PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849848

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849848

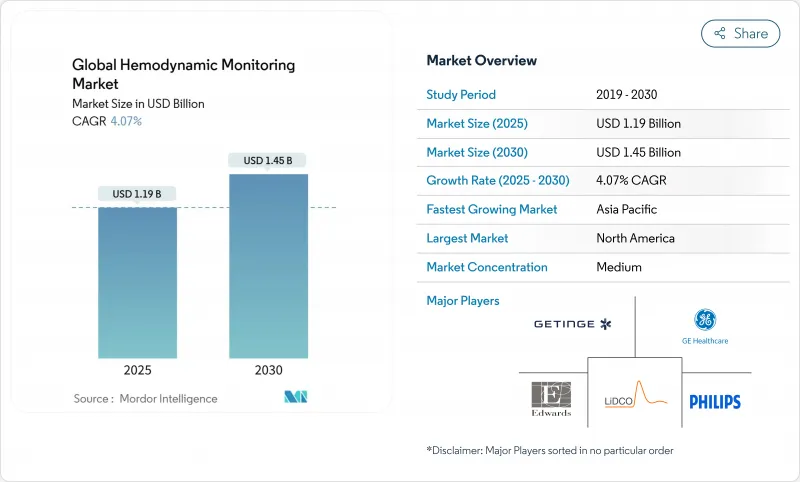

Global Hemodynamic Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Global Hemodynamic Monitoring Market size is estimated at USD 1.19 billion in 2025, and is expected to reach USD 1.45 billion by 2030, at a CAGR of 4.07% during the forecast period (2025-2030).

Growth remains steady rather than rapid because providers prioritize cost control and outcome gains, steering investments toward non-invasive platforms and AI-powered analytics that cut complications and staff workload. Aging populations in North America, Europe, Japan, and increasingly China lift the clinical demand curve for continuous cardiovascular surveillance, while hospital-at-home models open fresh demand pockets for remote monitoring hardware and software. Manufacturers respond by integrating goal-directed therapy algorithms, sepsis early-warning scores, and predictive blood-pressure indices into unified dashboards that shorten ICU stays. Competitive dynamics intensified after BD bought Edwards Lifesciences' Critical Care unit. This deal immediately gave the buyer the largest installed base of intelligent monitors and set an acquisition premium for end-to-end platforms.

Global Hemodynamic Monitoring Market Trends and Insights

Increasing Critically Ill Geriatric Population

People aged 65 and older are the fastest-growing hospital demographic, driving durable demand for continuous hemodynamic surveillance. Elderly surgical patients experience higher instability rates, and goal-directed therapy reduces complications by 58%, making predictive monitors essential to resource planning. Hospitals favor non-invasive technologies that cut infection risk and improve comfort, and payers reimburse longer observation windows to curb readmissions. Consequently, vendors market platforms that integrate arterial-waveform analytics with frailty scores to guide fluid resuscitation in real time.

Rising Prevalence of Cardiovascular Disorders & Diabetes

Diabetes triples the likelihood of perioperative cardiovascular events, pushing ICUs to adopt dual glucose-and-pressure monitoring suites. FDA clearance of the Sepsis ImmunoScore AI tool, which delivers 85% diagnostic accuracy, illustrates the value of algorithmic triage in mixed-risk patients. Each avoided septic-shock incident saves USD 50,000 in critical-care costs, and hospitals use such economics to justify enterprise-wide rollouts of integrated hemodynamic dashboards.

Complications Associated with Invasive Monitoring Systems

Infection, bleeding, and vascular injury occur in 2-15% of catheter insertions, prompting clinicians to reserve invasive lines for only the sickest cases. Studies confirm non-invasive impedance cardiography can replace arterial lines in many moderate-risk surgeries without compromising outcome quality. As litigation concerns mount, administrators update protocols to favor ultrasound-guided cannulation or entirely catheter-free modalities.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements in Minimally & Non-Invasive Monitoring

- Growing Adoption of Hemodynamic Optimization During ERAS Protocols

- Stringent FDA / CE Approval Pathways

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Minimally invasive platforms captured 42.11% of the hemodynamic monitoring market share in 2024, reflecting decades of clinician familiarity and detailed waveform analytics. Yet non-invasive systems top the growth league at a 5.01% CAGR, propelled by miniaturized sensors that match catheter precision and by payer pressure to limit infection-related extensions of stay. Across ICUs and step-down units, staff now rotate between cuffless blood-pressure cuffs for stable cases and arterial-waveform modules for acute decompensation within unified workstations. Hospitals cite reduced line-care costs and faster mobilization to justify capital spending.

Demand momentum signals a structural pivot: vendors bundle impedance cardiography, Doppler ultrasound, and photoplethysmography channels into one dockable chassis, meeting multiple acuity tiers with a single fleet. Software upgrades introduce deep-learning stroke-volume variation calculations that alert staff long before hypotension manifests, embedding clinical decision support at the bedside. As a result, the hemodynamic monitoring market size for non-invasive modalities is projected to add USD 160 million new revenue between 2025 and 2030, narrowing the gap with legacy invasive systems.

The Hemodynamic Monitoring Systems Market Report Segments the Industry Into System Type (Minimally Invasive Monitoring Systems, and More), Device (Pulmonary Artery Catheters, Pulse Contour Analysis Devices, and More), End User (Hospitals and Clinics, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 40.20% revenue share in 2024. Market dominance stems from robust ICU infrastructure, favorable private-payer contracts, and early integration of AI modules into perioperative workflows. The region adopts bundled-payment models that reward fewer complications, aligning economic incentives with algorithmic early-warning systems. Partnerships such as Philips and Mass General Brigham's live-data collaboration illustrate demand for enterprise-scale analytics platforms.

Asia-Pacific is the fastest-growing region, with a 6.13% CAGR through 2030. China fuels half the regional gain under Healthy China 2030 policies that subsidize advanced monitors in Tier-2 city hospitals. Japan's conditional approval pathway shortens time-to-market for breakthrough devices, while India's expanding middle class spurs private-hospital chains to deploy non-invasive cardiac output modules. Private equity flows into Asian telehealth portfolios further accelerate the hemodynamic monitoring market by financing remote patient monitoring rollouts.

Europe sustains measured expansion anchored in guideline standardization and perioperative care optimization. ERAS Society endorsements drive procurement of stroke-volume variation monitors across surgical wards. Although Brexit injects dual regulatory pathways, mutual-recognition arrangements keep supply chains stable. Tender committees increasingly demand evidence of cost-utility alongside performance, favoring platforms with peer-reviewed outcome data.

- Edwards Lifesciences Corp.

- Koninklijke Philips

- Getinge

- Baxter

- GE HealthCare Technologies Inc.

- ICU Medical

- Dragerwerk

- Masimo Corp.

- LiDCO Group

- Deltex Medical Group PLC

- Tensys Medical

- CNSystems Medizintechnik GmbH

- Terumo Corp.

- Mindray Bio-Medical Electronics Co.

- Nihon Kohden Corp.

- Schwarzer Cardiotek

- Uscom Ltd.

- Flosonics Medical

- Smiths Group

- Change Healthcare

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Critically Ill Geriatric Population

- 4.2.2 Rising Prevalence of Cardiovascular Disorders and Diabetes

- 4.2.3 Technological Advancements in Minimally and Non-invasive Monitoring

- 4.2.4 Growing Adoption of Hemodynamic Optimization During ERAS Protocols

- 4.2.5 AI-driven Predictive Analytics for Early Sepsis and Shock Detection

- 4.2.6 Wearable Doppler Ultrasound Patches Enabling Remote Monitoring

- 4.3 Market Restraints

- 4.3.1 Complications Associated with Invasive Monitoring Systems

- 4.3.2 Stringent FDA / CE Approval Pathways

- 4.3.3 Alarm Fatigue & Data Overload Reducing Clinical Uptake

- 4.3.4 Reimbursement Gaps for Peri-operative Optimization Bundles

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers / Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By System Type

- 5.1.1 Minimally Invasive Monitoring Systems

- 5.1.2 Invasive Monitoring Systems

- 5.1.3 Non-invasive Monitoring Systems

- 5.2 By Device

- 5.2.1 Pulmonary Artery Catheters

- 5.2.2 Pulse Contour Analysis Devices

- 5.2.3 Esophageal Doppler Systems

- 5.2.4 Electrical/Bio-impedance and Bio-reactance Monitors

- 5.2.5 Volume Clamp / CNAP Devices

- 5.2.6 Wearable Doppler Ultrasound Patches

- 5.2.7 Other Devices

- 5.3 By End User

- 5.3.1 Hospitals and Clinics

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Cath Labs and Diagnostic Centers

- 5.3.4 Home-care and Remote Patient Monitoring

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Edwards Lifesciences Corp.

- 6.3.2 Koninklijke Philips N.V.

- 6.3.3 Getinge AB

- 6.3.4 Baxter International Inc.

- 6.3.5 GE HealthCare Technologies Inc.

- 6.3.6 ICU Medical Inc.

- 6.3.7 Draegerwerk AG & Co. KGaA

- 6.3.8 Masimo Corp.

- 6.3.9 LiDCO Group PLC

- 6.3.10 Deltex Medical Group PLC

- 6.3.11 Tensys Medical Inc.

- 6.3.12 CNSystems Medizintechnik GmbH

- 6.3.13 Terumo Corp.

- 6.3.14 Mindray Bio-Medical Electronics Co.

- 6.3.15 Nihon Kohden Corp.

- 6.3.16 Schwarzer Cardiotek GmbH

- 6.3.17 Uscom Ltd.

- 6.3.18 Flosonics Medical

- 6.3.19 Smiths Medical

- 6.3.20 Change Healthcare

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment