PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849916

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849916

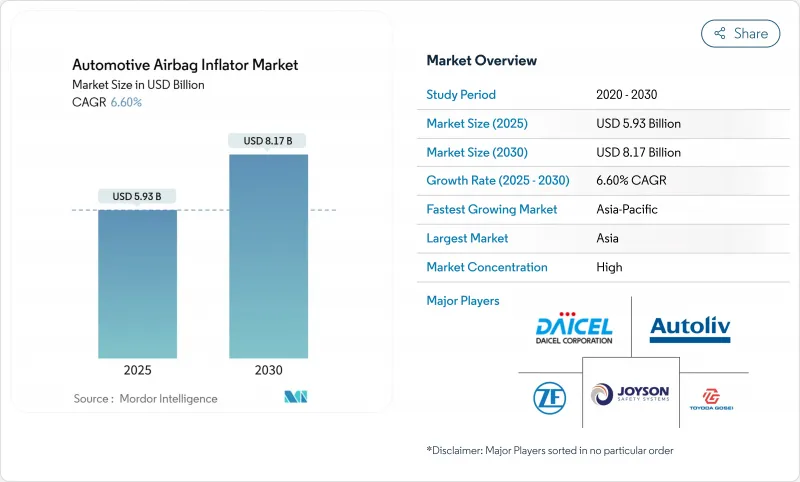

Automotive Airbag Inflator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The automotive airbag inflator market size stands at USD 5.93 billion in 2025 and is forecast to touch USD 8.17 billion by 2030, advancing at a 6.60% CAGR between 2025 and 2030.

Stronger crash-safety legislation, heightened consumer attention to occupant protection, and continuous inflator chemistry and packaging gains underpin the automotive airbag inflator market climb. Suppliers that control design-to-manufacture workflows secure higher margins because they answer new regulatory tests faster than firms that rely on contract assemblers. Regulators in North America and Europe have signalled upcoming side-impact and cybersecurity audits, which will raise costs and lift replacement volumes, sustaining the automotive airbag inflator market even during flat vehicle-production cycles. The Asia-Pacific region already shows a 7.50% CAGR, led by technology-rich Chinese mid-SUV programs and India's fast-scaling export hubs, suggesting the region could represent nearly half of new inflator units by the decade's close

Global Automotive Airbag Inflator Market Trends and Insights

Stricter Crash-Safety Mandates

Upgraded frontal, side-impact, and pedestrian-protection protocols push automakers to adopt higher-performance restraint systems, expanding the automotive airbag inflator market. North American FMVSS updates and Europe's General Safety Regulation lift baseline fitment for side-torso and curtain solutions. OEMs now tender inflators with compliance documentation, compressing design windows, and favouring vertically integrated suppliers. Increased audit frequency has prompted on-site propellant test cells near final assembly lines, shortening certification loops by up to four weeks. Higher replacement volumes partially offset cost pass-through, keeping overall inflator demand buoyant. Regulators have begun referencing cybersecurity readiness alongside gas-output metrics, nudging the industry toward smart inflator modules.

ADAS-Led Adoption of Multi-Stage Inflators

Sensor-rich mid-SUVs manufactured by Chinese brands fuse crash-severity data with inflator logic, allowing tailored gas releases that protect a wider occupant range. Five-star New Car Assessment Program scores support showroom appeal and showcase multi-stage inflators as visible proof of ADAS value. Automakers that lag in multi-stage deployment risk negative showroom comparisons, creating fast-follower pressure. Software updates allow future calibration tweaks, shielding OEMs from retooling costs. Component suppliers leverage the trend to upsell firmware maintenance contracts, adding an annuity-style revenue layer. Therefore, the convergence of sensor fusion and inflator modulation sustains premium price points within the automotive airbag inflator market.

Helium Supply Crunch

Geopolitical disruptions lifted industrial-grade helium spot prices, inflating the bill of materials for stored-gas inflators and squeezing margins. Exploration campaigns in Tanzania seek green helium, with preliminary flow-rate data suggesting a viable commercial supply for safety-system producers. OEMs react by shifting procurements toward hybrid inflators that dilute helium use with pyrotechnic gas. Contract clauses now include helium-price adjustment formulas, transferring part of the risk back to suppliers. While temporary, cost spikes have already slowed new stored-gas design iterations, moderating near-term growth for that sub-segment of the automotive airbag inflator market.

Other drivers and restraints analyzed in the detailed report include:

- Phase-Out of Azide Propellants

- Emergence of Indian Export Hubs

- EU Carbon Border Tariff

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Curtain airbags representing 34.10% of the automotive airbag inflator market share. Their dominance rests on star-rating protocols that mandate robust side-impact protection. Recent refreshes reveal interest in segmented gas channels that enhance fill uniformity along narrow roof rails. Emerging giga-cast EV frames create slimmer rails, so oval-section cylinders preserve gas volume without raising roof-height constraints. The automotive airbag inflator market continues to reward platforms that mix shape innovation with reliable chemistry.

Knee airbags register the fastest 8.60% CAGR outlook. Crash dummies that weigh more on lower-leg injuries and insurance scoring models reinforce uptake. Suppliers now offer one-piece housings that clip into existing under-dash beams, trimming line-side assembly minutes. Fleet buyers highlight lower worker-compensation claims when knee protection is present, boosting specification rates. Growing traction strengthens the long-term diversity of the automotive airbag inflator industry, which benefits from multiple growth vectors rather than a single dominant category.

Pyrotechnic inflators earned USD 3.28 billion in revenue during 2024, equal to 59.25% of the automotive airbag inflator market size. Their compact form, proven reliability, and immunity to helium supply swings keep them the default for driver airbags. Non-azide compounds let engineers thin metal walls, saving grams and supporting fleet-average emissions objectives. Plant data show particulate emissions after deployment drop when guanidine-nitrate blends replace legacy mixes, easing clean-room maintenance.

Hybrid inflators are forecast for a 7.90% CAGR. Their design marries a small stored-gas chamber with a pyrotechnic main charge, cutting helium volumes while retaining modulation latitude. OEMs view hybrid assemblies as procurement hedges, noting that dual-chemistry lines dampen supply-chain shocks. Development road maps point to wider use in dual-stage curtain and far-side airbags. The automotive airbag inflator industry, therefore, treats hybrid capacity as an insurance policy against future commodity swings.

The Automotive Airbag Inflator Market Report is Segmented by Airbag Type (Driver, Passenger, and More), Inflator Type (Pyrotechnic, Stored Gas, Hybrid), Vehicle Type (Passenger Cars, LCV, and More), Propellent Chemistry (Azide-Based, Non-Azide), Technology Stage ( Single Stage and Multi-Stage), Sales Channel (OEM Fitted and Aftermarket) and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

North America contributed nearly 31.10% of global revenue in 2024. The National Highway Traffic Safety Administration's probe into specific inflator variants focuses on legal exposure, motivating OEMs to favour proven designs and traceable manufacturing records. Cyber-secure inflator modules that comply with UN-R155 have gained traction, adding software validation layers to the regional supply chain. High market maturity channels competition toward lifecycle services such as crash-data analytics, shifting emphasis from hardware pricing to value-added support.

Asia-Pacific records the strongest 7.50% CAGR, driven by China, India, and ASEAN economies. Chinese mid-SUV platforms with dual-stage inflators demonstrate how local innovations meet global benchmarks, and five-star safety ratings raise export appeal. Indian manufacturing hubs leverage cost advantages and local supplier parks to backfill capacity gaps elsewhere, thereby capturing a larger slice of the automotive airbag inflator market. Suppliers that co-locate propellant labs and test rigs near Chennai and Pune compress logistics risk and win shorter certification cycles.

Europe shows steady, compliance-centred demand. The region's near-complete shift to non-azide chemistry keeps aftermarket volumes healthy through retrofit programs. Carbon-neutrality pledges drive aluminium recyclate adoption for inflator casings, aligning material choices with corporate sustainability goals. Pedestrian safety requirements encourage research into external airbags, which could incrementally widen the inflator addressable market.Carbon border tariffs influence sourcing as much as unit price, prompting a gradual relocation of machining steps to Eastern Europe.

- Autoliv Inc.

- ZF Friedrichshafen AG

- Joyson Safety Systems (Key SS)

- Daicel Corporation

- Nippon Kayaku Co.

- ARC Automotive Inc.

- Toyoda Gosei Co.

- Hyundai Mobis Co.

- Continental AG

- Denso Corporation

- Yanfeng Safety Systems

- Nihon Plast Co.

- Ashimori Industry Co.

- Takata (Residual Recall Operations)

- Kolon Industries Inc.

- GWR Safety Systems

- ARC China Ltd.

- Tenaris Inflators

- Jinzhou Jinheng Automotive

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Phase-out of Azide Propellants Driving EU & Japan Retrofit Demand

- 4.1.2 ADAS-Led Adoption of Multi-Stage Inflators in Chinese Mid-SUVs

- 4.1.3 Emergence of Indian Export Hubs Elevating Captive Inflator Off-take

- 4.1.4 EV Giga-Casting Chassis Creating Need for Ultra-Slim Curtain Inflators

- 4.1.5 UN-R155 Cyber-Security Compliance Boosting Smart Inflator Modules in NA

- 4.1.6 L4/L5 Autonomous Vehicle Rollout Demanding Advanced Multi-Directional Inflator Arrays

- 4.2 Market Restraints

- 4.2.1 Helium Supply Crunch Inflating Stored-Gas Inflator Pricing

- 4.2.2 EU Carbon Border Tariff Raising Cost of Asian Inflator Imports

- 4.2.3 Proliferation of Counterfeit Inflators in MEA Eroding OEM Programs

- 4.2.4 Lithium-ion Battery Fire Risks Delaying EV Airbag System Integration

- 4.3 Value / Supply-Chain Analysis

- 4.4 Regulatory or Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value & Volume)

- 5.1 By Airbag Type

- 5.1.1 Passenger

- 5.1.2 Curtain

- 5.1.3 Knee

- 5.1.4 Side

- 5.1.5 Pedestrian Protection

- 5.2 By Inflator Type

- 5.2.1 Pyrotechnic

- 5.2.2 Stored-Gas

- 5.2.3 Hybrid

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Heavy Commercial Vehicles

- 5.4 By Propellant Chemistry

- 5.4.1 Azide-Based

- 5.4.2 Non-Azide (e.g., Guanidine Nitrate)

- 5.5 By Technology Stage

- 5.5.1 Single-Stage

- 5.5.2 Dual-Stage & Multi-Stage

- 5.6 By Sales Channel

- 5.6.1 OEM Fitted

- 5.6.2 Aftermarket / Recall Replacement

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.1.4 Rest of North America

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Nordics

- 5.7.3.5 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East

- 5.7.5.1 Gulf Cooperation Council

- 5.7.5.2 Rest of Middle East

- 5.7.6 Africa

- 5.7.6.1 South Africa

- 5.7.6.2 Nigeria

- 5.7.6.3 Rest of Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Autoliv Inc.

- 6.4.2 ZF Friedrichshafen AG

- 6.4.3 Joyson Safety Systems (Key SS)

- 6.4.4 Daicel Corporation

- 6.4.5 Nippon Kayaku Co.

- 6.4.6 ARC Automotive Inc.

- 6.4.7 Toyoda Gosei Co.

- 6.4.8 Hyundai Mobis Co.

- 6.4.9 Continental AG

- 6.4.10 Denso Corporation

- 6.4.11 Yanfeng Safety Systems

- 6.4.12 Nihon Plast Co.

- 6.4.13 Ashimori Industry Co.

- 6.4.14 Takata (Residual Recall Operations)

- 6.4.15 Kolon Industries Inc.

- 6.4.16 GWR Safety Systems

- 6.4.17 ARC China Ltd.

- 6.4.18 Tenaris Inflators

- 6.4.19 Jinzhou Jinheng Automotive

7 Market Opportunities & Future Outlook