employee Engagement Levels in Wellness Initiatives

- 4.3.2 Heightened Data-Privacy and Cyber-Security Risks for Sensitive Health Information

- 4.3.3 High Up-Front Program Implementation Costs Limiting Adoption by SMEs

- 4.3.4 Difficulty Quantifying Intangible Benefits, Hindering Budget Allocation and Executive Buy-In

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Service Type

- 5.1.1 Health Risk Assessment

- 5.1.2 Fitness & Nutrition Programs

- 5.1.3 Stress Management

- 5.1.4 Smoking Cessation

- 5.1.5 Mental & Behavioral Health Management

- 5.1.6 Other Service Types

- 5.2 By Delivery Model

- 5.2.1 On-site

- 5.2.2 Off-site / Virtual

- 5.2.3 Hybrid

- 5.3 By End User

- 5.3.1 Large Organizations

- 5.3.2 Small & Medium Organizations

- 5.3.3 Public Sector & Other End Users

- 5.4 By Ownership

- 5.4.1 In-house Managed Programs

- 5.4.2 Outsourced Vendor-Managed Programs

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle-East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ComPsych Corporation

- 6.4.2 Virgin Pulse

- 6.4.3 EXOS

- 6.4.4 Optum, Inc.

- 6.4.5 Quest Diagnostics Health & Wellness

- 6.4.6 Wellness Corporate Solutions (LabCorp)

- 6.4.7 Privia Health

- 6.4.8 Marino Wellness

- 6.4.9 Vitality Group International

- 6.4.10 Wellsource Inc.

- 6.4.11 TotalWellness

- 6.4.12 Fitbit Health Solutions

- 6.4.13 Curtis Health

- 6.4.14 Bridges Health

- 6.4.15 Medcan

- 6.4.16 Truworth Wellness

- 6.4.17 Central Corporate Wellness

- 6.4.18 Anthem Inc.

- 6.4.19 Cigna Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment