PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849857

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849857

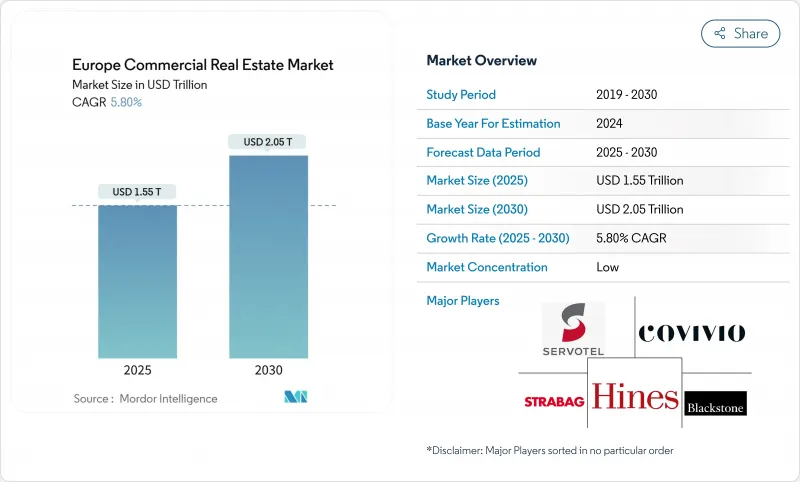

Europe Commercial Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The European commercial real estate market stands at USD 1.55 trillion in 2025 and is forecast to reach USD 2.05 trillion by 2030, reflecting a 5.8% CAGR as ample liquidity returns and investors pivot toward high-quality, sustainable assets.

A 25% rebound in transaction volumes to EUR 213 billion in 2025 signals renewed confidence, spurred by the European Central Bank's rate reductions and improving financing conditions Capital is gravitating toward Grade-A logistics facilities and green-certified offices, while mixed-use "living-as-a-service" projects gain traction for their resilience and alignment with new urban lifestyles. Regional performance is increasingly polarized: the United Kingdom retains scale leadership, Central and Eastern Europe accelerate on near-shoring demand, and Southern Europe leverages special-economic-zone incentives to attract fresh capital. Corporate net-zero mandates, demographic realignments, and evolving occupier preferences collectively sustain the growth outlook of the European commercial real estate market through 2030.

Europe Commercial Real Estate Market Trends and Insights

Demographic-led Urbanisation Clusters Reshaping Development Priorities

Secondary cities such as Manchester, Birmingham, Munich and Hamburg are absorbing population growth outpacing national averages, compressing office vacancy 2-3 percentage points below primary markets. Investment volumes in these German hubs grew 23% in 2024 as institutional capital seeks stable yields outside saturated capitals. Retail and mixed-use developments tailored to emerging live-work hubs dominate new pipelines, reflecting the European commercial real estate market's shift toward decentralised growth nodes . Developers now prioritise flexible floor plates and community-oriented amenities that match the demographic profile of young, mobile workforces. The trend is expected to influence land-use planning, infrastructure spending and forward-funding structures over the medium term.

E-commerce Acceleration Transforms Logistics Landscape

Online retail penetration is projected to reach 25% of total European sales by 2030, intensifying demand for modern distribution centres along key corridors in Poland, the Netherlands and Germany. Urban logistics hubs within 30-minute drive times of major populations command 15-20% rent premiums and near 98% occupancy. Forward leasing often secures entire projects before completion, underscoring scarcity of scalable, automation-ready stock. Advanced picking and sorting systems are incorporated into 73% of new warehouses as operators chase fulfilment speed and lower cost-per-package. The European commercial real estate market is therefore seeing logistics yields compress faster than any other sector, setting new benchmarks for prime-grade performance.

Regulatory Compliance Costs Strain Investment Returns

EU energy-performance requirements oblige owners in Germany, France, Spain and Italy to spend EUR 165 billion on retrofits by 2024 or risk asset stranding over the next decade. Renovations can exceed 30% of asset value, discouraging upgrades in lower-grade stock and widening the valuation gap between prime and secondary holdings. Financing for heavy-capex assets is scarce, steering capital toward already compliant buildings and amplifying a two-tier market. As a consequence, the European commercial real estate market is seeing opportunistic funds target discounted secondary inventories for deep-green repositioning strategies that can unlock value post-compliance.

Other drivers and restraints analyzed in the detailed report include:

- Near-shoring Initiatives Fuel Industrial Real Estate Boom

- Corporate Sustainability Mandates Redefine Office Quality Standards

- Financing Conditions Create Market Uncertainty

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Offices retained the largest share of 32% of 2024 revenue, but shifting work models and sustainability imperatives force owners to reposition portfolios. Prime CBD towers and adaptive-reuse campuses outperform, while legacy suburban stock falls into value-add or opportunistic territory. Retail is stabilising around experiential flagships that integrate digital-native concepts, registering 3.5% annual rental growth in top high-street districts. Meanwhile, data centres, life-science labs and hospitality are expanding faster than the broader European commercial real estate market, supported by AI workloads, demographic travel rebounds and specialised operator demand.

Logistics assets are projected to clock the fastest 7.1% CAGR between 2025-2030, propelled by near-shoring, e-commerce and the need for resilient distribution networks. Occupancy for new-generation facilities stays close to 95% despite robust development pipelines, evidencing structural undersupply. Tenant demand emphasises automation readiness, ESG certification and proximity to multimodal nodes, attributes that allow landlords to pass through indexed rental escalations. In the European commercial real estate market size calculations, logistics' incremental revenue contribution is set to outstrip offices through the forecast horizon.

The Europe Commercial Real Estate Market is Segmented by Property Type (Offices, Retail, Logistics, Others (industrial Real Estate, Hospitality Real Estate, Etc. ), by Business Model (Sales and Rental), by End-User (Individuals/Households, Corporates & SMEs, Others) and by Country (United Kingdom, Germany, France, Netherlands, Spain, Italy, Sweden, Poland and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Unibail-Rodamco-Westfield

- Covivio

- SEGRO Plc

- Landsec

- Vonovia SE

- British Land Company

- Klepierre SA

- Gecina SA

- Prologis Europe

- Goodman European Partnership

- Logicor Europe

- Blackstone Inc. (European Real Estate)

- Brookfield Asset Management (European Real Estate)

- Hines Europe

- Tishman Speyer Europe

- Strabag Real Estate

- HB Reavis Group

- CA Immo

- AG Real Estate

- Futureal Group

- Merlin Properties Socimi

- Deka Immobilien

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Commercial Real Estate Buying Trends - Socio-economic & Demographic Insights

- 4.3 Rental Yield Analysis

- 4.4 Capital-Market Penetration & REIT Presence

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Insights into Real Estate Tech and Startups Active in the Real Estate Segment

- 4.8 Insights into Existing and Upcoming Projects

- 4.9 Market Drivers

- 4.9.1 Demographic-led Urbanisation Clusters in Germany & the UK

- 4.9.2 Accelerated E-commerce Demand for Industrial & Logistics Assets

- 4.9.3 Near-shoring & Re-industrialisation Programs in CEE

- 4.9.4 Corporate Net-Zero Mandates Pushing Grade-A Green Offices

- 4.9.5 SEZ-linked Tax Incentives in Southern Europe

- 4.9.6 Rise of 'Living-as-a-Service' Mixed-Use Formats

- 4.10 Market Restraints

- 4.10.1 EPC-Class Upgrade Costs under EU Taxonomy

- 4.10.2 Monetary-Policy-Driven Financing Volatility

- 4.10.3 Geopolitical Risk Premium (Russia-Ukraine Spill-over)

- 4.10.4 Saturation of Prime High-Street Retail in Western Europe

- 4.11 Value / Supply-Chain Analysis

- 4.11.1 Overview

- 4.11.2 Real Estate Developers and Contractors - Key Quantitative and Qualitative Insights

- 4.11.3 Real Estate Brokers and Agents - Key Quantitative and Qualitative Insights

- 4.11.4 Property Management Companies - Key Quantitative and Qualitative Insights

- 4.11.5 Insights on Valuation Advisory and Other Real Estate Services

- 4.11.6 State of the Building Materials Industry and Partnerships with Key Developers

- 4.11.7 Insights on Key Strategic Real Estate Investors/Buyers in the Market

- 4.12 Porters Five Forces

- 4.12.1 Threat of New Entrants

- 4.12.2 Bargaining Power of Buyers/Occupiers

- 4.12.3 Bargaining Power of Suppliers (Developers/Builders)

- 4.12.4 Threat of Substitutes

- 4.12.5 Competitive Rivalry Intensity

5 Market Size & Growth Forecasts (Value)

- 5.1 By Property Type

- 5.1.1 Offices

- 5.1.2 Retail

- 5.1.3 Logistics

- 5.1.4 Others (industrial real estate, hospitality real estate, etc.)

- 5.2 By Business Model

- 5.2.1 Sales

- 5.2.2 Rental

- 5.3 By End-user

- 5.3.1 Individuals / Households

- 5.3.2 Corporates & SMEs

- 5.3.3 Others

- 5.4 By Country

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Netherlands

- 5.4.5 Spain

- 5.4.6 Italy

- 5.4.7 Sweden

- 5.4.8 Poland

- 5.4.9 Russia

- 5.4.10 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Unibail-Rodamco-Westfield

- 6.4.2 Covivio

- 6.4.3 SEGRO Plc

- 6.4.4 Landsec

- 6.4.5 Vonovia SE

- 6.4.6 British Land Company

- 6.4.7 Klepierre SA

- 6.4.8 Gecina SA

- 6.4.9 Prologis Europe

- 6.4.10 Goodman European Partnership

- 6.4.11 Logicor Europe

- 6.4.12 Blackstone Inc. (European Real Estate)

- 6.4.13 Brookfield Asset Management (European Real Estate)

- 6.4.14 Hines Europe

- 6.4.15 Tishman Speyer Europe

- 6.4.16 Strabag Real Estate

- 6.4.17 HB Reavis Group

- 6.4.18 CA Immo

- 6.4.19 AG Real Estate

- 6.4.20 Futureal Group

- 6.4.21 Merlin Properties Socimi

- 6.4.22 Deka Immobilien

7 Market Opportunities & Future Outlook