PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848309

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848309

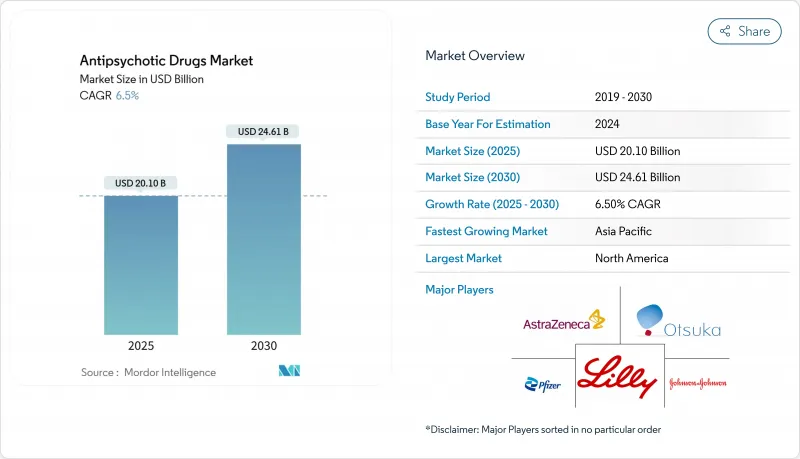

Antipsychotic Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Antipsychotic Drugs Market size is estimated at USD 20.10 billion in 2025, and is expected to reach USD 24.61 billion by 2030, at a CAGR of 6.5% during the forecast period (2025-2030).

Growth rests on three pillars: the steady rise in diagnosed mental-health disorders, brisk uptake of third-generation agents with dopamine-partial-agonist or muscarinic-receptor activity, and sustained public-payer funding that lowers patients' out-of-pocket costs. Consolidation among innovators is reshaping the competitive arena, with recent high-value acquisitions designed to secure intellectual property and fast-track differentiated assets. In parallel, long-acting injectables gain momentum as real-world evidence confirms superior relapse prevention and cost offsets. Generics, however, intensify price pressure as patents expire on blockbuster atypical molecules, prompting firms to bundle medicines with digital-therapeutic companions that reinforce adherence and extend product lifecycles.

Global Antipsychotic Drugs Market Trends and Insights

Rising LAI Adoption in Community Mental-Health Programs

Long-acting injectable antipsychotics are closing the 50% non-adherence gap that undermines oral therapy. A 2024 Journal of Clinical Psychopharmacology study reported 30-day readmission rates of 1.9% for LAIs versus 8.3% for oral drugs, translating to a 77% reduction in early rehospitalizations. Early LAI initiation within 12 months of diagnosis delivers annual healthcare savings of USD 7,195 per patient by cutting emergency-department. These findings persuade payers to reimburse LAIs earlier in treatment algorithms, accelerating penetration across community clinics.

Expanding Early-Psychosis Intervention Centers

Coordinated Specialty Care programs are scaling rapidly. The National Alliance on Mental Illness estimates that broader roll-out could reach 600,000-800,000 additional patients and generate USD 115-140 billion in system savings over a decade . A 2024 Hong Kong study in JAMA Network Open linked implementation of the EASY Plus model to steep declines in self-harm episodes among adults aged 26-44 years. These centers favor newer agents with balanced efficacy and tolerability profiles, fuelling demand for third-generation options.

Patent Cliffs of Key Atypical Molecules

Major brands face imminent loss of exclusivity. Abilify Maintena's patent expiry in June 2025 threatens 44% of its prescription base. Johnson & Johnson's Invega Sustenna posted USD 2.9 billion in 2023 U.S. sales, yet generics from Teva and Viatris loom. Price erosion depresses branded revenue and compresses margins across the antipsychotic drugs market.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Medicaid/Medicare Coverage for Third-Generation Agents

- Digital-Therapeutic Companion Apps Boosting Medication Adherence

- Addiction Caused Due to the Antipsychotic Drugs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Atypical formulations generated the largest antipsychotic drugs market size in 2024, capturing 73.05% revenue on the back of broad indications and payer familiarity. Third-generation agents, though smaller in absolute dollars, are forecast to outpace the overall market with a 7.10% CAGR through 2030. Their dopamine-partial-agonist or dual muscarinic activity mitigates extrapyramidal side effects, a clear advantage that bolsters clinician confidence. Bristol Myers Squibb's Cobenfy (xanomeline-trospium), the first new mechanistic class in 70 years, underscores this pivot.

Improved metabolic profiles and reduced tardive-dyskinesia risk strengthen payer value propositions. The antipsychotic drugs market size attached to third-generation products is predicted to expand steadily as pipeline entrants such as roluperidone advance toward possible approval. First-generation agents remain useful in acute agitation and resource-strained settings, yet their share declines annually due to tolerability concerns.

The Report Covers Global Antipsychotic Drugs Market Share and It is Segmented Drug Classification (First Generation and Second Generation and Third Generation), by Application (Schizophrenia, Bipolar Disorder, and More), by Route of Administration (Oral and Injectables), and Geography (North America, Europe and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 39.60% of global revenue in 2024, buoyed by early adoption of third-generation agents and payer reforms that cap annual patient out-of-pocket spend at USD 2,000 under Medicare Part D cms.gov. FDA approvals for muscarinic-receptor therapies and once-bimonthly LAIs sustain clinical enthusiasm, while Canada and Mexico add incremental growth through mental-health investment schemes.

Asia-Pacific is the fastest-growing territory at a 7.99% CAGR. China's domestic innovators secured the first U.S. nod for a Chinese-developed paliperidone palmitate LAI in 2024, spotlighting the region's research ascent. Improved insurance penetration and destigmatization campaigns in India and Southeast Asia enlarge the treated population, further propelling the antipsychotic drugs market.

Europe retains solid share anchored by universal health coverage and a regulatory focus on real-world evidence. The 2025 approval of Rxulti for adolescent schizophrenia widens access in a sensitive demographic. Price-volume agreements temper list-price inflation, yet offsetting uptake of novel therapies supports steady value growth. South America and the Middle East & Africa, though smaller, are forecast to out-perform historic averages as governments integrate mental-health services into national benefit packages.

- Radiometer Medical

- Siemens Healthineers

- Instrumentation Laboratory

- Abbott Laboratories

- Roche

- Nova Biomedical

- Medica Corporation

- Sensa Core

- Nihon Kohden

- Eschweiler GmbH

- Grifols

- Arkray

- OPTI Medical (IDEXX)

- Convergent Technologies

- EKF Diagnostics

- PHC Holdings (Ascensia)

- WerfenLife Diagnostics China

- Terumo Cardiovascular

- Edan Instruments

- Sphere Medical

- Brolis Sensor Technology

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising LAI Adoption in Community Mental-Health Programs

- 4.2.2 Expanding Early-Psychosis Intervention Centers

- 4.2.3 Surge in Medicaid/Medicare Coverage for Third-Generation Agents (US)

- 4.2.4 Increasing Focus of Governments and Health Care Organizations on Mental Health

- 4.2.5 Digital-Therapeutic Companion Apps Boosting Medication Adherence

- 4.3 Market Restraints

- 4.3.1 Patent Cliffs of Key Atypical Molecules

- 4.3.2 Addiction Caused Due to the Antipsychotic Drugs

- 4.3.3 Black-Box Warnings Limiting Pediatric Prescriptions (US, EU)

- 4.3.4 Price-Control Expansion under China's NRDL

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Pipeline & Clinical-Trial Landscape

5 Market Size & Growth Forecasts (Value)

- 5.1 By Drug Class

- 5.1.1 Typical (First-Generation) Antipsychotics

- 5.1.2 Atypical (Second-Generation) Antipsychotics

- 5.1.3 Dopamine Partial Agonists (Third-Generation)

- 5.2 By Therapeutic Application

- 5.2.1 Schizophrenia

- 5.2.2 Bipolar Disorder

- 5.2.3 Major Depressive Disorder

- 5.2.4 Dementia-Related Psychosis

- 5.2.5 Others

- 5.3 By Route of Administration

- 5.3.1 Oral

- 5.3.2 Injectables

- 5.3.2.1 Long-Acting Injectables (LAIs)

- 5.3.2.2 Short-Acting Injectables

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Radiometer Medical

- 6.3.2 Siemens Healthineers

- 6.3.3 Instrumentation Laboratory

- 6.3.4 Abbott Laboratories

- 6.3.5 Roche Diagnostics

- 6.3.6 Nova Biomedical

- 6.3.7 Medica Corporation

- 6.3.8 Sensa Core

- 6.3.9 Nihon Kohden

- 6.3.10 Eschweiler GmbH

- 6.3.11 Grifols

- 6.3.12 ARKRAY Inc.

- 6.3.13 OPTI Medical (IDEXX)

- 6.3.14 Convergent Technologies

- 6.3.15 EKF Diagnostics

- 6.3.16 PHC Holdings (Ascensia)

- 6.3.17 WerfenLife Diagnostics China

- 6.3.18 Terumo Cardiovascular

- 6.3.19 Edan Instruments

- 6.3.20 Sphere Medical

- 6.3.21 Brolis Sensor Technology

7 Market Opportunities & Future Outlook