PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849884

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849884

Business-Process-as-a-Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

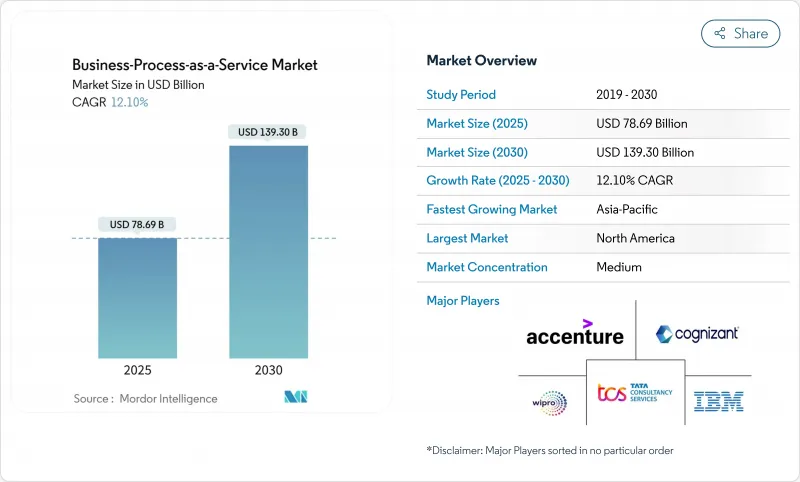

The Business-Process-as-a-Service Market size is estimated at USD 78.69 billion in 2025, and is expected to reach USD 139.30 billion by 2030, at a CAGR of 12.10% during the forecast period (2025-2030).

Accelerating adoption of cloud-native delivery models, rapid progress in artificial intelligence, and stronger regulatory pressure for resilient operations are reshaping organizational strategies. Enterprises are converting fixed costs into variable outlays while gaining immediate access to advanced automation, analytics, and industry-specific best practices-capabilities that once required years of capital investment. Intensifying focus on operational resilience after recent supply-chain disruptions has further positioned BPaaS as a preferred route for standardized processes that scale globally yet remain locally compliant. Vendors are responding through outcome-based commercial models, sovereign-cloud options, and ESG-linked process bundles, all of which deepen the strategic role of the Business-Process-as-a-Service market in digital transformation programs.

Global Business-Process-as-a-Service Market Trends and Insights

Growing Demand for Cloud Services and Standardized Processes

Universal migration toward cloud platforms underpins large-scale process standardization. Ninety-four percent of enterprises now leverage cloud solutions to streamline workflows, shorten deployment cycles, and ensure consistent governance. Elastic resource allocation supports rapid pivots in demand without forcing new capital decisions. IBM notes that 77% of firms already run hybrid architectures, enabling them to unify core processes over multiple clouds while keeping strategic workloads in preferred jurisdictions. Standardized, cloud-native modules accelerate compliance tasks in banking and insurance, where uniform audit trails are essential. As a result, the Business-Process-as-a-Service market experiences sustained multi-year momentum across sectors that demand speed, resilience, and global reach.

Need to Reduce Operational Cost and Boost Productivity

Economic headwinds intensify pressure to replace fixed costs with consumption-based models. BPaaS converts multi-year license contracts, data-center depreciation, and labor overhead into variable fees that align with actual usage. DXC Technology reports savings of 20-30% when organizations shift from traditional outsourcing to BPaaS frameworks. Process automation embedded in these services delivers additional productivity gains, with some enterprises citing 40% efficiency improvements in finance back-office tasks. These combined financial and operational benefits reinforce the Business-Process-as-a-Service market as a pragmatic lever for near-term profitability and long-term competitiveness.

Heightened Data-Security and Privacy Concerns

BPaaS deployments involve a distributed infrastructure that can enlarge the threat surface. The South African Reserve Bank cautions that cloud computing amplifies operational and systemic risks when controls are weak. European GDPR and California CCPA regulations impose severe penalties for non-compliance, compelling providers to implement sophisticated encryption, identity management, and regional data-residency architectures. Heightened scrutiny temporarily slows decision cycles, limiting short-term adoption in sensitive verticals even as security-enhanced platforms emerge to rebuild trust in the Business-Process-as-a-Service market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of AI / Hyper-automation in BPaaS

- Expansion of Outcome-based (Gain-share) BPaaS Pricing Models

- Integration Complexity with Legacy Core Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large Enterprises dominated 2024 with 64.3% of the Business-Process-as-a-Service market share, leveraging standardized global workflows to simplify audits and cut duplicative platforms. They often start by outsourcing non-core finance and HR tasks, then extend coverage to customer experience and supply-chain analytics once governance structures prove resilient. Integration remains a priority; many deploy middleware layers that blend on-premise ERPs with public-cloud microservices, preserving strategic data control while maximizing vendor innovation. In parallel, fresh enterprise-wide governance councils monitor vendor performance under outcome-based contracts, ensuring continuous alignment with strategic objectives.

SMEs, though historically under-represented, now display the strongest momentum with a forecast 13.3% CAGR. Cloud-first solutions remove traditional barriers such as capital outlay, specialist talent shortages, and infrastructure maintenance. Japan's Kubell Co. reports that its Chatwork platform served 605,000 SME clients by September 2024, underscoring the segment's pent-up demand. SMEs typically begin with single-process modules-payroll, invoicing, or help-desk automation-before scaling to end-to-end suites as reliability is proven. The elastic fee model offers crucial cash-flow flexibility during growth spurts or economic contractions. Consequently, the Business-Process-as-a-Service market size attributable to SMEs is projected to widen substantially through 2030 as providers release pre-configured bundles tailored for industry-specific compliance.

Human Resource Management retained 24.1% of 2024 revenue, reflecting global recognition that standardized recruitment, payroll, and talent-engagement workflows lower compliance risk and enhance employee experience. Many providers now pair HR modules with predictive analytics that forecast attrition, identify skill gaps, and recommend learning content. Accounting and Finance processes also gain traction as robotic invoice matching, automated reconciliations, and AI-driven fraud checks boost accuracy while shrinking cycle times. Supply Chain and Procurement solutions improve vendor collaboration and inventory visibility, critical in volatile logistics environments.

Customer Service and Support, forecast to rise 14.6% annually, leads growth as brands pivot to omnichannel engagement. AI-driven chatbots and voice analytics deliver instant, personalized responses at far lower cost than traditional call centers. Sutherland Global's deployments cut average response time while raising first-contact resolution, enhancing NPS scores, and reducing escalations. Sales and Marketing BPaaS complements these advances, synchronizing campaign data with front-office analytics to sharpen lead quality. Operations modules apply workflow engines to field-service dispatch, plant-maintenance scheduling, and quality assurance. Together, these innovations anchor sustained expansion of the Business-Process-as-a-Service market.

Business Process As A Service Market is Segmented by Organization Size (Large Enterprises and Small and Medium Enterprises), Process (Human Resource Management, Accounting and Finance, and More), Deployment Model (Public Cloud BPaaS, Private Cloud BPaaS, and Hybrid/Multi-Cloud BPaaS), End-User Industry (BFSI, IT and Telecommunications, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 41.2% of 2024 revenue for the Business-Process-as-a-Service market, buoyed by early cloud uptake and deep provider ecosystems. Financial institutions use BPaaS to consolidate compliance documentation across jurisdictions, while retail groups pursue AI-led customer-service automation. Cloud infrastructure concentration is notable; the UK Competition and Markets Authority estimates AWS and Microsoft hold 40-50% and 30-40% of North American infrastructure, respectively. This dominance encourages BPaaS vendors to forge strategic alliances with hyperscalers for latency optimization and joint go-to-market programs.

Asia-Pacific is projected to record the fastest 12.8% CAGR between 2025 and 2030. Governments in India, the Philippines, and Indonesia promote "cloud first" mandates to reduce operating costs and improve citizen services. The Data Security Council of India notes that the national cloud market reached USD 7.70 billion by 2022, underscoring the readiness of foundational infrastructure. Indigenous providers partner with global players to address regional data-localization requirements. Japanese enterprises, challenged by labor shortages, lean on BPaaS to automate routine functions, stimulating demand across manufacturing and retail sectors.

Europe exhibits measured growth as stringent privacy rules guide deployment choices. GDPR compliance shapes contract terms, data-residency clauses, and shared-responsibility frameworks. Germany's BPO market, forecast to hit USD 21.32 billion by 2029, already registers 81% cloud adoption among firms. Financial institutions prefer hybrid models, pairing local sovereign clouds with scalable public resources to satisfy supervisory guidance outlined by Eurofi. The region's strong ESG agenda fuels demand for sustainability-centric BPaaS solutions that automate carbon accounting and social-impact reporting.

- Accenture plc

- IBM Corporation

- Tata Consultancy Services (TCS)

- Cognizant Technology Solutions

- Wipro Limited

- HCL Technologies

- Capgemini SE

- Infosys Limited

- Genpact Ltd.

- Fujitsu Ltd.

- Oracle Corporation

- SAP SE

- Deloitte Touche Tohmatsu Limited

- NTT DATA

- CGI Inc.

- DXC Technology

- Tech Mahindra

- EXL Service Holdings

- ADP Inc.

- Alight Solutions

- Paychex Inc.

- UKG (Ultimate Kronos Group)

- TriNet Group

- Ceridian HCM

- WNS Global Services

- Sutherland Global Services

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for cloud services and standardized processes

- 4.2.2 Need to reduce operational cost and boost productivity

- 4.2.3 Rapid adoption of AI/hyper-automation in BPaaS

- 4.2.4 Expansion of outcome-based BPaaS pricing models

- 4.2.5 ESG-linked reporting mandates driving sustainability BPaaS

- 4.2.6 Demand for industry-specific BPaaS solutions

- 4.3 Market Restraints

- 4.3.1 Heightened data-security and privacy concerns

- 4.3.2 Integration complexity with legacy core systems

- 4.3.3 Vendor lock-in and interoperability limitations

- 4.3.4 Sovereign-cloud requirements restricting cross-border BPaaS

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Organization Size

- 5.1.1 Large Enterprises

- 5.1.2 Small and Medium Enterprises (SMEs)

- 5.2 By Process

- 5.2.1 Human Resource Management (HRM)

- 5.2.2 Accounting and Finance

- 5.2.3 Customer Service and Support

- 5.2.4 Sales and Marketing

- 5.2.5 Supply Chain and Procurement

- 5.2.6 Operations and Other Horizontal Processes

- 5.3 By Deployment Model

- 5.3.1 Public Cloud BPaaS

- 5.3.2 Private Cloud BPaaS

- 5.3.3 Hybrid/Multi-Cloud BPaaS

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 IT and Telecommunications

- 5.4.3 Healthcare and Life Sciences

- 5.4.4 Retail and E-Commerce

- 5.4.5 Manufacturing

- 5.4.6 Government and Public Sector

- 5.4.7 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Singapore

- 5.5.4.7 Malaysia

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Accenture plc

- 6.4.2 IBM Corporation

- 6.4.3 Tata Consultancy Services (TCS)

- 6.4.4 Cognizant Technology Solutions

- 6.4.5 Wipro Limited

- 6.4.6 HCL Technologies

- 6.4.7 Capgemini SE

- 6.4.8 Infosys Limited

- 6.4.9 Genpact Ltd.

- 6.4.10 Fujitsu Ltd.

- 6.4.11 Oracle Corporation

- 6.4.12 SAP SE

- 6.4.13 Deloitte Touche Tohmatsu Limited

- 6.4.14 NTT DATA

- 6.4.15 CGI Inc.

- 6.4.16 DXC Technology

- 6.4.17 Tech Mahindra

- 6.4.18 EXL Service Holdings

- 6.4.19 ADP Inc.

- 6.4.20 Alight Solutions

- 6.4.21 Paychex Inc.

- 6.4.22 UKG (Ultimate Kronos Group)

- 6.4.23 TriNet Group

- 6.4.24 Ceridian HCM

- 6.4.25 WNS Global Services

- 6.4.26 Sutherland Global Services

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment