PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849814

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849814

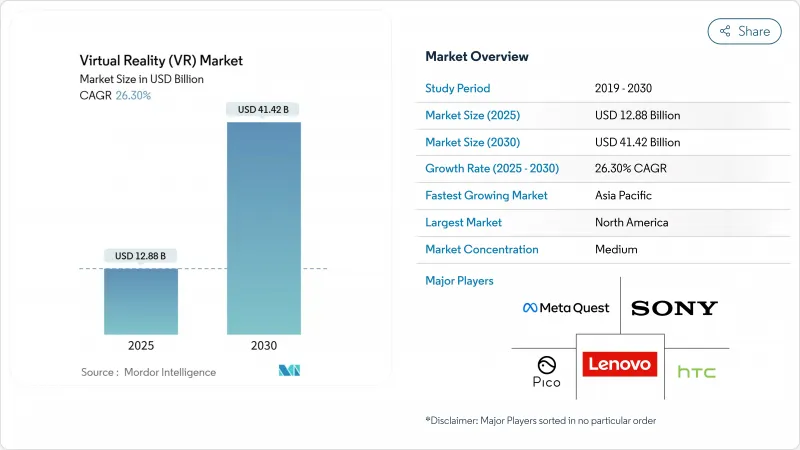

Virtual Reality (VR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Virtual Reality market size is estimated at USD 12.88 billion in 2025 and is projected to reach USD 41.42 billion by 2030, advancing at a 26.30% CAGR.

Rapid enterprise adoption of immersive training platforms, rising availability of mixed-reality-ready processors, and maturing 5G edge infrastructure underpin this expansion. Corporate net-zero pledges accelerate demand for virtual-first events, while regulatory clearances for therapeutic applications extend the technology's reach beyond entertainment. Hardware innovation remains vital, yet software and services gain momentum as organizations prioritize tailored content, robust analytics, and seamless integration with learning-management systems.

Global Virtual Reality (VR) Market Trends and Insights

Rising Enterprise-Wide VR Training Adoption

Organizations roll out full-scale VR training programs after pilot success, citing a 75% reduction in training time and a 275% jump in learner confidence versus conventional methods. Boeing recorded a 75% cut in training hours, and Delta Air Lines raised technician proficiency checks by 5,000%. Break-even arrives at 375 learners and becomes 52% more cost-effective once cohorts exceed 3,000. Over 75% of Fortune 500 companies now embed VR in learning strategies, including Walmart's retail simulations and the U.S. Army's mental-health modules, while Japanese insurers such as SOMPO deploy VR hazard simulations to curb workplace incidents. The outcome is stronger knowledge retention and safer on-the-job performance, cementing training as the principal enterprise gateway into the Virtual Reality market.

Mainstreaming of Mixed-Reality-Ready GPUs and SoCs

Next-generation chipsets like Qualcomm's Snapdragon XR2+ Gen 2 deliver 4.3 K-per-eye resolution and orchestrate a dozen cameras for spatial mapping, bringing flagship performance to mid-range headsets. Apple's Vision Pro employs dual chips to drive 23 million-pixel micro-OLED panels, illustrating processing demand curves. Display components alone add USD 530 to unit costs, so dynamic foveated rendering and eye-tracking become essential for efficiency. Samsung's three-way alliance with Google and Qualcomm signals mainstream commercialisation of these silicon advances, progressively lowering price points and broadening access to the Virtual Reality market.

Cybersickness and Long-Term Vestibular Concerns

Motion-to-photon discrepancies trigger nausea, headache, and disorientation, discouraging extended sessions. Sensory-conflict research pinpoints combined visual-vestibular mismatch as the main cause, intensified in mobile VR where device sway adds complexity. FDA guidelines for medical-grade headsets mandate prominent nausea warnings, highlighting clinical gravity. Hardware makers pursue higher refresh rates and latency cuts, yet physiological limits persist. Enterprises mitigate risk through shorter modules, raising content design costs and dampening near-term Virtual Reality market growth.

Other drivers and restraints analyzed in the detailed report include:

- 5G/Edge-Powered Untethered Streaming of VR Content

- Corporate Net-Zero Pledges Driving Virtual-First Events

- Eye-Box Heat Build-Up Limiting Continuous Usage

For complete list of drivers and restraints, kindly check the Table Of Contents.

List of Companies Covered in this Report:

- Meta Platforms (Meta Quest)

- Sony Corporation

- HTC Corporation

- Samsung Electronics Co. Ltd

- Apple Inc.

- Qualcomm Technologies Inc.

- Lenovo Group Ltd

- Pico Interactive Inc.

- Valve Corporation

- Varjo Technologies Oy

- Microsoft Corporation

- Magic Leap Inc.

- Vuzix Corporation

- FOVE Inc.

- DPVR (Lexiang Tech Co. Ltd)

- Unity Technologies Inc.

- Unreal Engine (Epic Games Inc.)

- Autodesk Inc.

- Dassault Systemes SE

- 3D Systems Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising enterprise-wide VR training adoption

- 4.2.2 Mainstreaming of "mixed reality-ready" GPUs and SoCs

- 4.2.3 5G/Edge-powered untethered streaming of VR content

- 4.2.4 Corporate Net-Zero pledges driving 'virtual-first' events

- 4.2.5 Regulatory approvals for VR-based mental-health therapies

- 4.2.6 Ultrasound-haptics enabling controller-free interaction

- 4.3 Market Restraints

- 4.3.1 Cybersickness and long-term vestibular concerns

- 4.3.2 Eye-box heat build-up limiting continuous usage

- 4.3.3 Scarcity of AAA-grade VR content outside gaming

- 4.3.4 Data-privacy compliance costs for eye-tracking analytics

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 Assessment of Macroeconomic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Device Form Factor

- 5.2.1 Tethered HMD

- 5.2.2 Stand-alone HMD

- 5.2.3 Screenless Viewer

- 5.2.4 CAVE / Immersive Rooms

- 5.3 By Immersion Level

- 5.3.1 Non-Immersive

- 5.3.2 Semi-Immersive

- 5.3.3 Fully-Immersive

- 5.4 By End-User Industry

- 5.4.1 Gaming

- 5.4.2 Media and Entertainment

- 5.4.3 Healthcare

- 5.4.4 Education and Training

- 5.4.5 Military and Defense

- 5.4.6 Retail and eCommerce

- 5.4.7 Real Estate and Architecture

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Meta Platforms (Meta Quest)

- 6.4.2 Sony Corporation

- 6.4.3 HTC Corporation

- 6.4.4 Samsung Electronics Co. Ltd

- 6.4.5 Apple Inc.

- 6.4.6 Qualcomm Technologies Inc.

- 6.4.7 Lenovo Group Ltd

- 6.4.8 Pico Interactive Inc.

- 6.4.9 Valve Corporation

- 6.4.10 Varjo Technologies Oy

- 6.4.11 Microsoft Corporation

- 6.4.12 Magic Leap Inc.

- 6.4.13 Vuzix Corporation

- 6.4.14 FOVE Inc.

- 6.4.15 DPVR (Lexiang Tech Co. Ltd)

- 6.4.16 Unity Technologies Inc.

- 6.4.17 Unreal Engine (Epic Games Inc.)

- 6.4.18 Autodesk Inc.

- 6.4.19 Dassault Systemes SE

- 6.4.20 3D Systems Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment