PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849927

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849927

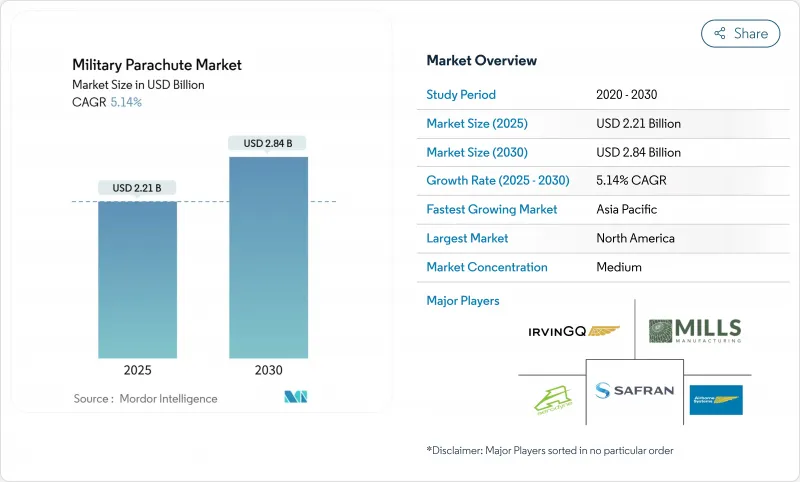

Military Parachute - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The military parachute market size stood at USD 2.21 billion in 2025 and is forecasted to reach USD 2.84 billion by 2030, reflecting a 5.14% CAGR.

Budget expansions across NATO and the Indo-Pacific, combined with the shift from round to precision-guided ram-air systems, continue to unlock new procurement cycles despite cost pressures. Humanitarian airdrop missions and the need to sustain dispersed operations have increased demand for steerable cargo canopies that minimise drop-zone exposure. Meanwhile, emerging drone-glider hybrids are altering the competitive calculus, nudging manufacturers toward integrated guidance kits and smart-fabric offerings that improve glide ratios, cut weight, and support autonomous flight. Moderate consolidation persists, yet private-equity interest and defense prime acquisitions are widening the technology pipeline and intensifying rivalry in the military parachute market.

Global Military Parachute Market Trends and Insights

Rising Defense Outlays in Key NATO and Indo-Pacific Nation

Alliance members reassessed threat scenarios and elevated 2%-of-GDP spending norms, signalling multi-year procurement pipelines for next-generation parachute delivery assets. Indo-Pacific programs followed a similar path, with Japan hosting 12-nation island-defense drills and Indonesia adding CN235-220 transports configured for 34 paratroopers. These initiatives shorten replacement cycles, promote interoperability, and drive recurring orders for systems capable of resisting electronic-warfare interference while sustaining GPS-denied navigation. Procurement budgets increasingly pair hardware outlays with sustainment funds, prioritizing smart-fabric maintenance diagnostics and raising the addressable military parachute market. Vendors demonstrating rapid certification turnarounds and digital-thread support ecosystems remain best positioned to capture funding allocations earmarked for near-peer operations.

Expansion of Special-Operations and Airborne Units

Great-power competition triggered a global expansion of elite airborne formations, from Russia's 45,000-strong VDV to the US Army's reactivated 11th Airborne Division. These units seek high-altitude, low-signature insertion kits that merge glide performance with autonomous steering for pinpoint landings. Programs such as Personnel Air Mobility Systems-motorised paragliders with 62-mile range-underscore how powered-parachute hybrids blur category lines and swell the tactical envelope. As altitude ceilings rise toward 30,000 feet, demand intensifies for oxygen-integration, thermal-protection layers, and rapid-rigging solutions that reduce pre-jump timelines. The net effect is a steady uptick in premium-priced specialised canopies within the military parachute market.

High Cost of Advanced Fabrics and Guidance Kits

Kevlar fibres offering 23 g/d break tenacity and 425-480 °C decomposition temperatures remain energy-intensive, driving up end-item pricing. UHMWPE yarns require specialised extrusion and gel-spinning lines that restrict supplier bases and elevate lead times. Precision kits that embed GPS, Inertial, and Bluetooth-mesh links multiply bill-of-material line items, making guided systems three to five times costlier than legacy round canopies. Fiscal trade-offs sharpen as programs juggle parachutes, UAVs, and loitering munitions within finite procurement envelopes. Unless volume production scales or alternative fibres emerge, cost inflation will restrain adoption rates in segments of the military parachute market.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Precision-Guided Ram-Air Systems

- Surge in Humanitarian Airdrop Missions

- Stringent Safety/Air-Worthiness Certification

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Round canopies held 49.52% of the military parachute market in 2024, retaining dominance through cost-effective mass-drop capability and legacy inventory integration. Though smaller in unit volumes, Ram-air designs are accelerating at a 6.12% CAGR thanks to 5:1 glide ratios and steerable profiles for GPS-denied insertions. The military parachute market size for ram-air variants is projected to rise steadily as NATO mandates include steerability and autonomous options in new tenders. Cruciform models meet niche cargo missions, offering balanced drag and oscillation control that protects fragile loads upon landing. Annular and drogue parachutes serve as egress and recovery solutions for fast-jet seats, where rapid inflation and quasi-stable drag characteristics are imperative.

Industry focus shifted toward integrating hybrid propulsion pods into ram-air frames, creating semi-powered descent profiles that stretch glide envelopes beyond 60 km. This convergence with ultralight aviation calls for new rigging curricula and multi-domain airworthiness baselines that combine manned and unmanned standards. Vendors experimenting with active-fabric control surfaces are engineering canopies whose cell-deformation mechanics adjust in flight, positioning ram-air systems at the frontier of the military parachute market. Adoption continues to hinge on cost-efficiency tipping points and the availability of battery chemistries that tolerate extreme-altitude cold-soak conditions.

Personnel drops commanded 55.45% of 2024 revenue as airborne brigades and special-operations units relied on parachutes for contested-area insertions. Yet, cargo airdrop expanded at 5.78% CAGR, propelled by distributed-operations doctrine and low-level resupply missions that demand sub-100-metre accuracy. The military parachute market size allocated to cargo applications will climb alongside conflict-zone humanitarian needs and high-altitude, high-speed delivery platforms. Training segments preserve steady budgets; simulators and VR-based rigging aids fill instructor gaps while lowering accident rates during live jumps.

Technology fusion is most apparent in cargo drops where autonomous gliders such as Grasshopper complement parachutes by extending standoff distance while preserving disposable cost profiles. Glide-and-flare algorithms work with canopy reefing stages to adjust descent as wind vectors shift, enhancing supply reliability for platoon-level units. Such cross-pollination widens addressable spend and invites inter-modal competition that can cap volume growth for conventional cargo canopies. As a result, suppliers embed modular guidance kits that retrofit round or cruciform systems, preserving legacy stock while meeting precision mandates, thereby sustaining momentum in the military parachute market.

The Military Parachute Market Report is Segmented by Type (Round Parachute, Cruciform Parachute, Ram-Air Parachute, and More), Application (Personnel Airdrop, Cargo Airdrop, Training), Material (Nylon, Kevlar and Aramid Blends, and More), Deployment System (Static-Line, and Free-Fall) and Geography (North America, Europe, Asia-Pacific, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America dominated the military parachute market with a 41.25% share in 2024, aided by the US Department of Defense's USD 842 billion request prioritising survivability upgrades, hazard-pay increases, and next-generation aerial-delivery trials. Contractual vehicles such as multi-year Indefinite-Delivery and Indefinite-Quantity awards underpin long-run volume stability and create favourable economies of scale for incumbent US suppliers. Canada's joint jumps with US units at Fort Liberty reinforced interoperability agendas that stimulate cross-border standardisation and pooling of reserve-parachute stocks.

Europe follows as a mature yet innovation-centric arena, where France's Airbus A400M supply-glider tests and the UK's large-scale Gaza aid drops spotlight niche technologies unavailable elsewhere. NATO harmonisation projects continue to press for interchangeable static-line and ram-air assemblies, reducing duplication and expanding competitive tender fields. Eastern-front security concerns further anchor spending on airborne brigade refits, ensuring sustained demand even as fiscal discipline tightens.

Asia-Pacific exhibits the fastest 5.59% CAGR through 2030, propelled by China's long-range gliding airdrop mechanics breakthroughs and India's indigenous MCPS roll-out. Japan's 12-nation remote-island drill and Indonesia's CN235-220 order illustrate regional commitment to strategic lift and rapid-response capability. Emerging economies such as the Philippines, Malaysia, and Vietnam now participate in multilateral airborne exercises, opening new addressable segments for mid-tier suppliers willing to localise rigging and maintenance support. Collectively, these vectors cement Asia-Pacific as the pivotal expansion theatre within the global military parachute market.

- Airborne Systems North America

- Safran SA

- Mills Manufacturing Corporation

- Precision Aerodynamics, Inc..

- FXC Corporation

- Aerodyne Research LLC

- CIMSA Ingenieria de Sistemas, S.A.

- IrvinGQ

- Butler Parachute Systems

- Performance Designs, Inc.

- Saxon Specialty Manufacturing GmbH

- Complete Parachute Solutions

- MarS a.s.

- Bourdon Forge Co, Inc.

- Paradigm Parachute and Defense Inc.

- Tactical Parachute Delivery Systems, Inc.

- Kohli Enterprises Pvt. Ltd.

- YILTEX SKY USA LLC

- Oriental Weaving & Processing Mill Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising defense outlays in key NATO and Indo-Pacific nations

- 4.2.2 Expansion of special-operations and airborne units

- 4.2.3 Shift toward precision-guided ram-air systems

- 4.2.4 Surge in humanitarian airdrop missions

- 4.2.5 Training modernization programs

- 4.2.6 Miniaturised sensors enabling health-monitoring canopies

- 4.3 Market Restraints

- 4.3.1 High cost of advanced fabrics and guidance kits

- 4.3.2 Stringent safety/air-worthiness certification

- 4.3.3 High-tenacity nylon and Kevlar supply-chain risk

- 4.3.4 Emerging drone-based resupply alternatives

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Parachute Type

- 5.1.1 Round Parachute

- 5.1.2 Cruciform Parachute

- 5.1.3 Ram-air Parachute

- 5.1.4 Annular/Drogue Parachute

- 5.1.5 Others

- 5.2 By Application

- 5.2.1 Personnel Airdrop

- 5.2.2 Cargo Airdrop

- 5.2.3 Training

- 5.3 By Material

- 5.3.1 Nylon

- 5.3.2 Kevlar and Aramid Blends

- 5.3.3 Ultra-high-molecular-weight Polyethylene (UHMWPE)

- 5.4 By Deployment System

- 5.4.1 Static-Line

- 5.4.2 Free-Fall

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Russia

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Israel

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Airborne Systems North America

- 6.4.2 Safran SA

- 6.4.3 Mills Manufacturing Corporation

- 6.4.4 Precision Aerodynamics, Inc..

- 6.4.5 FXC Corporation

- 6.4.6 Aerodyne Research LLC

- 6.4.7 CIMSA Ingenieria de Sistemas, S.A.

- 6.4.8 IrvinGQ

- 6.4.9 Butler Parachute Systems

- 6.4.10 Performance Designs, Inc.

- 6.4.11 Saxon Specialty Manufacturing GmbH

- 6.4.12 Complete Parachute Solutions

- 6.4.13 MarS a.s.

- 6.4.14 Bourdon Forge Co, Inc.

- 6.4.15 Paradigm Parachute and Defense Inc.

- 6.4.16 Tactical Parachute Delivery Systems, Inc.

- 6.4.17 Kohli Enterprises Pvt. Ltd.

- 6.4.18 YILTEX SKY USA LLC

- 6.4.19 Oriental Weaving & Processing Mill Pvt. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and unmet-need assessment