PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848324

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848324

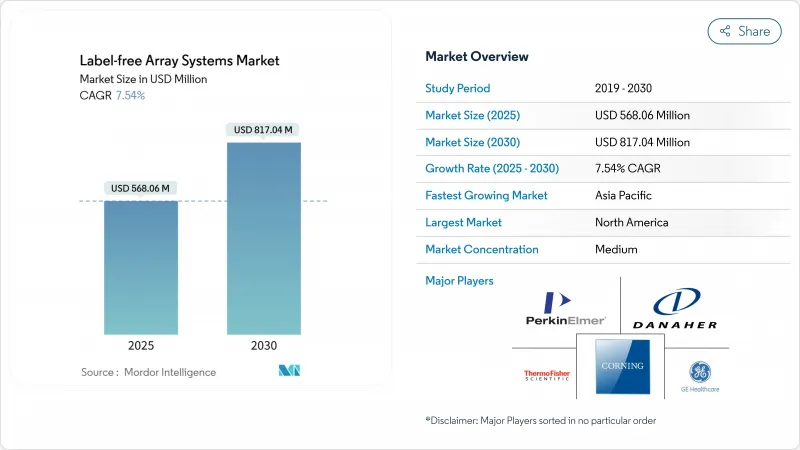

Label-free Array Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The label-free array systems market is valued at USD 568.06 million in 2025 and is forecast to reach USD 817.04 million by 2030, registering a 7.54% CAGR over 2025-2030.

Escalating pharmaceutical R&D budgets, rising demand for real-time kinetic data, and the migration toward complex biologics are solidifying the technology's role across discovery and development programs. Major sponsors now embed label-free detection early in hit-to-lead cascades to shorten project timelines and improve candidates' success rates. Consolidation among instrument vendors, coupled with AI-enhanced analytics, is accelerating platform upgrades and lowering data-analysis barriers. Meanwhile, regional funding initiatives in North America, the European Union, China, and India are creating a fertile environment for new applications extending into point-of-care diagnostics and cell-therapy manufacturing. Persistent challenges-chiefly high capital outlays for flagship SPR and BLI platforms and a shortage of trained nano-optics personnel-continue to temper adoption in price-sensitive segments, yet shared-facility models and leasing schemes are starting to offset cost hurdles.

Global Label-free Array Systems Market Trends and Insights

Advantages over Labeled Detection Techniques

Label-free methods eliminate fluorescent or radioactive tags, thereby preventing steric hindrance and signal quenching that often distort binding kinetics. Hit rates jump when fragment-based campaigns capitalize on unmodified ligands, as demonstrated by 12.4% primary hits with 92% crystallographic confirmation. Because no secondary reagents are required, assay development time drops 40-60%, freeing medicinal-chemistry teams to iterate rapidly. Stanford University's SENSBIT platform further highlights durability gains by maintaining 70% signal after one month in serum against 11-hour lifespans for conventional sensors. Collectively, these performance premiums underpin the label-free array systems market's swift pivot away from legacy labeled assays.

Increase in R&D Spending by Pharma & Biotech Firms

Global pharmaceutical R&D outlays reached USD 288 billion in 2024, up 1.5% year-on-year, and sizeable fractions are earmarked for advanced analytical platforms. Merck alone channelled USD 17.9 billion into discovery programs, explicitly prioritizing label-free screening capacity. As therapeutics portfolios tilt toward multispecific antibodies, gene editors, and cell therapies, high-content kinetic datasets become mission-critical for regulatory dossiers. Daiichi Sankyo's robotics-enabled San Diego laboratory illustrates this shift, integrating automation and AI-driven label-free analytics to compress bench-to-IND timelines. The resulting uplift in Phase 1 success rates-from 60-70% with traditional screens to 80-90% on AI-paired label-free platforms-reinforces executive commitment to sustained investment.

High Capital Cost of Instrumentation

Premium SPR systems list between USD 200,000 and USD 500,000, while fully featured BLI rigs exceed USD 300,000 before service contracts. Semiconductor labor shortages that could require 67,000 additional U.S. engineers by 2030 inflate optics-component prices. Export restrictions on gallium and germanium have lengthened lead times, and 75% of photonics manufacturers report hiring challenges. Consequently, smaller biotechs and academic centers defer purchases, nudging them toward shared-core facilities or vendor-financed leasing programs that spread cost over multi-year horizons.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Technology Upgrades in SPR, BLI & CDS Platforms

- Integration of AI Analytics with High-Throughput Label-Free Screens

- Limited User-Side Awareness & Training

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Surface Plasmon Resonance contributed 41.45% of 2024 revenue, making it the largest slice of the label-free array systems market. Vendors sustain leadership by pushing sub-nanomolar detection limits and adding multiplex cartridges that measure up to 32 interactions concurrently. The label-free array systems market size attributed to SPR platforms is expected to rise steadily at the overall industry CAGR as pharma customers modernize aging instruments. Localised SPR, however, promises the fastest growth at a 9.65% CAGR because nano-plasmonic metasurfaces deliver superior small-molecule sensitivity and suit portable diagnostics.

National Taiwan University's pH-responsive DNA nanoswitches achieved 0.57 pM microRNA limits of detection, nudging LSPR closer to clinic-ready assays. Parallel advances in whispering-gallery-mode microlasers offer amplified evanescent fields suited to early cancer biomarker panels. The competition is spurring incumbents to incorporate nano-fabricated chips into next-gen SPR lines, blurring boundaries between bulk-optic SPR and chip-based LSPR. As price differentials narrow, procurement decisions will hinge on throughput, service footprint, and AI-analytics plug-ins rather than on raw sensitivity alone.

The Label-Free Array Systems Market Report is Segmented by Technology (Surface Plasmon Resonance (SPR), and More), Application (Drug Discovery, and More), End User (Pharmaceutical & Biotechnology Companies, Contract Research Organizations (CROs), and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the label-free array systems market with a 44.56% revenue share in 2024, supported by deep capital pools, FDA-aligned validation pathways, and Thermo Fisher's USD 2 billion domestic expansion plan. U.S. semiconductor and photonics ecosystems, despite skilled-labor shortages, continue to supply critical optics faster than any other region, reducing downtime for instrument upgrades. Capital-intensive biopharma clusters in Boston-Cambridge, the San Francisco Bay Area, and the Raleigh-Durham corridor collectively anchor over 40% of North American label-free install base units.

Asia-Pacific is the fastest-growing territory at an 8.65% CAGR thanks to China's precision-medicine boom, which topped 2,400 billion yuan in 2023 and is rising 12% annually. India's 2024 BioE3 policy designates biomanufacturing as a strategic pillar, while Japan's JST program seeks a USD 1 trillion multiplex-sensing prize. Shimadzu's new Karnataka factory, due 2027, will localize chromatograph and mass-spec production, trimming import dependencies. Regional growth is further bolstered by biotech parks in Shanghai's Zhangjiang and Hyderabad's Genome Valley that offer subsidized core-facility access to start-ups.

Europe holds a meaningful footprint, buoyed by Germany, the United Kingdom, and Switzerland's legacy pharma majors. Waters Corporation's new 45,000 sq ft UK machining center triples local capacity for MS components, improving resilience against supply-chain shocks. Nonetheless, industry groups advocate a "Chips Act 2.0" to protect photonics competitiveness as U.S. and Chinese incentives lure wafer-fab investments abroad. Horizon Europe grants and European Innovation Council funds continue to seed university-industry consortia that pilot label-free microfluidic prototypes for decentralized testing.

- Danaher Corporation (ForteBio / Molecular Devices)

- Bruker

- Corning

- Thermo Fisher Scientific

- Sartorius AG (Octet BLI)

- Carterra Inc.

- GE Healthcare

- PerkinElmer

- Waters Corporation

- Agilent Technologies

- Nicoya Lifesciences

- Gator Bio

- Malvern Panalytical

- HORIBA

- Attana AB

- Quanterix Corp.

- Plexera Bioscience

- Fluidic Analytics

- Delta Life Science

- Biosensor Tools LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Advantages Over Labeled Detection Techniques

- 4.2.2 Increase In R&D Spending by Pharma & Biotech Firms

- 4.2.3 Rapid Technology Upgrades In SPR, BLI & CDS Platforms

- 4.2.4 Integration Of AI Analytics with High-Throughput Label-Free Screens

- 4.2.5 Adoption In Personalised-Medicine & Cell-Therapy Manufacturing

- 4.2.6 Nano-Plasmonic & Metasurface Miniaturisation for POC Diagnostics

- 4.3 Market Restraints

- 4.3.1 High Capital Cost of Instrumentation

- 4.3.2 Limited User-Side Awareness & Training

- 4.3.3 Data-Integration & Standardisation Hurdles for Phenotypic Assays

- 4.3.4 Shortage Of Nano-Optics Fabrication Talent

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Technology

- 5.1.1 Surface Plasmon Resonance (SPR)

- 5.1.2 Localised Surface Plasmon Resonance (LSPR)

- 5.1.3 Bio-Layer Interferometry (BLI)

- 5.1.4 Cellular Dielectric Spectroscopy (CDS)

- 5.1.5 Other Technologies

- 5.2 By Application

- 5.2.1 Drug Discovery

- 5.2.2 Protein-Protein / Interface Analysis

- 5.2.3 Antibody Characterisation & Development

- 5.2.4 Protein Complex & Cascade Analysis

- 5.2.5 Other Applications

- 5.3 By End User

- 5.3.1 Pharmaceutical & Biotechnology Companies

- 5.3.2 Contract Research Organisations (CROs)

- 5.3.3 Academic & R&D Laboratories

- 5.3.4 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Danaher Corporation (ForteBio / Molecular Devices)

- 6.3.2 Bruker Corporation

- 6.3.3 Corning Incorporated

- 6.3.4 Thermo Fisher Scientific, Inc.

- 6.3.5 Sartorius AG (Octet BLI)

- 6.3.6 Carterra Inc.

- 6.3.7 GE HealthCare

- 6.3.8 PerkinElmer, Inc.

- 6.3.9 Waters Corporation

- 6.3.10 Agilent Technologies

- 6.3.11 Nicoya Lifesciences

- 6.3.12 Gator Bio

- 6.3.13 Malvern Panalytical

- 6.3.14 Horiba Ltd.

- 6.3.15 Attana AB

- 6.3.16 Quanterix Corp.

- 6.3.17 Plexera Bioscience

- 6.3.18 Fluidic Analytics

- 6.3.19 Delta Life Science

- 6.3.20 Biosensor Tools LLC

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment