PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849866

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849866

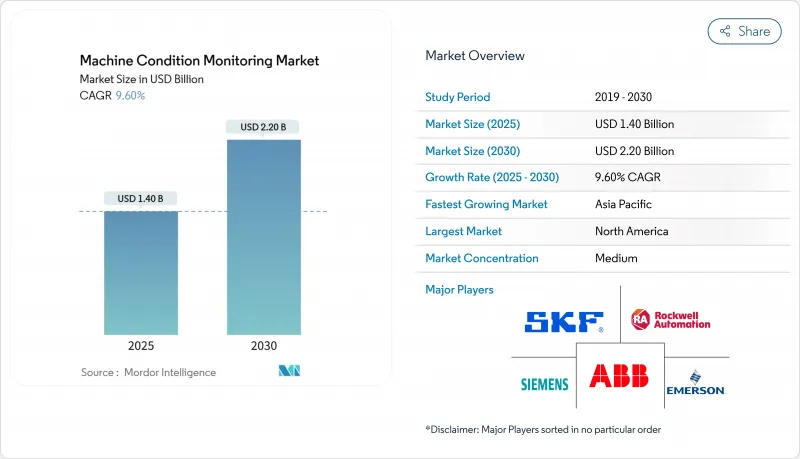

Machine Condition Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The machine condition monitoring market reached a value of USD 1.4 billion in 2025 and is on course to attain USD 2.2 billion by 2030, reflecting a 9.6% CAGR.

The shift from reactive repair to data-driven predictive maintenance underpins this momentum, supported by rising wireless IIoT sensor deployments and AI-enabled diagnostics platforms that shorten decision cycles. Industrial producers face constrained workforces and escalating uptime targets, which heighten demand for automated fault-detection systems. Wireless sensor nodes paired with edge analytics reduce total cost of ownership and unlock coverage for smaller, previously unmonitored assets. Sustainability mandates further elevate adoption because continuous insight into energy performance helps manufacturers meet emissions disclosure rules. Competitive intensity remains moderate as incumbents rely on installed-base scale while AI-centric entrants contest value through advanced analytics and SaaS delivery.

Global Machine Condition Monitoring Market Trends and Insights

Predictive-maintenance focus to cut unplanned downtime

Manufacturing operations lose USD 50 billion each year to surprise stoppages, so firms are replacing calendar-based servicing with predictive approaches that trim downtime by 20-50% and maintenance spend by 5-10% . Machine-learning algorithms draw on multi-sensor data streams to pinpoint failures weeks ahead, letting teams intervene during scheduled pauses. Automotive plants show success as BMW and Tesla extend equipment life cycles using real-time analytics . Digital twin models refine schedules by simulating wear scenarios and optimizing parts procurement.

Adoption of industry 4.0 edge-analytics platforms

Edge processing moves analytics to the sensor node, eliminating latency while maintaining insight during network outages. STMicroelectronics positions its microcontrollers for condition monitoring use cases that require sub-second detection . Siemens' SIMOCODE M-CP embeds monitoring within motor control centers via Single Pair Ethernet, trimming wiring effort and extending diagnostics to smaller motors . Early adopters report millisecond-level anomaly detection and bandwidth cuts of up to 50%.

Retrofit cost for legacy brown-field assets

Older facilities rarely feature sensor mounts or network backbones, so rollout involves engineering changes, safety approvals, and staged shutdowns that can stretch over 18 months. The US Marine Corps flagged conflicting legacy policies as barriers during Condition Based Maintenance Plus adoption, echoing similar struggles in civilian process plants. Wireless devices ease wiring pain yet power delivery and hazardous-area certification still raise budgets, prompting firms to phase projects by criticality.

Other drivers and restraints analyzed in the detailed report include:

- Surging Asset-intensive sectors in emerging Asia

- Wireless IIoT sensors slashing total cost of ownership

- ESG-driven push for energy-efficient plant operations

- Shortage of vibration-analysis specialists

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware claimed 45% of 2024 revenue, underscoring the indispensable role of sensors, gateways, and acquisition units in every installation. This segment benefits from steady advances in micro-electromechanical systems that boost sensitivity while lowering power draw. Siemens blended hardware with licensable analytics modules in its SIMOCODE M-CP to simplify adoption for switchboard users . Services revenue expands as manufacturers outsource round-the-clock surveillance; SKF's USD 60 million agreement with LKAB packages vibration measurements and remote diagnostics into a multi-year contract.

Wireless IIoT sensor networks are forecast to grow at 12.4% annually, underlining customer preference for low-touch retrofits. As adoption broadens, integrated platforms convert raw streams into maintenance tickets, creating recurring SaaS income. These factors collectively preserve scale benefits for incumbents while introducing fresh margin pools in analytics subscriptions.

Vibration analysis retained 34.2% share in 2024. Practitioners trust its rich fault signature library for rotating assets, and equipment makers bundle accelerometers at purchase, reinforcing network effects. Ultrasound emission is projected to expand 11.8% per year as plants value early bearing fault detection and compressed-air leak identification even in high-noise areas.

Thermography adoption rises with AI that flags thermal anomalies in cloud dashboards, aided by wearable integrations like the Teledyne FLIR and RealWear partnership. Motor current signature and oil analysis round out multi-modal suites that boost diagnostic confidence and extend reach into electrical and lubrication systems.

The Machine Condition Monitoring Market report segments the industry into Type (Hardware [Vibration Condition Monitoring Equipment, Thermography Equipment, and more], Software, Services), End User Industry (Oil and Gas, Power Generation, and more), and Geography (North America [United States, Canada], Europe [United Kingdom, Germany, France], Asia [China, Japan, India], and more).

Geography Analysis

North America held 32.4% of 2024 revenue, sustained by stringent safety codes and early Industry 4.0 rollouts. SEC emissions reporting and California SB 253 guide firms toward continuous efficiency measurement . Mature installed bases further encourage upgrade cycles to edge-capable sensors.

Asia-Pacific is poised for 9.9% annual growth. Smart-manufacturing subsidies in China and India defray upfront costs, while Japan's sensor innovation hub showcases domain expertise at IEEE SENSORS 2024 . Rapid expansion of battery, semiconductor, and renewable-equipment factories embeds predictive maintenance from conception.

Europe leverages ESG frameworks to justify investment, and the Middle East aligns monitoring with oil and gas mega-projects. Latin America records emerging growth as miners digitalize conveyor fleets and hydro plants seek reliability uplift.

- SKF AB

- Emerson Electric Co. (Bently Nevada)

- Rockwell Automation Inc.

- ABB Ltd.

- Siemens AG

- Meggitt PLC

- Bruel and Kjaer Vibro

- Fluke Corporation

- FLIR Systems Inc.

- Parker Hannifin Corp. (Kittiwake)

- AMETEK Inc. (Spectro Scientific)

- Thermo Fisher Scientific Inc.

- Bentley Nevada (Baker Hughes)

- Schaeffler Group

- Azima DLI

- Honeywell International Inc.

- National Instruments Corp.

- Schneider Electric SE

- Gastops Ltd.

- Wilcoxon Sensing Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Predictive-maintenance focus to cut unplanned downtime

- 4.2.2 Adoption of Industry 4.0 edge-analytics platforms

- 4.2.3 Surging asset-intensive sectors in emerging Asia

- 4.2.4 Wireless IIoT sensors slashing total cost of ownership

- 4.2.5 ESG-driven push for energy-efficient plant operations

- 4.2.6 Military & space programs requiring zero-fault tolerance (under-the-radar)

- 4.3 Market Restraints

- 4.3.1 Retrofit cost for legacy brown-field assets

- 4.3.2 Shortage of vibration-analysis specialists

- 4.3.3 Cyber-security concerns in always-connected systems

- 4.3.4 Rising trade barriers limiting hardware supply chains (under-the-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE & GROWTH FORECASTS

- 5.1 By Offering

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Monitoring Technique

- 5.2.1 Vibration Analysis

- 5.2.2 Thermography

- 5.2.3 Ultrasound Emission

- 5.2.4 Lubricating-Oil Analysis

- 5.2.5 Motor-Current Signature

- 5.2.6 Corrosion & Wear Debris

- 5.2.7 Other Techniques

- 5.3 By Deployment

- 5.3.1 Online/Continuous Systems

- 5.3.2 Portable/Periodic Instruments

- 5.3.3 Wireless IIoT Sensor Networks

- 5.4 By End-user Industry

- 5.4.1 Oil & Gas

- 5.4.2 Power Generation

- 5.4.3 Metals & Mining

- 5.4.4 Chemicals & Petrochemicals

- 5.4.5 Automotive & Transportation

- 5.4.6 Aerospace & Defense

- 5.4.7 Food & Beverage

- 5.4.8 Marine

- 5.4.9 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Russia

- 5.5.4 Asia

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.5 Middle East & Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 UAE

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 SKF AB

- 6.4.2 Emerson Electric Co. (Bently Nevada)

- 6.4.3 Rockwell Automation Inc.

- 6.4.4 ABB Ltd.

- 6.4.5 Siemens AG

- 6.4.6 Meggitt PLC

- 6.4.7 Bruel and Kjaer Vibro

- 6.4.8 Fluke Corporation

- 6.4.9 FLIR Systems Inc.

- 6.4.10 Parker Hannifin Corp. (Kittiwake)

- 6.4.11 AMETEK Inc. (Spectro Scientific)

- 6.4.12 Thermo Fisher Scientific Inc.

- 6.4.13 Bentley Nevada (Baker Hughes)

- 6.4.14 Schaeffler Group

- 6.4.15 Azima DLI

- 6.4.16 Honeywell International Inc.

- 6.4.17 National Instruments Corp.

- 6.4.18 Schneider Electric SE

- 6.4.19 Gastops Ltd.

- 6.4.20 Wilcoxon Sensing Technologies

7 MARKET OPPORTUNITIES & FUTURE OUTLOOK

- 7.1 White-space & Unmet-need Assessment