PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849865

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849865

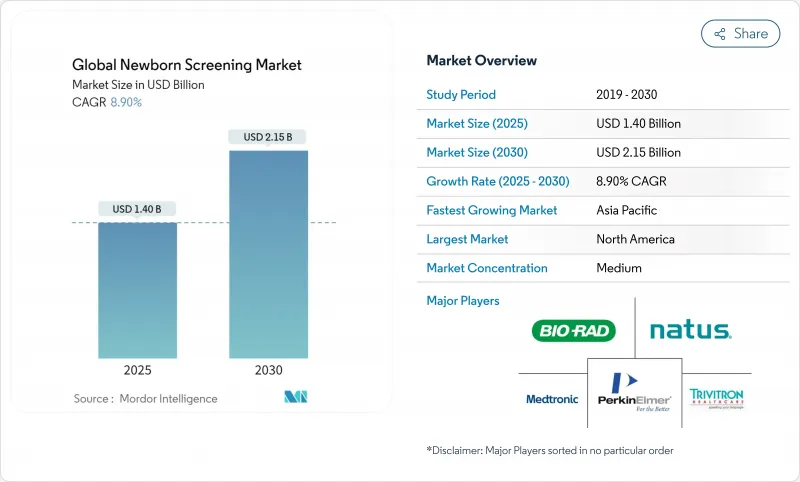

Global Newborn Screening - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The newborn screening market is valued at USD 1.40 billion in 2025 and is forecast to reach USD 2.15 billion by 2030, advancing at an 8.9% CAGR.

Momentum comes from the rapid shift toward genomic platforms that identify hundreds of genetic conditions quicker than conventional assays, alongside artificial-intelligence tools that cut false-positive rates dramatically. Strong government backing, wider reimbursement, and clearer regulatory pathways spur faster technology adoption, while North America retains leadership and Asia-Pacific posts the steepest growth. Robust investment flows, growing pilot programs, and public-health mandates continue to deepen market penetration of tandem mass spectrometry and whole-genome sequencing. Ongoing shortages of biochemical-genetics specialists and data-privacy concerns temper growth but have yet to derail expansion.

Global Newborn Screening Market Trends and Insights

Rising burden of congenital & inherited metabolic disorders

Incidence rates for inherited metabolic diseases are climbing, with Iranian data indicating prevalence as high as 1:1,000 births, far above historical averages. High consanguinity in parts of the Middle East magnifies risk, prompting Saudi Arabia to expand its panel to 18 disorders and prepare to add hemoglobinopathies. Demographic shifts toward older maternal age and improved survival of affected infants sustain demand for broader panels. Early-genome initiatives such as BeginNGS have demonstrated a 97% reduction in false positives while preserving >99% sensitivity, lowering lifetime treatment costs by enabling presymptomatic therapy. Health-system economics favor preventive screening as untreated cases drive high downstream expenditures.

Government mandates & funding expansions for national panels

The World Health Organization issued April 2024 guidance promoting universal hearing and hyperbilirubinemia screening, accelerating legislative action across multiple regions . In the United States, spinal muscular atrophy reached implementation in 48 programs by late-2024, while the Food and Drug Administration formed the Genetic Metabolic Diseases Advisory Committee to streamline review of new assays. Belgium's BabyDetect pilot covered 165 disorders with 90% parental uptake, revealing 71 actionable cases, 30 of which conventional panels would miss . Funding pools attached to such mandates create predictable procurement cycles that reward suppliers with proven throughput.

Lack of global uniformity in NBS policies & test panels

Panels vary from fewer than 10 to more than 50 conditions worldwide, complicating cross-border technology deployment and training. The United Kingdom's updated population-screening pathway highlights ever-shifting protocols that vendors must track. Divergent consent standards for genomic tests slow multinational roll-outs, while inconsistent data formats limit algorithm performance. Suppliers consequently absorb higher customization costs, delaying time-to-market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid adoption of tandem-mass-spectrometry platforms

- AI algorithms reducing false positives

- Acute shortage of biochemical-genetics specialists

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tandem MS/MS accounted for 24.85% of newborn screening market share in 2024 as the method of choice for high-throughput metabolic testing. Integrated software such as iDIA-QC now automates quality control across dozens of labs, cutting manual oversight and error rates. The newborn screening market size for enzyme-based assays is projected to rise at 9.54% CAGR as regional laboratories search for low-maintenance alternatives. Pulse-oximetry equipment continues stable uptake following universal critical-congenital-heart-defect mandates, with screening costs ranging USD 5-14 per newborn.

Whole-genome sequencing is reshaping long-term growth. Ultra-rapid protocols deliver diagnoses within three hours, positioning genomics to displace multiple standalone assays within one workflow. BeginNGS validations across 255 conditions showcase scalability with near-perfect sensitivity. As instrument prices fall, hybrid models combining MS/MS for metabolites and sequencing for complex genetics are gaining favor among public laboratories.

The Newborn Screening Market Report Segments the Industry Into by Technology (Tandem Mass Spectrometry, Pulse Oximetry, and More), by Test Type (Dried Blood Spot, Hearing Screening, and More), by End User (Hospitals, Diagnostic & Reference Laboratories, Other End Users), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 42.73% of 2024 revenue, buoyed by comprehensive Recommended Uniform Screening Panel adoption across 53 programs and favorable reimbursement. The newborn screening market benefits from FDA guidance on laboratory-developed tests and the Genetic Metabolic Diseases Advisory Committee, which accelerate assay clearance. GeneDx's GUARDIAN study of 17,000 infants revealed conditions missed by traditional panels in 3.7% of cases, underscoring latent demand for genomic expansion.

Asia-Pacific exhibits a 10.54% CAGR, fueled by China's large NBGS pilots that outperformed enzyme assays for lysosomal storage disorders. Taiwan's five-year spinal muscular atrophy program confirmed 23 presymptomatic cases among 446,966 newborns, illustrating tangible clinical benefits. India's cystic-fibrosis screening initiatives and Thailand's 98.6% coverage in rural settings point to mounting public investment.

Europe sustains stable expansion through coordinated projects such as Belgium's BabyDetect, which screens 165 disorders at EUR 365 per infant with 90% acceptance. The United Kingdom modernized operational agreements to tighten specimen processing times and awarded Revvity a USD 37.8 million contract for rare-disease screening. In emerging regions, sub-Saharan Africa confronts 400,000 annual sickle-cell births, highlighting urgent need for cost-adapted technologies .

- PerkinElmer / Revvity

- Natus Medical

- Bio-Rad Laboratories

- Thermo Fisher Scientific

- SCIEX (AB Sciex)

- Waters Corporation

- Agilent Technologies

- GE Healthcare

- Masimo

- Demant

- Trivitron Healthcare

- ZenTech

- Baebies

- Labsystems Diagnostics

- GeneDx

- Illumina

- LabCorp

- BGI

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising burden of congenital & inherited metabolic disorders

- 4.2.2 Government mandates & funding expansions for national panels

- 4.2.3 Rapid adoption of tandem-mass-spectrometry (MS/MS) platforms

- 4.2.4 AI / machine-learning algorithms slashing false-positive rates

- 4.2.5 Roll-out of ultra-rapid whole-genome sequencing in NICUs

- 4.2.6 Emergence of at-home supplemental DNA newborn kits

- 4.3 Market Restraints

- 4.3.1 Lack of global uniformity in NBS policies & test panels

- 4.3.2 Persisting false-positive/false-negative follow-ups

- 4.3.3 Acute shortage of biochemical-genetics specialists

- 4.3.4 Data-privacy & consent concerns around genomic data

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis Analysis

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Technology

- 5.1.1 Tandem Mass Spectrometry

- 5.1.2 Pulse Oximetry

- 5.1.3 Enzyme-based Assays

- 5.1.4 DNA / Genome Sequencing Assays

- 5.1.5 Other Technologies

- 5.2 By Test Type

- 5.2.1 Dried Blood Spot (DBS)

- 5.2.2 Hearing Screening

- 5.2.3 Critical Congenital Heart Defect (CCHD)

- 5.2.4 Other Test Types

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Diagnostic & Reference Laboratories

- 5.3.3 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 PerkinElmer / Revvity

- 6.3.2 Natus Medical

- 6.3.3 Bio-Rad Laboratories

- 6.3.4 Thermo Fisher Scientific

- 6.3.5 SCIEX (AB Sciex)

- 6.3.6 Waters Corporation

- 6.3.7 Agilent Technologies

- 6.3.8 GE HealthCare

- 6.3.9 Masimo Corporation

- 6.3.10 Demant A/S

- 6.3.11 Trivitron Healthcare

- 6.3.12 ZenTech SA

- 6.3.13 Baebies

- 6.3.14 Labsystems Diagnostics

- 6.3.15 GeneDx

- 6.3.16 Illumina

- 6.3.17 Labcorp

- 6.3.18 BGI Genomics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment