PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848341

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1848341

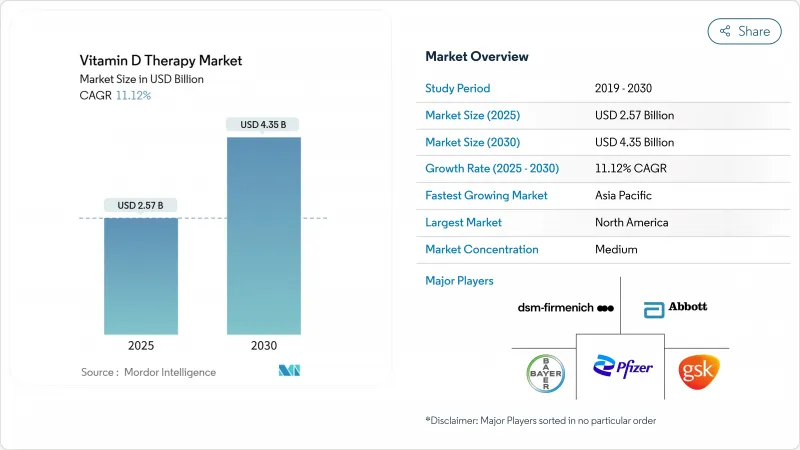

Vitamin D Therapy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The vitamin D therapy market size currently generates USD 2.57 billion in 2025 and is forecast to reach USD 4.35 billion by 2030, expanding at an 11.12% CAGR.

The shift from reactive supplementation toward proactive clinical management is accelerating as mounting evidence links deficiency with autoimmune, cardiovascular, and immune dysfunction. Intensifying supply-chain pressures on 7-dehydrocholesterol have boosted investment in genetically engineered yeast fermentation and alternative D2 sources, supporting resilience despite raw-material volatility. Tight integration of home testing with personalized dosing platforms is redefining adherence, while government-backed public-health campaigns anchor demand in emerging economies. Competitive momentum now centers on bioavailability-enhanced calcifediol and depot injectable formats that address absorption limitations across vulnerable populations.

Global Vitamin D Therapy Market Trends and Insights

Huge Patient Pool with Sedentary Lifestyle & Ageing Population

Demographic aging converges with sedentary behavior, sharply enlarging the treatable pool for the vitamin D therapy market. Skin synthesis capacity in adults over 65 drops 75% compared with younger cohorts. Only 18.5% of U.S. adults currently supplement, underlining latent demand. DSM-Firmenich is advancing fast-acting variants to serve elderly patients with compromised absorption. Institutional care settings, where deficiency reaches 80%, are negotiating long-term bulk contracts, ensuring sustained uptake beyond traditional retail settings.

Rising Awareness Campaigns by Governments & Manufacturers

Asia-Pacific health authorities now push prevention ahead of treatment, with the Philippines FDA capping supplement levels at 25 mcg/day in 2025 to standardize safety. Haleon's Bone Up program, expanded from China into the Philippines and South Korea, demonstrates scalable education that converts low-income groups into steady users. Public-private alliances amplify reach, aligning corporate messaging with national deficiency targets and granting first-mover advantage to brand leaders.

Consumption of Vitamin-D-Fortified Foods Reducing Therapy Need

Aggressive fortification programs create direct substitution pressure. Bayer's genome-edited tomatoes deliver therapeutic D3 doses through daily diets. The U.S. FDA is reviewing vitamin D2 mushroom powder as a food additive, indicating growing mainstream acceptance. While fortification may shrink general-population demand, it simultaneously opens higher-potency niches for malabsorption, CKD, or bariatric patients where food cannot reach therapeutic thresholds.

Other drivers and restraints analyzed in the detailed report include:

- Growing Osteoporosis & Osteopenia Prevalence

- Price Volatility in 7-Dehydrocholesterol Driving Supply-Chain Shifts

- Hypercalcaemia & Toxicity Concerns Tempering High-Dose Use

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Oral formats retained 87.54% of the vitamin D therapy market in 2024 due to convenience and price leadership. Yet parenteral products are rising at 13.45% CAGR, helped by studies showing a single 300,000 IU injection keeps 25-OH levels higher for 12 weeks versus weekly oral doses. Hospitals use intramuscular vitamin D to prepare orthopedic patients for surgery, while intensive-care protocols embrace rapid normalization.

Innovation favors 3-month depot formulations that cut dosing visits and ensure compliance among malabsorption or CKD cohorts. VITdALIZE-KIDS phase III is evaluating safety in pediatric critical care, potentially unlocking new pediatric indications. As providers value pharmacokinetic predictability, parenteral penetration will likely accelerate beyond acute settings, reinforcing growth prospects for the vitamin D therapy market.

Tablets secured 55.43% revenue in 2024, underpinned by low production cost and generic ubiquity. Capsules, however, are expanding at 13.67% CAGR, leveraging liposomal and nano-delivery to enhance fat-soluble absorption. Consumers migrating from chalky tablets cite palatability and perceived efficacy as purchase drivers.

Gummy offerings, previously limited by vitamin D stability, now incorporate microencapsulated actives, widening family appeal. Injectable and softgel niches address clinical or high-potency needs, while experimental intraoral toothpaste aims to deliver daily prophylactic doses during brushing, reinforcing habitual adherence. Formulation diversity underscores manufacturers' pivot to user-centric design across the vitamin D therapy market.

The Vitamin D Therapy Market Report is Segmented by Route of Administration (Oral and Parenteral), Dosage Form (Tablets, Capsules, and More), Purchasing Pattern (Prescription and Over-The-Counter), Application (Osteoporosis, and More), Distribution Channel (Hospital Pharmacies, and More), End User (Adults, and More), Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 44.35% of 2024 revenue, reflecting ingrained screening protocols and insurance coverage that embed vitamin D prescriptions into routine care. Home testing and subscription programs flourish in the U.S., while Canada's diagnostic approval accelerates precision-dosing adoption. Europe ranks second, catalysed by the EU's 2024 clearance of calcidiol monohydrate, which provides a faster-acting alternative for malabsorption cases.

Asia-Pacific is the fastest-growing region at 12.45% CAGR, buoyed by government education drives and rising middle-class health spending. The vitamin D therapy market size is swelling as campaigns like Bone Up tailor culturally resonant messages, lifting awareness from China to the Philippines. Japan's functional-food regime offers parallel growth through fortified foods under the Foods with Function Claims program.

Middle East & Africa and South America show strong upside, anchored by high deficiency prevalence and gradually improving distribution infrastructure. Regulatory moves toward OTC injectables in Mexico and Brazil widen access. Investments in fortified staple foods run parallel to supplement growth, ensuring the vitamin D therapy market penetrates socio-economic tiers previously beyond reach.

- Ortho Molecular Products

- Biotics Research

- GlaxoSmithKline

- Abbott Laboratories

- Pfizer

- Atrium Innovations (Nestl? Health Science)

- Merck

- Zydus Group

- Alkem Laboratories Ltd.

- Torrent Pharmaceuticals

- Amway Corp.

- Bayer

- Nature's Bounty

- Church & Dwight

- DSM-Firmenich

- Garden of Life

- Nordic Naturals

- Reckitt Benckiser Group

- Pharmavite LLC

- Sun Pharmaceuticals Industries

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Huge Patient Pool with Sedentary Lifestyle & Ageing Population

- 4.2.2 Rising Awareness Campaigns by Governments & Manufacturers

- 4.2.3 Growing Osteoporosis & Osteopenia Prevalence

- 4.2.4 Price Volatility in 7-Dehydrocholesterol Driving Supply-Chain Shifts

- 4.2.5 Home Test Kits & Personalised Dosing Platforms Boosting Adherence

- 4.2.6 Regulatory Re-Classification of High-Dose Injectables in EMS

- 4.3 Market Restraints

- 4.3.1 Consumption of Vitamin-D-Fortified Foods Reducing Therapy Need

- 4.3.2 Hypercalcaemia & Toxicity Concerns Tempering High-Dose Use

- 4.3.3 Shift Toward Multifunctional Gummies/Liquids Cannibalising Mono-D

- 4.3.4 Sustainability Scrutiny of Lanolin-Derived D3 Supply Chain

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers/Consumers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Route of Administration

- 5.1.1 Oral

- 5.1.2 Parenteral

- 5.2 By Dosage Form

- 5.2.1 Tablets

- 5.2.2 Capsules

- 5.2.3 Softgels

- 5.2.4 Gummies

- 5.2.5 Injectable Solutions

- 5.3 By Purchasing Pattern

- 5.3.1 Prescription

- 5.3.2 Over-the-Counter

- 5.4 By Application

- 5.4.1 Osteoporosis

- 5.4.2 Muscle Weakness

- 5.4.3 Autoimmune Disorders

- 5.4.4 Other Applications

- 5.5 By Distribution Channel

- 5.5.1 Hospital Pharmacies

- 5.5.2 Retail Pharmacies/Drug Stores

- 5.5.3 E-commerce

- 5.6 By End User

- 5.6.1 Pediatric

- 5.6.2 Adults

- 5.6.3 Geriatric

- 5.7 Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 Australia

- 5.7.3.5 South Korea

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 Middle East & Africa

- 5.7.4.1 GCC

- 5.7.4.2 South Africa

- 5.7.4.3 Rest of Middle East & Africa

- 5.7.5 South America

- 5.7.5.1 Brazil

- 5.7.5.2 Argentina

- 5.7.5.3 Rest of South America

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Ortho Molecular Products

- 6.3.2 Biotics Research Corporation

- 6.3.3 GSK plc

- 6.3.4 Abbott Laboratories

- 6.3.5 Pfizer Inc.

- 6.3.6 Atrium Innovations (Nestl? Health Science)

- 6.3.7 Merck & Co., Inc.

- 6.3.8 Cadila Healthcare Ltd.

- 6.3.9 Alkem Laboratories Ltd.

- 6.3.10 Torrent Pharmaceuticals Ltd.

- 6.3.11 Amway Corp.

- 6.3.12 Bayer AG

- 6.3.13 Nature's Bounty Co.

- 6.3.14 Church & Dwight Co., Inc.

- 6.3.15 DSM-Firmenich

- 6.3.16 Garden of Life

- 6.3.17 Nordic Naturals

- 6.3.18 Reckitt Benckiser Group plc

- 6.3.19 Pharmavite LLC

- 6.3.20 Sun Pharmaceutical Industries Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-need assessment