PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848303

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848303

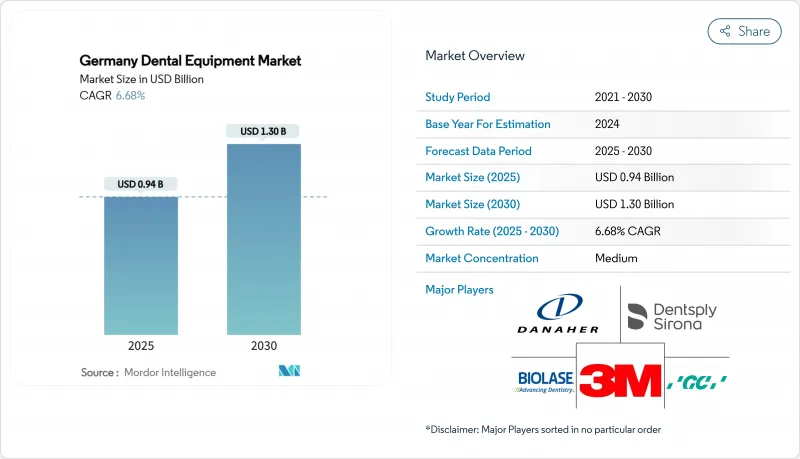

Germany Dental Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The German dental equipment market size reached USD 0.94 billion in 2024 and is forecast to expand to USD 1.30 billion by 2030, registering a CAGR of 6.68% during 2025-2030.

Demand is accelerating as digital technologies lower chair time, corporate Dental Service Organizations (DSOs) consolidate purchasing power, and an aging population increases restorative treatment volumes. Intraoral scanners, 3D printers, and laser systems are moving from niche to mainstream, while refurbished imports temper average selling prices. Competitive pressure is intensifying: global leaders are bundling cloud-based software with hardware, mid-tier specialists focus on feature depth, and budget suppliers leverage EU secondary markets. Germany's robust statutory insurance coverage keeps baseline procedure flows predictable, yet limited reimbursement for aesthetic care channels equipment spending toward high-margin private treatments concentrated in metropolitan areas.

Germany Dental Equipment Market Trends and Insights

Rapid Uptake of CAD/CAM Systems

German clinics are integrating chairside CAD/CAM ecosystems that pair Primescan 2 scanners with cloud-based DS Core design software, cutting single-visit restoration time in half and reducing lab dependencies. Uptake is most visible in multi-chair urban offices where higher patient throughput justifies capital outlays. DSOs standardize these platforms across networks, enabling centralized training and bulk pricing leverage. As material choices widen-from hybrid ceramics to zirconia blocks-clinicians improve margin capture by bringing milling in-house. Financing models offering five-year 0% plans mitigate cost barriers, yet solo practices in rural regions still postpone adoption, widening the technology gap within the German dental equipment market.

Booming Clear Aligner Demand

German patients pay privately for aesthetic correction, prompting clinics to invest in high-accuracy scanners, treatment-planning AI, and 3D printers for aligner models. Practice marketing pivots toward "invisible dentistry," and metro offices report case fees 20% above 2022 levels. The resulting equipment upgrade cycle sustains scanner and printing sales while driving recurring revenue from software subscriptions, cementing digital workflows within the German dental equipment market.

Capital-Intensity of Digital Workflows

A full in-office digital chain-scanner, design software, milling unit, and 3D printer-can cost more than USD 162,000. While DSOs amortize this across multiple sites, solo owners face strain, delaying upgrades and lengthening payback periods. Rapid innovation cycles amplify obsolescence fears, making leasing and pay-per-use models attractive yet complex to manage. This funding gap risks widening performance disparities across the German dental equipment market.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Laser Periodontal Therapy Reducing Surgical Downtime

- Increasing Dental Disease Incidence

- Price Competition & Limited Reimbursement

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dental consumables sustained a 62.54% share of the German dental equipment market in 2024 as restorative and implant procedures remained routine. Recurrent demand for bonding agents, impression materials, and biomaterials provides manufacturers with predictable volume, offsetting price erosion. Meanwhile, the general and diagnostics equipment category is projected to grow fastest at 7.34% CAGR through 2030, propelled by demand for radiation-free intraoral cameras like KaVo's DIAGNOcam Vision Full HD.

Dental chairs now ship with integrated electric motors, touch-screen controls, and IoT sensors that feed maintenance analytics into cloud dashboards. Partnerships such as the 2025 KaVo-A-dec integration enable plug-and-play handpiece connectivity, improving operatory ergonomics. Laser platforms covering diode, Er:YAG, and Nd:YAG wavelengths gain traction for soft-tissue contouring and cavity preparation. Emerging "other devices" lines, including digital shade-matching cameras and sleep-apnea oral appliances, add ancillary revenue streams yet remain sub-5% of the German dental equipment market.

The German Dental Equipment Market Report is Segmented by Product (General and Diagnostics Equipment, Dental Consumables, Other Dental Devices), Treatment (Orthodontic, Endodontic, Peridontic, Prosthodontic, Periodontic), End User (Dental Hospitals, Dental Clinics, Academic & Research Institutes), and Geography (Germany). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Dentsply Sirona GmbH

- KaVo Dental GmbH

- Straumann Group

- Durr Dental SE

- Henry Schein Dental Deutschland GmbH

- 3M Deutschland GmbH (3M Oral Care)

- Nobel Biocare Services

- Planmeca

- Carestream Dental Germany GmbH

- GC Corporation

- VOCO

- BEGO GmbH & Co. KG

- Kulzer

- Ivoclar Vivadent

- Align Technology GmbH

- A-dec Inc. (Germany)

- VATECH Europe GmbH

- Digital Dental & Healthcare Technology

- Medicover DDent MVZ GmbH

- Dr. Fischer Dental GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Level-1

2 Introduction

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

3 Research Methodology

4 Executive Summary

5 Market Landscape

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Rapid Uptake of CAD/CAM Systems in German Dental Practices

- 5.2.2 Booming Clear Aligner Demand Fuelled by Adult Orthodontics

- 5.2.3 Increasing Incidences of Dental Diseases

- 5.2.4 Shift to Laser Periodontal Therapy Reducing Surgical Downtime

- 5.2.5 Growing Corporate Dental Service Organizations (DSOs) Driving Bulk Equipment Procurement

- 5.2.6 Strong Export Incentives for "Made-in-Germany" Handpieces & Imaging Units

- 5.3 Market Restraints

- 5.3.1 Capital-Intensity of Digital Workflows for Solo Practices

- 5.3.2 Price Competition from Refurbished Units Imported from Rest of EU along with Limited Reimbursement for Aesthetic Procedures

- 5.3.3 Stringent MDR Re-certification Costs for Legacy Devices

- 5.3.4 Limited Reimbursement for Aesthetic Procedures Dampening High-end Implant Sales

- 5.4 Supply-Chain Analysis

- 5.5 Regulatory Outlook

- 5.6 Technological Outlook

- 5.7 Porter's Five Forces

- 5.7.1 Threat of New Entrants

- 5.7.2 Bargaining Power of Buyers

- 5.7.3 Bargaining Power of Suppliers

- 5.7.4 Threat of Substitutes

- 5.7.5 Intensity of Competitive Rivalry

6 Market Size & Growth Forecasts (Value, USD)

- 6.1 By Product

- 6.1.1 General and Diagnostics Equipment

- 6.1.1.1 Dental Laser

- 6.1.1.1.1 Soft Tissue Lasers

- 6.1.1.1.2 Hard Tissue Lasers

- 6.1.1.2 Radiology Equipment

- 6.1.1.2.1 Extra Oral Radiology Equipment

- 6.1.1.2.2 Intra-oral Radiology Equipment

- 6.1.1.3 Dental Chair and Equipment

- 6.1.1.4 Other General and Diagnostic equipment

- 6.1.2 Dental Consumables

- 6.1.2.1 Dental Biomaterial

- 6.1.2.2 Dental Implants

- 6.1.2.3 Crowns and Bridges

- 6.1.2.4 Other Dental Consumables

- 6.1.3 Other Dental Devices

- 6.1.1 General and Diagnostics Equipment

- 6.2 By Treatment

- 6.2.1 Orthodontic

- 6.2.2 Endodontic

- 6.2.3 Peridontic

- 6.2.4 Prosthodontic

- 6.2.5 Periodontic

- 6.3 By End User

- 6.3.1 Dental Hospitals

- 6.3.2 Dental Clinics

- 6.3.3 Academic & Research Institutes

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 7.4.1 Dentsply Sirona GmbH

- 7.4.2 KaVo Dental GmbH

- 7.4.3 Straumann Group

- 7.4.4 Durr Dental SE

- 7.4.5 Henry Schein Dental Deutschland GmbH

- 7.4.6 3M Deutschland GmbH (3M Oral Care)

- 7.4.7 Nobel Biocare Services AG

- 7.4.8 Planmeca Oy

- 7.4.9 Carestream Dental Germany GmbH

- 7.4.10 GC Europe N.V.

- 7.4.11 VOCO GmbH

- 7.4.12 BEGO GmbH & Co. KG

- 7.4.13 Kulzer GmbH

- 7.4.14 Ivoclar Vivadent AG

- 7.4.15 Align Technology GmbH

- 7.4.16 A-dec Inc. (Germany)

- 7.4.17 VATECH Europe GmbH

- 7.4.18 Digital Dental & Healthcare Technology GmbH & Co. KG

- 7.4.19 Medicover DDent MVZ GmbH

- 7.4.20 Dr. Fischer Dental GmbH

8 Market Opportunities & Future Outlook

- 8.1 White-space & Unmet-need Assessment

9 Company

10 Dentsply Sirona GmbH

11 Dentsply Sirona GmbH

12 KaVo Dental GmbH

13 KaVo Dental GmbH

14 Straumann Group (Germany)

15 Straumann Group (Germany)

16 Durr Dental SE

17 Durr Dental SE

18 Henry Schein Dental Deutschland

19 Henry Schein Dental Deutschland

20 3M Deutschland (Oral Care)

21 3M Deutschland (Oral Care)

22 Planmeca Oy - Deutschland

23 Planmeca Oy - Deutschland

24 Carestream Dental Germany

25 VOCO GmbH

26 VOCO GmbH

27 BEGO GmbH & Co. KG

28 Kulzer GmbH

29 Kulzer GmbH

30 VATECH Europe GmbH

31 Align Technology GmbH

32 Align Technology GmbH