PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849904

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849904

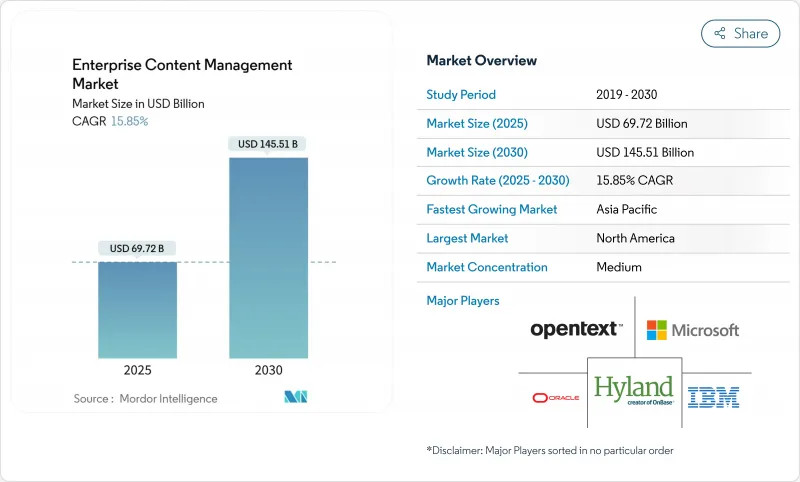

Enterprise Content Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

Current estimates place the enterprise content management market size at USD 69.72 billion in 2025 and forecast it to reach USD 145.51 billion by 2030, expanding at a 15.85% CAGR.

Rapid gains reflect a decisive move from traditional file repositories toward AI-enabled platforms that transform unstructured data into usable intelligence. Regulatory mandates, the surge in remote work, and a pivot to cloud-native architectures combine to create a resilient demand curve. Vendors that marry compliance capabilities with scalable cloud offerings stand to capture outsized opportunities, while organizations that modernize early benefit from productivity lifts and cost avoidance. Intensifying competition centers on embedded analytics and integration with collaboration suites that embed content management inside daily workflows.

Global Enterprise Content Management Market Trends and Insights

Regulatory compliance mandates for content lifecycle governance

Growing data-protection laws turn content governance into a board-level obligation. GDPR enforcement in Europe demonstrated the financial and reputational costs of non-compliance, motivating enterprises to adopt platforms that automate retention, deletion, and audit logging. New AI legislation now under debate requires transparent data handling, adding urgency to the upgrade cycle. Financial institutions must capture immutable audit trails to satisfy Basel III, while healthcare providers secure telemedicine records under HIPAA.As penalties tighten, enterprises prioritize unified solutions over fragmented repositories, ensuring consistent policy execution and lowering legal exposure.

Explosion of enterprise unstructured data volumes

Petabytes of multimedia files, sensor logs, and social interactions overwhelm legacy file shares. Banks archive millions of customer chats and video calls, manufacturers manage CAD designs and inspection images, and global design teams generate real-time feedback loops.Remote work has scattered content across personal devices and disparate cloud apps, causing retrieval delays and duplicated effort. Modern platforms that apply machine learning to classify and surface content give organizations a path to transform data sprawl into accessible knowledge, unlocking collaboration gains and faster decision cycles.

Security and privacy concerns in cloud/mobile ECM

Risk-averse sectors hesitate to move regulated content off-premises. Encryption key management, jurisdictional control, and vendor lock-in remain top questions for CISOs. Mobile access introduces endpoints lacking enterprise hardening, expanding the attack surface. Although cloud providers invest in continuous penetration testing and confidential computing, perception lags reality, adding extra approval cycles and slowing rollouts, especially in Europe where data-residency clauses are stringent.

Other drivers and restraints analyzed in the detailed report include:

- Accelerated shift to cloud-native ECM deployments

- AI-driven content intelligence and hyper-automation

- Complexity of merging legacy repositories post-M&A

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Document Management retained a 32.3% leading share of the enterprise content management market in 2024, underscoring its role as the backbone for regulated records and everyday files. Demand remains steady among finance, healthcare, and public agencies that require check-in/out, version control, and audit capabilities. The enterprise content management market size linked to Digital Asset Management is accelerating at a 16.2% CAGR through 2030 as marketers orchestrate rich media across omnichannel campaigns.

Hybrid platforms blur traditional boundaries because vendors embed DAM, workflow orchestration, and records management inside a single interface. This convergence reflects buyer preference for unified licensing and lower integration overhead. Case Management tools serve litigation teams, insurers, and public benefits programs, while Workflow Management aligns with broader process automation suites. Record Management continues to secure long-term archives in energy, pharmaceutical, and aerospace sectors where retention spans decades and penalties for loss are severe.

On-premises deployments held 57.1% of the enterprise content management market size in 2024, a testament to entrenched infrastructure and strict compliance constraints. Nevertheless, cloud subscriptions registered a 15.3% CAGR that outpaced all other modes. The Japanese government's mandate to migrate core systems by 2025 exemplifies the policy push behind adoption, forcing agencies to modernize aging stacks under tight timelines.

Organizations now weigh operational resilience and real-time collaboration more heavily than historical capex accounting. Security objections decline as providers offer customer-managed keys and regional data centers. Hybrid patterns persist, keeping sensitive archives in internal data centers while leveraging SaaS for collaboration. This phased approach eases skills gaps and budget planning yet often serves as a bridge to eventual full-cloud commitment.

Enterprise Content Management Market is Segmented by Component by Solution Type (Content Management, Document Management, and More), by Deployment Mode (On-Premises, Cloud), by Enterprise Size (Small and Medium Enterprises and Large Enterprises), by End-User Industry (Telecom and IT, BFSI, and More), by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 31.6% revenue in 2024 and remains the most mature territory, supported by a deep partner ecosystem and clarified regulatory environment that de-risks project approvals. United States banks modernize legacy imaging systems, and healthcare providers digitize patient records to meet interoperability rules. Canadian federal and provincial agencies migrate their paper archives to the cloud to enhance transparency. Mexican manufacturers adopt ECM for cross-border supply-chain documentation, illustrating spillover effects across the USMCA corridor.

Asia-Pacific delivers the highest 17.4% CAGR through 2030. Japan's public cloud program accelerates adoption across ministries and prefectures. India's Digital India initiative brings ECM to state services and public universities, while South Korea and Australia push AI enhancements in established deployments. These factors combine to give the enterprise content management market its most dynamic regional expansion in Asia-Pacific.

Europe balances opportunity with compliance complexity. GDPR continues to direct spending toward solutions that guarantee data sovereignty, and proposed AI rules tighten documentation controls. Germany's industrial base embeds ECM in Industry 4.0 workflows, the United Kingdom's finance sector pursues paperless mortgage underwriting, and France upgrades hospital and university repositories. Smaller economies such as the Nordics invest in vertical solutions for energy and life sciences, seeking resilience and traceable workflows suitable for highly specialized exports.

- Microsoft Corporation

- OpenText Corporation

- IBM Corporation

- Hyland Software Inc.

- Oracle Corporation

- Box Inc.

- Adobe Inc.

- Xerox Corporation

- M-Files Corp.

- Alfresco Software Inc. (Hyland)

- DocuWare GmbH

- Datamatics Global Services Ltd.

- Hewlett Packard Enterprise Co.

- Capgemini SE

- Newgen Software Technologies Ltd.

- Laserfiche Inc.

- SER Group

- Fabasoft AG

- Everteam Global Services

- KnowledgeLake Inc.

- iManage LLC

- Egnyte Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory compliance mandates for content lifecycle governance

- 4.2.2 Explosion of enterprise unstructured data volumes

- 4.2.3 Accelerated shift to cloud-native ECM deployments

- 4.2.4 AI-driven content intelligence and hyper-automation

- 4.2.5 Convergence of ECM with collaboration hubs (Teams, Slack)

- 4.2.6 EU digital-sovereignty hosting requirements

- 4.3 Market Restraints

- 4.3.1 Security and privacy concerns in cloud/mobile ECM

- 4.3.2 Complexity of merging legacy repositories post-MandA

- 4.3.3 Cross-border data-transfer restrictions (GDPR, DPDPA, etc.)

- 4.3.4 Talent gap in information-governance professionals

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macro Economic Factors on the Market

- 4.8 Porters Five Forces

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution Type

- 5.1.1 Content Management

- 5.1.2 Document Management

- 5.1.3 Case Management

- 5.1.4 Workflow Management

- 5.1.5 Record Management

- 5.1.6 Digital Asset Management

- 5.1.7 Others

- 5.2 By Deployment Mode

- 5.2.1 On-Premises

- 5.2.2 Cloud

- 5.3 By Enterprise Size

- 5.3.1 Small and Medium Enterprises (SME)

- 5.3.2 Large Enterprises

- 5.4 By End-user Industry

- 5.4.1 Telecom and IT

- 5.4.2 BFSI

- 5.4.3 Retail and E-commerce

- 5.4.4 Education

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Government and Public Sector

- 5.4.8 Others

- 5.5 By Region

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Kenya

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Microsoft Corporation

- 6.4.2 OpenText Corporation

- 6.4.3 IBM Corporation

- 6.4.4 Hyland Software Inc.

- 6.4.5 Oracle Corporation

- 6.4.6 Box Inc.

- 6.4.7 Adobe Inc.

- 6.4.8 Xerox Corporation

- 6.4.9 M-Files Corp.

- 6.4.10 Alfresco Software Inc. (Hyland)

- 6.4.11 DocuWare GmbH

- 6.4.12 Datamatics Global Services Ltd.

- 6.4.13 Hewlett Packard Enterprise Co.

- 6.4.14 Capgemini SE

- 6.4.15 Newgen Software Technologies Ltd.

- 6.4.16 Laserfiche Inc.

- 6.4.17 SER Group

- 6.4.18 Fabasoft AG

- 6.4.19 Everteam Global Services

- 6.4.20 KnowledgeLake Inc.

- 6.4.21 iManage LLC

- 6.4.22 Egnyte Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment