PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849934

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849934

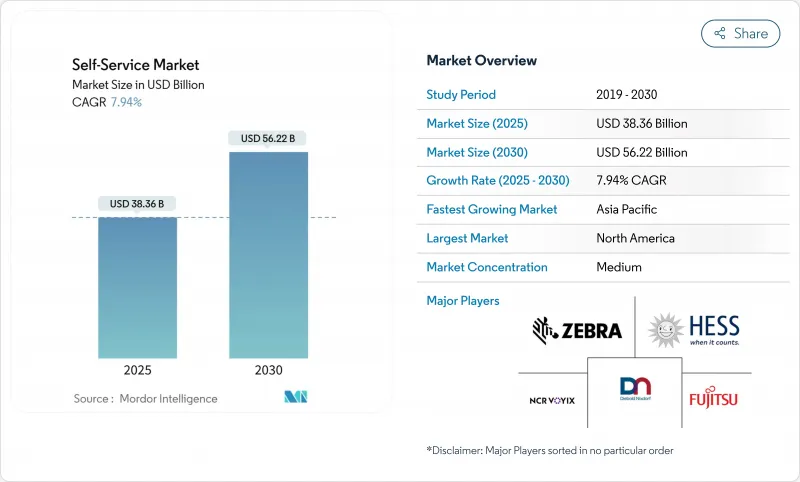

Self-Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The self-service market size stood at USD 38.36 billion in 2025 and is forecast to advance to USD 56.22 billion by 2030, reflecting a 7.9% CAGR over the period.

This growth links directly to the shift toward contactless engagement that gathered pace after the pandemic, tighter corporate mandates for digitization, and broad public familiarity with digital wallets. Hardware and software suppliers are responding by embedding AI, computer vision, and biometric modules that cut wait times, strengthen security, and open new use-cases across banking, retail, healthcare, and public venues. Payment ecosystems built on QR and NFC are now mainstream in many urban centers, and they underpin steady demand for self-service terminals able to accept any credential the user prefers. Vendors also highlight service contracts and platform fees, turning what was once a one-off hardware sale into a recurring revenue stream that smooths cash flow. However, resilience against vandalism, outdoor weather extremes, and e-commerce substitution remains a prerequisite for profitable roll-outs.

Global Self-Service Market Trends and Insights

Ubiquity of Contact-Free Transactions Post-COVID

Global digital payment participation jumped from 44% in 2014 to two-thirds of adults in 2022, confirming a permanent tilt toward cashless behaviors. European research shows sustained intentions to avoid cash because of hygiene concerns, and operators of micro-markets report higher revenues after installing cashless modules. Countries like Sweden, where cash use halved in the past decade, underscore how rapidly policy, merchants, and consumers converge on digital rails. This preference extends to biometric taps and voice prompts, driving every corner of the self-service market to support no-touch authentication.

Rapid Rollout of Smart Retail Formats

Autonomous stores relying on RFID gates, computer vision, and smart shelving are projected to grow significantly. Germany counted more than 5,000 self-checkout outlets recently, and retailers plan further acceleration. In the United States, wholesale chains such as Sam's Club deployed AI-enhanced devices that scan carts in seconds, shrinking queues and redeploying staff. Micro-fulfilment hubs, despite integration headaches, promise same-hour replenishment for densely populated districts, creating a pull for lockers and hybrid kiosks able to dispense and accept goods around the clock.

Persistent Vandalism and Cash-Handling Security Risks

Data from British Telecom revealed tens of thousands of attacks on pay-phones each year until ruggedized locks and alarms curbed incidents. Sophisticated jackpotting and skimming drives a physical and cyber security market forecast to reach USD 32.4 billion by 2032. Operators add fingerprint, facial recognition and multi-factor prompts to counter fraud, yet every new module raises cost per unit and elongates certification cycles. Collaborative patrols with police and AI-driven surveillance mitigate losses but cannot erase them entirely.

Other drivers and restraints analyzed in the detailed report include:

- Omni-Channel Banking Automation Wave

- Government Push for Cash-Lite Societies

- High TCO for Outdoor Deployments in Harsh Climates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Kiosks controlled 36.2% self-service market share in 2024, highlighting their flexibility across check-in, ticketing, and bill payment. The self-service market size tied to kiosks benefits from continuous software refreshes that add language packs, AI avatars, and payment choices. Self-checkout lanes are growing at an 8.3% CAGR as grocers and general merchandisers curb labor expenses and speed the line. ATMs still anchor cash ecosystems, yet annual installations are plateauing because mobile transfers now satisfy many low-value needs. Vending machines move beyond snacks into OTC medicines, PPE, and time-sensitive vaccines, which widens their social footprint. Smart lockers registered brisk orders from logistics firms under pressure to cut last-mile costs and allow after-hours parcel pick-up. Healthcare kiosks, projected to ramp from USD 0.8 billion in 2024 to USD 1.81 billion by 2028, illustrate how diagnosis, telehealth, and prescription renewal can converge in compact footprints. Retailers adopt computer vision so cameras automatically weigh produce, minimizing errors and shopper frustration. The product mix will continue to reward vendors who merge durability with cloud hooks that unlock real-time insights and remote service.

Kiosk suppliers invest in antimicrobial surfaces, haptic feedback, and wheelchair-friendly layouts to stay ahead of accessibility rules. Self-checkout makers partner with fintech gateways to switch on buy-now-pay-later while still conforming to payment security standards. ATM vendors pivot toward Video Teller Machines and cryptocurrency modules to preserve relevance. Vending specialists test dynamic refrigeration and AI planograms to display fast-moving inventory first, which uplifts sales per square inch. Locker providers add temperature control for the grocery and pharmaceutical segments. Portfolio breadth, therefore, remains a hedge against shifts in consumer flow and merchant economics within the self-service market.

Hardware was responsible for 54.0% of revenue in 2024, yet software is advancing 9.0% each year and is the key to lifetime monetization. Vendors deploy containerized operating systems that permit secure updates without field visits, shortening mean-time-to-market for new features. Cloud dashboards spotlight usage spikes, allowing retailers to preload staff only when traffic demands. Diebold Nixdorf's DN Vynamic suite connects more than 230,000 endpoints and pushes predictive maintenance alerts that reduce unscheduled downtime. AI engines sit at the edge, flagging suspicious withdrawal patterns within milliseconds and supporting instant lockouts. Integrations with loyalty platforms also open upsell moments right on the screen.

Services round out the component play, spanning installation, decommissioning, software patching, and compliance audits. As recurring contracts expand, service margins may eclipse those of hardware shipments. Accessibility consultants ensure adherence to tactile, speech, and visual standards laid out in the Federal Register. Firms that couple ERP and point-of-sale data with kiosk telemetry enable closed-loop analytics showing sales uplift by SKU, shift, and location. This visibility is central to procurement decisions at large chains that roll kiosks worldwide on thin capex cycles within the self-service market.

The Self-Service Market Report is Segmented by Product Type (Kiosk, ATM, and More), Component (Hardware, Software, and Services), End-User Industry (BFSI, Retail and Quick-Service Restaurant, and More), Technology (Biometric-Enabled, NFC / Contactless, AI-Driven and Computer-Vision, and More), Deployment Location (Indoor and Outdoor), and Geography.

Geography Analysis

North America held 39.4% of revenue in 2024, reflecting long-standing adoption of automated teller technology, wide retail deployment, and supportive privacy regulations. Payment card penetration is nearly universal, and digital wallets are mainstream, so merchants prioritize terminals that handle chip, tap, and mobile credentials. Federal agencies devote stimulus budgets to broadband and digital government portals, fostering a consistent user experience in public service kiosks. Corporate appetite for AI, cloud, and cybersecurity rises each budget cycle, reinforcing demand for software-centric upgrades that sit atop existing hardware.

Europe balances sustainability and inclusion. The European Commission urges eco-design and transparent supply chains, pushing manufacturers to lengthen device lifespans and publish carbon footprints. Accessibility law compels tactile keypads, audio prompts, and adjustable font sizes, which influence BOM and firmware design. Germany's EHI initiative demonstrates commercial appetite by counting thousands of self-checkout lanes, while the region debates best formats for a digital euro that could seamlessly link to kiosks and ATMs. Operators retrofit remote telemetry to trim service van miles, aligning with climate targets.

Asia-Pacific, advancing at an 8.5% CAGR, benefits from pro-digitization edicts and an explosion of smartphone-linked QR payments. India stages billions of UPI transfers each month, normalizing QR taps even in rural kiosks. China pilots a central bank digital currency that will likely integrate into transit and vending networks, placing pressure on operators to update firmware fast. Governments in ASEAN fund e-government lobbies inside post offices, reducing red tape while ensuring remote citizens receive equal service. South America and the Middle East trail but accelerate as telcos push mobile money and as tourism revives interest in multi-language ticketing stations.

- NCR Corporation

- Diebold Nixdorf

- Crane Payment Innovations

- Fujitsu Ltd.

- Glory Global Solutions

- Zebra Technologies

- Advantech Co. Ltd.

- Frank Mayer and Associates Inc.

- HESS Cash Systems GmbH

- Azkoyen Group

- Embross

- SEDCO

- IER Group

- Maas International B.V.

- RedyRef Interactive

- Olea Kiosks Inc.

- Posiflex Technology Inc.

- SlabbKiosks

- KIOSK Information Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ubiquity of contact-free transactions post-COVID

- 4.2.2 Rapid rollout of smart retail formats

- 4.2.3 Omni-channel banking automation wave

- 4.2.4 Government push for cash-lite societies

- 4.2.5 AI-powered adaptive user interfaces

- 4.2.6 Micro-fulfilment and 24/7 unmanned concepts

- 4.3 Market Restraints

- 4.3.1 Persistent vandalism and cash-handling security risks

- 4.3.2 High TCO for outdoor deployments in harsh climates

- 4.3.3 Limited accessibility standards harmonisation

- 4.3.4 Rising e-commerce bypassing vending channels

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Major Technological Developments

- 4.7.1 Evolution of Self-Service Kiosks

- 4.7.2 Barrier-Free Kiosk Standards and Working Groups

- 4.7.3 Leading Case Studies and User-Surveys

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Kiosk

- 5.1.2 ATM

- 5.1.3 Vending Machine

- 5.1.4 Self-Checkout System

- 5.1.5 Smart Locker / Parcel Station

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 Retail and Quick-Service Restaurant

- 5.3.3 Hospitality

- 5.3.4 Healthcare

- 5.3.5 Transportation and Travel Hubs

- 5.3.6 Government and Public Sector

- 5.4 By Technology

- 5.4.1 Biometric-Enabled

- 5.4.2 NFC / Contactless

- 5.4.3 AI-Driven and Computer-Vision

- 5.4.4 Cloud-Connected

- 5.5 By Deployment Location

- 5.5.1 Indoor

- 5.5.2 Outdoor

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 ASEAN

- 5.6.3.6 Australia and New Zealand

- 5.6.3.7 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 UAE

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 NCR Corporation

- 6.4.2 Diebold Nixdorf

- 6.4.3 Crane Payment Innovations

- 6.4.4 Fujitsu Ltd.

- 6.4.5 Glory Global Solutions

- 6.4.6 Zebra Technologies

- 6.4.7 Advantech Co. Ltd.

- 6.4.8 Frank Mayer and Associates Inc.

- 6.4.9 HESS Cash Systems GmbH

- 6.4.10 Azkoyen Group

- 6.4.11 Embross

- 6.4.12 SEDCO

- 6.4.13 IER Group

- 6.4.14 Maas International B.V.

- 6.4.15 RedyRef Interactive

- 6.4.16 Olea Kiosks Inc.

- 6.4.17 Posiflex Technology Inc.

- 6.4.18 SlabbKiosks

- 6.4.19 KIOSK Information Systems

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment