PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848323

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848323

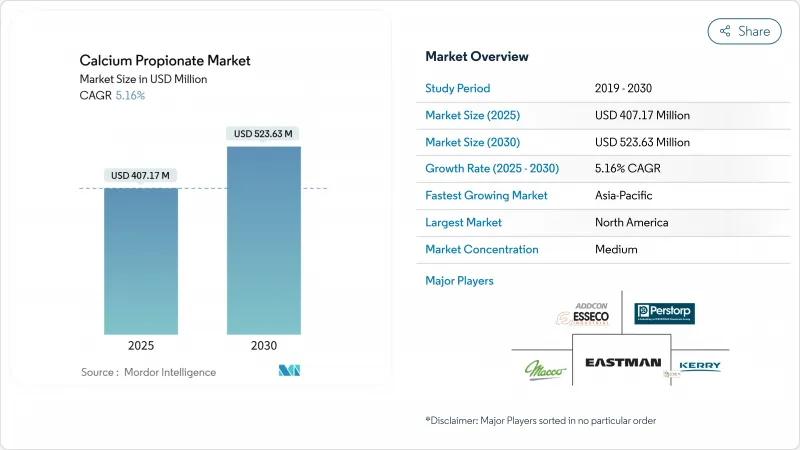

Calcium Propionate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Calcium Propionate Market size is estimated at USD 407.17 million in 2025, and is expected to reach USD 523.63 million by 2030, at a CAGR of 5.16% during the forecast period (2025-2030).

Growth comes from wider use in bakery preservation, expanding feed approvals, and new pharmaceutical functions that position the salt as more than a commodity antimicrobial. North America anchors demand through its large packaged-bread sector, while Asia Pacific accelerates on the back of urban diets that rely on processed staples with long shelf-life. Consolidation among ingredient suppliers is reshaping competitive tactics as firms seek cost advantages in propionic-acid sourcing and fermentation-based production. Supply-chain risk remains the single most material headwind after the March 2025 feedstock price spike, yet the ability of major producers to pass through costs partially cushions margin pressure. Mid-term opportunities lie in active packaging, rumen-health additives, and clean-label gluten-free formulations that highlight calcium enrichment.

Global Calcium Propionate Market Trends and Insights

Rising Demand for Mold Inhibitors in Industrial-Scale Packaged Bakery Hubs Across Asia Pacific

The proliferation of automated bakeries across Southeast Asia has lifted preservative demand because ambient humidity accelerates mold outbreaks. Calcium propionate delivers reliable inhibition at dough pH below 5.5, so plant operators can standardize proofing times without risking spoilage. Its compatibility with yeast-leavened formulas avoids the gas-retention losses that accompany sorbate use, allowing factories to extend distribution from local to national reach. Regional bakery chains also prize the salt's neutral flavor profile, which preserves the soft crumb texture favored in Asian sliced bread. Ongoing capacity additions in Indonesia, Thailand, and Vietnam, therefore, place the calcium propionate market on a durable growth footing in this geography.

Europe's Authorization of Calcium Propionate in Aquaculture Diets Expands the Addressable Feed Market

European regulators classified calcium propionate as a permitted additive in finfish and crustacean diets, opening a new revenue lane for preservative suppliers. Feed formulators value the compound's dual benefit: suppressing microbial spoilage during warm-weather storage and improving feed conversion ratios by moderating gut pH. Premium salmon farms in Norway blend the salt at 2-3 g per kg, citing stable pellet moisture and reduced waste. Pilot studies report 3% improvements in feed efficiency and lower Vibrio counts, reinforcing the ingredient's ability to support economic and biosecurity targets. This regulatory milestone is expected to echo in Canada and Chile, further enlarging the calcium propionate market.

Growing Demand for Preservative-free Food Products

Consumer surveys in Germany, Canada, and Japan show double-digit growth in categories explicitly labeled "free from artificial preservatives". Retailers now curate dedicated shelf space for such offerings, pressuring mainstream brands to cut additive loads. While calcium propionate is still permitted and recognized as safe, perception concerns push formulators to trial cultured wheat and vinegar blends. These natural systems are rarely drop-in alternatives, often raising unit costs and shortening product life. Manufacturers, therefore, face a trade-off between market access and operational efficiency, tempering the expansion pace of the calcium propionate market over the long horizon.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Roll-out of Convenience-Food Retail Chains in GCC Boosting Shelf-life Solutions Demand

- Clean-label "Calcium-Based" Preservative Positioning in Premium Gluten-Free Bakery Ranges in North America.

- Rise of Natural Fermented Mold-Inhibitors in Asia Pacific Cannibalising Synthetic Demand

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Powder and granule forms held 65% of revenue in 2024 because dough manufacturers prefer dry blending for dosing accuracy and shelf stability. Plants integrate the preservative via automated silos, ensuring homogeneity even in 10-ton dough mixers.

Liquid suspensions, however, are picking up traction at a 5.61% CAGR driven by liquid feed, dairy sauces, and active-packaging films. Recent polymer research embedded calcium propionate within pectin-rich films that release 92.62% of the salt once activated by endogenous pectinase, thereby creating a smart barrier against spoilage. Such technology enlarges future addressable demand scenarios that the calcium propionate market can monetize beyond traditional dry-blend models.

The Calcium Propionate Market Segments the Industry by Form (Dry (Powder, Granular), and Liquid / Suspension), Grade (Food Grade, Feed Grade, and More), Application (Pharmaceutical, Animal Feed, Food and Beverage, and More), and Geography (Asia-Pacific, North America, Europe, South America, and the Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 40% of global demand in 2024 because its packaged bread sector values the additive's mold-inhibiting efficacy and regulatory clarity. The region's gluten-free and organic segments may question synthetics, yet repositioning calcium propionate as a calcium source helps retain usage even in premium loaves that reach shelf life targets of 14-17 days.

Asia Pacific delivers the most dynamic trajectory, clocking a 5.88% CAGR through 2030. Rapid urban migration in India, Indonesia, and the Philippines is boosting demand for pre-packed staples that must survive tropical transit. Europe sustains steady consumption underpinned by stringent hygiene mandates and the new aquaculture additive code that broadens feed usage.

Elsewhere, South America benefits from rising industrial bread output in Brazil, while the Middle East and Africa region leverages convenience-store roll-outs and wheat-flour subsidy programs that favor shelf-life prolongation. Collectively, these territories add incremental but meaningful tonnage to the calcium propionate market.

- A.M FOOD CHEMICAL CO., LIMITED

- AB Mauri (UK) Limited

- ADDCON GmbH

- Barentz

- BASF

- Creative Enzymees

- Dow

- Eastman Chemical Company

- Fine Organic Industries Limited

- Impextraco NV

- Kemin Industries, Inc.

- Kemira Oyj

- Kerry Group plc.

- Macco

- Perstorp

- Titan Biotech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for mold inhibitors in industrial-scale packaged bakery hubs across Asia Pacific

- 4.2.2 Europe authorization of calcium propionate in aquaculture diets expanding addressable feed market

- 4.2.3 Rapid roll-out of convenience-food retail chains in GCC boosting shelf-life solutions demand

- 4.2.4 Clean-label "calcium-based" preservative positioning in premium gluten-free bakery ranges in North America

- 4.3 Market Restraints

- 4.3.1 Growing Demand for Preservative-less Food Products

- 4.3.2 Feed-stock price volatility affecting margins

- 4.3.3 Rise of natural fermented mold-inhibitors in Asia Pacific cannibalising synthetic demand

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Form

- 5.1.1 Dry (Powder, Granular)

- 5.1.2 Liquid / Suspension

- 5.2 By Grade

- 5.2.1 Food Grade

- 5.2.2 Feed Grade

- 5.2.3 Pharmaceutical Grade

- 5.2.4 Industrial Grade

- 5.3 By Application

- 5.3.1 Pharmaceutical

- 5.3.2 Animal Feed

- 5.3.3 Food and Beverage

- 5.3.4 Personal Care

- 5.3.5 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 A.M FOOD CHEMICAL CO., LIMITED

- 6.4.2 AB Mauri (UK) Limited

- 6.4.3 ADDCON GmbH

- 6.4.4 Barentz

- 6.4.5 BASF

- 6.4.6 Creative Enzymees

- 6.4.7 Dow

- 6.4.8 Eastman Chemical Company

- 6.4.9 Fine Organic Industries Limited

- 6.4.10 Impextraco NV

- 6.4.11 Kemin Industries, Inc.

- 6.4.12 Kemira Oyj

- 6.4.13 Kerry Group plc.

- 6.4.14 Macco

- 6.4.15 Perstorp

- 6.4.16 Titan Biotech

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Innovations to Strengthen Demand from New Emerging Markets