PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849849

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849849

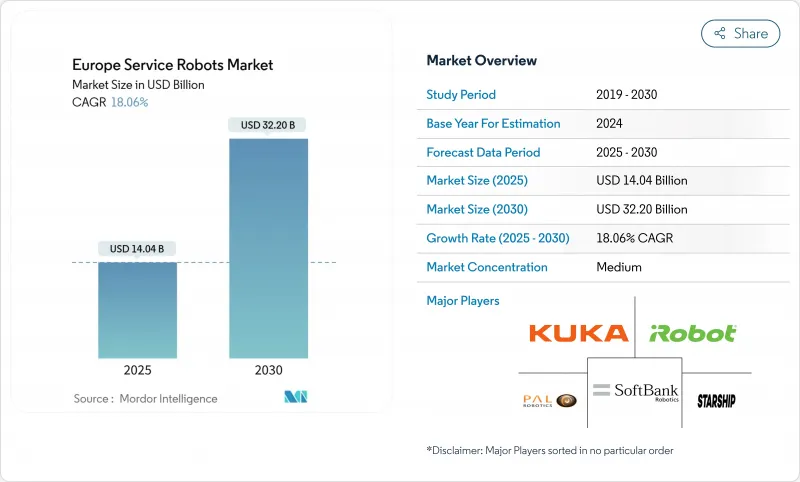

Europe Service Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe service robots market size is valued at USD 14.04 billion in 2025 and is forecast to reach USD 32.20 billion by 2030, advancing at an 18.06% CAGR.

The growth path is propelled by policy-backed automation programs, large-scale demographic shifts, and expanding e-commerce networks that collectively accelerate capital spending on autonomous systems. Strategic EU funding of nearly EUR 500 million (USD 548 million) under Horizon Europe has de-risked R&D for robotics start-ups and deep-tech suppliers, while labor shortages exceeding 1 million vacancies in health, hospitality, and logistics continue to tighten wage structures and sharpen the return-on-investment logic for robotic deployments. Professional platforms currently dominate the Europe service robots market through their proven ability to replace repetitive manual tasks in warehouses, hospitals, and farms, yet the personal segment is scaling rapidly as aging-in-place initiatives create budget lines for socially assistive devices.

Europe Service Robots Market Trends and Insights

Rapid Labour-Shortage-Driven Demand for AMRs in Logistics & Grocery Fulfilment

E-commerce volumes continue to outpace available warehouse labor, pushing third-party logistics providers toward aggressive adoption of autonomous mobile robots. DHL expects 30% of its material-handling assets to be robotic by 2030, a position echoed by Toyota Material Handling Europe, which confirms that 24/7 uptime imperatives are no longer negotiable and human-only workflows are uneconomical. German integrators such as Movu Robotics are securing multi-site contracts that bundle storage, picking, and pallet transport modules into unified automation stacks, allowing retailers to compress order-to-ship cycles even during seasonal labor crunches. Investment appetite remains strong as robotics leasing and robots-as-a-service arrangements lower balance-sheet risk for mid-sized operators. The result is a structurally higher baseline for autonomous deployments in the Europe service robots market.

EU "Farm to Fork" Subsidies Accelerating Agri-Robot Adoption

The European Commission's EUR 30 million (USD 32.9 million) AgrifoodTEF program offers test beds and advisory services that speed certification for agricultural robots, translating policy into tangible capital projects on Spanish, French, and Dutch farms. Vineyard operators in Spain report energy use of 1.42 kWh/h for electric tracked weed-removal robots, proving economic viability against fuel-powered tractors. Germany's robotics association notes measurable drops in soil compaction and emissions when lightweight field robots replace tractors, creating an environmental co-benefit that appeals to regulators and investors alike. Subsidy certainty through 2027 has pulled orders forward, lifting visibility in manufacturer order books and reinforcing the Europe service robots market's pivot toward outdoor applications.

Fragmented Safety Standards Delaying Multi-Country Roll-Outs

The transition from the Machinery Directive to the new Machinery Regulation and the simultaneous introduction of the AI Act create a patchwork of certification hurdles. Manufacturers must perform redundant conformity assessments that lengthen development cycles and increase compliance costs. ISO 13482's pending revision adds another moving target, while TUV-certification bottlenecks slow time-to-market for SMEs. An EU-level Service Desk is planned for 2025, yet the interim uncertainty curbs the scale-up ambitions of pan-European fleets, tempering the otherwise strong trajectory of the Europe service robots market

Other drivers and restraints analyzed in the detailed report include:

- Hospital Infection-Control Protocols Boosting UV-C Disinfection Robots

- Ageing-in-Place Policies Spurring Elder-Care Companion Robots

- Persistent Public Scepticism Over Autonomous Systems in Heritage City Centres

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Professional robots generated 63% of 2024 revenue, confirming their status as the economic backbone of the Europe service robots market. Uptake is concentrated in logistics, healthcare, and agriculture, where quantifiable savings on labor and uptime deliver rapid payback. The Europe service robots market size for professional platforms is forecast to expand in sync with fleet expansion programs at 3PLs and hospital chains, supported by robots-as-a-service contracts that shift spending from CapEx to OpEx. Software-centric moves by KUKA underline how incumbents are wrapping value-added analytics around hardware, a trend that reinforces switching costs for enterprise clients.

Personal robots remain a minority in absolute dollars yet emerge as the fastest-growing slice at 19.8% CAGR through 2030. Aging-in-place subsidies, falling component prices, and cloud connectivity create favorable economics for mobile assistants that handle routine chores and social interaction. Pilot data from Nordic programs confirm that care-robot usage cuts caregiver visits by 12% without compromising patient outcomes, offering fiscal relief for national health budgets. As social-acceptance studies progress, the Europe service robots market will likely witness a demand curve that mirrors the smartphone diffusion cycle rather than industrial automation pacing.

Ground robots captured 71% of 2024 sales, reflecting regulatory maturity and proven ROI in structured indoor settings. Warehouses, hospitals, and hotels provide controlled environments where AMRs can leverage SLAM navigation with limited risk, ensuring predictable throughput gains. The Europe service robots market size associated with ground deployments continues to grow as retailers convert brownfield sites into automated micro-fulfilment hubs.

Aerial platforms, however, post a 21.4% CAGR on the back of infrastructure inspection and precision-agriculture use cases. BVLOS exemptions and the rollout of 5G standalone networks furnish the bandwidth and regulatory clarity needed for routine unmanned flights over power lines, pipelines, and crop fields. German utilities estimate that drone-based inspections cut outage-related penalties by 15%, creating a compelling TCO narrative. As risk-based SORA frameworks harmonize across member states, aerial volumes are expected to carve out an increasingly material share of the Europe service robots market.

The Europe Service Robots Market is Segmented by Type (Personal Robots, Professional Robots), Operating Environment (Aerial, Land, and More), Components (Sensors, Actuators, and More), End-User Industry (Military and Defense, Agriculture, Construction and Mining, and More), and by Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- KUKA AG

- iRobot Corporation

- SoftBank Robotics Group

- PAL Robotics

- Starship Technologies

- Amazon Robotics

- Northrop Grumman Corporation

- DJI

- Parrot SA

- Blue Ocean Robotics

- Boston Dynamics

- ANYbotics

- Lely Holding

- SeaRobotics Corporation

- GeckoSystems Corporation

- RedZone Robotics

- Dyson Ltd.

- Robotnik Automation

- Husqvarna Group

- Robobuilder Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid labour-shortage-driven demand for AMRs in logistics & grocery fulfilment

- 4.2.2 EU Farm to Fork subsidies accelerating agri-robot adoption

- 4.2.3 Hospital infection-control protocols boosting UV-C disinfection robots

- 4.2.4 Ageing-in-place policies spurring elder-care companion robots

- 4.2.5 Start-ups exploiting low-cost spatial-AI chips for micro-mobility delivery bots

- 4.2.6 Pay-per-use RaaS models unlocking SME affordability

- 4.3 Market Restraints

- 4.3.1 Fragmented safety standards delaying multi-country roll-outs

- 4.3.2 Persistent public scepticism over autonomous systems in heritage city centres

- 4.3.3 Shortage of certified service-robot technicians

- 4.3.4 Lithium-ion supply volatility inflating BoM costs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Personal Robots

- 5.1.1.1 Domestic

- 5.1.1.2 Research & Education

- 5.1.1.3 Entertainment

- 5.1.2 Professional Robots

- 5.1.2.1 Field (Agriculture, Forestry)

- 5.1.2.2 Defense and Security

- 5.1.2.3 Medical and Healthcare

- 5.1.2.4 Logistics and Warehouse AMRs

- 5.1.2.5 Others

- 5.1.1 Personal Robots

- 5.2 By Operating Environment

- 5.2.1 Aerial (UAV/Drone)

- 5.2.2 Ground / Land

- 5.2.3 Marine and Underwater

- 5.3 By Component

- 5.3.1 Sensors

- 5.3.2 Actuators

- 5.3.3 Control Systems and Edge AI

- 5.3.4 Software (Navigation, Vision, Fleet-Mgmt)

- 5.3.5 Power Systems (Batteries, Fuel-cells)

- 5.4 By End-User Industry

- 5.4.1 Military and Defense

- 5.4.2 Agriculture, Construction & Mining

- 5.4.3 Transportation and Logistics

- 5.4.4 Healthcare and Life-Sciences

- 5.4.5 Government and Municipal Services

- 5.4.6 Hospitality and Retail

- 5.4.7 Others

- 5.5 By Country

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Netherlands

- 5.5.7 Sweden

- 5.5.8 Denmark

- 5.5.9 Finland

- 5.5.10 Norway

- 5.5.11 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 KUKA AG

- 6.4.2 iRobot Corporation

- 6.4.3 SoftBank Robotics Group

- 6.4.4 PAL Robotics

- 6.4.5 Starship Technologies

- 6.4.6 Amazon Robotics

- 6.4.7 Northrop Grumman Corporation

- 6.4.8 DJI

- 6.4.9 Parrot SA

- 6.4.10 Blue Ocean Robotics

- 6.4.11 Boston Dynamics

- 6.4.12 ANYbotics

- 6.4.13 Lely Holding

- 6.4.14 SeaRobotics Corporation

- 6.4.15 GeckoSystems Corporation

- 6.4.16 RedZone Robotics

- 6.4.17 Dyson Ltd.

- 6.4.18 Robotnik Automation

- 6.4.19 Husqvarna Group

- 6.4.20 Robobuilder Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment