PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849868

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849868

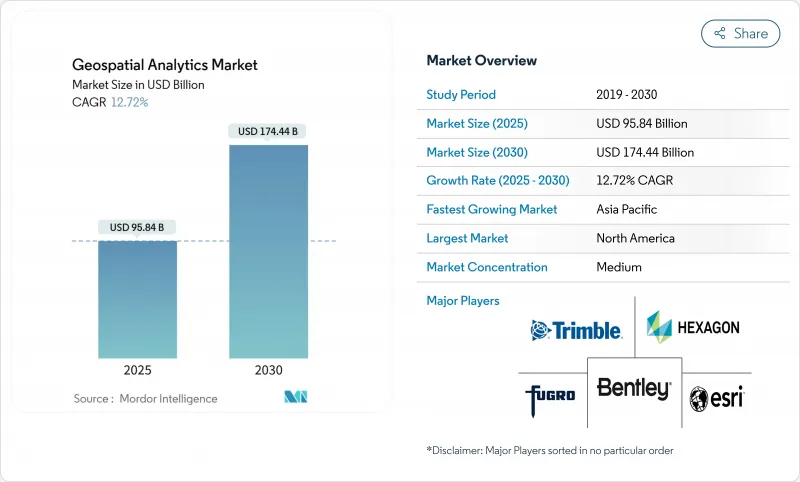

Geospatial Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The geospatial analytics market is valued at USD 95.84 billion in 2025 and is forecast to reach USD 174.44 billion by 2030, advancing at a 12.72% CAGR.

Rising demand for location-based insights, rapid satellite constellation launches, and smart-city investments position the discipline as an essential pillar of digital transformation. Enterprises use spatial intelligence to unlock operational efficiency, mitigate risk, and streamline strategic decisions as artificial intelligence automates feature extraction and predictive modeling. Government stimulus for digital twins, the rollout of 5G, and edge computing's ability to process sensor data locally further propel adoption. Meanwhile, heightened privacy regulation and hardware supply-chain pressures temper growth but have not slowed the overall upward trajectory.

Global Geospatial Analytics Market Trends and Insights

Adoption of Smart-City Programs

Urban digital-twin initiatives accelerate demand for the geospatial analytics market as municipalities seek real-time visibility across transportation, energy, and utilities. Japan's Project PLATEAU delivers 3D models for 200+ cities to support disaster prevention and land-use planning. China's digital infrastructure mandate embeds standardized spatial frameworks in local governments, driving continuous platform purchases. The United Kingdom's Public Sector Geospatial Agreement unlocks GBP 1 billion for underground asset mapping, minimizing construction strikes and maintenance delays. European councils also use digital twins to track carbon-neutrality progress, tightening the link between sustainability targets and location intelligence. Together, these programs sustain multi-year buying cycles and embed spatial analytics deep inside municipal operations.

Integration of 5G-Enabled Location Services

5G's sub-meter positioning accuracy and millisecond latency unlock real-time geospatial applications from dynamic traffic orchestration to autonomous drone routing. Ericsson's Istres deployment shows how dedicated network slices guarantee bandwidth for mission-critical mapping workloads.Edge computing co-located at base stations processes imagery and sensor feeds locally, ensuring compliance with data-sovereignty rules in healthcare and defense. Retailers adopt indoor positioning for shopper navigation, while factories optimize asset tracking without GPS. The synergy between 5G and AI shortens detection-to-decision cycles, raising expectations for always-on, context-aware spatial services.

High Costs and Operational Complexity

Entry barriers remain steep as enterprises budget for high-precision LiDAR-costing up to USD 150,000 per scanner-and annual software licenses approaching USD 50,000. Integrating satellite, drone, and legacy GIS archives demands rare skill sets; geospatial data scientists command 20-30% salary premiums. Firms spend most project hours cleansing coordinate systems and harmonizing formats, delaying time-to-value. Subscriptions reduce capex yet rapidly inflate opex when analytics run at full cadence. Training programs and certifications add USD 10,000-25,000 per employee each year, straining SME budgets.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of IoT-Derived Spatial Data

- Smallsat Constellations Enabling High-Revisit Imagery

- Legal and Privacy Hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services are forecast to grow at a 12.9% CAGR, reflecting a widening skills gap as organizations adopt increasingly complex spatial solutions. Software maintained 42.7% geospatial analytics market share in 2024, but buyers now prioritize consulting and managed offerings to accelerate rollouts. Hardware revenue rises steadily through sensor price erosion and satellite expansion, although growth tempers as commoditization sets in.

Rising uptake of managed analytics illustrates the shift from license ownership toward outcome-based engagements. CARTO's collaboration with Indigo Ag shows how agribusinesses outsource data-fusion and dashboard delivery, freeing staff for crop-science innovation. Outsourcing models also mitigate talent shortages in insurance and real estate, where spatial risk scoring is vital yet non-core. As a result, the services segment anchors long-term recurring revenue streams across the geospatial analytics market.

Surface analysis accounted for 35.7% of the geospatial analytics market size in 2024, underpinning flood forecasting and infrastructure siting. Executive teams, however, increasingly demand intuitive visuals, propelling geovisualization at a 14.8% CAGR. Network analysis retains momentum, supporting utility routing and last-mile delivery optimization.

Echo Analytics' pedestrian-traffic dashboards illustrate how 3D visuals and heat maps accelerate city-center retail planning. Augmented-reality overlays foster stakeholder buy-in for zoning approvals and capital works funding. As artificial intelligence auto-generates thematic maps, geovisualization lowers the entry barrier for non-GIS professionals, enlarging the addressable geospatial analytics market.

Geospatial Analytics Market is Segmented by Component (Software, Services, and Hardware), Analysis Type (Surface Analysis, Network Analysis, and More), Deployment Model (On-Premises and Cloud), End-User Vertical (Government, Defense and Intelligence and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 24.7% of the geospatial analytics market in 2024, supported by mature satellite infrastructure, extensive 5G rollout, and sustained defense spending. The U.S. Department of Defense's plan for 1,000 surveillance satellites will inject fresh imagery streams, spurring upgrades in analytic platforms. Canada's geospatial open-data initiatives and Mexico's urban-mobility pilots add incremental regional demand, though the United States dominates revenue. Federal programs such as the National Geospatial-Intelligence Agency's Luno commercial analytics contracts reinforce consistent procurement flows.

Asia-Pacific is forecast to register a 14.5% CAGR through 2030, propelled by smart-city grants, transport-corridor build-outs, and rising private-sector investment. China's remote-sensing market could quadruple by 2033 as Beijing funds hyperspectral and radar payloads. Japan's Project PLATEAU and India's National Spatial Data Infrastructure further validate public-sector appetite for standardized platforms. Rapid urbanization across Indonesia, Vietnam, and the Philippines drives municipal spending on flood-risk modeling, traffic orchestration, and land-tax digitization, deepening the regional geospatial analytics market.

Europe posts steady growth aided by open-data policies and green-transition funding. The United Kingdom's GBP 1 billion geospatial strategy underpins national asset registers and digital twin rollouts. Germany embeds location analytics in Industry 4.0 roadmaps, while France cooperates with Ukraine on joint intelligence capabilities, highlighting defense-market pull. Northern Europe leverages spatial tools for carbon budgeting and precision farming, fostering cross-border interoperability standards that simplify solution exports.

- Esri Inc.

- Hexagon AB

- Trimble Inc.

- Maxar Technologies Inc.

- Bentley Systems Inc.

- Fugro NV

- L3Harris Technologies Inc.

- Airbus Defence and Space

- MDA Ltd.

- Atkins PLC (SNC-Lavalin)

- Intermap Technologies

- Oracle Corporation

- SAP SE (HANA Spatial)

- Google LLC (Google Maps Platform)

- Amazon Web Services (Location Service)

- Microsoft Corporation (Azure Maps)

- HERE Technologies

- TomTom NV

- CARTO

- Precisely (MapInfo)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adoption of Smart-City Programs

- 4.2.2 Integration of 5G-enabled Location Services

- 4.2.3 Proliferation of IoT-derived Spatial Data

- 4.2.4 Smallsat Constellations Enabling High-Revisit Imagery

- 4.2.5 Hyper-local ESG and Climate-Risk Analytics Demand

- 4.2.6 Real-time Geofencing for Autonomous Operations

- 4.3 Market Restraints

- 4.3.1 High Costs and Operational Complexity

- 4.3.2 Legal and Privacy Hurdles

- 4.3.3 Data-bias in AI-driven Spatial Models

- 4.3.4 Interoperability Across Heterogeneous Standards

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services

- 5.1.3 Hardware

- 5.2 By Analysis Type

- 5.2.1 Surface Analysis

- 5.2.2 Network Analysis

- 5.2.3 Geovisualization

- 5.2.4 Others

- 5.3 By Deployment Model

- 5.3.1 On-Premises

- 5.3.2 Cloud

- 5.4 By End-user Vertical

- 5.4.1 Government

- 5.4.2 Defense and Intelligence

- 5.4.3 Agriculture

- 5.4.4 Natural Resources

- 5.4.5 Utility and Communication

- 5.4.6 Transportation and Logistics

- 5.4.7 Healthcare and Life Sciences

- 5.4.8 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Southeast Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Middle-East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Esri Inc.

- 6.4.2 Hexagon AB

- 6.4.3 Trimble Inc.

- 6.4.4 Maxar Technologies Inc.

- 6.4.5 Bentley Systems Inc.

- 6.4.6 Fugro NV

- 6.4.7 L3Harris Technologies Inc.

- 6.4.8 Airbus Defence and Space

- 6.4.9 MDA Ltd.

- 6.4.10 Atkins PLC (SNC-Lavalin)

- 6.4.11 Intermap Technologies

- 6.4.12 Oracle Corporation

- 6.4.13 SAP SE (HANA Spatial)

- 6.4.14 Google LLC (Google Maps Platform)

- 6.4.15 Amazon Web Services (Location Service)

- 6.4.16 Microsoft Corporation (Azure Maps)

- 6.4.17 HERE Technologies

- 6.4.18 TomTom NV

- 6.4.19 CARTO

- 6.4.20 Precisely (MapInfo)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment