PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848339

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848339

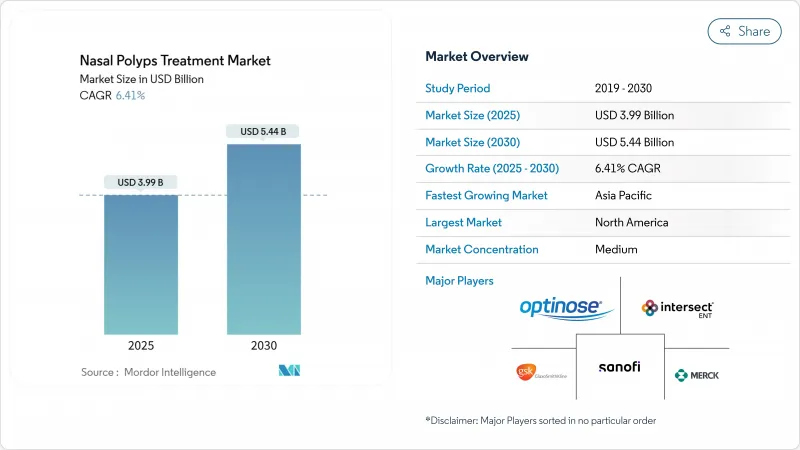

Nasal Polyps Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The nasal polyps treatment market size is valued at USD 3.99 billion in 2025 and is forecast to reach USD 5.44 billion by 2030, advancing at a 6.41% CAGR.

Demand is rising as physicians shift from broad corticosteroid use toward precision biologics that interrupt interleukin-4, -5 and -13 signaling pathways. Growth is reinforced by the high coexistence of asthma and chronic rhinosinusitis with nasal polyps (CRSwNP), the expansion of fast-track biologic approvals, and steady uptake of minimally invasive delivery systems that improve intranasal drug deposition. Competition intensifies as large pharmaceutical groups protect market positions through life-cycle management and co-promotion agreements, while smaller biotechnology companies target under-served patient segments through differentiated mechanisms of action. Digital pharmacy channels, broader ENT specialist networks, and favorable reimbursement pilots in developed markets further expand patient access, although cost containment policies in price-sensitive regions remain a headwind.

Global Nasal Polyps Treatment Market Trends and Insights

Growing Prevalence of Chronic Rhinosinusitis With Nasal Polyps

Global CRSwNP prevalence is climbing as environmental pollutants, urban allergens, and ageing populations converge, raising disease incidence to roughly 4% of adults worldwide. Diagnosis rates improve in developed markets thanks to widespread endoscopic screening, but limited ENT capacity in emerging regions delays detection. About 60% of CRSwNP patients also have asthma, compounding morbidity and increasing the need for combination therapies that deliver longer-lasting symptom remission. North American and European payers already recognize the economic burden of recurrent surgeries and systemic steroid use, prompting policy discussions around earlier biologic intervention. In Asia-Pacific, rapid industrial expansion intensifies air-quality issues, which, together with the build-out of tertiary hospitals, is generating a pronounced uptick in patient volumes.

Increasing Adoption of Biologic Therapies in Treatment Protocols

Targeted biologics such as dupilumab, tezepelumab, and stapokibart ease nasal obstruction, reduce polyp grade, and lower surgery rates, prompting guideline updates that prioritize their use in refractory CRSwNP. Dupilumab's 2024 adolescent approval broadened the eligible U.S. cohort by about 9,000 patients, while tezepelumab's Phase III WAYPOINT trial reported a 98% cut in surgical interventions, positioning it as a competitive benchmark. Physicians increasingly combine biologics with topical corticosteroids to consolidate control, and payers reward documented improvements in work productivity and reduced emergency visits. China's stapokibart authorization in 2024 signaled a strategic move toward local innovation, setting the stage for wider Asia-Pacific penetration of premium biologics. Ongoing head-to-head trials will likely refine positioning by endotype, driving incremental share shifts within the biologics segment.

High Treatment Costs and Limited Reimbursement for Biologics

Annual dupilumab therapy exceeds USD 30,000 in the United States, placing pressure on commercial payers to deploy prior-authorization hurdles that elongate treatment timelines. Cost-effectiveness studies show biologics outperform systemic steroids in quality-adjusted life-years, yet budget impact for health plans remains substantial, particularly when layered on top of expanding specialty drug pipelines. In lower-middle-income economies, biologic usage is often limited to self-pay urban elites, widening equity gaps. Biosimilar entry after 2028 may ease price tension, but payers will still negotiate steep rebates to curb specialty spending growth. Ancillary costs, including injection training and pharmacovigilance, further complicate universal coverage in stewardship-driven reimbursement systems.

Other drivers and restraints analyzed in the detailed report include:

- Rising Healthcare Expenditure and Access to ENT Surgical Care

- Favorable Regulatory Approvals and Fast-Track Designations for Novel Drugs

- Stringent Regulatory and Safety Requirements for Nasal Implants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Corticosteroids retained 42.34% share of the nasal polyps treatment market in 2024 on the back of favorable pricing and wide prescriber familiarity. Yet biologic therapies within the "Other Drug Class" bracket are expanding at an 8.54% CAGR, propelled by robust real-world effectiveness and multi-cohort label extensions. Antibiotic usage is falling as mechanistic focus shifts from infectious to type 2 inflammatory drivers. Leukotriene modifiers remain niche, serving patients with comorbid asthma yet limited standalone benefit in polyp regression.

The competitive tide is evident in hospital formularies, where biologic utilization in high-surgery-risk cohorts is rising quarter-on-quarter. Dupilumab's adolescent indication, tezepelumab's near-approval status, and China's stapokibart launch intensify attention on disease-modifying results that reduce revision surgeries and cumulative systemic steroid exposure. Payer scrutiny is tightening but long-term cost offsets from fewer operating-room episodes and productivity gains strengthen the biologic value narrative. Post-2028 biosimilar waves should gradually unlock fuller access while sustaining innovation incentives for next-generation cytokine targets.

Nasal sprays delivered 48.43% revenue share in 2024, benefiting from patient-friendly formats and over-the-counter steroid options that manage mild-to-moderate symptoms. Exhalation delivery systems, led by XHANCE's closed-palate mechanism, are on track for an 8.66% CAGR by 2030 as studies confirm deeper sinus penetration and better polyp shrinkage scores. Oral and injectable routes remain relevant for systemic treatments, especially during acute exacerbations or for biologic dosing every 2-8 weeks. Implantable devices, exemplified by SINUVA and LATERA, occupy an early-adopter niche awaiting further long-term safety data.

Emerging solutions combine handheld battery-assisted atomizers with sensors that log dosing compliance to cloud portals, supporting remote physician oversight. Stryker's LATERA absorbable implant reportedly saves USD 2,200 per patient compared with functional endoscopic sinus surgery in suitable lateral wall collapse cases. Uptake of such implants remains country-specific, hinging on specialist skill sets and reimbursement scheduling. As device makers refine ergonomics and integrate digital guidance, payers may favor these technologies for their potential to lower intensive surgical episodes.

The Nasal Polyps Treatment Market Report is Segmented by Drug Class (Corticosteroids, Antibiotics, and More), Route of Administration (Nasal Sprays, Oral Tablets & Suspensions, and More), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and More), End User (Hospitals, and More), Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the nasal polyps treatment market in 2024 with 42.45% share, underpinned by strong prescribing of FDA-cleared biologics, widespread insurance coverage for specialty drugs, and active patient advocacy groups that facilitate early diagnosis. The United States accounts for the bulk of regional revenue, leveraging real-time benefits checks and manufacturer copay programs that offset high list prices. Canada's provincial drug plans steadily add biologics to formularies following health-technology assessments, while Mexico's growing private insurance pool is accelerating corticosteroid spray and balloon sinuplasty uptake. Ongoing payer negotiations create heterogeneous access, yet steady commercial uptake has cemented the region's leadership.

Europe shows balanced growth, supported by centralized EMA reviews that streamline multinational launches. Germany and the United Kingdom anchor clinical research networks and employ stringent cost-effectiveness thresholds, accelerating tender competition and risk-sharing contracts for biologic reimbursement. France and Italy benefit from specialist training programs and universal coverage, keeping surgery queues short and biologic adoption steady. Spain, with upgraded tertiary ENT hubs and improving macroeconomics, is emerging as a significant volume contributor. EU aging demographics and stringent workplace wellness mandates sustain long-term demand.

Asia-Pacific is projected to achieve the fastest 7.45% CAGR through 2030 as healthcare spending expands, infrastructure modernizes, and patient awareness rises. China's stapokibart approval marked a milestone in domestic innovation and opened the door for locally produced monoclonals at regionally competitive price points. Japan's robust innovation funding and single-payer insurance framework support high biologic penetration, while Australia and South Korea mirror Western adoption curves. India's ENT workforce shortfall remains a constraint, though tele-medicine and policy emphasis on noncommunicable diseases could unlock latent demand later this decade. Urban-rural disparities will persist, but incremental expansion of public hospital capacity and private insurance penetration is set to widen treatment access.

- Sanofi

- Regeneron Pharmaceuticals

- GlaxoSmithKline

- OptiNose Inc.

- Intersect ENT

- Teva Pharmaceutical Industries

- Merck

- Roche

- Novartis

- Pfizer

- AstraZeneca

- Allakos Inc.

- Lyra Therapeutics Inc.

- Medtronic

- Stryker

- Amgen

- Bristol-Myers Squibb

- Takeda Pharmaceuticals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Prevalence of Chronic Rhinosinusitis With Nasal Polyps

- 4.2.2 Increasing Adoption of Biologic Therapies In Treatment Protocols

- 4.2.3 Rising Healthcare Expenditure and Access to ENT Surgical Care

- 4.2.4 Favorable Regulatory Approvals and Fast-Track Designations For Novel Drugs

- 4.2.5 Expansion of Tele-ENT Consultations and Remote Prescription Fulfillment

- 4.2.6 Integration of AI-Based Diagnostic Tools Enhancing Early Detection Rates

- 4.3 Market Restraints

- 4.3.1 High Treatment Costs and Limited Reimbursement for Biologics

- 4.3.2 Stringent Regulatory and Safety Requirements For Nasal Implants

- 4.3.3 Low Awareness and Diagnosis Rates in Emerging Markets

- 4.3.4 Competition From Alternative Therapies and Over-The-Counter Remedies

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Buyers

- 4.5.3 Bargaining Power Of Suppliers

- 4.5.4 Threat Of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Drug Class

- 5.1.1 Corticosteroids

- 5.1.2 Antibiotics

- 5.1.3 Leukotriene Inhibitors

- 5.1.4 Other Drug Class

- 5.2 By Route Of Administration

- 5.2.1 Nasal Sprays

- 5.2.2 Oral Tablets & Suspensions

- 5.2.3 Injectable / IV

- 5.2.4 Exhalation Delivery Systems

- 5.2.5 Implantable Devices

- 5.3 By Distribution Channel

- 5.3.1 Hospital Pharmacies

- 5.3.2 Retail Pharmacies

- 5.3.3 Online Pharmacies

- 5.3.4 Specialty Clinics

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 ENT Clinics

- 5.4.3 Ambulatory Surgery Centers

- 5.4.4 Home-Care Settings

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Sanofi S.A.

- 6.3.2 Regeneron Pharmaceuticals Inc.

- 6.3.3 GlaxoSmithKline Plc

- 6.3.4 OptiNose Inc.

- 6.3.5 Intersect ENT Inc.

- 6.3.6 Teva Pharmaceutical Industries Ltd.

- 6.3.7 Merck & Co., Inc.

- 6.3.8 F. Hoffmann-La Roche AG

- 6.3.9 Novartis AG

- 6.3.10 Pfizer Inc.

- 6.3.11 AstraZeneca Plc

- 6.3.12 Allakos Inc.

- 6.3.13 Lyra Therapeutics Inc.

- 6.3.14 Medtronic Plc

- 6.3.15 Stryker Corporation

- 6.3.16 Amgen Inc.

- 6.3.17 Bristol Myers Squibb

- 6.3.18 Takeda Pharmaceutical Co. Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment