PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849863

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849863

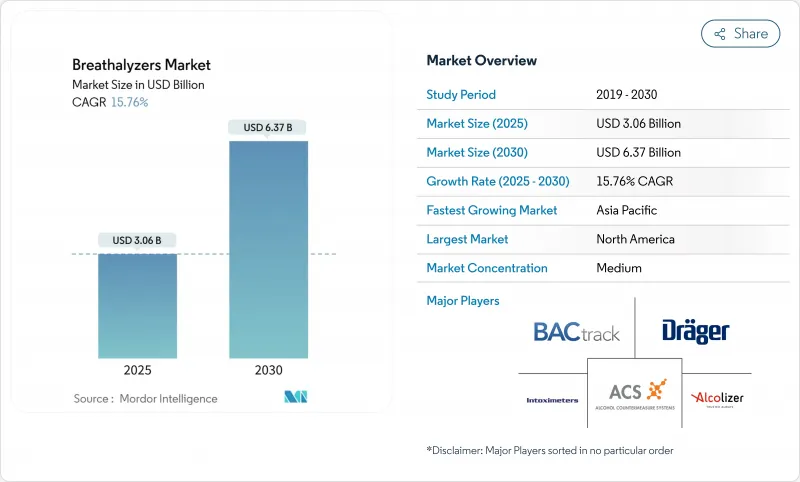

Breathalyzers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The breathalyzers market size is valued at USD 3.06 billion in 2025, is projected to climb to USD 6.37 billion by 2030, and is set to advance at a 15.76% CAGR through the forecast period.

Expanding ignition-interlock mandates across major economies keep a steady flow of orders for professional-grade units and sustain long-term service contracts for recalibration. At the same time, miniaturized, smartphone-linked models are opening a consumer channel that moves the market beyond deterrence and into everyday self-monitoring. Manufacturers are also being pulled toward healthcare as breath-based disease diagnostics gain scientific backing, prompting new partnerships between traditional safety firms and medical-device specialists. These overlapping opportunities are encouraging strategic investments in sensor accuracy, connectivity, and cloud analytics, while also blurring the line between public-sector and retail demand. Competitive differentiation is therefore shifting from hardware alone to integrated ecosystems that promise continuous compliance and actionable data.

Global Breathalyzers Market Trends and Insights

Tightening DUI Legislation and Expansion of Ignition-Interlock Mandates

National and sub-national authorities continue to lower acceptable blood-alcohol content (BAC) thresholds, sustaining demand momentum for evidential Breathalyzer market equipment. Expansion of ignition-interlock mandates in 31 US states ensures a recurring equipment replacement cycle, while similar legal tightening in South Korea and parts of Europe reinforces a dependable order pipeline. Utah's 0.05% limit and South Korea's revised Road Traffic Act illustrate a wider policy pivot. As legal frameworks converge on "all-offender" ignition-interlock schemes, device volume per offender rises, a dynamic that indirectly elevates service revenues from calibration programs. In practice, suppliers that offer mobile field-service vans cut downtime for probationers, which both courts and offenders find appealing. The trend implies that distributors with robust after-sales networks could capture disproportionate breathalyzers market share, especially where offenders must prove compliance before license reinstatement.

Rising Technological Advancements and Increasing Funding

Miniaturized fuel-cell sensors coupled with Bluetooth deliver laboratory-grade accuracy in palm-sized housings, encouraging repeat use by non-technical consumers. Concurrently, venture investment in breath-based oncology screening has surged, signalling a path for cross-subsidizing research costs with alcohol-testing cash flow. Manufacturers that license diagnostic IP therefore secure early optionality in adjacent health markets without diluting their breathalyzer industry identity. Investment analysts note that this diversification reduces revenue cyclicality tied to DUI enforcement budgets, making publicly traded suppliers more attractive to institutional investors.

High Life-Cycle Calibration and Consumable Costs

Annual calibration charges and replaceable mouthpieces still deter small fleets from upgrading to professional-grade units. However, recent state subsidies covering up to 50% of ignition-interlock fees in Louisiana demonstrate that public funding can neutralize this barrier. An observable outcome is rising interest in "as-a-service" models that bundle maintenance into a flat monthly rate, smoothing cash flow for price-sensitive buyers. Some vendors now employ predictive maintenance algorithms that flag sensors likely to drift out of tolerance, allowing proactive recalibration and reducing costly evidence disputes.

Other drivers and restraints analyzed in the detailed report include:

- Corporate Zero-Alcohol Workplace Policies

- Usage-Based-Insurance Sober-Driving Programs

- Competition from Camera / Wearable Impairment Tech

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fuel cell sensors held 63.12% of the breathalyzers market share in 2024, underscoring their status as the evidential benchmark for police and court systems. Agencies confirm that fuel-cell units show minimal cross-reactivity with acetone, a finding that directly underpins admissibility in legal proceedings. A notable consequence is that budget cuts rarely affect replacement cycles for this specific technology, safeguarding vendor revenue streams even during downturns. Meanwhile, semiconductor oxide sensors retain relevance because novice users value low sticker prices over ultimate precision, keeping this category profitable in consumer retail.

Infrared spectroscopy's market size is forecast to expand by a 19.41% CAGR between 2025-2030, narrowing the historical gap with fuel-cell solutions. Recent uncooled micro-bolometer arrays reduce power draw, letting manufacturers design battery-operated infrared handhelds that were not commercially feasible five years ago. This shift enables multi-substance detection, suggesting future devices may scan for both alcohol and controlled drugs in a single breath. Start-ups exploring carbon-nanotube coatings could leapfrog both incumbent technologies by offering trace-level sensitivity without frequent calibration, and developmental prototypes already demonstrate promising baseline stability over 12-month test horizons.

Hand-held breathalyzers market size accounted for 54.24% of revenue in 2024, thanks to ease of use in roadside scenarios. Police officers note that lightweight casings accelerate traffic-stop throughput, indirectly freeing patrol resources for other duties. For consumers, keychain models double as novelty items at social events, creating viral word-of-mouth that free-rides on social media platforms. Standardization around USB-C charging further lifts user satisfaction, suggesting that ancillary accessory sales (cables, power banks) will follow hardware adoption.

Smartphone plug-in devices are projected to secure a 21.78% CAGR, rewriting the breathalyzers industry revenue mix. Integration with wellness apps means a single reading feeds into broader health dashboards, weaving alcohol data into daily fitness routines. Desktop units remain indispensable in booking stations because they withstand heavy use and connect to secure databases, but their growth is inherently tied to public-sector budget cycles. Continuous-wear biosensors like transdermal wristbands introduce a passive alternative, yet early adopters still purchase traditional breath devices as a verification fallback given regulatory familiarity.

The Breathalyzers Market Report is Segmented by Technology (Fuel Cell, Semiconductor Oxide Sensor, and More), Product Type (Hand-Held / Portable and More), Distribution Channel (Direct Tender / Contracts and More), Application (Alcohol Detection and More), End-User (Law-Enforcement Agencies and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remained the most significant regional contributor to the breathalyzer market size with 41.78% share in 2024, catalyzed by federal infrastructure legislation that obliges automakers to integrate impaired-driving prevention technologies. That mandate, while vehicle-centric, indirectly stimulates aftermarket breathalyzer sales as public discourse spotlights alcohol safety. Canada's emergence as an R&D hub creates spill-over effects: domestic suppliers secure early-adopter trials that later translate to export orders, tightening the regional feedback loop between innovation and commercialization. Evidence suggests that insurers in both countries are experimenting with telematics-linked sober-driving discounts, a move likely to sustain consumer segment growth and elevate data-analytics demand.

Europe ranks second in breathalyzer industry revenue, with France's requirement for motorists to carry disposable testers illustrating how policy nuances influence unit volumes. GDPR compliance pushes vendors to embed advanced anonymization protocols into connected devices, inadvertently upgrading global product standards. A new observation is that cross-border truck fleets adopt pan-European testing guidelines to avoid logistical confusion, creating multi-country bulk orders that favor manufacturers with multilingual software interfaces. The region's aging demographic also elevates medical breath-diagnostics demand, as early detection aligns with preventive-health policy goals that curb long-term healthcare costs.

Asia-Pacific records the fastest forecast CAGR with 17.51% to 2030, as rising disposable incomes intersect with stricter traffic enforcement. China's high-profile anti-drunk-driving campaigns have moved roadside testing from sporadic to routine, swelling public-sector orders. Japan's zero-tolerance stance stimulates technological experimentation; local firms are piloting cabin-embedded sensors that auto-lock ignition if alcohol is detected. India shows latent demand in workplace safety, where multinational corporations apply uniform global policies that exceed local legal minimums. The region is also witnessing government encouragement for low-cost sensor innovation, suggesting that home-grown suppliers may soon challenge Western incumbents on price without sacrificing core accuracy, thereby reshaping competitive equations.

- Abbott Laboratories

- Alcohol Countermeasure Systems Corp.

- Alcolizer Technology

- Andatech

- BACtrack (KHN Solutions)

- Bedfont Scientific

- CMI, Inc.

- Dragerwerk

- Giner Labs

- Guardian Interlock Systems

- Hanwei Electronics Group

- Honeywell International (EnviteC)

- Intoximeters

- Lifeloc Technologies Inc.

- LifeSafer, Inc.

- Lion Laboratories Ltd

- Quest Diagnostics

- Shenzhen Well Electric Co.

- Smart Start Inc.

- Tokai Denshi Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tightening DUI legislation and expansion of ignition-interlock mandates

- 4.2.2 Rising technological advancements and increasing funding

- 4.2.3 Miniaturized smartphone-connected devices

- 4.2.4 Corporate zero-alcohol workplace policies

- 4.2.5 Breath-based disease-diagnostics funding

- 4.2.6 Usage-based-insurance sober-driving programs

- 4.3 Market Restraints

- 4.3.1 Accuracy variability in low-cost sensors

- 4.3.2 High life-cycle calibration/consumable cost

- 4.3.3 Data-privacy & liability concerns (GDPR, HIPAA)

- 4.3.4 Competition from camera / wearable impairment tech

- 4.4 Supply Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Technology

- 5.1.1 Fuel Cell

- 5.1.2 Semiconductor Oxide Sensor

- 5.1.3 Infrared Spectroscopy

- 5.1.4 Others

- 5.2 By Product Type

- 5.2.1 Hand-held / Portable

- 5.2.2 Desktop / Stationary

- 5.2.3 Others

- 5.3 By Distribution Channel

- 5.3.1 Direct Tender / Contracts

- 5.3.2 Retail & Specialty Stores

- 5.3.3 Online Stores & E-commerce

- 5.4 By Application

- 5.4.1 Alcohol Detection

- 5.4.2 Drug-abuse Detection

- 5.4.3 Disease Diagnostics

- 5.5 By End-User

- 5.5.1 Law-Enforcement Agencies

- 5.5.2 Hospitals & Clinics

- 5.5.3 Workplace / Industrial

- 5.5.4 Personal Consumers

- 5.5.5 Other End-Users

- 5.6 By Geography (Value)

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Competitive Benchmarking

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Abbott Laboratories

- 6.4.2 Alcohol Countermeasure Systems Corp.

- 6.4.3 Alcolizer Technology Pty Ltd

- 6.4.4 Andatech Pty Ltd

- 6.4.5 BACtrack (KHN Solutions)

- 6.4.6 Bedfont Scientific Ltd

- 6.4.7 CMI, Inc.

- 6.4.8 Dragerwerk AG & Co. KGaA

- 6.4.9 Giner Labs

- 6.4.10 Guardian Interlock Systems

- 6.4.11 Hanwei Electronics Group

- 6.4.12 Honeywell International (EnviteC)

- 6.4.13 Intoximeters Inc.

- 6.4.14 Lifeloc Technologies Inc.

- 6.4.15 LifeSafer, Inc.

- 6.4.16 Lion Laboratories Ltd

- 6.4.17 Quest Diagnostics Inc.

- 6.4.18 Shenzhen Well Electric Co.

- 6.4.19 Smart Start Inc.

- 6.4.20 Tokai Denshi Co.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment