PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848314

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848314

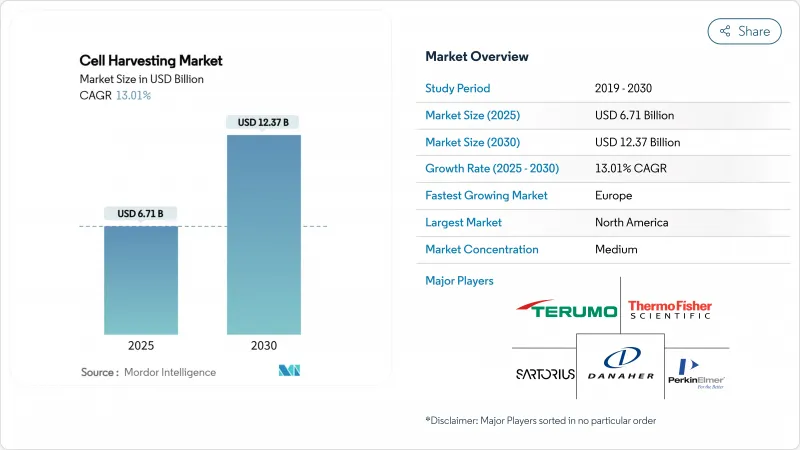

Cell Harvesting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cell harvesting market size is USD 6.71 billion in 2025 and will rise to USD 12.37 billion by 2030, reflecting a 13.01% CAGR.

Widespread adoption of advanced, closed, and automated harvesters that cut labor requirements by up to 75% and improve batch consistency is the prime growth catalyst. Public- and private-sector financing worth USD 2.3 billion over the past decade, regulatory commitments to approve 10-20 cell and gene therapies per year, and supply-chain investments in point-of-care (PoC) manufacturing hubs reinforce this expansion. North American early-adopter demand, Asia-Pacific capacity build-outs, and continuous platform innovation that combines AI analytics with single-use hardware create additional momentum.

Global Cell Harvesting Market Trends and Insights

Growing Investment in Cell and Gene Therapies

More than USD 2.3 billion in equity has entered cell and gene therapy ventures during the last decade, underpinning over 1,500 active clinical studies worldwide. The FDA cleared eight novel advanced therapies in 2024, including the first mesenchymal stromal cell product, Ryoncil, demonstrating regulatory confidence in complex biologics. Pharmaceutical majors are scaling quickly: Bristol Myers Squibb opened three dedicated CAR-T plants, and AstraZeneca spent USD 425 million for EsoBiotec to accelerate in vivo programs. Capital inflows shorten development timelines and increase the volume of autologous and allogeneic batches that require reliable, high-throughput harvesters. Investors now prioritize platforms that can support multiproduct pipelines, lifting the appeal of integrated harvest devices with modular add-ons.

Expansion of Biopharmaceutical Manufacturing Infrastructure

Fujifilm Diosynth's USD 1.6 billion Denmark-Texas expansion adds eight 20,000 L bioreactors and specialized downstream suites, while Lotte Biologics is committing USD 1 billion for its Songdo Bio Campus to reach 120,000 L capacity by 2027. Such mega-projects create regional clusters that need harvesters compatible with both single-use and stainless-steel trains. Many CDMOs still operate at less than 50% utilization, prompting demand for flexible systems that can cost-effectively handle clinical-scale autologous lots today and pivot to large allogeneic runs tomorrow. Suppliers offering modular skid architecture with interchangeable centrifugation or filtration elements address this utilization gap and can be rapidly redeployed as production priorities change.

Ethical and Regulatory Concerns Around Stem Cell Sourcing

Embryonic stem cell research and unproven adipose-derived procedures face increased oversight after U.S. appellate courts confirmed that reinjected cells fall under FDA biologics regulation. Divergent donor screening rules in the EU, United States, and Asia complicate multinational studies and raise documentation costs. Unlicensed clinics advertising miracle cures in regions with light enforcement undermine public confidence, prompting regulators to publish warning letters and mandate clinic closures. Compliant suppliers that document ethical sourcing and GMP provenance can differentiate, but they must navigate evolving consent requirements and tissue-bank audits that vary by country.

Other drivers and restraints analyzed in the detailed report include:

- Rising Prevalence of Chronic Diseases Requiring Cell Therapies

- Technological Advancements in Automated Cell Processing

- High Cost of Automated Harvesting Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Automated systems held 63.45% of the cell harvesting market share in 2024 thanks to closed, programmable workflows that cut labor hours and contamination risk. They are projected to record a 15.45% CAGR through 2030. Manual harvesters remain relevant for exploratory work or highly variable early-phase protocols that benefit from hands-on manipulation. However, even academic labs are adopting semi-automated modules that bolt onto legacy incubators, blending tactile oversight with digital monitoring. Industry-wide migration toward continuous processing and single-use assemblies will likely elevate automated systems to more than 70% of the cell harvesting market size by decade's end.

Automation's momentum aligns with factory digitization goals. Vendors are bundling integrated centrifugation, filtration, and washing in one chassis to streamline line clearance and validation. Remote diagnostics and software updates provide shorter downtimes and keep performance within specification. Suppliers able to certify systems in multiple jurisdictions and offer 24-hour parts support gain a competitive edge as global trials expand.

The Cell Harvesting Market Report is Segmented by Type of Cell Harvesting (Manual Cell Harvesters and Automated Cell Harvesters), Application (Biopharmaceutical Application, Stem-Cell Research, and Other Applications), End User (Biotechnology & Biopharmaceutical Companies, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 39.42% of global revenue in 2024, supported by a mature CGT regulatory framework, extensive CDMO network, and specialized logistics operators. Yet fewer than 20% of eligible U.S. patients accessed available therapies in 2024, underscoring process inefficiencies that automated harvesters can mitigate. Regional growth also depends on skilled labor supply, prompting partnership programs between equipment vendors and community colleges to cultivate technicians.

Asia-Pacific is projected to expand at 14.56% CAGR to 2030. China hosted 37% of global CGT trials in 2024, and Japan's Fast Track and South Korea's Regenerative Medicine Law cut approval timelines. Domestic players like WuXi AppTec and SK Bioscience have invested heavily in CGT hubs, driving bulk orders for harvest modules compatible with local GMP guidelines. Lower operating costs, government incentives, and rising chronic-disease prevalence amplify demand, but suppliers must adapt to evolving import regulations and multilingual quality documentation.

Europe maintains a sizable share anchored by harmonized EMA guidelines and robust CDMO infrastructure in Denmark, Ireland, and Germany. Fujifilm Diosynth's Danish plant expansion exemplifies continued capital inflow aimed at increasing regional self-sufficiency. Energy costs push facilities to adopt energy-efficient harvesters with shorter cycle times. The Middle East & Africa and South America are emerging opportunity zones as healthcare systems invest in tertiary care and establish bilateral technology-transfer agreements. Compact, rugged harvesters that tolerate power fluctuations find growing reception in these regions.

- Thermo Fisher Scientific

- Danaher (Cytiva, Beckman Coulter)

- Sartorius

- Miltenyi Biotec

- Becton Dickinson & Co.

- Lonza Group

- Stem Cell Technologies

- Corning

- PerkinElmer

- Eppendorf

- Greiner Bio-One

- Eurofins

- Terumo

- Nipro

- Tomtec Inc.

- Alcami

- Esco Lifesciences

- PromoCell

- CellGenix

- Regen Lab SA

- PluriStem Therapeutics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Investment in Cell and Gene Therapies

- 4.2.2 Expansion of Biopharmaceutical Manufacturing Infrastructure

- 4.2.3 Rising Prevalence of Chronic Diseases Requiring Cell Therapies

- 4.2.4 Technological Advancements in Automated Cell Processing

- 4.2.5 Supportive Regulatory Frameworks for Advanced Therapies

- 4.2.6 Emergence of Personalized and Point-of-Care Cell Therapy Platforms

- 4.3 Market Restraints

- 4.3.1 Ethical and Regulatory Concerns Around Stem Cell Sourcing

- 4.3.2 High Cost of Automated Harvesting Systems

- 4.3.3 Variability and Quality Control Challenges in Donor-Derived Cells

- 4.3.4 Cold-Chain and Logistics Complexities for Live Cells

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers / Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Type of Cell Harvesting

- 5.1.1 Manual Cell Harvesters

- 5.1.2 Automated Cell Harvesters

- 5.2 By Application

- 5.2.1 Biopharmaceutical Application

- 5.2.2 Stem-Cell Research

- 5.2.3 Other Applications

- 5.3 By End User

- 5.3.1 Biotechnology & Biopharmaceutical Companies

- 5.3.2 Research Institutes

- 5.3.3 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Thermo Fisher Scientific

- 6.3.2 Danaher (Cytiva, Beckman Coulter)

- 6.3.3 Sartorius AG

- 6.3.4 Miltenyi Biotec

- 6.3.5 Becton Dickinson & Co.

- 6.3.6 Lonza Group

- 6.3.7 STEMCELL Technologies

- 6.3.8 Corning Inc.

- 6.3.9 PerkinElmer Inc.

- 6.3.10 Eppendorf SE

- 6.3.11 Greiner Bio-One

- 6.3.12 Eurofins Scientific

- 6.3.13 Terumo Corporation

- 6.3.14 Nipro Corporation

- 6.3.15 Tomtec Inc.

- 6.3.16 Alcami Corporation

- 6.3.17 Esco Lifesciences

- 6.3.18 PromoCell GmbH

- 6.3.19 CellGenix GmbH

- 6.3.20 Regen Lab SA

- 6.3.21 PluriStem Therapeutics

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment