PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849858

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849858

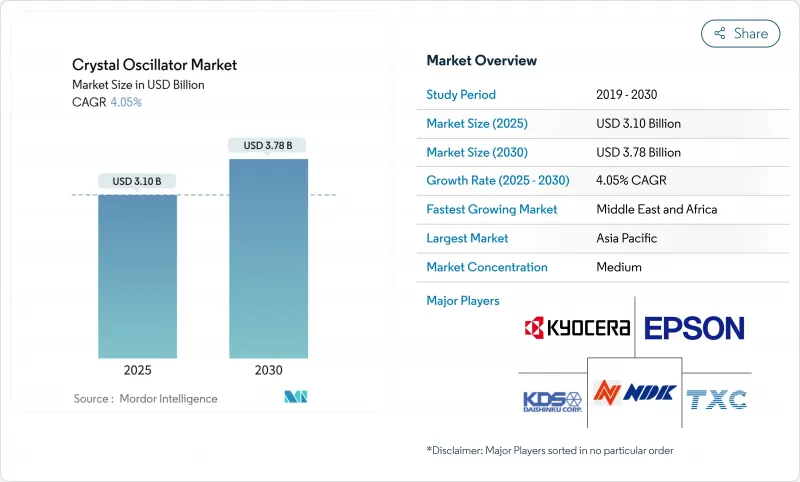

Crystal Oscillator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The crystal oscillator market is valued at USD 3.10 billion in 2025 and is forecast to reach USD 3.78 billion by 2030, advancing at a 4.05% CAGR.

The technology's entrenched role in 5G base stations, automotive radar, and precision industrial networks sustains demand even as component lifecycles shorten. Adoption accelerates wherever timing precision mitigates interference or data-integrity risks, such as 5G Time Division Duplex cells and GHz-level radar arrays. Migrations away from bulky rubidium standards toward compact Oven-Controlled Crystal Oscillators (OCXOs) in Low Earth Orbit satellites broaden the addressable base. Power-efficient designs for wearable and IoT nodes are expanding the reach of the crystal oscillator market into energy-harvesting environments where every microampere matters. Meanwhile, supply-chain fragility around synthetic quartz and tightening RoHS compliance remain persistent headwinds.

Global Crystal Oscillator Market Trends and Insights

Surge in 5G RRH and Small-Cell Deployments Requiring Ultra-Stable TCXOs

5G networks demand frequency and phase alignment within 1.5 µs to prevent uplink-downlink interference. Remote Radio Heads now embed +-50 ppb TCXOs and rely on Precision Time Protocol holdover when GNSS is spoofed, elevating timing from a cost line item to a quality-of-service safeguard. Network operators specify SC-cut crystal units from Epson that survive thermal shock, while small-cell vendors integrate board-level OCXO backups for indoor sites where GNSS is unavailable.

Automotive Radar and ADAS Uptake Driving GHz-Level OCXO Demand

The shift to 77-79 GHz radar enables centimeter-scale resolution but necessitates OCXOs with sub-100 fs jitter to avoid ghost targets. Vehicles hosting eight or more radar modules depend on coherent timing to fuse sensor data for Level-3 autonomy. Skyworks' Si5332 clock generator delivers ISO26262 compliance and phased-array synchronization to meet this requirement. Entry barriers rise because devices must pass AEC-Q200 and function from -40 °C to 125 °C, limiting competition to firms with deep automotive pedigrees.

MEMS Clock-Generator ASP Erosion Cannibalising Low-End Quartz XOs

SiTime's Clock-SoC integrates PLLs, resonators, and spread-spectrum functions, shrinking board area by 50% and letting OEMs drop multiple SPXOs. Although quartz still delivers 0.18 ps jitter at half the current of MEMS, the flexible frequency menu and reduced SKU count entice cost-sensitive buyers. Average selling prices on commodity SPXOs face down-pressure as MEMS volume grows, prompting quartz suppliers to double down on premium OCXO and automotive lines.

Other drivers and restraints analyzed in the detailed report include:

- Migration from Rubidium to High-Stability OCXOs in Space-Constrained LEO Satellites

- Rapid Proliferation of Wearable/IoT Nodes Mandating Miniature SPXOs and MEMS-XO Hybrids

- Supply-Chain Fragility of Synthetic Quartz Wafers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The TCXO category held a 36.2% slice of the crystal oscillator market in 2024, supported by telecom equipment that values +-100 ppb stability within tight budgets. Continuous miniaturization now reaches 2.0 X 1.6 mm packages without sacrificing +-1 ppm performance. However, the OCXO subsegment leads growth at 4.3% CAGR to 2030, fueled by LEO satellites and 5G edge servers demanding sub-ppm holdover. These trends position OCXOs to capture a larger share of the crystal oscillator market size for precision infrastructure spending.

OCXOs leverage double-oven designs, composite crystal cuts, and digital temperature compensation to slash warm-up power by 56% in Epson's OG7050CAN series. Simple Packaged Crystal Oscillators keep cost-driven consumer goods ticking, while VCXOs gain in Time-Sensitive Networking gateways that must retune frequency on demand. MEMS-based XOs command design wins where footprint trumps phase noise, despite higher BOM cost. FCXOs and SAW devices remain niche, serving test equipment and mm-wave links.

Surface-mount packages owned 68.7% revenue in 2024 and expand alongside smartphone and IoT board densities. Automated placement trims assembly minutes and frees designers to stack components on both PCB sides, reinforcing the crystal oscillator market's shift toward chip-level integration. The through-hole share persists only where vibration or thermal gradients threaten solder-joint integrity, such as rail-signaling modules or launch-vehicle avionics.

Legacy defense and space programs specify through-hole cans for field repairs and hermeticity. Rakon's space-qualified HC45 package offers 10-year aging below +-0.1 ppm, meeting QML-V screening levels. Meanwhile, surface-mount roadmap devices test 1,000-cycle-per-hour reflow profiles to endure consumer production lines. The dichotomy ensures both schemes stay relevant, although volume tilts further toward pick-and-place friendly outlines across the wider crystal oscillator market.

The Crystal Oscillator Market Report is Segmented by Crystal Type (Temperature-Compensated (TCXO), Oven-Controlled (OCXO), Voltage-Controlled (VCXO), and More), Mounting Scheme (Surface-Mount, and Thru-Hole), Crystal Cut (AT-Cut, BT-Cut, SC-Cut, and More), End-User Industry (Consumer Electronics, Telecom and Networking, Aerospace and Defense, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific held 47.6% of crystal oscillator market revenue in 2024, anchored by Japan's synthetic quartz autoclaves and China's PCB assembly scale. Japanese volumes dipped on weak Chinese handset output, with parts shipments down 25% year-on-year in 2024, yet regional capacity remained unrivaled for 8-inch wafer slicing. China's push for indigenous 5G radios still drives bulk SPXO purchases, cushioning producers against handset softness. South Korea and Taiwan specialize in midstream wafer processing, enabling regional closed-loop supply that lowers logistics cost per oscillator.

North America commands premium share in MEMS-based and military-grade OCXOs. SiTime's Silicon Valley fabless model co-opts TSMC MEMS lines, while Microchip's New Hampshire crystal plant supports Vectron-labelled aerospace cans. Defense budgets and datacenter upgrades prioritize performance over price, thus supporting higher average selling prices within the regional crystal oscillator market.

Europe concentrates on supply-chain hedge strategies. QuartzCom's Swiss wafers and Germany's R&D clusters mitigate Japan concentration risk. EU RoHS deadlines accelerate lead-free requalifications, creating services revenue for local test houses. Middle East and Africa advance fastest at 5.7% CAGR, spearheaded by Saudi Arabia's USD 266 million semiconductor hub forming 50 design houses by 2030. Smart-city rollouts in Riyadh and Dubai further expand regional demand for precise timing in IoT gateways and 5G small cells, broadening the crystal oscillator market footprint. South America remains modest, driven mainly by carrier upgrades in Brazil and Colombia, but logistic distances and limited upstream supply temper growth.

- Seiko Epson Corporation

- Kyocera Corporation

- Nihon Dempa Kogyo (NDK) Co. Ltd

- Daishinku Corp.

- TXC Corporation

- SiTime Corporation

- Rakon Ltd

- Vectron International (Microchip)

- Siward Crystal Technology Co. Ltd

- Hosonic Electronic Co. Ltd

- Fox Electronics

- CTS Corporation

- Abracon LLC

- ECS Inc.

- Micro Crystal AG

- Jauch Quartz GmbH

- Statek Corporation

- River Eletec Corporation

- Mercury Electronic Ind Co. Ltd

- Raltron Electronics Corporation

- Aker Technology Co. Ltd

- NEL Frequency Controls Inc.

- WTL Frequency Products Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in 5G RRH and Small-Cell Deployments Requiring Ultra-Stable TCXOs

- 4.2.2 Automotive Radar and ADAS Uptake Driving GHz-level OCXO Demand

- 4.2.3 Migration from Rubidium to High-Stability OCXOs in Space-Constrained LEO Satellites

- 4.2.4 Rapid Proliferation of Wearable/IoT Nodes Mandating Miniature SPXOs and MEMS-XO Hybrids

- 4.2.5 Factory-Floor Digitalisation (Industry 4.0) Elevating VCXO Use in Time-Sensitive Networking

- 4.2.6 Military Conversion to Software-Defined Radios Boosting SC-Cut OCXO Procurement

- 4.3 Market Restraints

- 4.3.1 MEMS Clock-Generator ASP Erosion Cannibalising Low-End Quartz XOs

- 4.3.2 Supply-Chain Fragility of Synthetic Quartz Wafers (Japan-Centric)

- 4.3.3 High-Temperature Drift Limiting XO Adoption in SiC-Based Powertrains

- 4.3.4 Stringent EU RoHS Lead-Free Solder Windows Raising Requalification Cost

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Trends on the Crystal Oscillator Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Crystal Type

- 5.1.1 Temperature-Compensated (TCXO)

- 5.1.2 Oven-Controlled (OCXO)

- 5.1.3 Voltage-Controlled (VCXO)

- 5.1.4 Simple Packaged (SPXO)

- 5.1.5 Frequency-Controlled (FCXO)

- 5.1.6 MEMS-Based Crystal Oscillators

- 5.1.7 Other Crystal Types

- 5.2 By Mounting Scheme

- 5.2.1 Surface-Mount

- 5.2.2 Thru-Hole

- 5.3 By Crystal Cut

- 5.3.1 AT-Cut

- 5.3.2 BT-Cut

- 5.3.3 SC-Cut

- 5.3.4 Others (IT-CUT, FC-Cut)

- 5.4 By End-user Industry

- 5.4.1 Consumer Electronics

- 5.4.2 Telecom and Networking

- 5.4.3 Automotive

- 5.4.4 Aerospace and Defense

- 5.4.5 Industrial Automation

- 5.4.6 Medical and Healthcare

- 5.4.7 Research and Measurement

- 5.4.8 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Nordics

- 5.5.2.5 Rest of Europe

- 5.5.3 South America

- 5.5.3.1 Brazil

- 5.5.3.2 Rest of South America

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South-East Asia

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Gulf Cooperation Council Countries

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Seiko Epson Corporation

- 6.4.2 Kyocera Corporation

- 6.4.3 Nihon Dempa Kogyo (NDK) Co. Ltd

- 6.4.4 Daishinku Corp.

- 6.4.5 TXC Corporation

- 6.4.6 SiTime Corporation

- 6.4.7 Rakon Ltd

- 6.4.8 Vectron International (Microchip)

- 6.4.9 Siward Crystal Technology Co. Ltd

- 6.4.10 Hosonic Electronic Co. Ltd

- 6.4.11 Fox Electronics

- 6.4.12 CTS Corporation

- 6.4.13 Abracon LLC

- 6.4.14 ECS Inc.

- 6.4.15 Micro Crystal AG

- 6.4.16 Jauch Quartz GmbH

- 6.4.17 Statek Corporation

- 6.4.18 River Eletec Corporation

- 6.4.19 Mercury Electronic Ind Co. Ltd

- 6.4.20 Raltron Electronics Corporation

- 6.4.21 Aker Technology Co. Ltd

- 6.4.22 NEL Frequency Controls Inc.

- 6.4.23 WTL Frequency Products Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment