PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849837

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849837

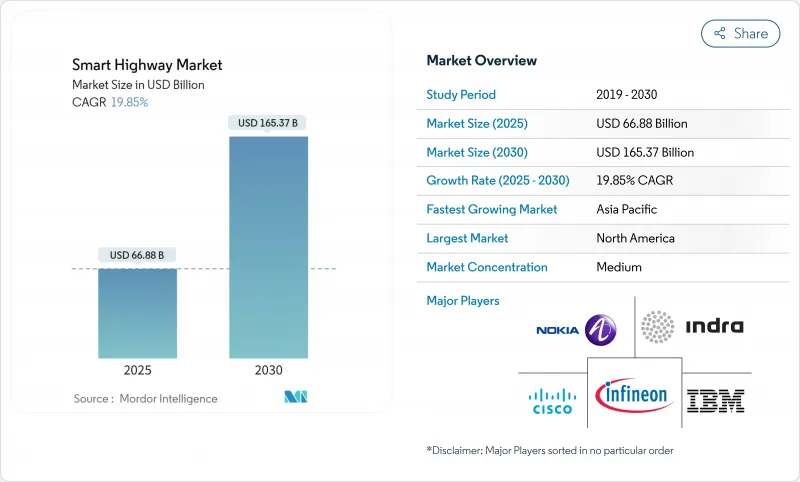

Smart Highway - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The smart highway market size is valued at USD 66.88 billion in 2025 and is forecast to reach USD 165.37 billion by 2030, rising at a 19.85% CAGR.

Strong public-sector capital programs, rapid advances in connected-vehicle standards, and steep declines in sensor prices anchor this growth trajectory. Asia-Pacific remains pivotal as central and provincial authorities channel funds into multi-lane expressways equipped with IoT nodes, while North America and Europe align regulatory road-safety targets with technology mandates. Large highway owners are shifting from asset-centric procurement to service-level contracting, paving the way for cloud-native traffic platforms that scale nationwide. Private operators view embedded EV-charging strips and solar surface tiles as fresh revenue lanes, and venture-backed software firms are racing to secure edge-analytics footholds before 5G latency advantages normalize.

Global Smart Highway Market Trends and Insights

Government smart-infrastructure spending surge

Record-level public appropriations are underwriting multi-year construction pipelines. The Infrastructure Investment and Jobs Act allocates USD 1.2 trillion, including a USD 7.5 billion carve-out for nationwide charging corridors, while India's 2025 budget channels INR 2,87,333 crore (USD 34.5 billion) toward highway modernisation. Dedicated grant programs tie funds to digital-infrastructure milestones, which effectively guarantee procurement for advanced sensing, analytics, and V2X modules.

Growing traffic-congestion costs

Urban congestion now erodes municipal GDP growth and undermines emissions targets, pressing authorities to deploy AI-directed adaptive signalling. Early deployments in Singapore and London showed measurable travel-time reductions and volatile-organic-compound declines, reinforcing the economic case for city-to-cloud traffic telemetry.

Rapid sensor / IoT cost decline

Unit prices for radar, lidar, and vision modules have fallen faster than Moore's Law projections, opening secondary corridors and peri-urban arterials to digital upgrades. Low-power cameras with on-board AI inference now ship at price points once reserved for basic CCTV, accelerating total lane-kilometre coverage.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory road-safety regulations

- High capex & long payback

- Data-privacy & cyber-security risks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services held 46% revenue share in 2024 as governments relied on integrators to dovetail legacy assets with edge-native platforms. Advisory teams orchestrate change-management programs, while managed-service contracts guarantee round-the-clock network uptime. Software revenue is smaller today yet grows at an 18.8% CAGR, propelled by subscription-based analytics that monetise traffic metadata. Hardware remains essential but is increasingly commoditised; the arrival of software-defined roadside units enables over-the-air feature releases without civil-works disruption. This architecture boosts lifetime ROI and eases compliance with evolving V2X standards.

Smart highway market operators recognise that labour-intensive design-build-operate contracts transfer performance risk to vendors. Outcome-oriented service-level agreements encourage predictive maintenance driven by digital twins that mirror pavement stress and signal latency, lowering unplanned closures. As procurement offices pivot toward total-cost-of-ownership metrics, service consortia are likely to consolidate, echoing trends seen in cloud-infra outsourcing during the prior decade.

Smart traffic management systems account for 38% of 2024 revenue and remain the entry point for municipal pilots. AI-guided signal phasing, variable-speed advisories, and hard-shoulder running demonstrate visible congestion relief that satisfies commuter watchdogs. Communication systems, projected to expand at 20.5% CAGR, underpin emerging cooperative-driving use cases. The edge-cloud mesh handles sub-ten-millisecond handshakes between connected vehicles and gantry radios, enabling lane-merge orchestration at scale.

A notable shift is the infusion of computer-vision cameras that dynamically adjust resolution grids to cut energy draw while tracking dense traffic scenes. Platform suppliers bundle these sensors with microservices that feed predictive engines, moving the smart highway market beyond reactive control loops to anticipatory optimisation.

The Smart Highway Market Report is Segmented by Component (Hardware, Software, and Services), by Product Technology (Smart Transport Management, and More) by Application (Traffic Congestion Management, Safety and Incident Detection, and More), by Deployment Model (On-Premise, Cloud-Based, and More), by Road Type (Highway, Urban Road, and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific secures 35% revenue and expands at an 18.3% CAGR through 2030. National governments position digital corridors as engines for economic rebalancing from coastal megacities to interior manufacturing hubs. China's rollout of nearly 800 smart-city pilots embeds roadway telemetry in wider data-governance frameworks.India deepens budget-line allocations, helped by multi-lateral green-bond issuances that ring-fence funds for ITS.

Europe commands 31% share and champions common standards that enable cross-border continuity. The UK's Connected & Automated Mobility roadmap assigns GBP 100 million (USD 126 million) to prove self-driving logistics corridors, projecting a GBP 42 billion market by 2035. Scandinavian administrations integrate smart highways with green-hydrogen truck stops to align with Fit-for-55 emissions ceilings, turning climate policy into procurement leverage.

North America holds 27% revenue and grows at 15.1% CAGR. Federal stimulus accelerates design-build finance models, while state DOTs embrace open-application-programming-interface mandates that level the playing field for mid-sized software vendors. Canada pilots digital-twin sub-layers beneath resurfaced asphalt to model freeze-thaw stress, and Mexico bundles ITS rollouts with fibre concessions along tollways to cross-subsidise capital outlays. The smart highway market size in North America is slated to reach USD 44.7 billion by 2030.

- Alcatel-Lucent Enterprise (Nokia)

- Cisco Systems Inc.

- IBM Corporation

- Indra Sistemas SA

- Infineon Technologies AG

- Huawei Technologies Co. Ltd

- Kapsch TrafficCom AG

- LG CNS Co. Ltd

- Schneider Electric SE

- Siemens AG

- Xerox Holdings Corporation

- Thales Group

- Iteris Inc.

- Cubic Transportation Systems

- SWARCO AG

- TransCore (Roper Tech.)

- Econolite Group Inc.

- TomTom N.V.

- Conduent Inc.

- Continental AG

- FLIR Systems Inc.

- PTC Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government smart-infrastructure spending surge

- 4.2.2 Growing traffic-congestion costs

- 4.2.3 Mandatory road-safety regulations

- 4.2.4 Rapid sensor/IoT cost decline

- 4.2.5 Emerging C-AV ready corridor pilots

- 4.2.6 Dynamic in-road EV-charging pilots

- 4.3 Market Restraints

- 4.3.1 High capex and long payback

- 4.3.2 Data-privacy and cyber-security risks

- 4.3.3 Inter-agency interoperability gaps

- 4.3.4 PPP procurement delays

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Industry Stakeholder Analysis

- 4.8 Key Recent Case Studies

- 4.9 Investment Analysis

- 4.10 Porter's Five Forces

- 4.10.1 Threat of New Entrants

- 4.10.2 Bargaining Power of Buyers

- 4.10.3 Bargaining Power of Suppliers

- 4.10.4 Threat of Substitutes

- 4.10.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Product Technology

- 5.2.1 Smart Traffic Management Systems

- 5.2.2 Smart Transport Management Systems

- 5.2.3 Monitoring Systems

- 5.2.4 Communication Systems

- 5.2.5 Lighting and Energy Systems

- 5.3 By Application

- 5.3.1 Traffic Congestion Management

- 5.3.2 Safety and Incident Detection

- 5.3.3 Smart Parking

- 5.3.4 Toll Collection

- 5.3.5 Emission Monitoring

- 5.3.6 Connected and Autonomous Vehicle Support

- 5.4 By Deployment Model

- 5.4.1 On-premise

- 5.4.2 Cloud-based

- 5.4.3 Hybrid

- 5.5 By Road Type

- 5.5.1 Highway

- 5.5.2 Urban Road

- 5.5.3 Expressway

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 APAC

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Rest of APAC

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Nigeria

- 5.6.5.6 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Alcatel-Lucent Enterprise (Nokia)

- 6.4.2 Cisco Systems Inc.

- 6.4.3 IBM Corporation

- 6.4.4 Indra Sistemas SA

- 6.4.5 Infineon Technologies AG

- 6.4.6 Huawei Technologies Co. Ltd

- 6.4.7 Kapsch TrafficCom AG

- 6.4.8 LG CNS Co. Ltd

- 6.4.9 Schneider Electric SE

- 6.4.10 Siemens AG

- 6.4.11 Xerox Holdings Corporation

- 6.4.12 Thales Group

- 6.4.13 Iteris Inc.

- 6.4.14 Cubic Transportation Systems

- 6.4.15 SWARCO AG

- 6.4.16 TransCore (Roper Tech.)

- 6.4.17 Econolite Group Inc.

- 6.4.18 TomTom N.V.

- 6.4.19 Conduent Inc.

- 6.4.20 Continental AG

- 6.4.21 FLIR Systems Inc.

- 6.4.22 PTC Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment