PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848326

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848326

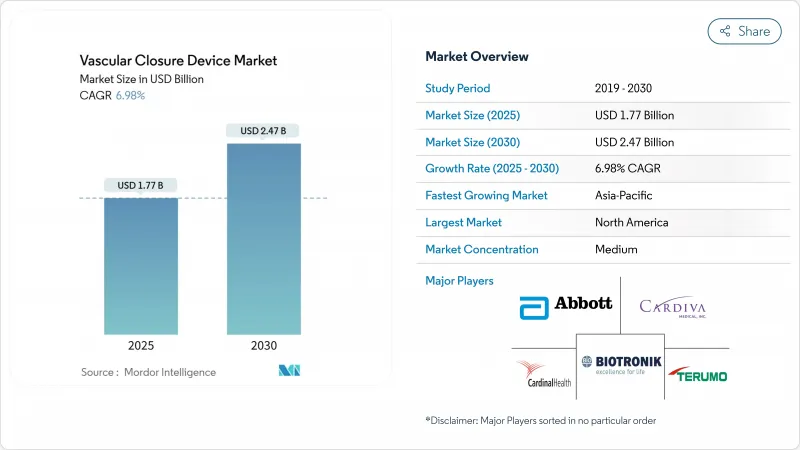

Vascular Closure Device - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The vascular closure devices market size is valued at USD 1.77 billion in 2025 and is forecast to reach USD 2.47 billion by 2030, registering a 6.98% CAGR over the period.

Heightened procedural complexity in transcatheter aortic valve replacement (TAVR), endovascular aneurysm repair (EVAR), neuro-interventions, and complex peripheral cases positions vascular closure as an indispensable step in contemporary endovascular therapy. Purchaser preference is tilting away from manual compression because large-bore access sites up to 25 Fr demand predictable hemostasis, and same-day discharge mandates rapid ambulation. Growing outpatient volumes, adoption of minimally invasive therapies for high-risk elderly patients, and expanding reimbursement for ambulatory care are reinforcing the business case for device-based closure. Innovation momentum is strongest in bio-absorbable materials and large-bore implant designs that shorten deployment time and remove operator variability. Concurrently, radial-specific compression bands address the procedural migration from femoral to radial routes, ensuring that the vascular closure devices market continues to evolve rather than stagnate.

Global Vascular Closure Device Market Trends and Insights

Increase in Catheterization-Related Procedures

Procedure counts have escalated as indications for percutaneous coronary interventions, structural heart repair, and complex peripheral revascularization broaden. Abbott confirmed that vessel closure products were a key contributor to its 12.5% medical devices revenue growth in Q1 2025, reflecting direct linkage between access-site volumes and device demand. Mechanical thrombectomy and high-sheath electrophysiology cases produce multiple puncture sites per patient, pushing operators toward closure systems that manage varied vessel sizes with consistent outcomes. Trials such as AMBULATE demonstrated a 54% reduction in time to ambulation when the VASCADE MVP system replaced manual compression, underscoring workflow gains. Together, these dynamics position procedural volume growth as a persistent catalyst for the vascular closure devices market.

Growing Preference for Minimally Invasive Interventions

Hospitals and ambulatory centers favor minimally invasive care to trim length of stay, reduce infection risk, and improve patient satisfaction. The Heart Rhythm Society and the American College of Cardiology endorse same-day discharge after intracardiac ablation when secure venous hemostasis is achieved, directly tying closure performance to throughput. Terumo's 15.6% revenue jump in its Cardiac & Vascular Company aligns with this macro-shift and illustrates how robust closure tools accelerate adoption of catheter-based therapies. Imaging navigation improvements further widen the scope of lesions treatable through small punctures, amplifying reliance on vascular closure devices market solutions that seal access quickly and predictably.

High Cost Of Advanced VCDs Versus Manual Compression

A single closure unit often prices between USD 200 and USD 250, contrasted with negligible material cost for manual compression. While high-income systems justify expenditure through staff time savings, many emerging markets still rely on manual pressure to contain budgets. Value-based purchasing is gradually shifting toward total episode economics, but capital scarcity keeps price sensitivity high, especially where catheter volumes are just now scaling. Manufacturers are responding with tiered product lines and targeted reimbursement dossiers that highlight reduced nursing hours and shorter admissions.

Other drivers and restraints analyzed in the detailed report include:

- Aging Population Expanding Cardiovascular Treatment Volumes

- Expansion of Large-Bore TAVR/EVAR Driving Next-Gen Device Demand

- Device-Related Complications And Product Recalls

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Active approximators controlled 54.34% of the vascular closure devices market in 2024. This leadership derives from their suture-mediated or clip-based mechanisms that lock arteriotomies immediately, enabling anticoagulated or large-bore patients to ambulate within hours. Abbott's Perclose ProGlide illustrates category strength by offering 100% procedural success in multiple high-sheath trials. Hospitals prize the deterministic closure these devices provide, particularly when intra-procedural anticoagulation is mandatory.

Passive approximators occupy a smaller base but are pacing growth at 8.45% CAGR through 2030. Plug, patch, and sealant systems such as Haemonetics' VASCADE MVP shorten deployment to a single push, reducing fluoroscopy and operator fatigue. The AMBULATE study confirmed a 54% decline in time-to-ambulation, showcasing workflow dividends that resonate with outpatient programs. Simplified technique lowers training barriers, raising adoption in mid-volume centers. As regulatory pressures favor same-day discharge, passive approximators are positioned to expand their contribution to the vascular closure devices market.

Collagen plugs retained 51.23% share in 2024, reflecting three decades of clinical familiarity. Terumo's Angio-Seal VIP employs a collagen sponge, a polymer anchor, and a suture that collectively resorb within 90 days, offering predictable vessel healing. Physicians value collagen's thrombin-rich matrix, which accelerates clot formation especially in anticoagulated patients.

Suture and filament devices built from polyglycolic acid, polyethylene glycol, or proprietary polymers are advancing at 8.95% CAGR. Vivasure's PerQseal Elite is entirely bio-absorbable and designed for 14-22 Fr TAVR sheaths, eliminating retained foreign material and imaging artifacts. Polymer innovations provide tailored degradation kinetics, enabling large-bore security without permanent implants. Clip-based metal systems remain a niche for cases where radiopaque markers aid follow-up imaging. Material diversification reinforces competitive differentiation inside the vascular closure devices market.

The Vascular Closure Device Market Report is Segmented by Product Type (Active Approximators and Passive Approximators), Material Composition (Collagen-Based, PEG/Polymer-based, and More), Mode of Access (Femoral Access), Procedure Type (Interventional Cardiology, and More), End-User (Hospitals, and More), Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America, with 42.67% share, remains the largest regional constituent of the vascular closure devices market. High per-capita procedure rates, early technology adoption, and robust reimbursement frameworks underpin leadership. The FDA granted 510(k) clearance for Cordis' MYNX CONTROL venous VCD in 2024, emphasizing the region's role as a primary gateway for next-generation systems. Notwithstanding recalls, North America maintains physician confidence through structured training and rapid post-market surveillance.

Asia-Pacific records the fastest 7.84% CAGR through 2030, spurred by health infrastructure build-out, government investment in cardiovascular care, and an aging population predisposed to stenotic and valvular disease. China's National Medical Products Administration accepted 61 innovative device dossiers in 2023, signaling accelerating regulatory throughput for local and foreign suppliers. Terumo's double-digit cardiovascular revenue growth and MicroPort CardioFlow's VitaFlow Liberty TAVI approval in early 2025 confirm vibrant regional demand. Although device cost sensitivity persists, expanding private insurance and public funding improve affordability.

Europe maintains steady, albeit slower, expansion amid transition to the Medical Device Regulation framework. CE marks awarded to Terumo's Angio-Seal VIP and Vivasure's PerQseal Elite under MDR attest to adaptability of manufacturers. Radial penetration in continental centers is higher than in North America, moderating femoral closure volumes, yet growth in large-bore structural heart programs counterbalances attrition. Economic pressures in Southern Europe constrain premium device uptake, but Northern European networks compensate with procedure innovation, sustaining the vascular closure devices market.

- Abbott Laboratories

- Terumo

- Medtronic

- Haemonetics Corp.

- Teleflex

- Cardinal Health / Cordis

- Beckton Dickinson

- B. Braun

- BIOTRONIK

- Merit Medical Systems

- Vivasure Medical

- Cardiva Medical

- Advanced Vascular Dynamics

- Essential Medical

- InSeal Medical

- Manta (Abbott-Manta)

- Forge Medical

- Rex Medical

- Morrison Medical

- Medeon Biodesign

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase In Catheterization-Related Procedures

- 4.2.2 Growing Preference for Minimally Invasive Interventions

- 4.2.3 Shift Toward Radial Access in PCI & Electrophysiology

- 4.2.4 Aging Population Expanding CVD Treatment Volumes

- 4.2.5 Expansion Of Large-Bore TAVR/EVAR Driving Next-Gen VCD Demand

- 4.2.6 Out-Patient & Same-Day Discharge Reimbursement Incentives

- 4.3 Market Restraints

- 4.3.1 High Cost of Advanced Vcds Vs. Manual Compression

- 4.3.2 Device-Related Complications & Product Recalls

- 4.3.3 Lengthy Approval Cycles for Bio-Absorbable Polymers

- 4.3.4 Cannibalisation From Low-Cost Radial Compression Bands

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Active Approximators

- 5.1.1.1 Clip-based Devices

- 5.1.1.2 Suture-based Devices

- 5.1.1.3 Plug-based Devices

- 5.1.2 Passive Approximators

- 5.1.2.1 Hemostatic Pads & Patches

- 5.1.2.2 Compression Devices

- 5.1.1 Active Approximators

- 5.2 By Material Composition

- 5.2.1 Collagen-based

- 5.2.2 PEG / Polymer-based

- 5.2.3 Suture / Filament-based

- 5.2.4 Metal Clip-based

- 5.3 By Mode of Access

- 5.3.1 Femoral Access

- 5.3.2 Large-bore Femoral

- 5.3.3 Radial Access

- 5.3.4 Other Mode of Access

- 5.4 By Procedure Type

- 5.4.1 Interventional Cardiology

- 5.4.2 Peripheral Vascular

- 5.4.3 Neurovascular

- 5.4.4 Structural Heart / TAVR

- 5.4.5 Electrophysiology

- 5.5 By End User

- 5.5.1 Hospitals

- 5.5.2 Ambulatory Surgical Centres

- 5.5.3 Cath-labs & Out-patient Vascular Centres

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Terumo Corporation

- 6.3.3 Medtronic plc

- 6.3.4 Haemonetics Corp.

- 6.3.5 Teleflex Inc.

- 6.3.6 Cardinal Health / Cordis

- 6.3.7 Becton, Dickinson & Co.

- 6.3.8 B. Braun Melsungen AG

- 6.3.9 Biotronik SE & Co. KG

- 6.3.10 Merit Medical Systems

- 6.3.11 Vivasure Medical Ltd

- 6.3.12 Cardiva Medical Inc.

- 6.3.13 Advanced Vascular Dynamics

- 6.3.14 Essential Medical

- 6.3.15 InSeal Medical

- 6.3.16 Manta (Abbott-Manta)

- 6.3.17 Forge Medical

- 6.3.18 Rex Medical

- 6.3.19 Morrison Medical

- 6.3.20 Medeon Biodesign

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment