PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849892

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849892

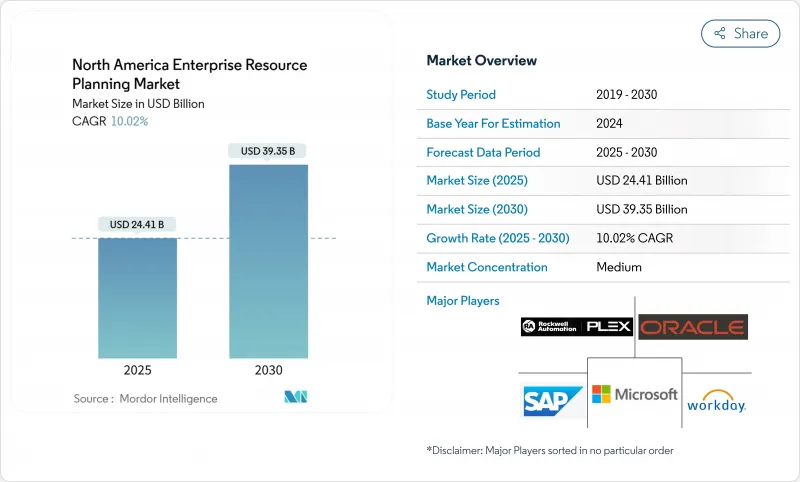

North America Enterprise Resource Planning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America enterprise resource planning market size stands at USD 24.41 billion in 2025 and is projected to reach USD 39.35 billion by 2030, reflecting a sturdy 10.0% CAGR.

This expansion mirrors the region-wide migration from legacy on-premise suites to cloud-native platforms that give firms agility, real-time insights, and consumption-based cost structures. Heightened interest in AI-embedded analytics is reshaping implementation roadmaps, while mandatory environmental, social, and governance (ESG) disclosures push companies to modernize their financial consolidation processes. Oracle overtook SAP as the region's largest ERP application supplier in 2024 with USD 8.7 billion in revenue and 6.63% North America enterprise resource planning market share, underscoring a sharpening rivalry among tier-1 vendors. Governments also catalyze uptake: the United States continues to modernize state and local systems, whereas Canada's Digital Adoption Program subsidizes manufacturing ERP investments, and Mexico leverages USMCA digital-trade provisions to streamline cross-border data flows.

North America Enterprise Resource Planning Market Trends and Insights

Rapid Shift Toward Cloud-First ERP Deployment Models

Cloud adoption is now the baseline for new ERP rollouts as cost, scalability, and remote-work support eclipse entrenched on-premise preferences. Clark County, Washington, recorded 60% faster payroll runs and cut unapproved spending by 15% after moving to Workday. Hybrid architectures remain common because highly regulated firms keep sensitive data on-premise while extending edge or specialty functionality in public clouds. Security investments rose sharply in manufacturing corridors, and subscription-pricing lets finance teams reallocate capital budgets to strategic innovation rather than hardware refresh cycles. Alongside technology upgrades, chief information officers prioritize stakeholder training so cultural adoption matches architectural transformation.

Surge in AI-Embedded Analytics for Real-Time Decision-Making

Generative and predictive models are reshaping ERP from transaction recorders to intelligent orchestration engines. IBM and Oracle now co-develop autonomous agents that recommend policy-compliant actions across finance, supply chain, and HR workflows. NetSuite's machine-learning accounts-payable module reduces manual invoice entry and speeds reconciliation, easing month-end close pressure. Manufacturers embed AI in plant-level modules for predictive maintenance, driving shorter unplanned downtime across the 95% of firms that already deploy smart-factory technologies. Healthcare providers leverage analytics to reconcile clinical and financial data, improving reimbursement accuracy and compliance reporting. All initiatives rely on robust governance because algorithmic bias or stale data can erode trust in automated decisions.

Up-Front and Life-Cycle Costs of Implementation and Change-Management

Comprehensive ERP projects absorb expenses that extend well beyond license or subscription fees. Data migration, business-process re-engineering, and staff training frequently double original budgets for hospitals and public agencies, as seen in multi-year modernizations at Baptist Health. SMEs rely on external consultants because they lack dedicated IT capacity, but scarce talent drives day-rates higher and stretches timelines. Cloud delivery softens capital expenditure yet does not eliminate the cultural shifts required for process standardization. Without robust change-leadership structures, expensive platforms risk under-utilization and diminished ROI.

Other drivers and restraints analyzed in the detailed report include:

- Two-Tier ERP Adoption to Harmonize HQ and Subsidiary Operations

- Rising SMB Demand for Affordable, Modular SaaS Suites

- Cyber-Security and Data-Sovereignty Concerns in Multitenant Clouds

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud-native suites accounted for 60.5% revenue in 2024, ensuring the North America enterprise resource planning market retains a strong baseline of broad-function platforms. Social/collaborative ERP, however, will grow fastest at 11.4% CAGR through 2030 as corporations seek consumer-grade user experiences. Knowledge workers adopt activity feeds, shared dashboards, and real-time chat inside finance and supply-chain transactions, lifting system usage rates and shortening approval cycles. Integrated mobile apps deliver the same capabilities at job sites or customer locations, reinforcing always-connected workflows. Vendor roadmaps increasingly bundle social elements by default rather than as optional modules, underscoring their strategic value. Over time, artificial-intelligence assistants embedded in these channels will recommend actions or flag exceptions, deepening the linkage between engagement and operational efficiency.

Finance and accounting maintained 55.7% of the North America enterprise resource planning market size in 2024, reflecting mandatory reporting and audit requirements. Nonetheless, supply-chain and operations modules will expand at a 10.8% CAGR. Edge computing and the Internet of Things feed real-time shop-floor data into planning algorithms, improving material availability and lowering working capital. Predictive shipment ETAs support omnichannel commitments, while automated quality-checks cut return rates. Human-capital modules meanwhile gain priority as manufacturers confront labour shortages and rising voluntary turnover. Customer-commerce add-ons connect order capture to inventory, letting firms promise exact delivery windows that boost conversion rates. Finance still acts as the system-of-record, but operational datasets increasingly drive profit-and-loss outcomes.

The North America Enterprise Resource Planning Market Report is Segmented by Type (Cloud-Native Suite, Mobile-First ERP, and More), Business Function (Finance and Accounting, and More), Deployment Model (On-Premise and Cloud), Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), Industry Vertical (Manufacturing, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- SAP SE

- Oracle Corporation

- Microsoft Corporation

- Workday Inc.

- Infor Inc.

- Epicor Software Corporation

- IBM Corporation

- The Sage Group plc

- Plex Systems Inc. (Rockwell Automation)

- FinancialForce.com Inc.

- Unit4 NV

- Deltek Inc.

- Deacom Inc.

- Acumatica Inc.

- IFS AB

- Syspro USA Inc.

- QAD Inc.

- Oracle NetSuite

- SAP Business One

- Odoo SA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid shift toward cloud-first ERP deployment models

- 4.2.2 Surge in AI-embedded analytics for real-time decision-making

- 4.2.3 Two-tier ERP adoption to harmonise HQ and subsidiary operations

- 4.2.4 Rising SMB demand for affordable, modular SaaS suites

- 4.2.5 ESG-linked reporting mandates accelerating system upgrades

- 4.2.6 Edge/IoT data integration for closed-loop operations

- 4.3 Market Restraints

- 4.3.1 Up-front and life-cycle costs of implementation and change-management

- 4.3.2 Cyber-security and data-sovereignty concerns in multitenant clouds

- 4.3.3 Shortage of North America-based ERP talent and project bandwidth

- 4.3.4 Vendor lock-in risk amid shrinking on-premise support windows

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Cloud-native Suite

- 5.1.2 Mobile-first ERP

- 5.1.3 Social / Collaborative ERP

- 5.1.4 Two-Tier / Edge ERP

- 5.2 By Business Function

- 5.2.1 Finance and Accounting

- 5.2.2 Supply-Chain and Operations

- 5.2.3 Human Capital Management

- 5.2.4 Customer Relationship and Commerce

- 5.2.5 Manufacturing Execution and Quality

- 5.3 By Deployment Model

- 5.3.1 On-premise

- 5.3.2 Cloud

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

- 5.5 By Industry Vertical

- 5.5.1 Manufacturing

- 5.5.2 Retail and E-commerce

- 5.5.3 BFSI

- 5.5.4 Government and Public Sector

- 5.5.5 IT and Telecom

- 5.5.6 Healthcare and Life Sciences

- 5.5.7 Others

- 5.6 By Country

- 5.6.1 United States

- 5.6.2 Canada

- 5.6.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 SAP SE

- 6.4.2 Oracle Corporation

- 6.4.3 Microsoft Corporation

- 6.4.4 Workday Inc.

- 6.4.5 Infor Inc.

- 6.4.6 Epicor Software Corporation

- 6.4.7 IBM Corporation

- 6.4.8 The Sage Group plc

- 6.4.9 Plex Systems Inc. (Rockwell Automation)

- 6.4.10 FinancialForce.com Inc.

- 6.4.11 Unit4 NV

- 6.4.12 Deltek Inc.

- 6.4.13 Deacom Inc.

- 6.4.14 Acumatica Inc.

- 6.4.15 IFS AB

- 6.4.16 Syspro USA Inc.

- 6.4.17 QAD Inc.

- 6.4.18 Oracle NetSuite

- 6.4.19 SAP Business One

- 6.4.20 Odoo SA

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment