PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848312

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848312

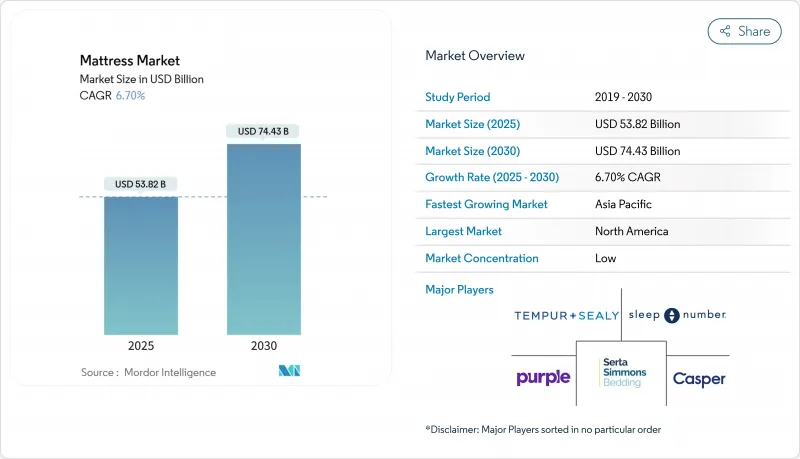

Mattress - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Mattress Market size is estimated at USD 53.82 billion in 2025, and is expected to reach USD 74.43 billion by 2030, at a CAGR of 6.70% during the forecast period (2025-2030).

Consumers now treat sleep as a wellness pillar, a shift supported by research that links quality rest to stronger immunity and sharper cognition. Artificial intelligence, IoT sensors, and advanced foams allow manufacturers to sell beds that adjust firmness, temperature, and pressure in real time, pushing average selling prices higher. North America demand gains are slowing because ownership rates are already high. Asia-Pacific is expanding fastest through 2030, driven by urbanization and middle-class income growth that supports premium mattress purchases.

Global Mattress Market Trends and Insights

Sleep-Health Awareness and Premiumization

Smart beds priced between USD 2,000 and USD 5,000 now outsell many mid-range models because shoppers view the purchase as a health investment . Wakefit in India unveiled the Regul8 mattress that uses AI to adjust temperature to user preference. DeRUCCI's T11 Pro adds health-metric alerts to reinforce prevention messaging. Saatva's sponsorship of Team USA ties high-end sleep products to athletic performance. Such branding elevates consumer willingness to upgrade before the traditional replacement cycle ends.

Direct-to-Consumer E-commerce Expansion

Online channels are rising at 7.8% CAGR, overtaking store traffic because buyers are comfortable ordering without a showroom trial. Casper's 2024 sale to Carpenter moved a digital brand into a larger manufacturing ecosystem that can spread fixed costs. Amazon dominates web sales in the United States, pushing competing retailers to accelerate click-and-collect programs. Customer-data feedback loops also help refine product lines quickly, although higher digital advertising costs are squeezing margins.

Raw-Material Price Volatility

Polyurethane hinges on petroleum prices, so oil swings quickly change foam costs. Mexico has become the fourth-largest PU consumer, tightening supply chains. Steel-coil tariffs rise innerspring quotes week by week, challenging price stability for large retail contracts.

Other drivers and restraints analyzed in the detailed report include:

- Hospitality and Real-Estate Pipeline Growth

- Rapid Material Innovation in Cooling and Foams

- Ownership Saturation in Mature Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Innerspring beds held 40% of 2024 revenue, anchoring the mattress market with broad price coverage and established retail placement. Latex models are rising at 7.1% CAGR as eco-labels and hypoallergenic messaging resonate with wellness shoppers. Memory-foam units keep a meaningful share, while hybrid constructions blend coils and foams to solve heat and motion challenges. Sleep Number disrupted smart-bed pricing by shipping the C1 at USD 599, widening access to connected sleep tools, theverge.com. Gel-cooled mattresses benefit from phase-change inserts that lower surface temperature without active power sources. The "other" category now includes extra-large Alaska options preferred by tall couples.

Hybrid engineering drives cross-segment gains. Brands are layering graphite-infused foams atop pocketed coils to balance support with cooling. Manufacturers that secure certified organic latex command premium margins and comply early with circular-economy mandates. As IoT frameworks mature, firmware updates will roll out to support health-alert algorithms, reinforcing brand lock-in.

Queen beds captured 46% of the 2024 mattress market share, offering the best ratio of sleep space to room footprint. King units exhibit the highest 7.6% CAGR because couples equate larger surfaces with better rest quality. Singles and doubles retain roles in student housing, guest rooms, and tight apartments. Custom oversized pieces, from Alberta to Alaska dimensions, carve a niche among luxury buyers.

Millennial and Gen Z homeowners furnish master suites with bigger frames, reflecting larger new-home blueprints. Hotels report higher guest-satisfaction scores when rooms include king bedding, encouraging property operators to upgrade. Home-goods chains now bundle adjustable bases with king and California king sets, making delivery and installation painless and boosting ticket size.

The Mattress Market Report is Segmented by Product Type (Innerspring Mattresses, Foam Mattresses, and More), by Size (Single-Size, Double-Size, and More), by End User (Residential, and Commercial), by Distribution Channel (B2B/Directly From the Manufacturers, B2C/Retail Channels (Online, and More)), and by Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commands the largest slice of the mattress market and enjoys diverse channel penetration. Yet saturation pushes players to premiumize or expand abroad. The United States hosts intense consolidation along with a pivot to tech-rich beds that promise health insights. Canada shows stable demand, helped by immigration-driven household formation. Mexico supplies coils and foams at competitive costs, reinforcing continental sourcing.

Asia-Pacific leads in volume growth. India's IPO wave among bedding brands funds store rollouts into second-tier cities. Chinese factories adopt Six Sigma quality protocols and acquire eco labels to satisfy European and Australian buyers. Japan and South Korea sustain niche demand for anti-allergy latex and robotic adjustable bases. Southeast Asia houses a burgeoning middle class that shops online first, encouraging cross-border e-commerce deliveries.

Europe marries regulation with innovation. The ESPR forces design for recyclability, pushing companies to develop glue-free laminated cores that separate easily. Scandinavian producers offer modular toppers to extend product life, reducing waste. Southern Europe sees tourist-driven refurbishment cycles, while the United Kingdom readies for 2% annual furniture growth aided by consumer preference for sustainable goods. The Gulf Cooperation Council funnels oil revenues into luxury hotels, all specify ing branded sleep programs that highlight premium mattresses.

- Tempur Sealy International Inc.

- Serta Simmons Bedding LLC

- Sleep Number Corporation

- Casper Sleep Inc.

- Purple Innovation Inc.

- KING KOIL Inc.

- Kingsdown Inc.

- Southerland Bedding Co.

- Spring Air Company

- Sealy Corporation

- Emma Sleep GmbH

- Saatva Inc.

- Sheela Foam Ltd (Sleepwell)

- Kurl-On Enterprises Ltd

- Leggett & Platt Incorporated

- IKEA

- Paramount Bed Holdings Co. Ltd

- Eight Sleep Inc.

- ReST Performance Mattress

- Airweave Inc.

- Dunlopillo GmbH

- Hastens

- Nectar Sleep

- Simba Sleep

- DreamCloud

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Consumer Awareness of Sleep-Health & Premiumization

- 4.2.2 Explosive Growth of Direct-to-Consumer E-commerce Channels

- 4.2.3 Expansion of Hospitality & Real Estate Pipelines Globally

- 4.2.4 Rapid Material Innovation (hybrid cooling gels, phase-change foams)

- 4.2.5 Circular-Economy Incentives for Natural/Organic & Recyclable Inputs

- 4.3 Market Restraints

- 4.3.1 Raw-Material Price Volatility (Petro-Foams, Steel Coils, Latex)

- 4.3.2 Mattress Ownership Saturation In Mature Markets

- 4.3.3 Extended-Producer-Responsibility Laws Raising Disposal Costs

- 4.3.4 Supply-Shortfall Of Certified Bio-Latex and Natural Fibers

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts (Value)

- 5.1 By Mattress Type

- 5.1.1 Innerspring Mattresses

- 5.1.2 Foam Mattresses (including memory foam)

- 5.1.3 Latex Mattresses

- 5.1.4 Hybrid Mattresses

- 5.1.5 Gel Mattresses

- 5.1.6 Other Mattresses

- 5.2 By Size

- 5.2.1 Single-size

- 5.2.2 Double-size

- 5.2.3 Queen-size

- 5.2.4 King-size

- 5.2.5 Other Sizes

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Distribution Channel

- 5.4.1 B2B/Directly from the Manufacturers

- 5.4.2 B2C/Retail Channels

- 5.4.2.1 Specialty Bedding and Mattress Stores

- 5.4.2.2 Multi-brand Stores/Home Centers

- 5.4.2.3 Online

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 Canada

- 5.5.1.2 United States

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Peru

- 5.5.2.3 Chile

- 5.5.2.4 Argentina

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.5.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 India

- 5.5.4.2 China

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.5.4.7 Rest of Asia Pacific

- 5.5.5 Middle East And Africa

- 5.5.5.1 United Arab of Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East And Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Tempur Sealy International Inc.

- 6.4.2 Serta Simmons Bedding LLC

- 6.4.3 Sleep Number Corporation

- 6.4.4 Casper Sleep Inc.

- 6.4.5 Purple Innovation Inc.

- 6.4.6 KING KOIL Inc.

- 6.4.7 Kingsdown Inc.

- 6.4.8 Southerland Bedding Co.

- 6.4.9 Spring Air Company

- 6.4.10 Sealy Corporation

- 6.4.11 Emma Sleep GmbH

- 6.4.12 Saatva Inc.

- 6.4.13 Sheela Foam Ltd (Sleepwell)

- 6.4.14 Kurl-On Enterprises Ltd

- 6.4.15 Leggett & Platt Incorporated

- 6.4.16 IKEA

- 6.4.17 Paramount Bed Holdings Co. Ltd

- 6.4.18 Eight Sleep Inc.

- 6.4.19 ReST Performance Mattress

- 6.4.20 Airweave Inc.

- 6.4.21 Dunlopillo GmbH

- 6.4.22 Hastens

- 6.4.23 Nectar Sleep

- 6.4.24 Simba Sleep

- 6.4.25 DreamCloud

7 Market Opportunities & Future Outlook

- 7.1 Rising Demand for Smart & Customizable Mattresses