PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849830

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849830

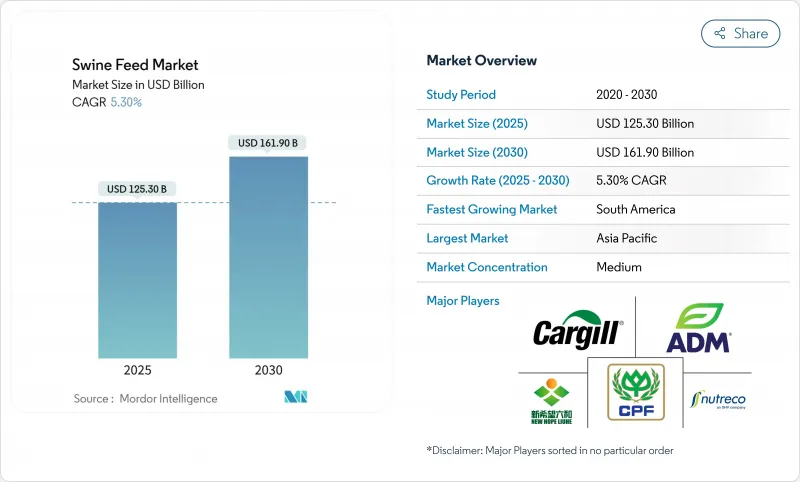

Swine Feed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The swine feed market size reached USD 125.3 billion in 2025 and is forecast to climb to USD 161.9 billion by 2030, advancing at a 5.3% CAGR.

A resilient rebound in China, Brazil's export-led expansion, and sustained adoption of precision nutrition underpin this healthy trajectory of the swine feed market. Europe's 3.1% CAGR mirrors tighter sustainability rules and cost inflation that squeeze margins yet spur innovation. South America posts a 5.4% CAGR on the back of Brazil's widening pork export capacity and new crushing plants that secure grain supplies. Functional additives, insect proteins, and single-cell proteins gain momentum as producers seek gut health gains, antibiotic alternatives, and lower carbon footprints. Meanwhile, anti-dumping duties on Chinese lysine imports lift amino-acid prices, reinforcing demand for locally sourced or fermented alternatives and adding another layer of complexity to the swine feed market.

Global Swine Feed Market Trends and Insights

Rising Demand for High-Value Animal Protein

Emerging market consumers continue to shift toward pork, lifting compound-feed volumes even when disease outbreaks temporarily curb supply. The U.S. Department of Agriculture expects a 1.7% rise in global pork output for 2025, led by Asia, which, in turn, magnifies feed demand. Brazil illustrates the multiplier effect: projected 6.6% export growth to 1.22 million tons in 2025 means domestic feed plants must widen capacity to keep breeders stocked. In commercial barns, every percentage point rise in pork output can add 1.5-2 points in feed volume because modern genetics rewards higher-density diets. Premium product positioning in mature economies reinforces the call for specialized formulations that command margin-friendly premiums.

Industrialization of Livestock Production

Large commercial farms dictate standardized, nutrient-dense rations and negotiate long contracts that stabilize inputs yet compress manufacturer margins. China's recovery underscores this shift: commercial barns expanded even as overall pork output dipped 1.5% in 2024, underlining the drift toward scale efficiencies. Precision dispensers and electronic sow feeders enable farms to feed 15-20% more per pig, yet improve conversion ratios by up to 30%. One study found precision feeding of lactating sows boosts weaning weights by 0.33 kg versus conventional practices.

Raw-Material Price Volatility and Supply Shocks

Cereal turbulence squeezes margins as floods dent kernel quality and inflate storage expenses. The 2024 U.S. corn crop suffered heavy rainfall that heightened mycotoxin risks and added cost layers for drying and cleaning. Egypt's surge in feedstuff prices showcases how import-heavy regions endure currency slides that ripple directly into livestock costs. Smaller mills lacking hedge programs feel the pinch first, prompting production cuts or recipe downgrades that jeopardize performance.

Other drivers and restraints analyzed in the detailed report include:

- Heightened Awareness of Pork Quality and Safety

- Genetic-Driven Surge in Amino-Acid Requirements

- Anti-Dumping Duties Inflating Lysine Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cereals remained the backbone of swine diets, holding 42% of the swine feed market in 2024 thanks to competitive pricing and ubiquitous supply chains. Cereal by-products such as Wheat middlings and distillers' grains are on a 6.1% CAGR growth path, encouraged by ethanol expansion and the search for cost-effective fiber sources. Oilseed meal posts 7.4% CAGR as crushing capacity grows in South America, supplying higher-lysine soybean meal aligned with modern genetics. Oils hold a steady 5.0% CAGR as energy-dense inclusions in high-performance rations. Molasses maintains a niche role in palatability and dust control, keeping volumes stable. Overall, ingredient diversification helps millers hedge price shocks and align with sustainability pledges, reinforcing the adaptive strength of the swine feed market.

The Swine Feed Market Report is Segmented by Ingredients (Cereals, Cereals by Products, Oilseed Meal, Oils, Molasses, and Others), Supplements (Antibiotics, Vitamins, Antioxidants, Amino Acids, Enzymes, Acidifiers, and Others), and Geography (North America, Europe, Asia-Pacific, South America, and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominates the global swine feed market with 46% market share in 2024, reflecting the region's massive pig production capacity and expanding commercial farming operations across China, India, and Southeast Asian countries. China's pork production declined 1.5% in 2024 for the first time in four years, yet this contraction masks underlying structural improvements in feed efficiency and production systems that position the market for sustained growth. The region's feed consumption patterns demonstrate resilience despite African swine fever pressures, with China's feed output dropping 6.6 million metric tons in 2024 while commercial operations continued capacity expansion to capture market share from smaller producers. Precision livestock farming adoption accelerates across the region, with smart pig farming technologies showing particular promise in Vietnam's transition from smallholder to commercial operations, supported by government initiatives promoting medium and large-scale farming infrastructure.

South America emerges as the fastest-growing regional market with a 5.4% CAGR through 2030, propelled by Brazil's expanding pork export capacity and Argentina's regulatory modernization in animal nutrition. Brazil's pork exports are projected to grow 6.6% in 2025 to 1.22 million tons, requiring domestic feed production increases of approximately 2.8% to support breeding operations and meet both domestic and international demand. The region's competitive advantage stems from low labor and feed costs, with companies like GSI targeting nearly USD 200 million in revenue within five years through expanded automation solutions for post-harvest systems. South America's emergence as the largest global feed producer, with 155,875 metric tons in 2023, including 89,067 metric tons for swine, reflects the region's strategic importance in global protein supply chains and its potential to benefit from trade disruptions affecting traditional suppliers.

North America and Europe register more modest growth rates of 4.2% and 3.1% CAGR, respectively, reflecting market maturity and regulatory complexity that favors innovation over volume expansion. The US pork industry shows cautious optimism for 2025 with projected production increases, though feed costs representing 66% of production expenses continue to pressure margins. European markets face particular challenges from sustainability regulations and ASF control measures, with EU pork prices anticipated to remain elevated through 2025 as production costs stabilize at higher levels.

- Cargill Inc.

- Charoen Pokphand Foods

- Archer Daniels Midland Company

- New Hope Group

- Nutreco NV

- DSM-Firmenich

- BASF SE

- Evonik Industries

- ForFarmers BV

- De Heus BV

- Alltech Inc.

- Ajinomoto Animal Nutrition

- Guangdong Haid Group

- KENT Nutrition Group

- J.D. Heiskell and Co.

- Phibro Animal Health

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for high-value animal protein

- 4.2.2 Industrialization of livestock production

- 4.2.3 Heightened awareness of pork quality and safety

- 4.2.4 Rapid adoption of functional feed additives

- 4.2.5 Genetic-driven surge in amino-acid requirements

- 4.2.6 Feed-biosecurity innovations against ASF and PED

- 4.3 Market Restraints

- 4.3.1 Raw-material price volatility and supply shocks

- 4.3.2 Stringent antibiotic and additive regulations

- 4.3.3 African swine fever-linked herd contractions

- 4.3.4 Anti-dumping duties inflating lysine costs

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of Substitute Products

- 4.6.4 Threat of New Entrants

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Ingredients

- 5.1.1 Cereals

- 5.1.2 Cereals By-products

- 5.1.3 Oilseed Meal

- 5.1.4 Oils

- 5.1.5 Molasses

- 5.1.6 Other Ingredients

- 5.2 By Supplements

- 5.2.1 Antibiotics

- 5.2.2 Vitamins

- 5.2.3 Antioxidants

- 5.2.4 Amino Acids

- 5.2.5 Enzymes

- 5.2.6 Acidifiers

- 5.2.7 Other Supplements

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 Spain

- 5.3.2.3 France

- 5.3.2.4 United Kingdom

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Egypt

- 5.3.5.3 Rest of Africa

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Cargill Inc.

- 6.4.2 Charoen Pokphand Foods

- 6.4.3 Archer Daniels Midland Company

- 6.4.4 New Hope Group

- 6.4.5 Nutreco NV

- 6.4.6 DSM-Firmenich

- 6.4.7 BASF SE

- 6.4.8 Evonik Industries

- 6.4.9 ForFarmers BV

- 6.4.10 De Heus BV

- 6.4.11 Alltech Inc.

- 6.4.12 Ajinomoto Animal Nutrition

- 6.4.13 Guangdong Haid Group

- 6.4.14 KENT Nutrition Group

- 6.4.15 J.D. Heiskell and Co.

- 6.4.16 Phibro Animal Health

7 Market Opportunities and Future Outlook