PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849914

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849914

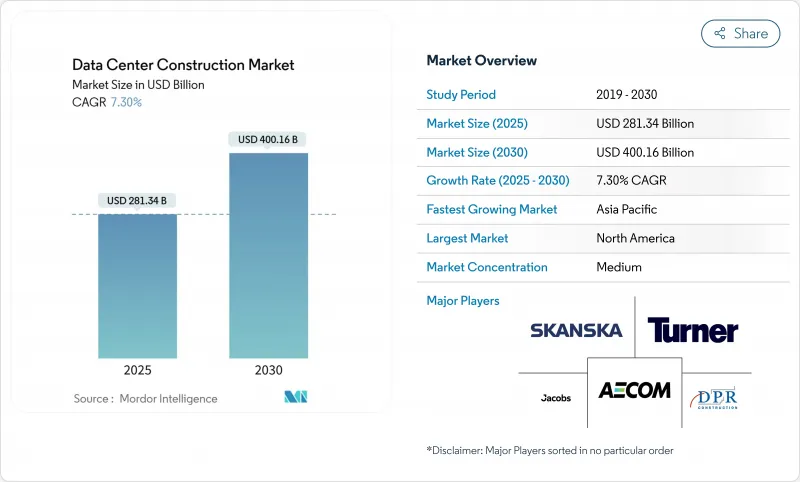

Data Center Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The data center construction market size is expected to be valued at USD 281.34 billion in 2025 and is forecast to reach USD 400.16 billion by 2030, advancing at a 7.30% CAGR during 2025-2030.

The expansion reflects surging demand for AI-ready capacity, widespread cloud migration, and edge deployments that place digital infrastructure closer to users. Capital spending by hyperscale operators has surged significantly, translating into a robust global construction pipeline that favors standardized, repeatable build models. Yet supply-chain disruptions in transformers and switchgear lengthen delivery lead times to more than 120 weeks, threatening schedule certainty and elevating project risk. Parallel regulatory pressure on energy efficiency pushes owners to integrate on-site renewables and heat-recovery systems from project inception, adding design complexity but also unlocking access to fast-growing pools of green-bond financing.

Global Data Center Construction Market Trends and Insights

Growing Cloud Applications, AI and Big Data Workloads

High-density AI racks now demand 50-100 kW per rack, fundamentally changing design briefs and favoring liquid cooling over legacy air systems. Microsoft alone has earmarked USD 80 billion in 2025 CAPEX for AI infrastructure, spurring builders to engineer gigawatt-scale campuses with redundant 400 kV feeds and on-site substations. Copper demand for these builds is already six times the level of conventional cloud facilities, which supports a growing specialty trade segment for advanced thermal-management installation. Projects such as Crusoe's 1.2 GW campus in Texas illustrate how the data center construction market is stretching traditional construction practices, requiring modular blocks, megawatt-class immersion tanks, and rapid permitting strategies that keep pace with AI compute roadmaps.

Accelerating Adoption of Hyperscale Facilities

Hyperscale capacity is forecast to triple by 2030, accounting for most incremental square footage added worldwide. Turner Construction's USD 2 billion Vantage facility in Ohio, with 192 MW of IT power, typifies the standardized, repeat-build approach that lowers unit costs via bulk procurement and prefabricated skids. While the model secures economies of scale, it concentrates activity in power-rich markets, tightening labor availability and driving wage premiums above 20% in regions such as Northern Virginia and Dublin. Financial structures depend on multibillion-dollar power-purchase agreements, meaning utility interconnection queues and clean-energy targets often dictate construction phasing.

Escalating Real-Estate, Installation and Maintenance Costs

Labor shortages layered on a 20% wage premium for electricians and pipefitters across Northern Virginia's 3.5 GW cluster, constraining contractor availability and extending project schedules. Developers increasingly scout secondary metros such as Phoenix and Madrid, where land and power remain comparatively inexpensive. Bulk-buy agreements for steel joists and switchgear plus long-term hedges on copper now underpin cost-control strategies at firms like DPR Construction, which completed a 100 MW campus in Texas on a fixed-price basis despite volatile commodity inputs. Steel framing remains cost-advantaged, with 20-year lifecycle outlays of USD 350,000 compared to USD 670,000-1.1 million for traditional concrete shells.

Other drivers and restraints analyzed in the detailed report include:

- Rising Edge-Computing Build-outs Near Population Hubs

- Renewable-Energy Mandates Shaping Facility Design

- Supply-Chain Volatility in High-Capacity Power Gear

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tier 3 assets retained 58.2% of the data center construction market share in 2024, reinforcing their role as the de facto enterprise standard thanks to balanced redundancy and capex profiles. Meanwhile, Tier 4 demand is projected to grow at 7.8% CAGR through 2030 as banks, stock exchanges, and public-sector cloud mandates pay premiums for 99.995% uptime. Tier 4 projects often double construction complexity: dual utility feeds, 2N power trains, and compartmentalized fire zones inflate budgets by up to 70% over Tier 2 blueprints. Turner Construction's modular Tier 4 build in North Carolina cut commissioning time by 15% using factory-tested power pods, illustrating how innovation tempers cost escalation.

Developers also weigh lifecycle economics. The data center construction market therefore, sees rising design-build consortiums that integrate mechanical, electrical, and controls to certify Tier 4 on first power-up. Prefabricated chillers and containerized UPS segments enable scale without sacrificing Tier 4 compliance, supporting multi-phase rollouts that align spend with demand growth.

Colocation retained 54.3% of 2024 revenue, underlining its value proposition of multi-tenant flexibility and speed-to-market. However, self-built hyperscalers will widen at 8.5% CAGR through 2030, reflecting strategic moves by cloud giants to own core infrastructure. The USD 10 billion Meta Louisiana campus uses a 4 million-square-foot layout dedicated to AI training clusters and backed by a 600 MW solar PPA, underscoring how scale economics tilt toward owner-operator models. Colocation operators respond by offering build-to-suit halls and liquid-cooling-ready floors, preserving relevance amid hyperscale expansion.

Construction modalities diverge. Colocation halls require flexible cage layouts, hot-aisle containment, and shared meet-me rooms that accommodate diverse tenant densities. Hyperscalers instead prefer 12 MW blocks replicated in cookie-cutter fashion to cut capex per MW by 20%. Factory-assembled structural steel frames arrive on site pre-welded, slashing erection times to three weeks for a 30-MW building. As a result, the data center construction market is increasingly segmenting EPC suppliers into multi-billion-dollar global framework agreements for hyperscalers and regional frameworks for edge and enterprise demand.

Data Center Construction Market is Segmented by Tier Type (Tier 1 and 2, Tier 3 and Tier 4), Data Center Type(Colocation, Self-Built Hyperscalers (CSPs), Enterprise, and Edge), and Infrastructure (Electrical Infrastructure, Mechanical Infrastructure), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Germany stands as the cornerstone of Europe's data center construction market, commanding approximately 6% of the global data center construction market size in 2024. The country's robust digital infrastructure, particularly concentrated in major hubs like Frankfurt, Berlin, and Hamburg, continues to attract significant investments from global technology giants. The nation's commitment to sustainable data center development is evident through strict energy efficiency regulations and the increasing adoption of renewable energy sources. Frankfurt, in particular, has emerged as a critical digital hub, benefiting from its central European location and extensive fiber connectivity. The country's data center landscape is further strengthened by its advanced technological ecosystem, skilled workforce, and stable political environment. German data centers are increasingly focusing on innovative cooling technologies and sustainable construction practices, setting new standards for environmental responsibility in the industry.

- AECOM

- Turner Construction Co.

- DPR Construction

- Jacobs Solutions Inc.

- Skanska AB

- Balfour Beatty plc

- Whiting-Turner Contracting Co.

- Hensel Phelps

- Fortis Construction Inc.

- Goodman Group

- PT Jaya Obayashi

- Hibiya Engineering Ltd.

- Fluor Corporation

- Keppel Data Centres Holding

- NTT Global Data Centers

- Equinix Inc.

- Digital Realty Trust Inc.

- QTS Realty Trust LLC

- China State Construction Engineering Corp.

- Larsen and Toubro Ltd. (LandT Construction)

- Bouygues Construction SA

- Vinci Energies (Actemium)

- Samsung CandT Corporation

- Collen Construction Ltd.

- Corgan

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing cloud applications, AI and big data workloads

- 4.2.2 Accelerating adoption of hyperscale facilities

- 4.2.3 Rising edge-computing build-outs near population hubs

- 4.2.4 Renewable-energy mandates shaping facility design

- 4.2.5 Prefabricated / modular builds shrinking time-to-market

- 4.2.6 ESG-linked green-bond financing unlocking capex

- 4.3 Market Restraints

- 4.3.1 Escalating real-estate, installation and maintenance cost

- 4.3.2 Stricter energy-consumption and carbon-compliance limits

- 4.3.3 Shortage of skilled labor for advanced liquid cooling

- 4.3.4 Supply-chain volatility in high-capacity power gear

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Key Data Center Statistics

- 4.8.1 Exhaustive Data Center Operators on Regional Level (in MW)

- 4.8.2 List of Major Upcoming Data Center Projects across various regions(2025-2030)

- 4.8.3 CAPEX and OPEX For Data Center Construction

- 4.8.4 Data Center Power Capacity Absorption In MW, regions, 2023 and 2024

- 4.9 Artificial Intelligence (AI) Inclusion in Data Center Construction across Various Regions

- 4.10 Regulatory and Compliance Framework

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Tier Type

- 5.1.1 Tier 1 and 2

- 5.1.1.1 Tier 3

- 5.1.1.2 Tier 4

- 5.1.2 By Data Center Type

- 5.1.2.1 Colocation

- 5.1.2.2 Self-build Hyperscalers (CSPs)

- 5.1.2.3 Enterprise and Edge

- 5.1.3 By Infrastructure

- 5.1.3.1 By Electrical Infrastructure

- 5.1.3.1.1 Power Distribution Solution

- 5.1.3.1.2 Power Backup Solutions

- 5.1.3.2 By Mechanical Infrastructure

- 5.1.3.2.1 Cooling Systems

- 5.1.3.2.2 Racks and Cabinets

- 5.1.3.2.3 Servers and Storage

- 5.1.3.2.4 Other Mechanical Infrastructure

- 5.1.3.3 General Construction

- 5.1.3.4 Service - Design and Consulting, Integration, Support and Maintenance

- 5.1.4 By Geography

- 5.1.4.1 North America

- 5.1.4.1.1 United States

- 5.1.4.1.2 Canada

- 5.1.4.1.3 Mexico

- 5.1.4.2 South America

- 5.1.4.2.1 Brazil

- 5.1.4.2.2 Argentina

- 5.1.4.2.3 Rest of South America

- 5.1.4.3 Europe

- 5.1.4.3.1 Germany

- 5.1.4.3.2 United Kingdom

- 5.1.4.3.3 France

- 5.1.4.3.4 Italy

- 5.1.4.3.5 Spain

- 5.1.4.3.6 Russia

- 5.1.4.3.7 Rest of Europe

- 5.1.4.4 Asia-Pacific

- 5.1.4.4.1 China

- 5.1.4.4.2 Japan

- 5.1.4.4.3 India

- 5.1.4.4.4 South Korea

- 5.1.4.4.5 Australia and New Zealand

- 5.1.4.4.6 Rest of Asia-Pacific

- 5.1.4.5 Middle East and Africa

- 5.1.4.5.1 Middle East

- 5.1.4.5.1.1 Gulf Corporation Countries

- 5.1.4.5.1.2 Turkey

- 5.1.4.5.1.3 Israel

- 5.1.4.5.1.4 Rest of Middle East

- 5.1.4.5.2 Africa

- 5.1.4.5.2.1 South Africa

- 5.1.4.5.2.2 Egypt

- 5.1.4.5.2.3 Nigeria

- 5.1.4.5.2.4 Rest of Africa

- 5.1.1 Tier 1 and 2

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Data Center Infrastructure Investment Based on Megawatt (MW) Capacity, 2024 vs 2030

- 6.5 Data Center Construction Landscape (Key Vendors Listings)

- 6.6 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.6.1 AECOM

- 6.6.2 Turner Construction Co.

- 6.6.3 DPR Construction

- 6.6.4 Jacobs Solutions Inc.

- 6.6.5 Skanska AB

- 6.6.6 Balfour Beatty plc

- 6.6.7 Whiting-Turner Contracting Co.

- 6.6.8 Hensel Phelps

- 6.6.9 Fortis Construction Inc.

- 6.6.10 Goodman Group

- 6.6.11 PT Jaya Obayashi

- 6.6.12 Hibiya Engineering Ltd.

- 6.6.13 Fluor Corporation

- 6.6.14 Keppel Data Centres Holding

- 6.6.15 NTT Global Data Centers

- 6.6.16 Equinix Inc.

- 6.6.17 Digital Realty Trust Inc.

- 6.6.18 QTS Realty Trust LLC

- 6.6.19 China State Construction Engineering Corp.

- 6.6.20 Larsen and Toubro Ltd. (LandT Construction)

- 6.6.21 Bouygues Construction SA

- 6.6.22 Vinci Energies (Actemium)

- 6.6.23 Samsung CandT Corporation

- 6.6.24 Collen Construction Ltd.

- 6.6.25 Corgan

- 6.7 List of Data Center Construction Companies

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment