PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849932

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849932

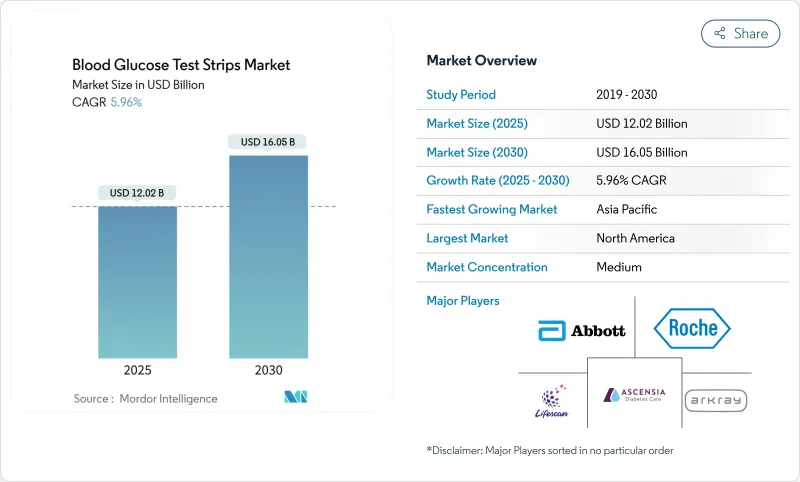

Blood Glucose Test Strips - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The blood glucose test strips market size is estimated at USD 12.02 billion in 2025, and is expected to reach USD 16.05 billion by 2030, at a CAGR of 5.96% during the forecast period (2025-2030).

Growth stems mainly from the relentless rise in diabetes prevalence, widening insurance coverage, and continuous product refinement that keeps finger-stick monitoring relevant even as newer technologies emerge. Companies are investing heavily in nanomaterial-enhanced electrodes to meet the United States Food and Drug Administration's tighter 2024 accuracy guidance, bringing detection limits down to 0.01 mM while holding retail prices within reach for daily users. At the same time, the disruptive appeal of continuous glucose monitoring (CGM) is forcing incumbents to defend the blood glucose test strips market by doubling down on convenience, accuracy and omnichannel reach.

Global Blood Glucose Test Strips Market Trends and Insights

Rising Prevalence of Diabetes

Record diabetes incidence is fundamentally redrawing the blood glucose test strips market. A pooled analysis of 1,108 population-representative studies covering 141 million participants found type 2 diabetes already represents 96% of all cases, and Western Pacific nations could see prevalence jump another 17.82% by 2050. This epidemiological surge fuels sustained strip demand because finger-stick testing remains the single most accessible daily monitoring tool in many health systems. As national diabetes counts climb, reaching a projected 852.5 million adults globally by 2050, manufacturers are tailoring distribution strategies for urban, peri-urban, and rural clinics alike to keep pace with shifting hot-spots.

Increasing Awareness and Self-Monitoring

Clinical evidence shows every additional daily SMBG measurement delivers meaningful A1c reductions, encouraging physicians to prescribe tighter self-testing schedules. Education programs funded by public-health agencies and advocacy groups boost patient confidence, which in turn lifts test-strip throughput in pharmacies. Personalized target ranges endorsed by the American Diabetes Association place further emphasis on routine monitoring for insulin titration. These twin forces-clinical endorsement and patient empowerment-reinforce the blood glucose test strips market's resilience even in digitally advanced economies.

High Cost of Test Strips

Prices in the USD 0.50-1.00 range per strip sound modest, yet multiply quickly for patients who test four or more times a day, especially outside the safety net of insurance. In developing economies where private coverage is rare, many users ration strips, leaving glucose control sub-optimal and undermining medical guidelines. The consequent volume shortfall trims the blood glucose test strips market growth outlook in low-income segments and heightens demand for cheaper alternatives or bundled subscription packs.

Other drivers and restraints analyzed in the detailed report include:

- Technology Advancements

- Government Initiatives and Insurance Coverage

- Surge in Uptake of CGM Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Thick film strips delivered 55.83% of 2024 revenue thanks to production costs running 30-40% below thin-film and photometric alternatives, translating into retail affordability that keeps testing volumes high. The blood glucose test strips market size for thick film will climb at a measured pace as rural clinics and value-oriented consumers continue favoring proven, inexpensive designs. Optical/photometric formats, while small in volume, post the strongest 7.23% CAGR to 2030 because photodiode readers dampen environmental interference and offer colorimetric feedback that appeals to tech-savvy users. Manufacturers now position photometric cartridges in connected starter kits aimed at early adopters, preventing outright migration to CGM while creating a premium pocket inside the broader blood glucose test strips market.

Future upgrades in nanocoatings and microfluidic channels will further push accuracy, but economies of scale continue to anchor thick film manufacturing lines across Asia and Eastern Europe. As vendors add Bluetooth-enabled meters to low-cost strip bundles, cost leadership converges with digital convenience, giving thick film an enduring moat. Meanwhile, joint ventures between optics specialists and meter OEMs could speed photometric penetration, yet supply chain complexity and higher per-unit costs may cap its blood glucose test strips market share below 20% through the forecast window.

Type 2 users generate 86.14% of 2024 strip sales, steering R&D toward ease of use, bulk packaging and loyalty programs that reduce per-test costs. This cohort often checks glucose once or twice daily, so reliable lancet-strip kits that fit into pockets remain the design priority. Conversely, Type 1 consumers, though representing a smaller slice, test 6-10 times every day and demand near-laboratory precision to fine-tune intensive insulin regimens. The blood glucose test strips market size for Type 1 is expanding 6.43% annually as pediatric and young adult patients embrace app-integrated meters that flag hypoglycemia trends in real time.

Manufacturers cater to this split by offering double-wide portfolios-value bundles for Type 2 maintenance and premium nano-enhanced strips for Type 1 fine dosing. Cross-subsidizing premium margins funds aggressive price promotions in developing economies, ensuring the blood glucose test strips market keeps river-like breadth even in the face of CGM encroachment.

The Blood Glucose Test Strips Market Report is Segmented by Product Type (Thick Film Strips, Thin Film Strips, and Optical / Photometric Strips), Diabetes Type (Type 1 Diabetes, Type 2 Diabetes, and More), End User (Hospitals and Clinics, Homecare / Personal Use and More) Distribution Channel (Hospital Pharmacies, and More) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 35.47% of global 2024 revenue, underpinned by high insurance penetration and Medicare policies that reimburse routine monitoring for seniors. A National Clinical Care Commission study showed regular self-testing rose 27% among beneficiaries after reimbursement tweaks, demonstrating how robust coverage underwrites steady strip turnover. Despite CGM enthusiasm, many primary-care clinics still prescribe finger-stick meters as baseline tools, keeping the blood glucose test strips market in positive territory.

Asia Pacific is the growth engine, advancing at 6.86% CAGR as China and India grapple with soaring diagnoses and urban lifestyles that spur carbohydrate-heavy diets. India alone could see diabetic adults rise from 89.8 million in 2024 to 156.7 million by 2050, forcing federal and state governments to subsidize essential monitoring supplies. Local manufacturers such as Sinocare ride cost advantages to flood tier-2 and tier-3 cities with affordable kits, yet premium multinationals still capture urban hospital contracts, preserving stratified competition inside the region's blood glucose test strips market.

Europe retains sizable share on the back of national health systems that fund routine testing and impose stringent CE marking requirements. These regulations create higher entry barriers, pushing suppliers to invest in precision engineering. Latin America and the Middle East & Africa trails but expands year after year as awareness campaigns and micro-insurance programs widen access to SMBG. Price-sensitive consumers in these areas favor thick-film kits, reinforcing cost-leadership strategies that maintain global reach for the blood glucose test strips market.

- Abbott Laboratories

- Roche

- LifeScan IP Holdings, LLC.

- Ascensia Diabetes Care Holdings AG.

- Arkray

- AgaMatrix

- Bionime

- Sinocare

- Trividia Health

- Rossmax

- Ypsomed

- SD Biosensor Inc.

- TaiDoc Technology

- i-SENS Inc.

- Omron Healthcare Co. Ltd.

- Nova Biomedical

- 77 Elektronika Kft.

- OK Biotech Co. Ltd.

- Acon Laboratories

- Prodigy Diabetes Care, LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Diabetes

- 4.2.2 Increasing Awareness and Self-Monitoring

- 4.2.3 Technology Advancements

- 4.2.4 Government Initiatives and Insurance Coverage

- 4.2.5 Growth in Online and Retail Distribution Channels

- 4.2.6 Aging Populations and the Associated Shift toward Home-based Chronic-disease Management

- 4.3 Market Restraints

- 4.3.1 High Cost of Test Strips

- 4.3.2 Surge in Uptake of CGM Systems

- 4.3.3 Stringent Regulatory Requirements

- 4.3.4 Growing Environmental and Biohazard Disposal Concerns

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Thick Film Strips

- 5.1.2 Thin Film Strips

- 5.1.3 Optical / Photometric Strips

- 5.2 By Diabetes Type

- 5.2.1 Type 1 Diabetes

- 5.2.2 Type 2 Diabetes

- 5.2.3 Gestational and Others

- 5.3 By End User

- 5.3.1 Hospitals and Clinics

- 5.3.2 Homecare / Personal Use

- 5.3.3 Diagnostic Laboratories

- 5.4 By Distribution Channel

- 5.4.1 Hospital Pharmacies

- 5.4.2 Retail Pharmacies

- 5.4.3 Online Pharmacies

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Vietnam

- 5.5.3.7 Malaysia

- 5.5.3.8 Indonesia

- 5.5.3.9 Thailand

- 5.5.3.10 Rest of Asia Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Saudi Arabia

- 5.5.4.2 Iran

- 5.5.4.3 Egypt

- 5.5.4.4 Oman

- 5.5.4.5 South Africa

- 5.5.4.6 Rest of Middle East and Africa

- 5.5.5 Latin America

- 5.5.5.1 Mexico

- 5.5.5.2 Brazil

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles ((includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 F. Hoffmann-La Roche Ltd

- 6.3.3 LifeScan IP Holdings, LLC.

- 6.3.4 Ascensia Diabetes Care Holdings AG.

- 6.3.5 ARKRAY Inc.

- 6.3.6 AgaMatrix

- 6.3.7 Bionime Corporation

- 6.3.8 Sinocare Inc.

- 6.3.9 Trividia Health Inc.

- 6.3.10 Rossmax International Ltd

- 6.3.11 Ypsomed AG

- 6.3.12 SD Biosensor Inc.

- 6.3.13 TaiDoc Technology Corporation

- 6.3.14 i-SENS Inc.

- 6.3.15 Omron Healthcare Co. Ltd.

- 6.3.16 Nova Biomedical

- 6.3.17 77 Elektronika Kft.

- 6.3.18 OK Biotech Co. Ltd.

- 6.3.19 ACON Laboratories Inc.

- 6.3.20 Prodigy Diabetes Care, LLC

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment