PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849829

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849829

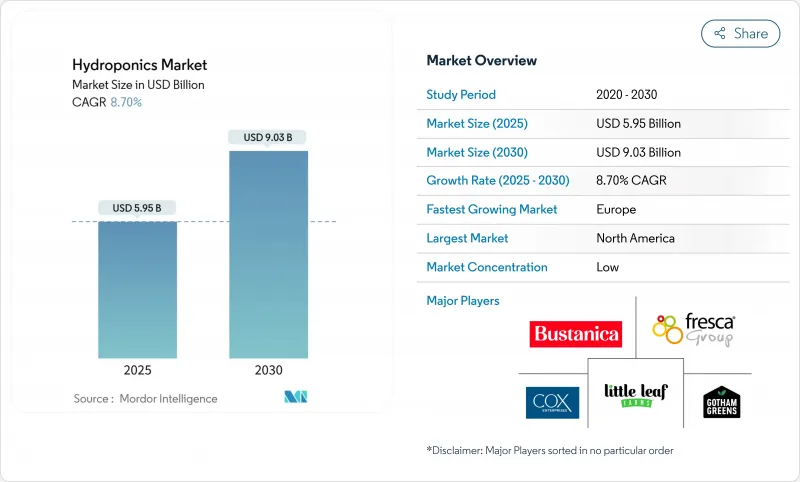

Hydroponics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Hydroponics Market size is estimated at USD 5.95 billion in 2025 and is projected to reach USD 9.03 billion by 2030, at a CAGR of 8.7% during the forecast period (2025-2030).

This upward trajectory is propelled by the convergence of urban population growth, corporate sustainability mandates, and rapidly improving controlled-environment technologies. Aggregate growing systems currently dominate because they are simple to operate, but liquid systems are expanding more quickly as operators seek higher resource efficiency. Companies are integrating AI-driven nutrient routines to boost yields and cut operating costs, while falling LED prices are making year-round production economical. Rising energy use remains a concern; however, improvements in lighting efficiency and access to onsite renewables are lowering exposure to volatile power prices.

Global Hydroponics Market Trends and Insights

High-yield per square meter and lower water use

Hydroponic installations deliver up to 11-fold higher output per square meter while cutting water consumption by 80-90%, making them compelling for arid or densely built environments. Vertical farms such as Skyscraper Farm recycle nearly all irrigation water, demonstrating 95-99% savings compared with field agriculture. Eden Green Technology's Texas facility produces 340,000 plants annually on just 62,000 square feet, validating how controlled-environment agriculture turns marginal real estate into reliable food sources. Rising municipal water tariffs strengthen the hydroponics market value proposition as each liter of savings converts directly into lower operating costs. Urban planners highlight water efficiency when approving new inner-city farms, accelerating permit cycles, and build-outs in land-constrained metro areas. The trend is particularly acute in Middle Eastern and Asian megacities, where groundwater depletion and import dependency drive policy support for closed-loop farming.

Urban population shift and demand for local food

Cities account for over 56% of the world's population, and residents increasingly demand produce grown within a short radius to guarantee freshness and traceability. During the COVID-19 period, supply chain shocks pushed retailers such as Walmart to co-invest in regional vertical-farm suppliers to safeguard shelf continuity. Municipal programs convert under-utilized downtown offices into year-round grow hubs, as seen in Calgary and Houston, demonstrating how commercial vacancies can become food factories. Younger consumers willingly pay a 15-20% premium for pesticide-free local greens, creating predictable cash flow for urban farms serving subscription boxes. Public-private grants offset start-up costs, allowing small operators to secure leases in prime locations once reserved for retail or coworking ventures. Together, these factors underpin a steady urban customer base that supports higher average selling prices and reduces distribution emissions.

Up-front capex and long pay-back periods

High upfront costs and long payback periods hinder commercial hydroponics adoption. Typical 500 square meter starter farms require USD 15,000-40,000, while monthly energy and nutrient bills can reach USD 1,300, deterring cash-constrained entrepreneurs. Energy accounts for up to 50% of operating costs, exposing margins to spot-price spikes in liberalized power markets. The 2023 shakeout that pushed several U.S. vertical farms into bankruptcy highlighted how aggressive expansion outpaced cash flow. Venture funding for indoor agriculture slipped 91% during early 2023, forcing firms to prioritize profitability over growth. In many developing countries, double-digit interest rates exacerbate pay-back horizons, slowing hydroponics market penetration despite latent demand. Where sovereign wealth funds subsidize food security infrastructure, larger commercial projects move forward, and smaller growers often delay investments until cheaper turnkey kits emerge.

Other drivers and restraints analyzed in the detailed report include:

- Reduced capital expenditure for LED technology

- Corporate on-site ESG farming mandates

- Skills gap in controlled-environment agronomy

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Aggregate substrates continued to command 79.6% of revenue in 2024, illustrating how familiarity reassures growers shifting from soil to soilless cultivation. Their lower capital needs and simple mechanics underpin persistent dominance. Liquid systems, however, are accelerating at a 12.6% CAGR through 2030 as operators pursue finer control of oxygenation and nutrient dosing. Deep-water culture and nutrient film technique installations boost leafy-green yields by 30-50% compared with aggregate counterparts. Closed-loop designs also recycle nearly all solution runoff, an important differentiator where water tariffs are rising.

Hybrid approaches are emerging: sensors embedded in inert substrates automatically trigger liquid nutrient pulses, merging the root stability of aggregates with the precision of liquids. Such adaptability aligns with corporate ESG targets and elevates return on invested capital. Hence, more producers are expected to upgrade from static substrates to sensor-guided nutrient film lines as the hydroponics market matures.

The Hydroponics Market Report is Segmented by Type (Aggregate System and Liquid System), by Crop Type (Tomato, Lettuce and Leafy Greens, Pepper, Cucumber, and More), and by Geography (North America, Europe, Asia-Pacific, South America, Middle East, and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America secured 35.8% of global revenue in 2024 on the back of mature infrastructure, proactive USDA grants, and abundant venture financing. The hydroponics market size for U.S. commercial operations continues to swell as hospitals, schools, and corporate campuses build onsite farms to trim food-mile emissions. Canada's controlled-environment expertise, honed during cannabis legalization, is migrating into vegetable production and adding technical depth.

Europe promises the fastest climb with a 13.2% CAGR through 2030. The EU's Farm-to-Fork initiative supplies clear policy backing, while countries such as the Netherlands deploy AI-fueled sensor networks that cut chemical inputs and lift yields. Germany's push to co-locate greenhouse clusters with renewable power assets is lowering operating expenses and broadening access to long-term financing. Spain's mainstream acceptance of hydroponic lettuce highlights strong consumer readiness, a factor that accelerates supermarket partnerships.

Asia-Pacific presents a large untapped upside. China has more than 60 specialized equipment manufacturers, and provincial incentives encourage vertical farming in megacities. India's start-ups demonstrate 40-fold yield gains over soil plots, enticing additional venture capital. Food-security concerns in Southeast Asian nations are winning legislative support for new projects, although inconsistent power supply still complicates scaling. The region's rising middle class and urban footprint suggest the hydroponics market will pivot eastward as technological costs fall.

- GrowUp Farms

- BrightFarms (COX Enterprises, Inc)

- Pure Harvest Smart Farms

- Little Leaf Farms

- Thanet Earth (Fresca Group)

- Hydro Produce

- Emirates Hydroponics Farms

- Revol Greens

- Gotham Greens

- Nutrifresh India

- Badia Farms

- Sundrop Farms (Centuria Capital)

- Emirates Bustanica

- Sky Greens

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High-yield per square meter and lower water use

- 4.2.2 Urban population shift and demand for local food

- 4.2.3 Reduced capital expenditure for LED technology

- 4.2.4 Corporate on-site ESG farming mandates

- 4.2.5 AI nutrient-mix optimization boosting ROI

- 4.2.6 Carbon-credit monetization of CEA farms

- 4.3 Market Restraints

- 4.3.1 Up-front capex and long pay-back periods

- 4.3.2 Skills gap in controlled-environment agronomy

- 4.3.3 Rising P-based nutrient-waste regulations

- 4.3.4 Grid-outage risk and energy-price volatility

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat from Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Type

- 5.1.1 Aggregate System

- 5.1.1.1 Closed System

- 5.1.1.2 Open System

- 5.1.2 Liquid System

- 5.1.1 Aggregate System

- 5.2 By Crop Type

- 5.2.1 Tomato

- 5.2.2 Lettuce and Leafy Greens

- 5.2.3 Pepper

- 5.2.4 Cucumber

- 5.2.5 Micro-greens

- 5.2.6 Other Crops (Strawberry, Basil, etc.)

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Netherlands

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East

- 5.3.6 Africa

- 5.3.6.1 South Africa

- 5.3.6.2 Rest of Africa

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 GrowUp Farms

- 6.4.2 BrightFarms (COX Enterprises, Inc)

- 6.4.3 Pure Harvest Smart Farms

- 6.4.4 Little Leaf Farms

- 6.4.5 Thanet Earth (Fresca Group)

- 6.4.6 Hydro Produce

- 6.4.7 Emirates Hydroponics Farms

- 6.4.8 Revol Greens

- 6.4.9 Gotham Greens

- 6.4.10 Nutrifresh India

- 6.4.11 Badia Farms

- 6.4.12 Sundrop Farms (Centuria Capital)

- 6.4.13 Emirates Bustanica

- 6.4.14 Sky Greens

7 Market Opportunities and Future Outlook