PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848333

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848333

Varicose Veins Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

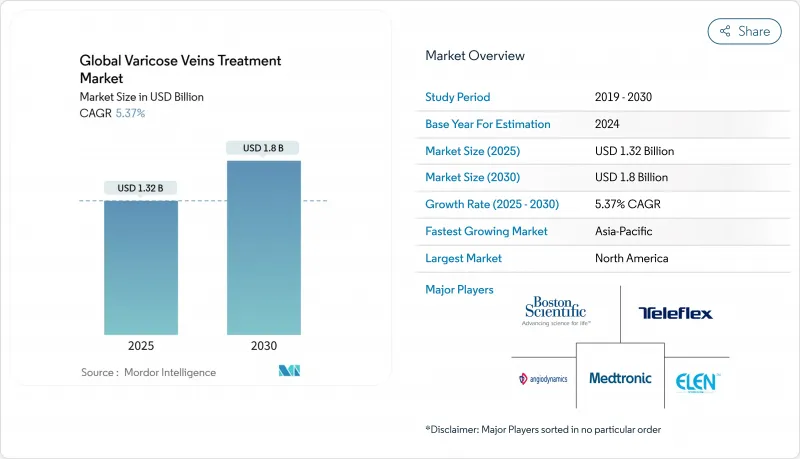

The Global Varicose Veins Treatment Market size is estimated at USD 1.32 billion in 2025, and is expected to reach USD 1.8 billion by 2030, at a CAGR of 5.37% during the forecast period (2025-2030).

Expansion is propelled by accelerated adoption of minimally invasive therapies, rising obesity-linked venous disease, and widening insurance coverage that together reinforce patient demand. North America remains the largest regional contributor, while aggressive capacity additions in Asia-Pacific point to a rising procedural volume that will reshape global revenue distribution. Portfolio diversification among medical-technology leaders is intensifying, exemplified by Boston Scientific's 2024 acquisition of Silk Road Medical, which underscores a shift toward comprehensive vascular solutions. Growing physician preference for endovenous techniques continues to displace legacy surgery, and specialty vein clinics are leveraging telehealth triage to capture an expanding outpatient clientele.

Global Varicose Veins Treatment Market Trends and Insights

Rising Preference for Minimally Invasive Surgeries

Patients increasingly opt for outpatient solutions that shorten recovery and minimize scarring. Endovenous ablation, cyanoacrylate closure, and foam sclerotherapy now dominate the varicose vein treatment market, offering clinical efficacy comparable to open surgery with fewer complications. VenaSeal achieves a 94.6% five-year closure rate and allows immediate return to activity, illustrating the competitive edge of catheter-based systems. The shift is accelerating the retirement of vein stripping, redirecting capital toward radiofrequency generators, endolaser consoles, and NTNT technologies that fit office-based workflows. As device portfolios broaden, technology leaders differentiate through lower recurrence rates and simplified anesthesia requirements. Product positioning around patient convenience has become a central marketing pillar that resonates across self-pay and reimbursed channels.

Obesity-Driven Chronic Venous Insufficiency

Escalating obesity prevalence correlates with heightened venous hypertension, propelling demand for interventional care. Overweight individuals experience a 1.5-fold greater risk of varicose pathology because excess weight impairs venous valve competence . Women with elevated BMI report lower quality-of-life scores and higher pain indices, pushing providers to recommend definitive procedures earlier in the disease course. This demographic trend expands the varicose vein treatment market by amplifying the need for compression therapy, ablative devices, and follow-up diagnostics. Device makers respond with larger-diameter catheters and enhanced delivery systems to accommodate diverse vein calibers. Public health initiatives that encourage weight reduction indirectly support procedure volume by improving caregiver awareness and referral patterns.

High Out-of-Pocket Cost

Procedures deemed purely cosmetic often fall outside insurance coverage, forcing patients to self-fund multiple sessions and ancillary imaging healthline. Emerging markets feel the pinch more acutely where payer networks remain nascent, dampening penetration of premium catheters and specialty adhesives. Providers respond by offering flexible payment plans and batching bilateral treatments to reduce per-leg cost, yet price sensitivity persists. The constraint steers some patients toward compression-only management, slowing adoption curves in lower-income segments. Equipment makers are therefore engineering simplified RF consoles with modular pricing to address clinics in cost-constrained geographies.

Other drivers and restraints analyzed in the detailed report include:

- Medicare Reimbursement Expansion for Endovenous Thermal Ablation

- Tele-consult Triaging Boosting Early Referrals

- Safety Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sclerotherapy controlled 68.70% of 2024 revenue, reflecting its versatility for small-diameter vessels and spider veins. Endovenous ablation, however, is registering a 7.13% CAGR that lifts its contribution to the varicose vein treatment market over the forecast horizon. The technique's success rides on devices such as ClosureFast, which posts 91.9% closure and 94.9% reflux-free outcomes five years after intervention. With each clinical update, payers grow more comfortable funding ablation as a first-line option, displacing ligation and stripping.

Technological momentum now centers on non-thermal, non-tumescent systems like ClariVein MOCA, which combines mechanical agitation with sclerosant delivery. Cyanoacrylate adhesive closure further lifts patient satisfaction by removing post-procedure stocking requirements, critical for compliance during warmer climates. These innovations lower anesthesia time and enable same-room turnover, advantages that specialty clinics convert into higher daily procedure volumes. As a result, segment analysts expect a continued reweighting toward catheter-based interventions within the varicose vein treatment market.

Ablation platforms generated 46.80% of 2024 sales, underscoring the primacy of RF and laser consoles. Yet accessories and compression products are growing 6.57% per year as they underpin peri-procedural success. Graduated stockings remain the mainstay of conservative therapy and post-ablation prophylaxis, endorsed by the American Venous Forum for symptom relief and ulcer prevention.

Foam-injection kits, epitomized by Varithena with patented Microfoam UDSS technology, reinforce the segment with a ready-to-use formulation that bypasses manual mixing steps . Ultrasound probes, disposable introducers, and fiberoptic light guides round out accessory demand by ensuring accurate vein access and thermal control. The procedural stack therefore widens the varicose vein treatment market size through ancillary revenue streams even as console margins compress. Manufacturing roadmaps emphasize ergonomic handles, single-use locking syringes, and color-coded catheter sets to streamline training and inventory tracking.

The Varicose Vein Treatment Market Report Segments the Industry Into Treatment Type (Endovenous Ablation, Sclerotherapy and More), Product (Ablation Devices, Venous Closure Products, and More), by End User (Hospitals, Specialized Vein Centers and Others), by Vein Type (Great Saphenous Vein, Small Saphenous Vein and More) and Geography (North America, Europe and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 43.20% revenue share in 2024, underpinned by advanced imaging infrastructure, high awareness, and favorable Medicare policies that reimburse endovenous ablation after failed conservative care . Hospital chains have widened outpatient suites, and payer bundles reward efficiency, enabling clinicians to schedule bilateral legs in one visit. Boston Scientific's launch of the FARAPULSE Pulsed Field Ablation System fed regional sales that rose 13.8% year over year, illustrating robust technology appetite .

Europe follows, buoyed by strong public systems in Germany, the United Kingdom, and France that swiftly incorporate evidence-backed devices. The region has embraced NTNT approaches, and regulatory clarity supports rapid rollouts once post-market surveillance confirms safety. Reimbursement parity between RF and laser methods levels competition and sparks iterative upgrades such as dual-heating catheters from BD. Southern European nations mirror adoption patterns with a lag tied to fiscal budgets, yet patient demand remains stable due to high cosmetic expectations.

Asia-Pacific posts the fastest 6.34% CAGR, driven by capacity expansion in Japan, China, and India. Japan's strict credentialing slows laser uptake but stimulates innovation in training simulators and e-credential platforms. China's 2024 approval of FARAPULSE unlocked a population base that can swell the varicose vein treatment market size once urban outpatient chains scale. Rapid private-insurance growth in India couples with rising middle-class incomes to fuel device imports. Australia and South Korea maintain steady upgrade cycles as clinics retire older diode lasers for RF generators. The Middle East, led by GCC states, adopts premium cyanoacrylate systems because affluent patients value compression-free recovery medtronic. Sub-Saharan Africa grows from a smaller base; supply chain volatility around sclerosant drugs curtails volume in public hospitals, but private centers in South Africa sustain modest uptake. South America, spearheaded by Brazil and Argentina, experiences rising procedural counts aligned with expanded private coverage.

- Medtronic

- AngioDynamics

- Boston Scientific

- Biolitec

- Lumenis

- Teleflex

- Venclose Inc.

- VVT Medical Ltd.

- Merit Medical Systems

- LeMaitre Vascular

- Theraclion SA

- F Care Systems

- Dornier MedTech

- Eufoton Srl

- Candela Medical

- Quanta System

- Won Tech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Preference for Minimally-invasive Surgeries

- 4.2.2 Rising Obesity-driven Chronic Venous Insufficiency

- 4.2.3 Medicare Reimbursement Expansion for Endovenous Thermal Ablation in the United States

- 4.2.4 Tele-consult Triaging Boosting Early Referrals

- 4.2.5 Surge in Office-based Vein Clinics Adopting NTNT* Technologies Across Europe

- 4.2.6 Rapid Uptake of Cyanoacrylate Adhesive Closure Systems in Middle-Eastern Private Hospitals

- 4.3 Market Restraints

- 4.3.1 High out-of-pocket Cost

- 4.3.2 Safety Concerns

- 4.3.3 Stock-outs of Sclerosant Drugs in Sub-Saharan Public Hospitals

- 4.3.4 Rigid Laser-ablation Credentialing Rules Slowing Adoption in Japan

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory & Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts -Value (USD Million)

- 5.1 By Treatment Type

- 5.1.1 Endovenous Ablation

- 5.1.1.1 Radiofrequency (RFA)

- 5.1.1.2 Laser (EVLA)

- 5.1.1.3 Mechanochemical (MOCA)

- 5.1.1.4 Cyanoacrylate Closure

- 5.1.2 Sclerotherapy

- 5.1.2.1 Liquid

- 5.1.2.2 Foam

- 5.1.3 Surgical Ligation & Stripping

- 5.1.4 Others

- 5.1.1 Endovenous Ablation

- 5.2 By Product

- 5.2.1 Ablation Devices

- 5.2.1.1 RFA Generators & Catheters

- 5.2.1.2 Laser Consoles & Fibers

- 5.2.1.3 Non-thermal Closure Systems

- 5.2.2 Sclerotherapy Injection Kits

- 5.2.3 Support Devices & Accessories

- 5.2.1 Ablation Devices

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Specialized Vein Centers

- 5.3.3 Others

- 5.4 By Vein Type

- 5.4.1 Great Saphenous Vein

- 5.4.2 Small Saphenous Vein

- 5.4.3 Perforator & Accessory Veins

- 5.5 By Region

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia- Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Medtronic plc

- 6.3.2 AngioDynamics Inc.

- 6.3.3 Boston Scientific Corp.

- 6.3.4 biolitec AG

- 6.3.5 Lumenis Ltd.

- 6.3.6 Teleflex Incorporated

- 6.3.7 Venclose Inc.

- 6.3.8 VVT Medical Ltd.

- 6.3.9 Merit Medical Systems Inc.

- 6.3.10 LeMaitre Vascular Inc.

- 6.3.11 Theraclion SA

- 6.3.12 F Care Systems

- 6.3.13 Dornier MedTech

- 6.3.14 Eufoton Srl

- 6.3.15 Candela Medical (Syneron Medical Ltd)

- 6.3.16 Quanta System

- 6.3.17 Won Tech Co. Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment