PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848319

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848319

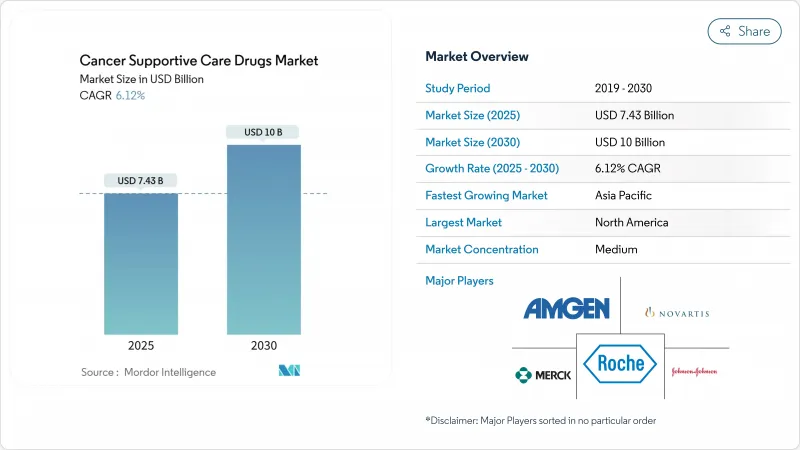

Cancer Supportive Care Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cancer supportive care drugs market size was valued at USD 7.43 billion in 2025 and is forecast to climb to USD 10.00 billion by 2030, translating into a 6.12% CAGR.

This expansion reflects rising global cancer incidence, wider use of multi-agent chemotherapy, and regulatory tailwinds for lower-priced biosimilars. Growing acceptance of value-based reimbursement encourages earlier, protocol-driven use of supportive therapies, while patient demand for self-administered formulations fuels innovation in oral and subcutaneous products. Competitive pressure intensifies as biosimilar G-CSFs and bone-protective agents win rapid uptake, trimming acquisition costs without sacrificing efficacy. At the same time, payers and providers focus on reducing hospital readmissions, a goal closely tied to more consistent supportive care adherence. These converging factors sustain a healthy outlook for the cancer supportive care drugs market through 2030.

Global Cancer Supportive Care Drugs Market Trends and Insights

Growing Burden of Cancer Worldwide

New cases are rising sharply: IARC projects 28.4 million annual diagnoses by 2040, a 55% jump from 2020. Younger patients-those under 50-saw a 79% surge in cancer incidence between 1990 and 2019, leading to longer survival horizons and repeated treatment cycles. These demographic shifts lengthen exposure to myelosuppressive regimens, elevating demand for G-CSFs, antiemetics, and anemia therapies across the cancer supportive care drugs market. Economic pressure is equally significant; Europe alone spent EUR 199 billion on cancer in 2018, with EUR 32 billion earmarked for oncology medicines. Asia-Pacific growth is pronounced, exemplified by China's projected USD 12.7 billion oncology spend by 2026, reinforcing a sizeable runway for supportive care uptake.

Rising Adoption of Chemotherapy and Combination Regimens

Combination protocols now dominate frontline therapy for solid tumors and hematologic malignancies, raising grade 3-4 hematologic toxicities by 40-60% versus monotherapy. The result is steady utilization of prophylactic G-CSFs, erythropoiesis-stimulating agents, and next-generation antiemetics. Emerging antibody-drug conjugates, such as trastuzumab deruxtecan, layer unique pulmonary and gastrointestinal toxicities onto conventional adverse-event profiles, widening the clinical remit of the cancer supportive care drugs market. As oncologists integrate targeted agents with backbone chemotherapy, supportive care protocols broaden to encompass both cytotoxic and immune-mediated side-effect prevention.

Emergence of Targeted and Immuno-Oncology Therapies with Lower Toxicity

Immune checkpoint inhibitors and precision small-molecule inhibitors frequently spare bone marrow, leading to 60-70% lower neutropenia rates compared with traditional chemotherapy. Consequently, G-CSF volumes may moderate in regions where these modalities become first-line standards. Nonetheless, the supportive care mandate evolves rather than disappears: immune-related adverse events demand corticosteroids, endocrine replacement, and dermatologic agents that occupy adjacent therapeutic niches within the cancer supportive care drugs market. Manufacturers that pivot pipelines toward these emerging needs can offset erosion in legacy categories.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Value-Based Oncology Care Models

- Expansion of Oral and Subcutaneous Formulations Enabling Home Care

- Safety Concerns Around Opioid Misuse and ESA-Linked Thrombotic Events

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

G-CSFs represented 35.23% of the cancer supportive care drugs market in 2024, underscoring their pivotal role in neutropenia prophylaxis. The segment's resilience stems from predictable chemotherapy-induced marrow suppression across tumor types and strong endorsement in clinical guidelines. Rapid biosimilar uptake compresses unit prices but expands treatment penetration, keeping revenue on an upward trajectory. Topical agents, including steroid mouthwashes and barrier gels for mucositis, post an 8.43% CAGR to 2030 by addressing toxicities that gain visibility as survival lengthens. ESAs remain essential for anemia unresponsive to transfusion yet face moderate headwinds from safety labeling. Antiemetics sustain incremental gains, supported by fixed-dose combination launches targeting delayed emesis. Bisphosphonates and denosumab biosimilars grow steadily alongside rising skeletal-related-event risk in aging populations. Meanwhile, opioid demand softens, mirroring changing pain-control paradigms. Collectively, these trends illustrate how clinical-practice evolution and reimbursement shifts continually reshape the drug-class landscape within the cancer supportive care drugs market.

In revenue terms, the cancer supportive care drugs market size for G-CSFs is projected to expand briskly through the forecast horizon, even as price competition intensifies. Conversely, opioid revenues diminish due to lower average daily doses despite stable patient counts, validating payer emphasis on risk-mitigating alternatives. Continuous innovation in topical and subcutaneous formats helps manufacturers diversify beyond commoditized injectables, anchoring sustainable double-digit growth in newer subclasses.

The Cancer Supportive Care Drugs Market Report is Segmented by Drug Class (G-CSFs, Esas, Antiemetics, and More), Indication (Chemotherapy-Induced Neutropenia, and More), Distribution Channel (Hospital Pharmacies, and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 43.23% of global revenue in 2024, underpinned by advanced oncology infrastructure and widespread insurance coverage that reimburses high-cost biologics. Value-based pilots such as the Enhancing Oncology Model demonstrate measurable savings, encouraging replication across commercial payers and fortifying guideline-aligned supportive care uptake.

Europe stands as the second-largest regional market. Aggressive biosimilar procurement cut cancer-medicine prices by up to 97.8% in select countries, broadening access and curbing budget impact. National health systems devote substantial outlays-EUR 32 billion in 2018-for oncology drugs, evidencing strong political commitment to supportive therapy coverage. Reimbursement variability across member states prompts manufacturers to tailor pricing strategies, but widespread HTA frameworks ensure cost-effectiveness remains front-of-mind.

Asia-Pacific is the fastest-growing region with a 7.45% CAGR, energized by demographic aging, expanding middle classes, and broader insurance penetration. China's oncology expenditure is on course to reach USD 12.7 billion by 2026, while India liberalizes foreign-direct-investment norms to spur domestic biologics manufacture. Government screening programs and rising diagnostic literacy heighten early detection rates, translating into larger treated cohorts and sustained demand in the cancer supportive care drugs market.

Latin America and the Middle East & Africa constitute smaller but steadily advancing markets. Procurement consortia in Brazil and Mexico negotiate volume-based discounts that align with biosimilar entry timelines. Meanwhile, Gulf Cooperation Council members invest in tertiary cancer centers, importing protocol-driven supportive care as part of broader medical-tourism aspirations. Collectively, these geographies add incremental volume that bolsters global growth momentum.

- Amgen

- Johnson & Johnson

- Roche

- Novartis AG (Sandoz & Hexal)

- Teva Pharmaceutical Industries

- Pfizer

- Sanofi

- Helsinn Healthcare

- Heron Therapeutics Inc.

- Dr. Reddy's Laboratories

- Sun Pharmaceuticals Industries

- Ipsen

- Kyowa Kirin Co. Ltd.

- Otsuka

- Accord Healthcare

- Fresenius

- Lupin

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Burden Of Cancer Worldwide

- 4.2.2 Rising Adoption Of Chemotherapy And Combination Regimens

- 4.2.3 Introduction Of Cost-Effective Biosimilars

- 4.2.4 Shift Toward Value-Based Oncology Care Models

- 4.2.5 Expansion Of Oral And Subcutaneous Formulations Enabling Home Care

- 4.3 Market Restraints

- 4.3.1 Emergence Of Targeted And Immuno-Oncology Therapies With Lower Toxicity

- 4.3.2 Safety Concerns Around Opioid Misuse And ESA-Linked Thrombotic Events

- 4.3.3 Pricing Pressures From Reference-Pricing And Tender Systems

- 4.3.4 Growing Use Of Digital Symptom Management Reducing Pharmacologic Demand

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Drug Class

- 5.1.1 G-CSFs

- 5.1.2 ESAs

- 5.1.3 Antiemetics

- 5.1.4 Bisphosphonates

- 5.1.5 Opioids

- 5.1.6 NSAIDs

- 5.1.7 Topical Agents

- 5.1.8 Other Drug Classes

- 5.2 By Indication

- 5.2.1 Chemotherapy-induced Neutropenia

- 5.2.2 Chemotherapy-induced Anemia

- 5.2.3 Nausea & Vomiting

- 5.2.4 Cancer-related Bone Loss

- 5.2.5 Cancer Pain

- 5.2.6 Oral & Dermal Mucositis

- 5.3 By Distribution Channel

- 5.3.1 Hospital Pharmacies

- 5.3.2 Retail Pharmacies

- 5.3.3 Online Pharmacies

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Amgen Inc.

- 6.3.2 Johnson & Johnson (Janssen)

- 6.3.3 F. Hoffmann-La Roche AG

- 6.3.4 Novartis AG (Sandoz & Hexal)

- 6.3.5 Teva Pharmaceutical Industries Ltd.

- 6.3.6 Pfizer Inc.

- 6.3.7 Sanofi

- 6.3.8 Helsinn Healthcare SA

- 6.3.9 Heron Therapeutics Inc.

- 6.3.10 Dr. Reddy's Laboratories

- 6.3.11 Sun Pharmaceutical Industries Ltd.

- 6.3.12 Ipsen Pharma

- 6.3.13 Kyowa Kirin Co. Ltd.

- 6.3.14 Otsuka Holdings Co. Ltd.

- 6.3.15 Accord Healthcare

- 6.3.16 Fresenius Kabi

- 6.3.17 Lupin Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment