PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848288

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848288

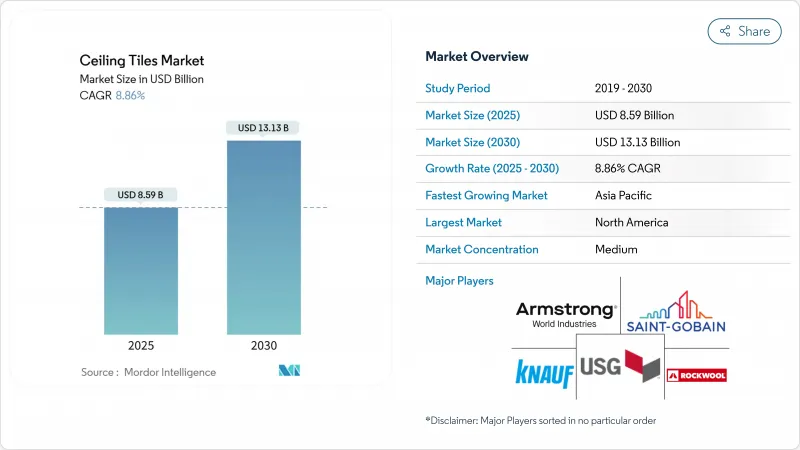

Ceiling Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Ceiling Tiles Market size is estimated at USD 8.59 billion in 2025, and is expected to reach USD 13.13 billion by 2030, at a CAGR of 8.86% during the forecast period (2025-2030).

Intensifying acoustic regulations, expanding retrofit programs aimed at energy efficiency, and rapid urban transport development continue to draw sustained investment into commercial and residential ceiling systems. Energy-focused innovations such as Phase Change Material (PCM) panels and low-embodied-carbon mineral wool boards now influence procurement decisions as much as aesthetics. Segment leaders are prioritizing circularity commitments, with verified recycling schemes gaining weight in bid evaluations. Meanwhile, the shift toward taller residential ceilings in China and premium digital-print gypsum tiles in Gulf luxury projects is broadening the addressable base, strengthening the long-term outlook for the ceiling tiles market.

Global Ceiling Tiles Market Trends and Insights

Rapid adoption of acoustic ceiling systems in open-plan offices across North America & Europe

Open-plan layouts dominate new corporate fit-outs, yet background chatter cuts measured employee focus time by 66%. To restore acoustic comfort, enterprises are installing mineral-wool and fiberglass panels with Noise Reduction Coefficient values above 0.90. Armstrong Sonata and Halcyon boards match these ratings while retaining a seamless white aesthetic. Technology and financial firms lead deployments because staff retention reviews now link acoustic privacy with mental wellness. Procurement teams are also specifying high Ceiling Attenuation Class for huddle rooms and call centers, accelerating order volumes in the ceiling tiles market.

Europe green-building credits accelerating mineral-wool tile retrofit demand

BREEAM and DGNB frameworks grant premium points for both acoustic excellence and recycled content. Mineral wool tiles that contain 30-70% reclaimed fibers therefore earn double credit, lifting their score profiles under the EU Energy Performance of Buildings Directive update of 2024. CertainTeed mineral wool boards, comprising more than 50% recycled material, have become a preferred drop-in during facade and HVAC refurbishments, allowing project owners to meet mandated energy thresholds without structural overhaul.

Energy-price volatility inflating mineral-wool costs

Mineral wool production relies on furnace temperatures above 1,450 °C, so spikes in natural-gas and electricity tariffs have lifted input costs by up to 40% for European lines in 2024. ROCKWOOL responded with a USD 100 million energy-efficient facility in Mississippi that optimizes heat-recovery loops, but near-term price pass-through options remain limited. Higher quote values encourage specifiers to substitute toward metal or composite boards, temporarily softening mineral-wool shipments in the ceiling tiles market.

Other drivers and restraints analyzed in the detailed report include:

- Asian metro & airport build-outs mandating non-combustible ceiling tiles

- Reduced carbon impacts in processing of raw materials for manufacturing ceiling tiles

- Threat of substitutes, such as asphalt and mortar

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mineral wool held the largest portion of the ceiling tiles market share at 41% in 2024, anchored by its class-leading acoustic absorption and non-combustibility. Project managers routinely select it for offices, classrooms, and healthcare corridors where both sound and fire codes are strict. Yet energy cost swings and embodied-carbon scrutiny are pressuring manufacturers to innovate. Ultima LEC boards that cut embodied carbon by 43% demonstrate how mineral-wool suppliers are repositioning around sustainability.

Metal panels are capturing mindshare in transport and prestige retail projects, advancing at an 8.99% CAGR to 2030. They satisfy stringent flame-spread limits and accept complex perforation patterns that balance acoustics and air-return requirements. Integral recyclability streams additionally support circular-economy targets, reinforcing their rise. Composite and bio-based hybrids occupy niche roles but provide laboratories for future low-carbon material science in the ceiling tiles market.

The Ceiling Tiles Market Report Segments the Industry by Raw Material (Mineral Wool, Metal, Gypsum, and Others), Property (Acoustic and Non-Acoustic), Application (Residential, Commercial, Industrial, and Institutional), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the ceiling tiles market with 35% revenue share in 2024, driven by a mature reroofing cycle, tight acoustic codes, and a culture of open-plan offices that amplifies sound-control needs. Federal incentives for energy-efficient retrofits support continued mineral-wool and PCM panel adoption across public-sector buildings. Large incumbents maintain domestic manufacturing bases, minimizing freight volatility and ensuring rapid service to distributors.

Europe follows closely, fueled by stringent green-building frameworks and refurbishment subsidies under national energy-performance plans. Mineral wool's high recycled content aligns neatly with BREEAM and DGNB credit metrics, fostering steady order flow despite energy-price volatility. Continental contractors are also trialing circular take-back schemes such as the Rockcycle program that reuses end-of-life tiles, reinforcing sustainability credentials in the ceiling tiles market.

Asia Pacific is the fastest-growing theatre, posting a 10.5% CAGR from 2025-2030 on the back of megaproject pipelines encompassing airports, metros, and mixed-use towers. China's directive to raise standard residential ceiling heights to 3 m expands surface area requirements, while India's metro expansion multiplies opportunities for Class A fire-rated metal boards. Yet local price sensitivity and entrenched POP practices pose competitive challenges for imported gypsum tiles. Elsewhere, GCC states pursue design-led premium solutions, highlighting Middle-East luxury as a distinct high-margin cluster within the ceiling tiles market.

- AWI Licensing LLC

- Foshan Ron Building Material Trading

- Georgia-Pacific

- Guangzhou Titan Building Materials Co., Ltd.

- Haining Shamrock Import & Export Co. Ltd.

- Hunter Douglas N.V.

- Imerys

- Kingspan Group

- Knauf Group

- Mada Gypsum Company

- New Ceiling Tiles LLC

- Odenwald Faserplattenwerk GmbH

- PVC Ceilings SA

- ROCKWOOL A/S

- Saint-Gobain

- SAS International

- Shandong Huamei Building Materials Co., Ltd.

- Techno Ceiling Products

- USG Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption of acoustic ceiling systems in open-plan offices across North America and Europe

- 4.2.2 Europe green-building credits accelerating mineral-wool tile retrofit demand

- 4.2.3 Asian metro and airport build-outs mandating non-combustible ceiling tiles

- 4.2.4 Reduced Carbon Impacts in Processing of Raw Materials for Manufacturing Ceiling Tiles

- 4.2.5 Digital-print gypsum tiles enabling premiumisation in Middle-East luxury real estate

- 4.3 Market Restraints

- 4.3.1 Energy-price volatility inflating mineral-wool costs

- 4.3.2 Threat of Substitutes, such as Asphalt and Mortar

- 4.3.3 Low-cost POP false ceilings constraining gypsum tile uptake in Asia Pacific

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Raw Material

- 5.1.1 Mineral Wool

- 5.1.2 Metal

- 5.1.3 Gypsum

- 5.1.4 Others (Composite, Plastic and Wood)

- 5.2 By Property

- 5.2.1 Acoustic

- 5.2.2 Non-Acoustic

- 5.3 By Application

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.3.4 Institutional

- 5.4 By Geography

- 5.4.1 Asia Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordics

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 Asia Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 AWI Licensing LLC

- 6.4.2 Foshan Ron Building Material Trading

- 6.4.3 Georgia-Pacific

- 6.4.4 Guangzhou Titan Building Materials Co., Ltd.

- 6.4.5 Haining Shamrock Import & Export Co. Ltd.

- 6.4.6 Hunter Douglas N.V.

- 6.4.7 Imerys

- 6.4.8 Kingspan Group

- 6.4.9 Knauf Group

- 6.4.10 Mada Gypsum Company

- 6.4.11 New Ceiling Tiles LLC

- 6.4.12 Odenwald Faserplattenwerk GmbH

- 6.4.13 PVC Ceilings SA

- 6.4.14 ROCKWOOL A/S

- 6.4.15 Saint-Gobain

- 6.4.16 SAS International

- 6.4.17 Shandong Huamei Building Materials Co., Ltd.

- 6.4.18 Techno Ceiling Products

- 6.4.19 USG Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Innovation in Gypsum Tiles for its Biodegradable Properties