PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849838

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849838

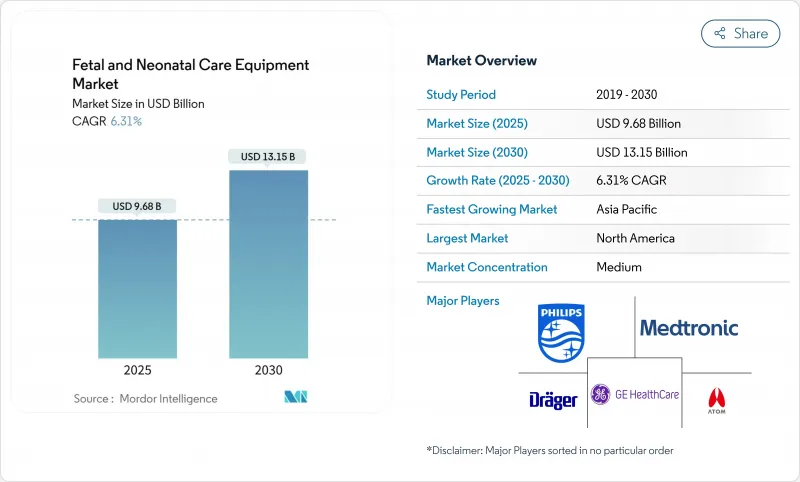

Fetal And Neonatal Care Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The fetal and neonatal care equipment market was valued at USD 9.68 billion in 2025 and is forecast to reach USD 13.15 billion by 2030, advancing at a 6.31% CAGR.

Growth stems from the convergence of higher preterm birth rates, wider use of AI-powered predictive analytics, and sizeable government investments that expand neonatal intensive-care capacity, especially in China where maternal mortality fell to 14.3 per 100,000 in 2024. Rising demand for wireless and portable monitors is dismantling long-standing reliance on tethered systems, while cybersecurity requirements influence product design and procurement decisions.Hospital buying power remains decisive, yet remote monitoring programs that enable early discharge are shifting revenue toward home-care channels. Competitive dynamics intensify as leading manufacturers integrate AI algorithms, secure-by-design architectures, and cloud connectivity, often through targeted acquisitions of start-ups that specialize in fetal diagnostics.

Global Fetal And Neonatal Care Equipment Market Trends and Insights

Increasing Number of Pre-Term and Low-Birth-Weight Deliveries

Preterm births rose to 10.4% of live births in the United States in 2023, a decade high that translates into sustained demand for advanced incubators, ventilators, and monitoring systems. The March of Dimes estimates annual economic losses of USD 25.2 billion from preterm births, sharpening hospital focus on early-intervention technologies. China's CARE-Preterm cohort noted a 10.74% mortality rate among very preterm infants, underscoring the clinical need for sophisticated support equipment. Higher maternal age intensifies risk: women aged 40 and older recorded a 14.8% preterm rate, creating a premium segment ready to pay for AI-enabled fetal diagnostics. These factors together lift demand for neonatal devices and recurring consumables that underpin the fetal and neonatal care equipment market.

Accelerating Demand for Point-of-Care Fetal Monitoring in Low-Resource Settings

Affordable innovations are redefining care pathways in emerging economies. A Malawian pilot showed the USD 56 Optoco external tocodynamometer produced clinically acceptable readings compared with premium systems. Uganda's deployment of the Moyo device improved intrapartum fetal heart-rate detection while maintaining user acceptance. NIH funding that rewards non-invasive prototypes incentivizes commercial scale-up of low-cost monitors nibib.nih.gov. China's neonatal mortality drop to 2.8 per mille in 2024 further illustrates how public funding lifts demand for accessible equipment. Collectively these trends enlarge the fetal and neonatal care equipment market by opening new buyer segments in low-resource settings.

Stringent Regulatory Timelines for Novel Device Approvals

FDA de-novo approvals fell to only 2 in 2025 versus 12 during 2024 as workforce reductions slowed reviews, adding months to commercialization schedules and deferring revenues. Harmonized Quality System Regulation amendments effective February 2026 introduce new documentation layers that raise compliance costs. Security documentation mandated under Section 524B further extends submission packages. Small innovators, often at the forefront of AI diagnostics, face resource constraints that can delay product launches and temper growth in the fetal and neonatal care equipment market.

Other drivers and restraints analyzed in the detailed report include:

- AI-Powered Predictive Analytics Improving Neonatal Outcomes

- Government Support to Boost NICU Capacity Expansion

- Cyber-Security Risks in Connected Fetal Monitoring Platforms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Neonatal equipment controlled 56.23% of 2024 revenue in the fetal and neonatal care equipment market, anchored by incubators, ventilators, and thermoregulation systems sold into expanding NICU footprints. Incubators led unit shipments, with enhancements such as humidity-regulated micro-environments and integrated jaundice forecasting software like Draeger's BiliPredics elevating clinical value. Respiratory support devices capitalized on rising very-preterm survival rates; Vyaire's fabian Therapy evolution now offers closed-loop FiO2 control that reduces manual titration time. The fetal and neonatal care equipment market size for neonatal respiratory devices is projected to climb at 7.2% CAGR through 2030 as guidelines favor early non-invasive ventilation.

Fetal care devices, though smaller in absolute revenue, are on track for an 8.02% CAGR. AI-enhanced ultrasound, exemplified by GE's Vscan Air CL and Exo's Iris handheld with SweepAI algorithms, shortens exam times while improving detection fidelity. NIH funding that awarded USD 75,000 to six RADx finalists validates pipeline momentum in non-invasive pulse-oximetry and wearable cardiotocography solutions. The fetal and neonatal care equipment market size for pulse oximeters is forecast to expand 9.4% annually, reflecting demand for continuous, cable-free oxygen-saturation tracking during labor and the early neonatal period.

The Fetal and Neonatal Care Equipment Market Report is Segmented by Product Type (Fetal Care Equipment [Fetal Dopplers and More] and Neonatal Care Equipment [Incubators and More]), End User (Hospitals, Home-Care Settings, and More), Modality (Stand-Alone Devices and Portable/Handheld Devices), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38.69% of global revenue in 2024 on the back of advanced NICU penetration and early AI adoption. Nevertheless, extended FDA timelines and cybersecurity compliance costs temper near-term growth. The fetal and neonatal care equipment market size in North America is set to rise from USD 3.75 billion in 2025 to USD 4.9 billion by 2030 at a 5.5% CAGR.

Asia Pacific charts a 9.01% CAGR, underpinned by Chinese and Indian public-health investments and aggressive technology scale-up programs. Samsung Medison's USD 93 million purchase of Sonio signals regional ambition to dominate AI-fetal diagnostics. India's National Health Mission continues to distribute free neonatal care packages that spur equipment demand in secondary-tier cities.

Europe maintains steady mid-single-digit expansion, helped by sustainability procurement rules that favor helium-free MRI and cableless monitors. Latin America focuses on cost-optimized imports, and the Middle East invests via public-private partnerships to upgrade maternal-fetal services.

- Atom Medical Corp.

- Beckton Dickinson

- Dragerwerk

- GE HealthCare Technologies Inc.

- Koninklijke Philips

- Masimo Corp.

- Medtronic

- Natus Medical

- Phoenix Medical Systems

- Vyaire Medical

- Fisher & Paykel Healthcare

- ICU Medical

- Nihon Kohden Corp.

- Inspiration Healthcare Group plc

- Mennen Medical Group

- Fanem LTDA

- Bispectral Medical

- Heinen + Lowenstein GmbH

- Utah Medical Products

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Number Of Pre-Term And Low-Birth-Weight Deliveries

- 4.2.2 Accelerating Demand For Point-Of-Care Fetal Monitoring In Low-Resource Settings

- 4.2.3 AI-Powered Predictive Analytics Improving Neonatal Outcomes

- 4.2.4 Government Support To Boost NICU Capacity Expansion

- 4.2.5 Shift Toward Non-Contact Phototherapy & Warmers To Reduce Infection Risk

- 4.2.6 Growth Of Single-Use Disposable Consumables In NICU Workflow

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Timelines For Novel Device Approvals

- 4.3.2 High Upfront Cost Of Advanced Integrated NICU Workstations

- 4.3.3 Shortage Of Trained Neonatologists & Nurses In Certain Regions

- 4.3.4 Cyber-Security Risks In Connected Fetal Monitoring Platforms

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- By Product Type

- 5.1 Fetal Dopplers

- 5.1.1 Fetal Magnetic Resonance Imaging (MRI) Devices

- 5.1.1.1 Ultrasound Devices

- 5.1.1.2 Fetal Pulse Oximeters

- 5.1.1.3 Other Fetal Care Equipment

- 5.1.2 Neonatal Care Equipment

- 5.1.2.1 Incubators

- 5.1.2.2 Neonatal Monitoring Devices

- 5.1.2.3 Phototherapy Equipment

- 5.1.2.4 Respiratory Assistance & Monitoring Devices

- 5.1.2.5 Other Neonatal Care Equipment

- 5.1.1 Fetal Magnetic Resonance Imaging (MRI) Devices

- 5.1 Fetal Dopplers

- 5.2 By End-user

- 5.2.1 Hospitals

- 5.2.2 Maternity Clinics & Birthing Centers

- 5.2.3 Home-Care Settings

- 5.3 By Modality

- 5.3.1 Stand-alone Devices

- 5.3.2 Portable/Hand-held Devices

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Atom Medical Corp.

- 6.3.2 Becton, Dickinson & Co.

- 6.3.3 Dragerwerk AG & Co. KGaA

- 6.3.4 GE HealthCare Technologies Inc.

- 6.3.5 Koninklijke Philips N.V.

- 6.3.6 Masimo Corp.

- 6.3.7 Medtronic plc

- 6.3.8 Natus Medical Inc.

- 6.3.9 Phoenix Medical Systems Pvt Ltd

- 6.3.10 Vyaire Medical Inc.

- 6.3.11 Fisher & Paykel Healthcare Ltd

- 6.3.12 ICU Medical

- 6.3.13 Nihon Kohden Corp.

- 6.3.14 Inspiration Healthcare Group plc

- 6.3.15 Mennen Medical Group

- 6.3.16 Fanem LTDA

- 6.3.17 Bispectral Medical

- 6.3.18 Heinen + Lowenstein GmbH

- 6.3.19 Utah Medical Products Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment