PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849835

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849835

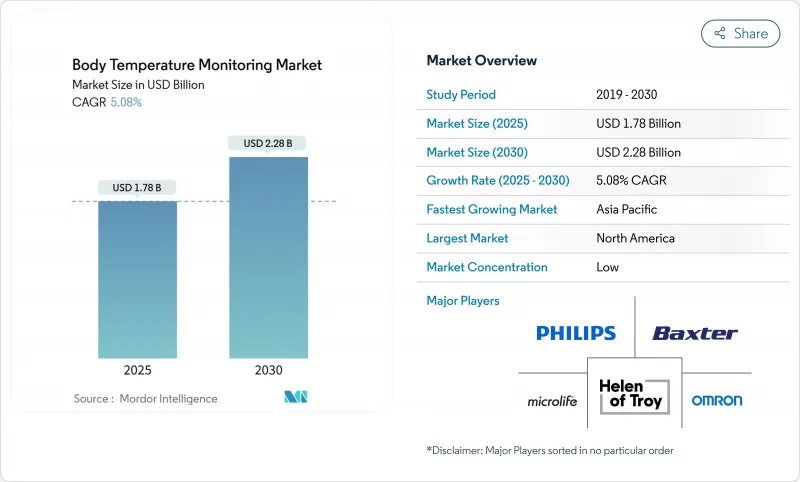

Body Temperature Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The body temperature monitoring market size stands at USD 1.78 billion in 2025 and is forecast to reach USD 2.28 billion by 2030, advancing at a 5.08% CAGR.

The healthy growth reflects a transformation from episodic thermometry toward always-on, IoT-enabled ecosystems that fuse temperature with hemodynamic and respiratory data. Pandemic-era screening routines, an aging global population, and regulatory incentives that phase out mercury devices all continue to stimulate demand. Contact devices retain clinical trust because of accuracy, but non-contact infrared (IR) systems and wearables expand quickly as hospitals, workplaces, and households embrace hygienic, touch-free workflows. Manufacturers accelerate vertical integration and software partnerships, aiming to bundle sensors, analytics, and cloud dashboards into one platform.

Global Body Temperature Monitoring Market Trends and Insights

Rising Infectious-Disease Outbreaks Drive Screening Demand

Temperature checks moved from ad-hoc crisis responses to permanent daily routines in hospitals, schools, and corporate campuses. The United States Food and Drug Administration issued performance recommendations for mass thermal screening systems, signaling regulatory acceptance of non-contact public venue deployment. AI-enhanced calibration and sensor fusion-linking thermal images with heart-rate or SpO2 inputs-now address the false-negative risk exhibited in early pandemic devices.

Digital & Wearable Sensor Innovations Lower Ownership Cost

Miniaturized thermistors, better power management, and relaxed regulatory pathways have pushed continuous temperature tracking into consumer wearables. Withings integrated greenteg's CALERA sensor into ScanWatch 2, enabling 24/7 core body temperature logging in a mass-market smartwatch. In June 2025 the US FDA exempted select Class II clinical electronic thermometers from premarket notification, shortening launch cycles and lowering compliance cost.

Accuracy & User-Error Concerns with IR Devices

Peer-reviewed evaluations show several forehead IR thermometers deviating by +-1 °C or more in uncontrolled environments, below clinical fever-screening thresholds. Variability from ambient temperature, humidity, and user alignment drives recall events and additional hospital protocol layers, tempering adoption pace. Suppliers invest in training, auto-distance targeting, and multi-spectral modules, yet fundamental physics of surface emissivity still limits error reduction in low-cost hardware.

Other drivers and restraints analyzed in the detailed report include:

- Hygiene-Focused Shift to Non-Contact IR Thermometers

- Expanding Pediatric & Geriatric Cohorts Needing Frequent Checks

- Mercury-Based Device Bans Squeezing Low-Income Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The contact segment accounted for 62.58% of the body temperature monitoring market in 2024 thanks to proven accuracy and decades-long clinician familiarity. Ear probes, digital stick thermometers, and ingestible pills anchor intensive-care protocols, especially where medication dosing or sepsis surveillance requires sub-0.2 °C precision. Non-contact IR devices are forecast to be the fastest-growing sub-category through 2030, propelled by infection-control guidelines and workplace deployment mandates. Continuous wearables, such as FDA-cleared Radius T0 and skin patches used in oncology trials, illustrate a shift toward persistent measurement that bridges hospital discharge and home recovery. Device makers now position hybrid portfolios, pairing disposable contact probes for invasive procedures with cloud-connected IR kiosks for visitor screening, allowing each care setting to select the optimal workflow.

The contact segment's breadth supports innovation beyond simple sticks. High-acuity wards increasingly automate readings via cable-free oral probes docked in central nursing dashboards. Algorithm-ready data streams enable early sepsis detection models and medication titration engines. Meanwhile, non-contact system improvements in optics, distance-to-spot ratio, and ambient compensation have narrowed the accuracy gap to +-0.4 °C in some premium SKUs. Suppliers layer AI on board to flag poor aiming or excessive environmental drift, reinforcing user confidence and expanding addressable clinical cases.

Hospitals and large clinics rely on vetted distributors, generating 71.47% of 2024 revenue through the offline channel. Group purchasing organizations bundle thermometers with infusion pumps and monitors, favoring suppliers that offer clinical evidence and technical service contracts. Despite offline strength, the body temperature monitoring market witnesses rapid e-commerce uptake as small practices and households order direct from brand sites or marketplaces. Online sales surged during COVID-19 lockdowns and sustained momentum as consumers accepted self-care roles. Emerging direct-to-consumer brands leverage data dashboards, app-based coaching, and firmware updates to differentiate beyond price.

Distributors respond by digitizing catalogues and enabling click-and-collect models that preserve fulfillment control. Manufacturers experiment with subscription-based firmware analytics, creating recurring revenue on top of device shipments. Regulation continues to anchor a sizable offline base because many institutional buyers need calibration certificates and technical in-service training not yet matched by pure-play e-commerce storefronts.

The Body Temperature Monitoring Market Report is Segmented by Product (Contact [Digital Thermometers and More], Non-Contact [Non-Contact Infrared Thermometers and More], and More), Distribution Channel (Offline and Online), Application (Oral Cavity and More), End Users (Hospitals and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America delivered the largest regional share at 41.58% in 2024, benefiting from mature reimbursement environments, hospital digitization programs, and early adoption of AI-enabled analytics. Integration partnerships between academic medical centers and OEMs fast-track pilots for multi-sensor platforms that combine temperature, blood oxygen, and motion data to predict deterioration events. The region's stable 4.49% CAGR is underwritten by chronic disease prevalence and an expanding remote-care ecosystem that reimburses continuous monitoring hardware.

Asia-Pacific is the fastest-growing territory at 5.75% CAGR, linked to rising middle-class healthcare expectations and government stimulus for smart hospitals. China's domestic manufacturers leverage scale and component verticalization to ship economical IR thermometers into export and domestic channels. Japan's super-aged society drives home-care wearable uptake. India's digital-health policy encourages remote vital sign kits in rural clinics, broadening the body temperature monitoring market footprint beyond urban tertiary centers. High smartphone penetration simplifies user onboarding for app-centric devices, while multinational brands form joint ventures to navigate heterogeneous regulatory schemes.

Europe maintains a robust trajectory with a 4.83% CAGR to 2030. Stringent data-protection rules catalyze on-device encryption and local gateway storage solutions, improving patient trust. Mercury device bans progress under the Minamata Convention alignment, triggering accelerated replacement cycles for digital and IR units. The Middle East and Africa, growing at 5.42% CAGR, channels oil revenues into tertiary healthcare clusters and public screening infrastructure. Mass events such as pilgrimages amplify demand for rapid, non-contact screening portals. South America progresses at 5.16% CAGR as public insurers upgrade basic equipment and private hospitals install connected monitoring suites. Currency swings and import tariffs continue to influence price positioning, rewarding value engineering and local assembly strategies.

- A&D Medical

- American Diagnostic Corp.

- Baxter

- Beckton Dickinson

- Bioland Technology Limited.

- Blue Spark Technologies, Inc.

- Briggs Healthcare

- Cardinal Health

- Citizen Systems Japan Co., Ltd.

- Easywell Biomedicals

- Exergen

- Famidoc Technology Co., Ltd.

- Guangzhou Berrcom Medical Device Co., Ltd.

- Hangzhou Hua'an Medical & Health Instruments Co.,Ltd.

- Hartmann Group

- Helen of Troy

- Hicks India

- iHealth Labs

- Kinsa Health, LLC

- Koninklijke Philips

- Microlife

- OMRON

- Shenzhen Jumper Medical Equipment Co., Ltd.

- Solventum Corporation

- Terumo

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising infectious-disease outbreaks drive screening demand

- 4.2.2 Digital & wearable sensor innovations lower ownership cost

- 4.2.3 Hygiene-focused shift to non-contact IR thermometers

- 4.2.4 Expanding pediatric & geriatric cohorts needing frequent checks

- 4.2.5 Smart-hospital IoT integration of temperature data

- 4.2.6 Fertility-tracking wearables using wrist-skin temperature

- 4.3 Market Restraints

- 4.3.1 Accuracy & user-error concerns with IR devices

- 4.3.2 Privacy pushback on continuous wearable data capture

- 4.3.3 Mercury-based device bans squeezing low-income markets

- 4.3.4 False-security risk from mass thermal imaging at public venues

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Contact

- 5.1.1.1 Digital Thermometers

- 5.1.1.2 Infrared Ear Thermometers

- 5.1.1.3 Other Contact Products

- 5.1.2 Non-Contact

- 5.1.2.1 Non-contact Infrared Thermometers

- 5.1.2.2 Thermal Scanners

- 5.1.3 Wearable & Continuous-Monitoring Devices

- 5.1.1 Contact

- 5.2 By Distribution Channel

- 5.2.1 Offline

- 5.2.2 Online

- 5.3 By Application

- 5.3.1 Oral Cavity

- 5.3.2 Rectum

- 5.3.3 Ear

- 5.3.4 Other Applications

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Clinics

- 5.4.3 Home-care Settings

- 5.4.4 Other End-Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Competitive Benchmarking

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 A&D Medical

- 6.4.2 American Diagnostic Corp.

- 6.4.3 Baxter International

- 6.4.4 Becton, Dickinson and Company

- 6.4.5 Bioland Technology Limited.

- 6.4.6 Blue Spark Technologies, Inc.

- 6.4.7 Briggs Healthcare

- 6.4.8 Cardinal Health

- 6.4.9 Citizen Systems Japan Co., Ltd.

- 6.4.10 Easywell Biomedicals

- 6.4.11 Exergen Corporation

- 6.4.12 Famidoc Technology Co., Ltd.

- 6.4.13 Guangzhou Berrcom Medical Device Co., Ltd.

- 6.4.14 Hangzhou Hua'an Medical & Health Instruments Co.,Ltd.

- 6.4.15 Hartmann Group

- 6.4.16 Helen of Troy Limited

- 6.4.17 Hicks India

- 6.4.18 iHealth Labs Inc.

- 6.4.19 Kinsa Health, LLC

- 6.4.20 Koninklijke Philips N.V.

- 6.4.21 Microlife Corporation

- 6.4.22 Omron Corporation

- 6.4.23 Shenzhen Jumper Medical Equipment Co., Ltd.

- 6.4.24 Solventum Corporation

- 6.4.25 Terumo Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment