PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849905

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849905

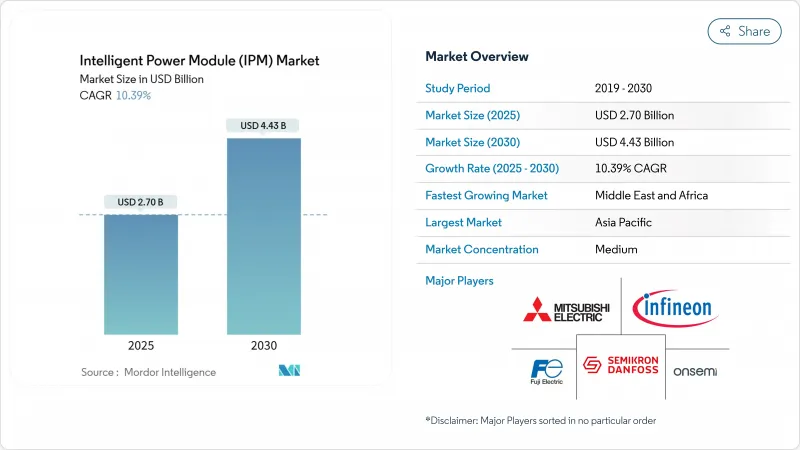

Intelligent Power Module (IPM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Intelligent Power Module market size was valued at USD 2.70 billion in 2025 and is forecast to reach USD 4.43 billion by 2030, expanding at a 10.39% CAGR.

This trajectory reflected the shift toward high-efficiency conversion in electric vehicles, renewable energy, industrial automation, and advanced consumer appliances. Demand was reinforced by policy-driven electrification, tighter energy-efficiency mandates, and rapid substitution of discrete power devices with compact modules that shorten design cycles. The integration of wide-bandgap semiconductors, especially silicon carbide (SiC) and gallium nitride (GaN), allowed higher switching frequencies, lower losses, and smaller heat sinks, setting new performance baselines that silicon IGBTs could not match. Vendors responded by releasing SiC-based IPMs with on-chip gate drivers and protection logic, enabling traction inverters that improve vehicle range and solar micro-inverters that lower the levelized cost of electricity. At the same time, supply-chain risk surrounding SiC wafer capacity and gallium export controls underscored the importance of vertical integration and multi-sourcing strategies.

Global Intelligent Power Module (IPM) Market Trends and Insights

Surge in SiC-Based IPMs for High-Efficiency EV Inverters in China

Chinese automakers accelerated the replacement of silicon IGBTs with SiC MOSFET Intelligent power modules in traction inverters to cut switching losses by up to 50% and shrink inverter volume by 30%, thereby extending vehicle range and reducing battery cost. Vertically integrated players such as BYD secured wafer supply by adding domestic SiC crystal growth lines, shortening lead times, and insulating themselves from export restrictions. The adoption rate of SiC IPMs in Chinese EVs is projected to exceed 65% by 2027, a benchmark that forces international competitors to accelerate their own SiC roadmaps. This regional leadership reshaped the global Intelligent power module market by shifting volume learning curves two years ahead of schedule, driving cost parity between SiC and silicon earlier than expected.

Rapid Adoption of IPM Servo Drives in European Industry 4.0 Retrofits

Small and medium-sized German machine builders retrofitted legacy motion systems with IPM-based servo drives, achieving 25-40% energy savings while adding predictive maintenance hooks that integrate into digital-twin platforms. Standardized form factors with embedded safety functions, such as KEB's COMBIVERT F6 controllers, simplified commissioning, and reduced downtime for mid-life equipment upgrades. Retrofits avoided full machine replacement and qualified for European energy-efficiency subsidies, unlocking a high-margin niche for module suppliers. The trend also stimulated demand for 600 V and 650 V IPMs that balance cost and performance for motors below 30 kW, reinforcing Europe's position as a premium automation market.

Wide-Band-Gap Wafer Supply Constraints

SiC wafer lead times stretched beyond 40 weeks after China restricted gallium exports critical to GaN production, creating a bifurcated market where automotive-grade substrates commanded priority access. Allocation policies favored incumbent customers, delaying new entrants and slowing diversification of module supply. Manufacturers raced to add crystal-growth capacity, yet furnace installations and crystal ingot qualification required 24-30 months, meaning meaningful relief is unlikely before 2027.

Other drivers and restraints analyzed in the detailed report include:

- On-Board Charger Integration Trend Among Tier-1 Automotive OEMs

- Regulatory Push for Ultra-Low-Standby Appliances in North America

- Thermal-Interface Reliability Beyond 1200 V Ratings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 600 V class retained 39.5% revenue in 2024 because it matched appliance and solar micro-inverter needs, anchoring the mid-range of the Intelligent Power Module market. Designers favored its mature supply chain, broad gate-driver ecosystem, and attractive price points. Yet the 1200 V segment expanded swiftly at a 14.2% CAGR, propelled by 800 V battery electric vehicles and three-phase string inverters. Here, SiC CoolSiC MOSFET IPMs achieved an on-resistance of 45 mΩ and failure rates under 100 ppm, validating their use in safety-critical EV drivelines. The 650-900 V range preserved share in industrial UPS and robotics, while 1700 V products addressed rail traction and medium-voltage drives where high insulation distances matter. Consequently, developers now select voltage classes by system-level efficiency targets rather than device limitations, reinforcing a diverse Intelligent power module market.

This voltage migration influenced cooling architecture and busbar design. For instance, 1200 V IPMs adopted baseplate-less layouts that lowered thermal resistance and trimmed weight in traction packs. At the same time, gate-driver ICs evolved to support negative gate voltages and reinforced isolation, aligning with rapid switching edges. As wide-bandgap costs fell, the Intelligent power module market size for 1200 V designs is projected to lift the segment's Intelligent power module market share at a significant rate.

IGBT IPMs still commanded 71.5% revenue in 2024, owing to decades of process learning and competitive cost positioning across appliances and general-purpose drives. However, SiC MOSFET modules posted a 27.8% CAGR because their higher breakdown field and faster switching cut conduction and turn-off losses, enabling higher power density. Electric-vehicle traction inverters adopted SiC IPMs to squeeze extra kilometers per kilowatt-hour and meet weight targets, pushing automotive OEMs to lock multi-year wafer agreements.

GaN FET IPMs gained traction in compact power supplies where 1 MHz switching shrinks magnetics, though they remained a nascent slice of the Intelligent power module industry. Si MOSFET IPMs continued in low-voltage motor drives and power tools, where cost weightings trumped efficiency. As a result, device selection became application-specific; system designers increasingly mixed technologies across sub-systems, broadening the competitive field and elevating design-in services as a differentiator.

Direct bonded copper (DBC) substrates held 46.1% in 2024 because their alumina or AlN ceramics balanced thermal conductivity and cost. Yet active-metal-brazed (AMB) copper rose at a 16.1% CAGR by offering stronger ceramic-copper bonds that survived more than 20,000 power cycles, a key metric for automotive warranties. AMB's superior fatigue life justified its higher price in traction and industrial drives above 30 kW.

Insulated metal substrate aluminium remained the low-cost option for residential inverters, while Si3N4 ceramics gained footholds where mechanical shock mattered, such as e-axles. Substrate innovation progressed hand in hand with wide-bandgap adoption, because higher power density required better thermal spreading. Consequently, module vendors vertically integrated substrate shops or formed long-term supply partnerships to secure capacity.

The Intelligent Power Module Market is Segmented by Operational Voltage (600 V Modules, and More), by Power Device (IGBT-Based IPMs, and More), by Substrate Material (Insulated Metal Substrate, and More), by Circuit Configuration (Half-Bridge, and More), by Current Rating (Up To 50 A, and More), by End-Use Industry (Consumer Electronics and Home Appliances, and More), by Sales Channel (OEM and Aftermarket/Retrofit), and Geography.

Geography Analysis

Asia-Pacific retained 48.3% of 2024 revenue for the Intelligent Power Module market, underpinned by China's aggressive EV production, Japan's consumer electronics heritage, and South Korea's battery supply chain scaling. China's domestic SiC crystal growth programs and EV subsidies anchored local module sourcing, while Japan's Mitsubishi Electric pioneered 1700 V rail modules that served regional high-speed trains. India accelerated industrial automation adoption through "Make-in-India," boosting demand for 650 V drives. Southeast Asia's contract manufacturers adopted IPM-based AC motors to meet energy codes, broadening regional volume.

North America followed, driven by factory-built housing, solar micro-inverters, and a resurgent EV industry that localized inverter and charger plants. The United States mandated tighter standby efficiency that favored integrated power stages, while Canada's renewable portfolios spurred demand for 600 V IPMs in string inverters. Mexico emerged as an export base for automotive power electronics, tying module demand to USMCA content rules.

Europe maintained a technology-centric profile, combining Industry 4.0 retrofits with stringent eco-design rules. Germany's Mittelstand machine builders adopted seven-pack IPMs with SIL3 safety, Italy's retrofit textile machinery, and France's upgraded HVAC networks. Solar mandates in Spain and Greece favored three-level IPMs.

The Middle East and Africa posted the fastest growth at 13.9% CAGR on renewable mega-projects led by Saudi Arabia and the UAE, which integrated smart-grid inverters requiring rugged IPMs. South Africa upgraded mining conveyors with IPM drives to cut energy intensity. Turkey invested in EV charger manufacturing, creating local demand for 1200 V SiC modules.

South America remained smaller yet steadily rising, with Brazil's solar auctions and Argentina's wind corridors utilizing 1700 V modules for utility-scale converters. Regional governments offered tax incentives for industrial efficiency, encouraging IPM installations in cement and paper mills.

- Mitsubishi Electric Corporation

- Infineon Technologies AG

- Fuji Electric Co., Ltd.

- ON Semiconductor Corporation

- Semikron Danfoss GmbH & Co. KG

- ROHM Co., Ltd.

- Vincotech GmbH

- STMicroelectronics N.V.

- Powerex Inc.

- Toshiba Electronic Devices & Storage Corp.

- Wolfspeed, Inc.

- Microchip Technology Inc. (Microsemi)

- Renesas Electronics Corporation

- Littelfuse, Inc. (IXYS)

- Dynex Semiconductor Ltd.

- CRRC Times Electric Co., Ltd.

- StarPower Semiconductor Ltd.

- Hitachi Energy Ltd.

- Navitas Semiconductor Corp.

- Alpha & Omega Semiconductor Ltd.

- Sanken Electric Co., Ltd.

- BYD Semiconductor Co., Ltd.

- Nanjing SilverMicro Electronics Co., Ltd.

- Vishay Intertechnology Inc.

- Danfoss Silicon Power GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in SiC-based IPMs for high-efficiency EV inverters in China

- 4.2.2 Rapid adoption of IPM servo drives in European Industry 4.0 retrofits

- 4.2.3 On-board charger integration trend among Tier-1 automotive OEMs

- 4.2.4 Regulatory push for ultra-low-stand-by home appliances in North America

- 4.2.5 Solar micro-/nano-inverter build-outs boosting 600 V IPM demand in the US

- 4.3 Market Restraints

- 4.3.1 Wide-band-gap wafer supply constraints

- 4.3.2 Thermal-interface reliability beyond 1200 V ratings

- 4.3.3 High automotive AEC-Q101 validation costs for module makers

- 4.3.4 IP infringement and price erosion by low-end Asian vendors

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macro Trends

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Operational Voltage

- 5.1.1 600 V Modules

- 5.1.2 650-900 V Modules

- 5.1.3 1200 V Modules

- 5.1.4 1700 V and Above Modules

- 5.2 By Power Device

- 5.2.1 IGBT-based IPMs

- 5.2.2 Si MOSFET-based IPMs

- 5.2.3 SiC MOSFET-based IPMs

- 5.2.4 GaN FET-based IPMs

- 5.3 By Substrate Material

- 5.3.1 Insulated Metal Substrate (Al)

- 5.3.2 DBC Ceramic (AlN / Al2O3)

- 5.3.3 AMB Copper

- 5.3.4 Si3N4 Ceramic

- 5.4 By Circuit Configuration

- 5.4.1 Half-Bridge

- 5.4.2 Six-Pack

- 5.4.3 Seven-Pack and Others

- 5.5 By Current Rating

- 5.5.1 Up to 50 A

- 5.5.2 51-100 A

- 5.5.3 Above 100 A

- 5.6 By End-Use Industry

- 5.6.1 Consumer Electronics and Home Appliances

- 5.6.2 Industrial Automation and Servo Drives

- 5.6.3 Electric and Hybrid Vehicles

- 5.6.4 Renewable Energy and ESS

- 5.6.5 Rail Traction and Infrastructure

- 5.6.6 HVAC and Building Systems

- 5.6.7 Others (Medical, Aerospace)

- 5.7 By Sales Channel

- 5.7.1 OEM

- 5.7.2 Aftermarket / Retrofit

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Mexico

- 5.8.2 South America

- 5.8.2.1 Brazil

- 5.8.2.2 Argentina

- 5.8.2.3 Rest of South America

- 5.8.3 Europe

- 5.8.3.1 Germany

- 5.8.3.2 United Kingdom

- 5.8.3.3 France

- 5.8.3.4 Italy

- 5.8.3.5 Spain

- 5.8.3.6 Russia

- 5.8.3.7 Rest of Europe

- 5.8.4 Asia-Pacific

- 5.8.4.1 China

- 5.8.4.2 Japan

- 5.8.4.3 India

- 5.8.4.4 South Korea

- 5.8.4.5 South-East Asia

- 5.8.4.6 Rest of Asia-Pacific

- 5.8.5 Middle East and Africa

- 5.8.5.1 Middle East

- 5.8.5.1.1 Saudi Arabia

- 5.8.5.1.2 United Arab Emirates

- 5.8.5.1.3 Turkey

- 5.8.5.1.4 Rest of Middle East

- 5.8.5.2 Africa

- 5.8.5.2.1 South Africa

- 5.8.5.2.2 Nigeria

- 5.8.5.2.3 Rest of Africa

- 5.8.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Mitsubishi Electric Corporation

- 6.4.2 Infineon Technologies AG

- 6.4.3 Fuji Electric Co., Ltd.

- 6.4.4 ON Semiconductor Corporation

- 6.4.5 Semikron Danfoss GmbH & Co. KG

- 6.4.6 ROHM Co., Ltd.

- 6.4.7 Vincotech GmbH

- 6.4.8 STMicroelectronics N.V.

- 6.4.9 Powerex Inc.

- 6.4.10 Toshiba Electronic Devices & Storage Corp.

- 6.4.11 Wolfspeed, Inc.

- 6.4.12 Microchip Technology Inc. (Microsemi)

- 6.4.13 Renesas Electronics Corporation

- 6.4.14 Littelfuse, Inc. (IXYS)

- 6.4.15 Dynex Semiconductor Ltd.

- 6.4.16 CRRC Times Electric Co., Ltd.

- 6.4.17 StarPower Semiconductor Ltd.

- 6.4.18 Hitachi Energy Ltd.

- 6.4.19 Navitas Semiconductor Corp.

- 6.4.20 Alpha & Omega Semiconductor Ltd.

- 6.4.21 Sanken Electric Co., Ltd.

- 6.4.22 BYD Semiconductor Co., Ltd.

- 6.4.23 Nanjing SilverMicro Electronics Co., Ltd.

- 6.4.24 Vishay Intertechnology Inc.

- 6.4.25 Danfoss Silicon Power GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment