PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848316

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848316

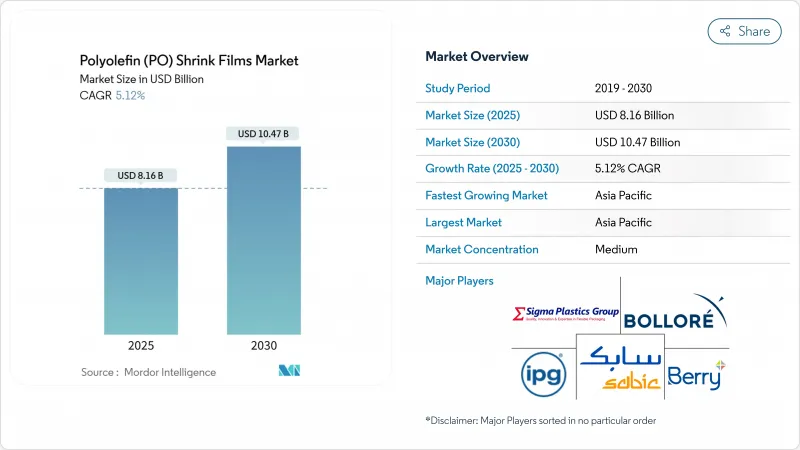

Polyolefin (PO) Shrink Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Polyolefin Shrink Films Market size is estimated at USD 8.16 billion in 2025, and is expected to reach USD 10.47 billion by 2030, at a CAGR of 5.12% during the forecast period (2025-2030).

Growth reflects the material's versatility, rising preference for recyclable solutions, and the steady replacement of PVC in food-contact applications. Surging e-commerce volumes, brand demand for 360-degree graphics, and the rapid roll-out of automation-ready thin-gauge cross-linked grades are expanding addressable use-cases for the polyolefin shrink film market. Across regions, Asian manufacturers scale capacity to serve export-oriented consumer goods, while North American converters emphasize tamper-evident wraps that build consumer trust. In Europe, policy pressure accelerates adoption of films containing post-consumer recycled (PCR) feedstock, encouraging proprietary blends that match both performance and recycling targets.

Global Polyolefin (PO) Shrink Films Market Trends and Insights

E-commerce tamper-evidence demand in North America

E-commerce growth has driven demand for tamper-evident polyolefin shrink films to secure products during transit. North American retailers use these films to protect goods and build consumer trust, with 78% of online shoppers valuing visible tamper-evidence. Intertape Polymer Group's ExlfilmPlus PCR, a polyolefin shrink film with 35% recycled content, addresses security and sustainability needs. The film combines high clarity with post-consumer recycled content, meeting e-commerce packaging challenges.

PVC-to-POF switch in European food-contact films

European food manufacturers pivot towards recyclable polyolefin films after April 2024 packaging legislation targeting a 5% waste reduction by 2030 . Parallel plastic taxes in the UK, Spain and Italy penalize films with under 30% recycled content. Clysar's Store-Drop-Off-qualified EV-HPG illustrates how converters combine food safety, clarity and recyclability.

PE & PP resin price volatility

Shale-feedstock disruptions in the United States heighten raw-material swings that already represent up to 70% of finished film cost. The OECD warns that plastic production may hit 736 million tonnes by 2040, intensifying feedstock competition. Converters hedge risks via multi-sourcing, shorter resin contracts, and recipes that dilute virgin inputs with PCR pellets.

Other drivers and restraints analyzed in the detailed report include:

- High-definition printing & branding

- Cost advantage over alternatives

- Single-use-plastic levies on over-wrap

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

General shrink film held the largest 54% polyolefin shrink film market share in 2024, underpinned by affordability and wide processing windows. The segment's clarity and ease of printing keeps it entrenched in food multipacks and promotional bundles across supermarkets. Yet converters increasingly upsell cross-linked grades where puncture resistance, scuff holdout and thinner profiles allow faster line speeds without wrap failure.

Cross-linked output is forecast to grow at a 6.88% CAGR from 2025 to 2030 as pharmaceutical blister bundles, boxed cosmetics and electronics seek lower sealing temperatures that protect heat-sensitive contents. Expanded capacity in Asia and North America narrows the price delta, encouraging switchovers that stretch the polyolefin shrink film market beyond traditional displays.

Polyethylene maintained a commanding 57% stake within the polyolefin shrink film market size in 2024, driven by transparency and cost competitiveness. Multi-layer PE blends permit tight seals even at low oven dwell times, making them a staple in beverage can dernests and produce trays. Processors now incorporate PCR streams to comply with brand circularity pledges without diluting optical properties.

Polypropylene is expected to rise 7.21% annually to 2030, buoyed by higher stiffness, chemical inertness and elevated heat-deflection points desirable for retorted foods and medical kits. New five-layer co-extruders co-blend PP with elastomer tie layers, retaining gloss while boosting tear resistance. This premium mix separates converters from commoditised PE offerings within the polyolefin shrink film market.

The Polyolefin Shrink Film Market Report Segments the Industry by Type (General Shrink Film and Cross-Linked Shrink Film), Material Type (Polyethylene and Polypropylene), Layer Structure (Monolayer and Multilayer), Application (Food and Beverage, Industrial Packaging, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific dominated the polyolefin shrink film market with 38% revenue contribution in 2024, and its projected 7.10% CAGR remains the fastest globally. China's entrenched extruder base partners with multinational FMCG packers, while India's rigid packaging boom responds to urban retail growth. Regional converters foster in-house plateless digital presses, enabling swift private-label promotion campaigns that capture domestic e-commerce surges.

Japan and South Korea focus on high-barrier multilayer technology, supplying niche cross-linked rolls for export pharmaceuticals; domestic demand leans on automation-ready thin gauges that fit compact factory footprints. Association grants channel R&D tax credits toward energy-efficient shrink ovens, reinforcing adoption inside the polyolefin shrink film market.

North America constitutes a mature yet innovation-led arena powered by the United States' omnichannel retail ecosystem. Canada and Mexico complement regional supply through proximity to resin production and tariff-favoured trade corridors, anchoring resilience against price swings.

Europe balances stringent regulatory oversight with high purchasing power. Circular economy directives push converters to certify recyclability and shift toward PCR blends by 2027. Germany, Italy and the United Kingdom represent core demand clusters owing to strong beverage, confectionery and pharmaceutical output. Southern and Eastern member states gradually catch up as retail chains harmonise packaging briefs across the bloc.

South America and the Middle East & Africa present smaller but increasingly attractive frontiers. Brazil leverages a robust petrochemical base to serve Mercosur neighbours, while Saudi Arabia's Vision 2030 encourages downstream polymer investments that extend the reach of the polyolefin shrink film market into Gulf Cooperation Council markets.

- Allen Plastic Industries Co., Ltd.

- Berry Global Inc.

- Bollore Group

- Bonset America Corporation

- Clysar, LLC

- Cosmo Films

- Coveris

- FlexiPack

- Innovia Films

- IPG

- Harwal Group of Companies

- Hubei HYF Packaging Co., Ltd.

- Kaneka Corporation

- Klockner Pentaplast

- Polyplex Corporation

- SABIC

- Sealed Air Corporation

- Sigma Plastics Group

- SYFAN USA

- Traco Packaging

- Winpak Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce demand for tamper-evident wrap accelerating small-pack use in North America

- 4.2.2 Shift from PVC to eco-safer POF in European food-contact films

- 4.2.3 Demand for High-Quality Printing and Branding

- 4.2.4 Cost-Effectiveness Compared to Alternatives

- 4.2.5 Automation-ready thin-gauge cross-linked films driving high-speed lines in Asia

- 4.3 Market Restraints

- 4.3.1 Escalating PE & PP resin price volatility caused shale-feedstock disruptions in US

- 4.3.2 Single-use-plastics taxes across Europe targeting shrink over-wrap

- 4.3.3 Trade-off between downgauging & shrink force limiting adoption in heavy-duty industrial packs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 General Shrink Film

- 5.1.2 Cross-Linked Shrink Film

- 5.2 By Material Type

- 5.2.1 Polyethylene (PE)

- 5.2.2 Polypropylene (PP)

- 5.3 By Layer Structure

- 5.3.1 Monolayer

- 5.3.2 Multilayer

- 5.4 By Application

- 5.4.1 Food & Beverage

- 5.4.2 Industrial Packaging

- 5.4.3 Personal Care & Cosmetics

- 5.4.4 Pharmaceutical

- 5.4.5 Printing & Stationery

- 5.4.6 Other Applications

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Allen Plastic Industries Co., Ltd.

- 6.4.2 Berry Global Inc.

- 6.4.3 Bollore Group

- 6.4.4 Bonset America Corporation

- 6.4.5 Clysar, LLC

- 6.4.6 Cosmo Films

- 6.4.7 Coveris

- 6.4.8 FlexiPack

- 6.4.9 Innovia Films

- 6.4.10 IPG

- 6.4.11 Harwal Group of Companies

- 6.4.12 Hubei HYF Packaging Co., Ltd.

- 6.4.13 Kaneka Corporation

- 6.4.14 Klockner Pentaplast

- 6.4.15 Polyplex Corporation

- 6.4.16 SABIC

- 6.4.17 Sealed Air Corporation

- 6.4.18 Sigma Plastics Group

- 6.4.19 SYFAN USA

- 6.4.20 Traco Packaging

- 6.4.21 Winpak Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment

- 7.2 Rising demand for eco-friendly and recyclable shrink films.