PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849912

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849912

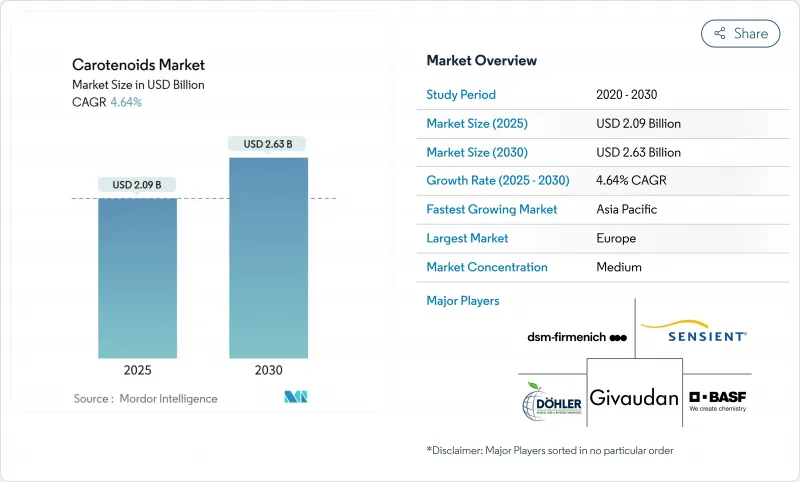

Carotenoids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The carotenoids market, valued at USD 2.09 billion in 2025, is expected to reach USD 2.63 billion by 2030, registering a CAGR of 4.64% during the forecast period.

Consumer demand for ingredient transparency and clean-label products is transforming the carotenoids industry. Manufacturers are reformulating their products with natural ingredients to meet these evolving consumer preferences. The industry continues to advance through improved extraction and production methods, focusing on sustainable and cost-effective processes. The market growth is further supported by increasing applications in food and beverage, animal feed, dietary supplements, and cosmetics industries. Natural carotenoids are gaining prominence over synthetic alternatives due to their perceived health benefits and environmental sustainability. The food and beverage sector is one of the prominent application segments, with manufacturers incorporating carotenoids as natural colorants and nutritional additives. Additionally, the growing awareness of the antioxidant properties of carotenoids and their role in promoting eye health, immune function, and skin health is driving demand in the dietary supplements segment.

Global Carotenoids Market Trends and Insights

Surging Use of Beta-Carotene as a Natural Supplement

The escalating consumer shift toward preventive healthcare is driving unprecedented demand for beta-carotene supplements, driven by broader awareness of its provitamin A properties and antioxidant benefits. Health Canada's 2025 natural health product guidelines recognize beta-carotene from various sources, including Dunaliella salina and synthetic origins, with standardized dosage recommendations. This regulatory clarity encourages supplement manufacturers to expand their product development across North America. The European Food Safety Authority (EFSA) and the United States Food and Drug Administration (FDA) are implementing measures for ingredient traceability and safe dosage thresholds, supporting market growth while prioritizing consumer safety. Further, the segment benefits from growing scientific evidence linking adequate carotenoid intake to reduced chronic disease risk, though regulatory bodies maintain caution regarding high-dose supplementation, particularly for smokers. This trend is particularly pronounced in markets where dietary carotenoid intake falls below recommended levels, creating substantial growth opportunities for targeted supplementation products.

Rising Demand for Natural Colorant in Processed Food and Beverage

Food manufacturers are shifting from synthetic to natural colorants in response to clean-label requirements and consumer demand for recognizable ingredients. This transition reflects a broader industry movement toward transparency and natural formulations. The European Commission's April 2024 approval of astaxanthin-rich oleoresin from Haematococcus pluvialis algae demonstrates regulatory acceptance of natural carotenoids in food applications, with defined usage parameters across food categories. The approval enables manufacturers to incorporate this natural colorant in various food products, including dairy, confectionery, and beverages. Plant-based meat manufacturers require thermostable carotenoids, such as beta-carotene and lycopene, to maintain color stability during heat processing, where conventional red pigments are ineffective. These carotenoids withstand high-temperature processing methods like extrusion and cooking while providing consistent coloration throughout the product lifecycle. Additionally, carotenoids offer both coloring properties and nutritional benefits, supporting functional food development, in turn, facilitating the demand for natural colorants in processed food and beverages.

Price Volatility of Raw Material Derived from Algae or Plants

Raw material cost fluctuations present persistent challenges for carotenoid manufacturers, particularly those dependent on algae cultivation and plant extraction processes that are susceptible to environmental variables and seasonal availability. Microalgae production costs remain significantly higher than synthetic alternatives, with current estimates suggesting that achieving cost parity with traditional plant proteins requires substantial scale optimization and technological advancement. Climate-related disruptions to marigold flower cultivation, the primary source of lutein, have created supply bottlenecks that drive price volatility across the xanthophyll segment. The challenge is compounded by energy-intensive cultivation requirements for microalgae, where LED lighting and controlled environment systems can represent up to 40% of production costs. Companies are responding through vertical integration strategies and alternative sourcing arrangements, though these approaches require substantial capital investment that may limit market entry for smaller players.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Adoption of Plant-Based Ingredients in Clean-Label Products

- Expansion of Vegan and Vegetarian Supplement Products

- Regulatory Variability Across Regions Restricts Global Adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Astaxanthin commands 24.31% market share in 2024 and leads growth projections with a 7.11% CAGR from 2025-2030, driven by its superior antioxidant potency and expanding applications beyond traditional aquaculture uses. Cyanotech Corporation's focus on natural astaxanthin production from Haematococcus pluvialis, representing approximately 65% of their USD 23.1 million net sales in fiscal 2024, illustrates the premium positioning that natural sources command over synthetic alternatives. Beta-carotene maintains a significant market presence through its dual functionality as both a colorant and provitamin A source, while lutein and zeaxanthin benefit from expanding eye health applications supported by clinical research.

Emerging production technologies are reshaping competitive dynamics within the type segmentation, particularly as microbial fermentation offers scalability advantages over traditional algae cultivation. Lycopene applications in functional foods continue expanding, supported by research linking its consumption to cardiovascular health benefits, while canthaxanthin serves specialized aquaculture markets where pigmentation requirements justify premium pricing. The segment's growth trajectory reflects increasing consumer willingness to pay premiums for natural, scientifically validated ingredients that deliver measurable health benefits.

The Carotenoids Market Report is Segmented by Type (Astaxanthin, Beta-Carotene, Canthaxanthin, Lutein, and More), Form (Powder and Liquid), Application (Food and Beverage, Dietary Supplement, Animal Feed, Personal Care and Cosmetics, and Pharmaceuticals), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe holds 34.19% market share in 2024, driven by regulations favoring natural ingredients and consistent demand from food, feed, and pharmaceutical sectors. The region's consumers demonstrate high awareness of natural ingredients and accept premium pricing for products with proven health benefits, especially in dietary supplements and functional foods. The region's research infrastructure and industry-academic collaborations enhance extraction technologies and bioavailability methods, further boosting the market demand.

Asia-Pacific exhibits the highest growth rate at 5.55% CAGR during 2025-2030, driven by aquaculture expansion, increasing disposable incomes, and regulatory shifts toward natural ingredients. The region's aquaculture sector, particularly in salmon and shrimp farming, requires astaxanthin and canthaxanthin for product coloration. The growth in India's middle class, evidenced by GDP per capita rising from USD 1,907 in 2020 to USD 2,480.8 in 2023 , has increased the demand for dietary supplements. In Japan, the aging population is driving higher consumption of eye health and cognitive function products that contain lutein and zeaxanthin. The region offers lower production costs and raw material accessibility, alongside developing quality control and regulatory standards.

North America demonstrates market stability through established regulations, informed consumers, and premium natural carotenoid products. United States Food and Drug Administration's (FDA) Generally Recognized as Safe (GRAS) approvals for multiple microalgae species and clear dietary supplement guidelines facilitate new product launches. Mexico's expanding middle class and aquaculture sector create new market opportunities. In the Middle East and Africa, increasing demand for fortified foods and government nutrition programs drive market growth. Countries in South America, specifically Brazil and Chile, shows market expansion due to abundant natural resources and increasing focus on health supplements and exports.

- BASF SE

- DSM-Firmenich AG

- Givaudan SA

- Divi's Laboratories Ltd

- Kemin Industries Inc.

- Sensient Technologies Corp.

- Dohler Group SE

- Solabia Group

- Allied Biotech Corp.

- EID-Parry (India) Ltd

- Cyanotech Corp.

- Lycored Ltd

- Guangzhou Leader Bio-Technology

- Fuji Chemical Industries

- Zhejiang NHU Co., Ltd

- Vidya Herbs Pvt Ltd

- Bio-gen Extracts Pvt Ltd

- DD Chemco

- Chenguang Biotech Group

- Archer Daniels Midland Company (ADM)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Use of Beta-Carotene as a Natural Supplement

- 4.2.2 Rising Demand for Natural Colorant in Processed Food and Beverage

- 4.2.3 Increasing Adoption of Plant-Based Ingredients in Clean-Label Products

- 4.2.4 Expansion of Vegan and Vegetarian Supplement Products

- 4.2.5 Consumer Preference for Naturally Pigmented Animal Products Driving Use for Carotenoid

- 4.2.6 Technological Advancement in Microencapsulation and Formulation Stability

- 4.3 Market Restraints

- 4.3.1 Price Volatility of Raw Material Derived from Algae or Plants

- 4.3.2 Regulatory Variability Across Regions Restricts Global Adoption

- 4.3.3 Limited Shelf Life Associated with Carotenoid

- 4.3.4 Challenges in Maintaining Color Consistency in Food Application

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Astaxanthin

- 5.1.2 Beta-Carotene

- 5.1.3 Canthaxanthin

- 5.1.4 Lutein

- 5.1.5 Lycopene

- 5.1.6 Zeaxanthin

- 5.1.7 Other Types

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Liquid

- 5.3 By Application

- 5.3.1 Food and Beverage

- 5.3.2 Dietary Supplement

- 5.3.3 Animal Feed

- 5.3.4 Personal Care and Cosmetics

- 5.3.5 Pharmaceuticals

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 DSM-Firmenich AG

- 6.4.3 Givaudan SA

- 6.4.4 Divi's Laboratories Ltd

- 6.4.5 Kemin Industries Inc.

- 6.4.6 Sensient Technologies Corp.

- 6.4.7 Dohler Group SE

- 6.4.8 Solabia Group

- 6.4.9 Allied Biotech Corp.

- 6.4.10 EID-Parry (India) Ltd

- 6.4.11 Cyanotech Corp.

- 6.4.12 Lycored Ltd

- 6.4.13 Guangzhou Leader Bio-Technology

- 6.4.14 Fuji Chemical Industries

- 6.4.15 Zhejiang NHU Co., Ltd

- 6.4.16 Vidya Herbs Pvt Ltd

- 6.4.17 Bio-gen Extracts Pvt Ltd

- 6.4.18 DD Chemco

- 6.4.19 Chenguang Biotech Group

- 6.4.20 Archer Daniels Midland Company (ADM)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK