PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849901

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849901

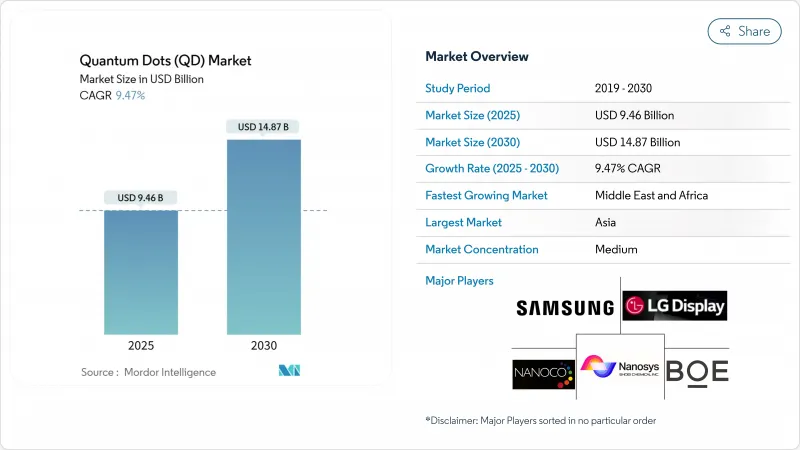

Quantum Dots (QD) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global quantum dots market stood at USD 9.46 billion in 2025 and is forecast to reach USD 14.87 billion by 2030, reflecting a 9.47% CAGR over the period.

Commercial maturity is accelerating as the technology migrates from laboratory discovery to mass-produced components in ultra-high-definition displays, quantum-secure communication nodes, and next-generation bio-imaging platforms. China's rapid uptake of quantum-dot televisions, the emergence of cadmium-free chemistries that comply with EU RoHS limits, and sustained government funding in Asia and the Middle East are sustaining long-term demand. Manufacturing scale advantages in Asia-Pacific, combined with perovskite breakthroughs that lift efficiency and color purity, are lowering unit costs faster than legacy OLED alternatives, opening mainstream consumer price points. In parallel, quantum computing architectures based on semiconductor quantum dots, and five-fold sensitivity gains in cancer diagnostics, are expanding total addressable opportunities well beyond displays.

Global Quantum Dots (QD) Market Trends and Insights

Quantum-dot adoption in ultra-high-definition television panels, led by China

Domestic panel makers have installed high-capacity quantum-dot film lines that deliver more than 100% NTSC color gamut, while TCL's QM6K series achieves 98%+ DCI-P3 coverage and 53% higher brightness through Super High Energy LED back-lights. BOE's USD 9 billion Gen-8.6 AMOLED facility, coming online in 2026, reinforces cost leadership and secures supply for regional brands. The shift from RGB OLED to QD-OLED architectures simplifies manufacturing, enhancing yield and lowering capex per square meter for 4K and 8K screens.

Regulatory push for cadmium-free quantum dots in EU consumer electronics

The EU's 0.01 wt% cadmium cap under RoHS is driving early movers toward copper-indium and indium-phosphide formulations. UbiQD's USD 20 million Series B round will scale cadmium-free production, while Applied Materials has proven lead-free devices matching cadmium performance in color conversion layers. Universities are commercializing aqueous synthesis routes that remove organic solvents and cut process emissions, creating cost and compliance advantages for adopters.

Supply-chain bottlenecks for high-purity indium-phosphide precursors

Indium demand from 6G infrastructure is projected to consume 4% of annual production, squeezing availability for indium-phosphide quantum dots and pushing prices higher. Soochow University's ink-engineering route lowers photovoltaic costs to USD 0.06/Wp but relies on consistent indium purity, which remains scarce outside a handful of refiners. Microwave-assisted and ionic-liquid syntheses reduce hazardous reagents yet still require secure metal feedstocks, keeping supply risk elevated through at least 2028.

Other drivers and restraints analyzed in the detailed report include:

- Rapid commercialization of perovskite quantum dots in display back-lighting

- Surge in quantum-dot bio-imaging agents in healthcare applications

- Performance degradation of perovskite quantum dots under moisture exposure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cadmium-based II-VI compounds held 48.3% of 2024 revenues, anchoring the quantum dots market through well-established supply chains and high quantum yields. Regulatory exposure, however, compresses their outlook as EU and California policies converge on lighter-element chemistries. Perovskite variants, supported by 11.7% CAGR, move from lab novelty to production-ready emitters that match cadmium brightness and achieve room-temperature single-photon purity, broadening relevance for secure communications. Indium-phosphide platforms benefit from UbiQD's scale-up funding and Applied Materials' process optimization, yet precursor shortages temper near-term penetration. Silicon and carbon quantum dots are carving biomedical niches, showing negligible cytotoxicity at clinically relevant doses and enabling fluorescence-guided surgery. Historic data reveal cadmium alternatives growing 15-20% annually versus sub-5% for cadmium incumbents from 2020-2024, signaling a structural pivot in the quantum dots market.

Second-generation materials diversify end-use reach. Graphene quantum dots fused with silicon nanoshells achieve 71% aphid-population suppression, positioning nanomaterials for precision agriculture beyond displays. Perovskite glow layers are now printable at 140 PPI, easing integration into mid-sized monitors, while silicon dots deliver stable infrared photoluminescence critical for wearable biosensors. The quantum dots market size for cadmium-free segments is projected to rise at double-digit rates, reinforcing supplier pivots toward low-toxicity chemistries. Heightened corporate ESG targets, plus upcoming RoHS exemptions sunsets, cement the transition path.

QD films remain revenue mainstays with 72.1% share in 2024, favored by television OEMs seeking plug-and-play color converters that slip into existing LCD stacks. Yet on-chip quantum dots display the highest 12.7% CAGR as semiconductor fabs capture photonic emitters directly on foundry platforms. University of Cambridge's 13,000-spin quantum register, achieving 69% fidelity at 130 µs coherence, underscores leapfrog potential for chip-scale quantum nodes. Core-shell nanopillars grown through microfluidic reactors now exhibit sub-5% size dispersion, crucial for coherent emission. Electrophoretic deposition on corrugated wafers yields crack-free near-infrared detectors, opening automotive LiDAR and medical endoscope markets. As line width reductions plateau, integrated photonics offers Moore-than-More scaling, with quantum dots supplying the single-photon sources missing from silicon photonics roadmaps.

Scaling pathways diverge. Inkjet printed QD-OLED panels already hit 31.5-inch diagonals at commercial yield, while electrohydrodynamic jetting produces micron-scale RGB pixels for microLED arrays. The quantum dots market size captured by on-chip formats is set to widen as performance gains in quantum computing justify higher ASPs. Investments in atomic-layer deposition and atomic-precision lithography will further align dot placement with transistor gateways, shrinking interconnect delays in quantum buses. Device OEMs are bundling intellectual property around packaging, thermal management, and lithographic alignment, creating new defensible moats.

The Quantum Dots (QD) Market is Segmented by Material Type (Cadmium-Based II-VI (CdSe, Cds, Cdte), Cadmium-Free III-V (InP, Gaas), and More), Device Form Factor (QD Films, On-Chip Quantum Dots, and More), Application (Displays, Lighting, Solar Cells and Photovoltaics, and More), End-Use Industry (Consumer Electronics, Healthcare and Life Sciences, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific maintains leadership with 38.4% of 2024 revenue due to vertically integrated panel makers and deliberate national R&D funding. Samsung Display's USD 10.9 billion conversion to QD-OLED lines and South Korea's KRW 491 billion quantum program cement the ecosystem, while China's BOE invests USD 9 billion in Gen-8.6 capacity that anchors local supply chains. Japan complements manufacturing heft with process innovation, hosting seminars to solve toxicity and durability bottlenecks. The quantum dots market size in Asia remains underpinned by domestic demand for premium TVs and by export flows into North America and Europe.

North America follows with deep research assets at University of Cambridge (Cambridge-US collaborations), MIT Lincoln Laboratory, and Los Alamos National Laboratory driving quantum-secure links and high-efficiency photovoltaics. Venture capital traction is robust, proven by UbiQD's USD 20 million raise and IonQ's headline acquisitions. Strong IP protection and federal funding ensure commercialization pipelines, and US export-control scrutiny over cadmium compounds nudges suppliers toward indium-phosphide builds. Europe leverages regulatory influence: RoHS compliance sparks cadmium-free adoption, while University of Liege's aqueous syntheses cut hazardous waste. Government green-deal funds deploy quantum-dot window films for energy-positive buildings.

The Middle East and Africa record the fastest 10.6% CAGR. UAE's Norma Center, Qatar's USD 10 million program, and Saudi R&D funds foster quantum-dot computing clusters, aiming to diversify oil economies. Import substitution policies encourage local assembly of QD-enhanced solar panels and medical devices. Latin America sees nascent demand in agrotechnology, where quantum-dot greenhouse sheets improve fruit yield in high-altitude farms, yet market penetration remains under 3%. Overall, geographic revenue dispersion reduces concentration risk: Asia's share inches lower toward 35% by 2030 as Middle East and Africa capture investment flows and as Western regions on-shore critical materials processing.

- Samsung Electronics Co., Ltd.

- Nanosys Inc.

- LG Display Co., Ltd.

- BOE Technology Group Co., Ltd.

- Nanoco Group PLC

- Quantum Materials Corporation

- UbiQD, Inc.

- Ocean NanoTech LLC

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Avantama AG

- Quantum Solutions Inc.

- QD Laser, Inc.

- OSRAM Licht AG

- Sony Corporation

- TCL CSOT

- Crystalplex Corporation

- Evident Technologies

- NN-Labs (NNCrystal US Corp.)

- Nanophotonica Inc.

- Quantum Science Ltd.

- Toray Industries, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Quantum Dot Adoption in Ultra-High-Definition Television Panels, Led by China

- 4.2.2 Regulatory Push for Cadmium-Free Quantum Dots in EU Consumer Electronics

- 4.2.3 Rapid Commercialization of Perovskite Quantum Dots in Display Back-Lighting

- 4.2.4 Surge in Quantum Dot-Based Bio-Imaging Agents in Healthcare Applications

- 4.2.5 Government-Funded Quantum-Materials R&D Programs in South Korea

- 4.3 Market Restraints

- 4.3.1 Supply-Chain Bottlenecks for High-Purity Indium-Phosphide Precursors

- 4.3.2 Performance Degradation of Perovskite QDs Under Moisture Exposure

- 4.3.3 Environmental-Compliance Costs of Cadmium Regulations in Europe

- 4.3.4 Limited Mass-Manufacturing Infrastructure for QD Micro-LED Integration

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook (Production Technology)

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

- 4.7 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Material Type

- 5.1.1 Cadmium-based II-VI (CdSe, CdS, CdTe)

- 5.1.2 Cadmium-Free III-V (InP, GaAs)

- 5.1.3 Perovskite Quantum Dots

- 5.1.4 Silicon Quantum Dots

- 5.1.5 Graphene and Carbon Quantum Dots

- 5.2 By Device Form Factor

- 5.2.1 QD Films

- 5.2.2 On-Chip Quantum Dots

- 5.2.3 Core-Shell and In-Shell Architectures

- 5.3 By Application

- 5.3.1 Displays

- 5.3.1.1 QD-LCD

- 5.3.1.2 QD-OLED

- 5.3.1.3 Micro-LED Integration

- 5.3.2 Lighting

- 5.3.2.1 General Illumination

- 5.3.2.2 Specialty Lighting

- 5.3.3 Solar Cells and Photovoltaics

- 5.3.4 Medical Imaging and Diagnostics

- 5.3.5 Drug Delivery and Theranostics

- 5.3.6 Sensors and Instruments

- 5.3.7 Quantum Computing and Security

- 5.3.8 Agriculture and Food

- 5.3.9 Others

- 5.3.1 Displays

- 5.4 By End-Use Industry

- 5.4.1 Consumer Electronics

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Energy and Power

- 5.4.4 Defense and Security

- 5.4.5 Agriculture

- 5.4.6 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Nordics

- 5.5.2.5 Rest of Europe

- 5.5.3 South America

- 5.5.3.1 Brazil

- 5.5.3.2 Rest of South America

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South-East Asia

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Gulf Cooperation Council Countries

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Samsung Electronics Co., Ltd.

- 6.4.2 Nanosys Inc.

- 6.4.3 LG Display Co., Ltd.

- 6.4.4 BOE Technology Group Co., Ltd.

- 6.4.5 Nanoco Group PLC

- 6.4.6 Quantum Materials Corporation

- 6.4.7 UbiQD, Inc.

- 6.4.8 Ocean NanoTech LLC

- 6.4.9 Thermo Fisher Scientific Inc.

- 6.4.10 Merck KGaA

- 6.4.11 Avantama AG

- 6.4.12 Quantum Solutions Inc.

- 6.4.13 QD Laser, Inc.

- 6.4.14 OSRAM Licht AG

- 6.4.15 Sony Corporation

- 6.4.16 TCL CSOT

- 6.4.17 Crystalplex Corporation

- 6.4.18 Evident Technologies

- 6.4.19 NN-Labs (NNCrystal US Corp.)

- 6.4.20 Nanophotonica Inc.

- 6.4.21 Quantum Science Ltd.

- 6.4.22 Toray Industries, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment