PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849878

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849878

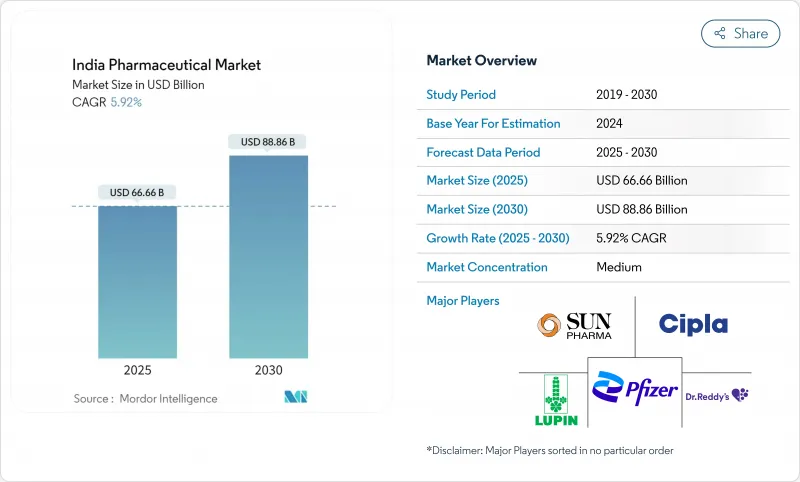

India Pharmaceutical - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

India pharmaceutical market stands at USD 66.66 billion in 2025 and is forecast to reach USD 88.86 billion by 2030, advancing at a 5.92% CAGR.

Chronic diseases, policy incentives and steady export demand give the market a balanced twin-engine of domestic consumption and international sales. Government Production Linked Incentive (PLI) funds, wider health-insurance coverage and fast digital adoption continue to lift volume while nudging the competitive mix toward higher-value specialty drugs. Online channels are expanding fastest, but the retail network of roughly 850,000 pharmacies still anchors distribution. The shift from acute to chronic therapies, coupled with rising contract manufacturing for global innovators, keeps investment flowing into sterile injectables, advanced formulations and large-scale API plants.

India Pharmaceutical Market Trends and Insights

Government PLI Schemes Accelerating API Self-Reliance

PLI funding rose to INR 2,444.93 crore for 2025-26, targeting 11 bulk-drug lines and drawing cumulative investment pledges topping INR 1.46 lakh crore. Manufacturers in Gujarat, Maharashtra and Telangana are using the incentive to add fermenters and continuous-processing lines that could cut Chinese API dependence, currently 80% of import volume. Early beneficiaries report shorter lead times on macrolide antibiotics and corticosteroid intermediates, boosting supply chain resilience. As greenfield projects cross validation stages in 2027-2028, domestic API output should narrow cost gaps and add pricing power for finished formulations sold in the India pharmaceutical market. A successful import-substitution cycle also cushions foreign-exchange risk on input bills.

Expansion of Health Insurance Penetration in Tier-2/3 Cities

Only 35% of Indians carry health insurance, but payor mix is shifting as schemes such as Ayushman Bharat and private plans like Tata AIG's MediCare Select add hospitals in emerging cities. Cash-less coverage reduces out-of-pocket hurdles, letting more households fill chronic prescriptions monthly instead of rationing doses. Claims data already show 30-40% higher medicine uptake among newly insured patients, especially for diabetes and cardiovascular care. The insurance wave feeds predictable demand into the India pharmaceutical market, enabling companies to launch adherence programs and smaller pack sizes tailored to semi-urban buying power. As network hospitals cross 14,000 in 2027, formulary-listed brands in chronic therapy should win durable volumes.

Drug-Price Controls under NLEM Compressing Margins

The NPPA ceiling caps on 384 essential drugs slice profitability, forcing some brands below breakeven . Violations flagged on 307 items underline compliance friction and sporadic stock-outs when firms exit loss-making lines. Although policymakers intend affordability, evidence shows restricted availability in rural clinics that rely on low-margin wholesalers. Companies hedge by tilting launches toward non-scheduled therapies or differentiated strengths outside NLEM scope, but that shift narrows treatment choice for price-sensitive patients. The India pharmaceutical market thus faces a margin-versus-access tension that shapes investment decisions in mature therapeutic classes.

Other drivers and restraints analyzed in the detailed report include:

- Burgeoning Demand for Chronic-Care Drugs Amid Ageing Population

- Low-Cost Manufacturing & Skilled Chemistry Talent Pool

- Surge in CDMO Outsourcing to India by Global Innovators

- Fast-growing E-Pharmacy Adoption Enabling Wider Access

- Regulatory Approval Delays for Novel Molecules

- High Dependence on Chinese APIs for Complex Molecules

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The therapeutic slate shows Anti-Infectives holding 19.6% India pharmaceutical market share in 2024, underscoring the lingering load of communicable diseases. Oncology however records the quickest 7.10% CAGR outlook, pushed by growing screening and expanded reimbursement for targeted therapies. Cardiovascular lines grew 10.7% in early 2025, making them the largest chronic pocket by value. Gastrointestinal drugs climbed 10.9% on back of proton-pump inhibitor combinations, whereas anti-diabetic scripts continued a steep 6.9% rise as lifestyle shifts bite.

Developers now allocate greater detailing budgets to chronic specialities, balancing mass-volume acute franchises with higher lifetime-value regimens. Patient-support helplines and mobile adherence tools have become standard in diabetes and cardiology marketing. Vaccines and ophthalmology, after pandemic highs, declined 12.8% and 8.6% respectively, prompting producers to rationalize SKU counts. The chronic swing reshapes site-of-care segmentation inside the India pharmaceutical market, pushing hospital sales ratios upward in oncology and dial-back clinics.

Generic prescriptions dominated 69% of the India pharmaceutical market size during 2024, powered by branded generics that capture 87% of prescription value. Price-elastic demand and pervasive physician familiarity keep the segment resilient even under price caps. At the same time OTC lines are projected to clock a 6.70% CAGR through 2030, driven by self-care, advertising and easy digital buying.

Major firms now run twin engines: specialist-rep-driven branded generics for clinics and brand-equity-laden OTC packs for chemist shelves and e-carts. With pharmacists increasingly recommending switch categories such as analgesics and gastro protectants, OTC revenues provide a hedge against tighter NLEM margins. Online channels bundle OTC items with chronic drug refills, lifting basket values inside the India pharmaceutical market.

The India Pharmaceutical Market Report Segments the Industry Into by Therapeutic Category (Anti-Infectives, Cardiovascular, Gastrointestinal, and More), Drug Type (Prescription Drug, OTC Drugs), Route of Administration (Oral, Inhalation, and More), Formulation (Tablets & Capsules, Injectables, and More), Distribution Channel (Retail Pharmacies, Hospital Pharmacies, and More), and Geography

List of Companies Covered in this Report:

- Sun Pharmaceuticals Industries

- Dr. Reddy's Laboratories Ltd.

- Cipla

- Lupin

- Aurobindo Pharma Ltd.

- Cadila Healthcare Ltd. (Zydus Lifesciences)

- Glenmark Pharmaceuticals

- Torrent Pharmaceuticals

- Biocon

- Serum Institute of India

- Bharat Biotech International Ltd.

- Divi's Laboratories Ltd.

- Natco Pharma Ltd.

- Abbott India Ltd.

- Pfizer Ltd. (India)

- Novartis India Ltd.

- Merck Ltd. (India)

- Sanofi India Ltd.

- Johnson & Johnson Pvt. Ltd.

- AstraZeneca Pharma India Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government PLI Schemes Accelerating API Self-Reliance

- 4.2.2 Expansion of Health Insurance Penetration in Tier-2/3 Cities

- 4.2.3 Burgeoning Demand for Chronic-Care Drugs Amid Ageing Population

- 4.2.4 Low-Cost Manufacturing & Skilled Chemistry Talent Pool

- 4.2.5 Surge in CDMO Outsourcing to India by Global Innovators

- 4.2.6 Fast-growing E-Pharmacy Adoption Enabling Wider Access

- 4.3 Market Restraints

- 4.3.1 Drug-Price Controls under NLEM Compressing Margins

- 4.3.2 Regulatory Approval Delays for Novel Molecules

- 4.3.3 Rising Quality-Compliance Costs (US-FDA, EMA)

- 4.3.4 High Dependence on Chinese APIs for Complex Molecules

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Therapeutic Category

- 5.1.1 Anti-Infectives

- 5.1.2 Cardiovascular

- 5.1.3 Gastrointestinal

- 5.1.4 Anti-Diabetic

- 5.1.5 Respiratory

- 5.1.6 Dermatologicals

- 5.1.7 Musculo-Skeletal System

- 5.1.8 Central Nervous System

- 5.1.9 Oncology

- 5.1.10 Others

- 5.2 By Drug Type

- 5.2.1 Prescription Drugs

- 5.2.1.1 Branded Drugs

- 5.2.1.2 Generic Drugs

- 5.2.2 OTC Drugs

- 5.2.1 Prescription Drugs

- 5.3 By Route of Administration

- 5.3.1 Oral

- 5.3.2 Parenteral

- 5.3.3 Topical

- 5.3.4 Inhalation

- 5.3.5 Others

- 5.4 By Formulation

- 5.4.1 Tablets & Capsules

- 5.4.2 Injectables

- 5.4.3 Syrups & Suspensions

- 5.4.4 Ointments & Creams

- 5.4.5 Others

- 5.5 By Distribution Channel

- 5.5.1 Retail Pharmacies

- 5.5.2 Hospital Pharmacies

- 5.5.3 Online Pharmacies

- 5.5.4 Drug Wholesalers

- 5.6 By Geography

- 5.6.1 North India

- 5.6.2 South India

- 5.6.3 East India

- 5.6.4 West India

- 5.6.5 Central India

- 5.6.6 Northeast India

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Sun Pharmaceutical Industries Ltd.

- 6.4.2 Dr. Reddy's Laboratories Ltd.

- 6.4.3 Cipla Ltd.

- 6.4.4 Lupin Ltd.

- 6.4.5 Aurobindo Pharma Ltd.

- 6.4.6 Cadila Healthcare Ltd. (Zydus Lifesciences)

- 6.4.7 Glenmark Pharmaceuticals Ltd.

- 6.4.8 Torrent Pharmaceuticals Ltd.

- 6.4.9 Biocon Ltd.

- 6.4.10 Serum Institute of India Pvt. Ltd.

- 6.4.11 Bharat Biotech International Ltd.

- 6.4.12 Divi's Laboratories Ltd.

- 6.4.13 Natco Pharma Ltd.

- 6.4.14 Abbott India Ltd.

- 6.4.15 Pfizer Ltd. (India)

- 6.4.16 Novartis India Ltd.

- 6.4.17 Merck Ltd. (India)

- 6.4.18 Sanofi India Ltd.

- 6.4.19 Johnson & Johnson Pvt. Ltd.

- 6.4.20 AstraZeneca Pharma India Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment