PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849929

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849929

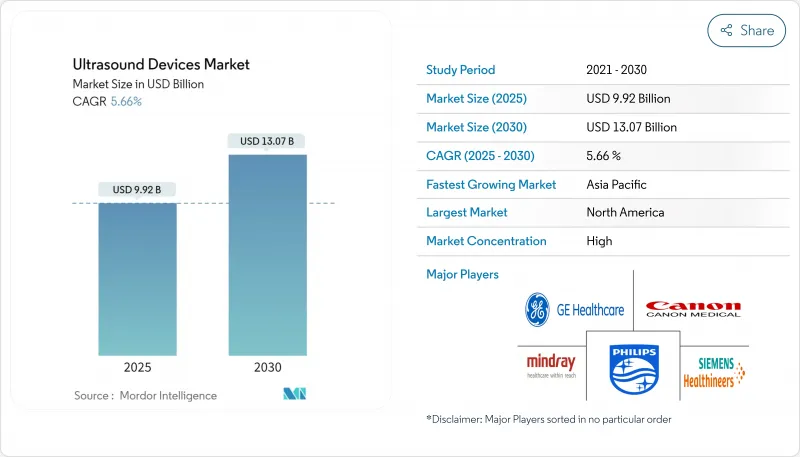

Ultrasound Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Ultrasound Devices Market size is estimated at USD 9.12 billion in 2025, and is expected to reach USD 10.98 billion by 2030, at a CAGR of 3.77% during the forecast period (2025-2030).

Consistent demand for real-time, radiation-free imaging, rapid uptake of artificial intelligence (AI) in image acquisition and interpretation, and widening use of handheld probes in primary care underpin this growth. Clinical evidence shows AI guidance can lift the diagnostic quality of scans performed by non-experts to 98.3%, matching specialist performance. Mature markets keep driving replacement demand for premium 3D & 4D systems, while emerging economies propel first-time purchases through public health programs. A pivot toward minimally invasive procedures, combined with multimodal fusion platforms that overlay real-time ultrasound on CT or MRI, broadens the technology's procedural role. At the same time, persistent reimbursement gaps for point-of-care devices in the United States and tightening global quality-system regulations temper momentum.

Global Ultrasound Devices Market Trends and Insights

Increasing Incidences of Chronic Diseases

Cardiovascular, oncologic, and respiratory disorders account for most ultrasound referrals, making chronic-disease management a structural demand catalyst. An AI model for ovarian-tumor detection achieved an F1 score of 83.5%, surpassing expert radiologists. Similarly, deep-learning tools pinpoint the median nerve in carpal-tunnel scans with high accuracy. The American Cancer Society projects 2.04 million new cancer cases in the United States in 2025, up from 2.00 million in 2024, reinforcing long-term imaging demand. As AI accelerates workflow and elevates accuracy, it compensates for shortages of trained sonographers, broadening the user base and sustaining the ultrasound devices market.

Growing Minimally-Invasive Diagnostics and Imaging Facilities

A global pivot toward needle-guided biopsies, regional anesthesia, and musculoskeletal injections is deepening ultrasound's procedural relevance. Fusion platforms that marry live ultrasound with CT, MRI, or PET scans are improving lesion targeting in complex cases. Facility growth reinforces the installed base: India counted 5,200 NABL-accredited labs in February 2024, 44% of which were radiology units. Australia listed 4,462 accredited imaging practices by December 2023, 81% clustered in three populous states. New centers such as ColumbiaDoctors/NY-Presbyterian's Manhattan site opened in January 2025 to serve high-density urban catchments. This geographic spread of facilities feeds steady demand for both premium and mid-range ultrasound consoles, bolstering the ultrasound devices market.

Limited Reimbursement for Hand-Held Scanners

Point-of-care ultrasound (POCUS) lacks dedicated billing codes for many primary-care indications. Fee-for-service models discourage broad deployment, constraining the ultrasound devices market in outpatient and home settings. Recent CMS proposals hint at progress, yet policy fragmentation across private payers persists, delaying return-on-investment for providers.

Other drivers and restraints analyzed in the detailed report include:

- Home-Based Pregnancy Monitoring Uptake

- Expansion of Tele-Ultrasound Networks

- Strict Regulation for Approval

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Radiology applications generated 23.3% of the ultrasound devices market revenue in 2024, fueled by multi-organ imaging needs. AI modules that flag ovarian malignancies now surpass human expertise, pushing hospitals to upgrade radiology workstations. Elastography refinements have also sharpened liver-fibrosis staging, widening non-invasive screening libraries.

Procedure-guided anesthesiology is fleetingly smaller but expanding at a 4.9% CAGR. Nerve-block adoption benefits from color-overlay aids such as ScanNav Anatomy PNB, which simplifies landmark recognition for trainees. Hospitals keen to cut anesthetic drug volumes and postoperative pain are buying specialized linear probes, scaling the ultrasound devices market in perioperative suites.

Growing hospital budgets for point-of-care scanners, together with national-level guidance encouraging opioid-sparing analgesia, will likely sustain double-digit equipment refresh rates in anesthesia departments. As AI curates preset imaging protocols, clinicians gain confidence to extend ultrasound-guided blocks beyond orthopedics into emergency and intensive-care environments. This cross-departmental spillover lifts utilization rates, reducing per-scan costs and reinforcing the economic case for investing in advanced platforms within the broader ultrasound devices market.

3D and 4D systems contributed 45.6% of the ultrasound devices market share in 2024. They are favored for obstetrics, pediatrics, and cardiology cases that need volumetric visualization. They are supported by machine-learning algorithms that auto-render fetal facial features in real time. Such automation frees clinicians to focus on counseling rather than knobology.

HIFU addresses niche but fast-scaling therapeutic areas from uterine fibroids to pancreatic tumors and is projected to grow at 5.1% CAGR. Academic trials indicate meaningful symptom relief with minimal recovery time, prompting payers in China and Europe to evaluate reimbursement frameworks. As surgical departments integrate HIFU into tumor boards, they diversify revenue streams while staying within radiology budgets, reinforcing the ultrasound devices market trajectory.

Integrated AI dashboards that quantify ablation zones instantaneously reduce intraoperative uncertainty. This precision complements oncology's shift to outpatient day-care models, where rapid turnover and reduced infection risk are premiums. Consequently, technology vendors that meld high-frame-rate imaging with therapy beams will likely capture outsized share of incremental capital spending within the ultrasound devices market.

The Ultrasound Devices Market Report Segments the Industry Into by Application (Anesthesiology, Cardiology, and More), Technology (2D Ultrasound Imaging and More), Portability (Stationary Ultrasound, and More), End User (Hospitals, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa and South America). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

North America retained a 38.1% revenue share in 2024 owing to strong payor coverage, a high chronic-disease burden, and steady technology refresh cycles. Launches such as Vave Health's whole-body wireless device and GE HealthCare's Automated Breast Ultrasound Premium illustrate the domestic appetite for AI-embedded innovation. Regulatory clarity and CPT codes for breast density screening underpin the quick onboarding of these solutions. Hospitals increasingly equip emergency departments with handheld probes, trimming triage times and improving bed flow, thus lifting the ultrasound devices market.

Asia-Pacific ranks as the fastest-growing region at a 4.8% CAGR. China dominates regional volume through procurement programs favoring domestically made consoles like Mindray's Consona series. India's "Make in India" ethos echoes through Wipro GE's Versana Premier R3, an AI-ready system assembled in Bengaluru. Adoption of point-of-care ultrasound in overcrowded primary-care centers accelerates first-time purchases, though the PCPNDT Act restrains obstetric volumes. Nevertheless, public insurers increasingly reimburse liver and cardiac scans, sustaining the ultrasound devices market's regional ascent.

Europe remains a technology-focused market. Agencies such as the European Medicines Agency require robust clinical data, prompting vendors to showcase evidence on dose-free imaging and interoperability with electronic health records. Focused-ultrasound milestones Insightec's MRgFUS for essential tremor winning NUB status 1 reimbursement in Germany highlight innovation's role in neurology and oncology insightec.com. WONCA Europe is rolling out structured ultrasound training for general practitioners, widening the community-care footprint. Collectively, these dynamics keep Europe a vital contributor to the ultrasound devices market.

- GE HealthCare Technologies Inc.

- Siemens Healthineers

- Canon

- Koninklijke Philips

- Fujifilm Sonosite Inc.

- Samsung Group

- Shenzhen Mindray Bio-medical Electronics Co., Ltd.

- Hologic

- Esaote

- Butterfly Network Inc.

- Clarius Mobile Health Corp.

- Terason Division

- Carestream Health

- Shantou Institute of Ultrasonic Instruments

- Sonoscape Medical Corp.

- Chison Medical Imaging Co.

- DRAMINSKI S.A.

- Holisto Veterinary Ultrasound

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Incidences of Chronic Diseases

- 4.2.2 Growing Minimally-Invasive Diagnostics and Increasing Number of Imaging Facilities

- 4.2.3 Home-based Pregnancy Monitoring Uptake

- 4.2.4 Expansion of Tele-Ultrasound Networks

- 4.2.5 Growing Adoption of Point-of-Care Ultrasound

- 4.2.6 AI-Enhanced Image Reconstruction Demand

- 4.3 Market Restraints

- 4.3.1 Limited Reimbursement for Hand-held Scanners

- 4.3.2 Strict Regulation for Approval

- 4.3.3 Portable Device Battery-life Fatigue

- 4.3.4 Acoustic Attenuation in Obese Patient Imaging

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD and Volume in Units)

- 5.1 By Application

- 5.1.1 Anesthesiology

- 5.1.2 Cardiology

- 5.1.3 Gynecology / Obstetrics

- 5.1.4 Musculoskeletal

- 5.1.5 Radiology

- 5.1.6 Critical Care

- 5.1.7 Urology

- 5.1.8 Vascular

- 5.1.9 Other Applications

- 5.2 By Technology

- 5.2.1 2D Ultrasound Imaging

- 5.2.2 3D & 4D Ultrasound Imaging

- 5.2.3 Doppler Imaging

- 5.2.4 Contrast-Enhanced Ultrasound

- 5.2.5 Elastography

- 5.2.6 High-Intensity Focused Ultrasound

- 5.3 By Portability

- 5.3.1 Stationary Systems

- 5.3.2 Portable Cart-based Systems

- 5.3.3 Hand-held / Pocket Devices

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Diagnostic Imaging Centers

- 5.4.3 Ambulatory Surgical Centers

- 5.4.4 Maternity & Fertility Clinics

- 5.4.5 Home-care Settings

- 5.4.6 Veterinary Hospitals

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 GE HealthCare Technologies Inc.

- 6.4.2 Siemens Healthineers AG

- 6.4.3 Canon Medical Systems Corp.

- 6.4.4 Koninklijke Philips N.V.

- 6.4.5 Fujifilm Sonosite Inc.

- 6.4.6 Samsung Electronics Co. Ltd

- 6.4.7 Shenzhen Mindray Bio-medical Electronics Co., Ltd.

- 6.4.8 Hologic Inc.

- 6.4.9 Esaote SpA

- 6.4.10 Butterfly Network Inc.

- 6.4.11 Clarius Mobile Health Corp.

- 6.4.12 Terason Division

- 6.4.13 Carestream Health

- 6.4.14 Shantou Institute of Ultrasonic Instruments

- 6.4.15 Sonoscape Medical Corp.

- 6.4.16 Chison Medical Imaging Co.

- 6.4.17 DRAMINSKI S.A.

- 6.4.18 Holisto Veterinary Ultrasound

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment