PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849881

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849881

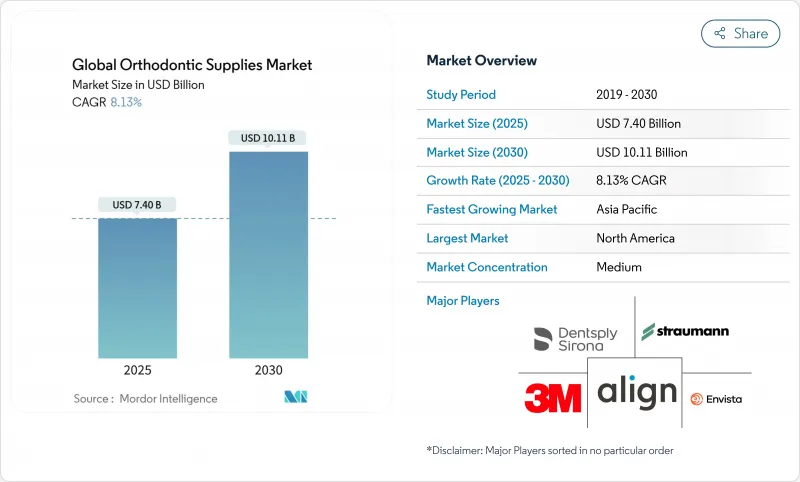

Global Orthodontic Supplies - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The orthodontic braces market generated USD 7.40 billion in 2025 and is forecast to reach USD 10.11 billion by 2030, advancing at an 8.13% CAGR.

Clear aligner systems are expanding at a 20.3% CAGR, confirming the shift toward aesthetic, digitally enabled orthodontics. Artificial intelligence tools that create predictive treatment plans strengthen practice efficiency, and adult demand now rivals pediatric volumes as working professionals seek discreet options. Thermoplastic polyurethane's 18.0% CAGR signals the importance of biocompatible, eco-friendly materials, while direct-to-consumer (DTC) platforms grow quickly despite tighter regulatory oversight. Consolidation among dental service organizations and AI-driven startups fuels competitive intensity, yet supply-chain risks in specialty alloys and uncertain rules around teledentistry temper long-term visibility.

Global Orthodontic Supplies Market Trends and Insights

Rising Prevalence of Malocclusion

Malocclusion affects up to 75% of the world's population, and complex cases are more common in China than in the United States, widening the treatment gap. Urbanization and diet shifts toward ultra-processed foods aggravate occlusal problems, while prolonged screen time reduces natural masticatory activity required for healthy craniofacial growth. Health agencies now link untreated malocclusion to temporomandibular disorders and poor oral hygiene, prompting broader reimbursement eligibility. Public health messaging positions orthodontic therapy not only as a cosmetic choice but as a preventive tool, spurring demand in both developed and emerging economies. The result is sustained patient inflow beyond traditional pediatric windows, feeding multi-year pipeline visibility for practices.

Technological Advances in Digital Orthodontics

Artificial intelligence algorithms reach 92% sensitivity and 88% specificity for malocclusion detection, with 94% of AI-generated treatment plans aligning with clinical guidelines. Widespread adoption of intraoral scanning and 3D printing allows mass customization and shorter chair time, and CBCT imaging integrated with AI yields precise root and bone mapping. Nearly every orthodontic office in North America now operates a digital workflow, elevating treatment visualization to a key differentiator for patient acquisition. Practices able to deliver short, predictable appointment schedules report higher conversion rates and better word-of-mouth referrals. Investment payback periods are shrinking as scanner prices fall and software moves to subscription models.

High Treatment Cost & Limited Reimbursement

Global dental spending hit USD 174 billion in 2023, yet orthodontic procedures often cost USD 3,000-10,000 each, a figure that exceeds coverage caps of many insurance plans. Out-of-pocket payments still dominate in emerging regions, curbing adoption among middle-income households. Geographic price disparities foster treatment tourism, but inconsistent follow-up raises outcome variability. Economic downturns typically defer elective spending, pressuring practice revenues in cash-pay markets. Flexible financing and value-based insurance models are gaining traction but remain fragmented.

Other drivers and restraints analyzed in the detailed report include:

- Adult Demand for Aesthetic Clear-Aligner Solutions

- Expansion of Direct-to-Consumer Orthodontics

- Clinical Risks & Complications

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Clear aligners are advancing at a 20.3% CAGR, outpacing the overall orthodontic braces market. Fixed braces still command 53.8% of the orthodontic braces market share in 2024, supporting complex torque and root movements that aligners cannot yet rival. Align Technology's Palatal Expander System approval in Turkey demonstrates clear aligners' shift into early-intervention territory, rather than limited relapse correction. Mass-customized aligners manufactured via 3D printing lower per-tray costs and boost scalability, widening practice eligibility. Meanwhile, innovations in self-ligating brackets with smart sensors enable real-time force monitoring, shortening fixed-case timelines by 10-15%. Sustainability is emerging as a differentiator: 40% of prospective patients now ask about recyclable trays, pushing suppliers toward bio-based polymers.

Clear aligners are projected to treat 70% of new cases by 2025, redefining the orthodontic braces market size hierarchy. Yet, fixed systems remain essential in cost-sensitive regions and for severe skeletal discrepancies. Advanced titanium-molybdenum archwires improve activation stability and reduce chair visits, sustaining relevance among budget-conscious populations. Ligature demand persists in emerging economies where material cost outweighs aesthetic preference, so the global sales mix keeps a balanced profile through 2030.

Adults account for a growing slice of the orthodontic braces market size, advancing at a 13.0% CAGR against 61.2% youth dominance in 2024. Professional adults seek discreet solutions that blend with their lifestyle, often opting for aligners priced at USD 6,500 on average. Their higher compliance lowers refinement rates, translating to predictable margins for clinics. Adult cases often include restorations and periodontal considerations, raising procedural complexity and billable chair time.

Pediatric and teenage cohorts keep volume leadership because early intervention remains clinically optimal. Preventive orthodontics, such as phase-one expansion, prevents severe malocclusion progression and lowers lifetime costs. Parents invest based on perceived long-term oral-health savings, maintaining a stable client base. Nevertheless, adult demand alters marketing strategies, pushing practices toward flexible scheduling and remote monitoring services.

The Orthodontic Supplies Market is Segmented by Product Type (Fixed Braces {Brackets, Archwires, and More}, Clear Aligners), Patient (Children & Teenagers and Adults), End User (Dental Clinics & DSOs, and More), Material (Metal Alloys, Ceramic and More), Distribution Channel (Offline and E-Commerce) and Geography (North America, Europe, Asia Pacific and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 34.5% of the orthodontic supplies market share in 2024, buoyed by widespread insurance coverage and a high concentration of board-certified specialists. AI-driven scanners and chair-side 3D printers reach mainstream status, allowing U.S. and Canadian clinics to offer same-day aligner pickup. Consolidation accelerates as DSOs acquire solo practices, enhancing purchasing power and IT standardization. However, elevated labor costs and supply-chain risks in nickel-titanium alloys drive price inflation, pushing some patients toward phased treatment plans or DTC options.

Asia Pacific is the fastest-growing region with an 11.0% CAGR, adding fresh volume to the orthodontic braces market. China's high malocclusion prevalence and rapidly urbanizing middle class produce sustained patient queues, though reimbursement gaps persist. Japan and South Korea showcase early adoption of AI diagnostics and self-ligating ceramic braces. Australia benefits from robust private-insurance uptake and government standards that support digital workflows. India's tier-one cities see rising adult demand, yet price sensitivity lengthens decision cycles, positioning installment plans as a key enabler.

Europe maintains steady mid-single-digit growth underpinned by universal dental coverage and a mature specialist network. Sustainability legislation moves the supply chain toward recyclable and bio-based aligner materials, giving European vendors a first-mover edge. Germany and the United Kingdom anchor regional revenue thanks to high per-capita dental spending and pioneering research hubs. France and Spain observe increasing adult treatment acceptance as financing products expand. Eastern European markets open new patient pools but require distributor-supported professional education to establish digital protocols.

- 3M

- Align Technology

- Envista Holdings (Ormco & Spark)

- Dentsply Sirona

- Straumann AG (ClearCorrect)

- Henry Schein

- American Orthodontics

- G&H Orthodontics

- Great Lakes Dental Technologies

- DB Orthodontics

- Argen

- Patterson Companies

- SmileDirectClub Inc.

- Byte (LD Products)

- Rocky Mountain Orthodontics Inc.

- Ultradent Products Inc. (Opal)

- Modern Dental Group Ltd

- Dentaurum GmbH & Co. KG

- Scheu-Dental GmbH

- Dynaflex

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of malocclusion

- 4.2.2 Technological advances in digital orthodontics

- 4.2.3 Adult demand for aesthetic clear-aligner solutions

- 4.2.4 Expansion of direct-to-consumer orthodontics

- 4.2.5 AI-driven chair-side treatment planning

- 4.2.6 Sustainable, bio-based orthodontic materials

- 4.3 Market Restraints

- 4.3.1 High treatment cost & limited reimbursement

- 4.3.2 Clinical risks & complications

- 4.3.3 Supply-chain volatility of specialty alloys

- 4.3.4 Regulatory pushback on teledentistry models

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Fixed Braces

- 5.1.1.1 Brackets

- 5.1.1.2 Archwires

- 5.1.1.3 Anchorage Appliances

- 5.1.1.4 Ligatures

- 5.1.1.5 Others

- 5.1.2 Removable Braces / Clear Aligners

- 5.1.1 Fixed Braces

- 5.2 By Patient

- 5.2.1 Children & Teenagers

- 5.2.2 Adults

- 5.3 By End User

- 5.3.1 Dental Clinics & DSOs

- 5.3.2 Hospitals

- 5.3.3 Direct-to-Consumer Platforms

- 5.4 By Material

- 5.4.1 Metal Alloys

- 5.4.2 Ceramic & Polymer-Hybrid

- 5.4.3 Thermoplastic Polyurethane (TPU)

- 5.4.4 Bio-resorbable & Eco Materials

- 5.5 By Distribution Channel

- 5.5.1 Offline (Distributor / Retail)

- 5.5.2 E-commerce Platforms

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 3M Company

- 6.3.2 Align Technology Inc.

- 6.3.3 Envista Holdings (Ormco & Spark)

- 6.3.4 Dentsply Sirona Inc.

- 6.3.5 Straumann AG (ClearCorrect)

- 6.3.6 Henry Schein Inc.

- 6.3.7 American Orthodontics

- 6.3.8 G&H Orthodontics

- 6.3.9 Great Lakes Dental Technologies

- 6.3.10 DB Orthodontics Ltd

- 6.3.11 Argen Corporation

- 6.3.12 Patterson Companies Inc.

- 6.3.13 SmileDirectClub Inc.

- 6.3.14 Byte (LD Products)

- 6.3.15 Rocky Mountain Orthodontics Inc.

- 6.3.16 Ultradent Products Inc. (Opal)

- 6.3.17 Modern Dental Group Ltd

- 6.3.18 Dentaurum GmbH & Co. KG

- 6.3.19 Scheu-Dental GmbH

- 6.3.20 Dynaflex

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment