PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849935

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849935

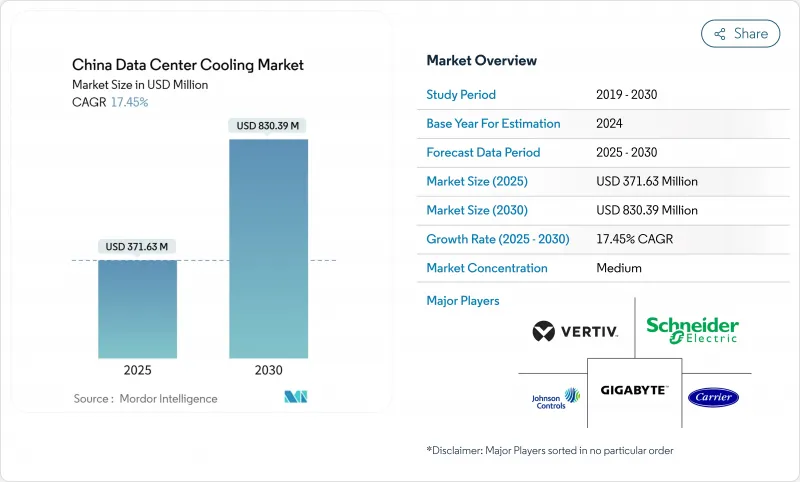

China Data Center Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The China data center cooling market is valued at USD 371.63 million in 2025 and is forecast to reach USD 830.39 million by 2030, advancing at a 17.45% CAGR during 2025-2030.

Mandatory Power Usage Effectiveness (PUE) caps, surging AI server rack densities that dissipate 6-8 times more heat than legacy workloads, and the government's Eastern Data and Western Compute program are converging to accelerate capital outlays for liquid-based cooling. Operators are prioritizing technology that keeps PUE below 1.3 in Tier 1 cities, driving a pivot away from conventional air systems toward direct-to-chip, immersion, and rear-door liquid solutions. At the same time, water-stress regulations are pushing closed-loop designs that minimise consumption while maximising thermal efficiency. Although equipment sales still dominate spending, demand for specialised services is climbing fast as facility owners seek expertise to retrofit or green-field liquid deployments.

China Data Center Cooling Market Trends and Insights

Surging hyperscale and AI-driven rack densities

Modern AI cabinets consume 20-130 kW versus 5-10 kW for legacy servers, rendering air cooling insufficient and propelling mass adoption of liquid technologies. Huawei's closed liquid-cooled cabinet cuts cooling power by 96% and lowers facility PUE to 1.1, proving viability at the hyperscale level. National flagship AI compute clusters in Gui'an, Ulanqab, and Wuhu now specify liquid solutions at the build-out stage, underscoring a structural shift that places thermal design on par with chip performance in data-center planning.

Government-mandated PUE caps for new builds

Beijing's 14th Five-Year plan requires all new data centers to operate below 1.5 PUE by 2025, while Shanghai tightens the threshold to 1.3. The 2023 Green Data Center standard expands compliance to water-consumption ratios and renewable-energy sourcing, cementing liquid cooling as the only practical route to meet efficiency targets at scale.

High electricity tariffs eroding TCO advantages

Data center power draw is expected to climb from 200 TWh in 2025 toward 400-600 TWh by 2030, with tariffs in Jiangsu and Zhejiang raising operating costs enough to negate savings from legacy equipment depreciation. The Eastern Data and Western Compute initiative counterbalances the burden by relocating load to renewable-rich provinces but requires operators to reconcile latency and fibre-backhaul constraints.

Other drivers and restraints analyzed in the detailed report include:

- Rapid colocation expansion

- Maturing liquid-cooling supply chain and local OEM scale-up

- Growing water-stress curbing evaporative-cooling permits

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hyperscalers accounted for 46.5% of 2024 revenue, and their contribution to the China data center cooling market size is forecast to expand at 17.9% CAGR through 2030. These firms build AI clusters that exceed 100 kW per rack, making liquid technology non-negotiable for thermal headroom and PUE compliance. Their scale also drives down per-rack cooling cost, creating a benchmark that enterprise and edge operators now emulate. Edge sites, however, favour compact rear-door heat exchangers due to space and maintenance limits. The hyperscaler wave ensures that liquid infrastructure will dominate new capacity additions, even though air systems retain a retrofit niche.

Colocation operators mirror this trajectory by bundling dedicated liquid zones as premium services, converting density into both margin and differentiated customer experience. Enterprise facilities lag on full immersion adoption but are piloting direct-to-chip loops to stretch existing chiller plants. Combined, these moves keep the China data center cooling market on a high-growth path as every operator segment advances toward AI-ready thermal architectures.

Tier 3 sites captured 67.1% of spending in 2024 thanks to their mature design frameworks and competitive balance of uptime vs. capex. Yet Tier 4 builds are growing at 19.2% CAGR because AI training workloads cannot afford even minutes of unplanned downtime. The China data center cooling market size for Tier 4 facilities will therefore rise swiftly as investors prioritise fault-tolerant, concurrently maintainable liquid systems that keep racks within 30 °C even during maintenance.

Tier 1 and Tier 2 footprints are steadily cannibalised as their power and cooling envelopes top out below 15 kW per rack. Meanwhile, Tier 3 specifications are being retrofitted with dual-loop liquid infrastructure so operators can satisfy new customer density requirements without a green-field Tier 4 budget. This tier evolution reinforces liquid technology as the baseline for any AI-centric build in China's data center cooling market.

China Data Center Cooling Market is Segmented by Data Center Type (Hyperscalers (Owned and Leased), Enterprise and Edge, Colocation), Tier Type (Tier 1 and 2, Tier 3, Tier 4), Cooling Technology (Air Based Cooling, Liquid Based Cooling), Component (Service, Equipment). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Schneider Electric SE

- Johnson Controls International plc

- GIGA-BYTE Technology Co. Ltd.

- Vertiv Group Corp.

- Carrier Global Corporation

- Rittal GmbH and Co. KG

- Munters Group AB

- Stulz GmbH

- Kstar Science and Technology Co. Ltd.

- Alfa Laval AB

- Huawei Technologies Co. Ltd.

- Hangzhou Envicool Technology Co. Ltd.

- Shenzhen Yimikang Technology Co. Ltd.

- Inspur Group Co. Ltd.

- Lenovo Group Ltd.

- CoolIT Systems Inc.

- Asetek A/S

- Sugon (Dawning Information Industry)

- Midea Group Co. Ltd. (Clivet Division)

- Iceotope Technologies Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging hyperscale and AI-driven rack densities

- 4.2.2 Government-mandated PUE caps for new builds

- 4.2.3 Rapid colocation expansion (+51.7 % rack share YoY)

- 4.2.4 Maturing liquid-cooling supply chain and local OEM scale-up

- 4.2.5 Eastern Data and Western Compute programme exploiting cold-climate free-cooling zones

- 4.2.6 Monetisation of server waste-heat into district-heating grids

- 4.3 Market Restraints

- 4.3.1 High electricity tariffs eroding TCO advantages

- 4.3.2 Growing water-stress curbing evaporative-cooling permits

- 4.3.3 Provincial power-quota caps delaying hyperscale projects

- 4.3.4 Import dependency on fluorinated coolants facing tariff risk

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Data Center Type

- 5.1.1 Hyperscalers (owned and Leased)

- 5.1.2 Enterprise and Edge

- 5.1.3 Colocation

- 5.2 By Tier Type

- 5.2.1 Tier 1 and 2

- 5.2.2 Tier 3

- 5.2.3 Tier 4

- 5.3 By Cooling Technology

- 5.3.1 Air-based Cooling

- 5.3.1.1 Chiller and Economizer (DX Systems)

- 5.3.1.2 CRAH

- 5.3.1.3 Cooling Tower (covers direct, indirect and two-stage cooling)

- 5.3.1.4 Others

- 5.3.2 Liquid-based Cooling

- 5.3.2.1 Immersion Cooling

- 5.3.2.2 Direct-to-Chip Cooling

- 5.3.2.3 Rear-Door Heat Exchanger

- 5.3.1 Air-based Cooling

- 5.4 By Component

- 5.4.1 By Service

- 5.4.1.1 Consulting and Training

- 5.4.1.2 Installation and Deployment

- 5.4.1.3 Maintenance and Support

- 5.4.2 By Equipment

- 5.4.1 By Service

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Schneider Electric SE

- 6.4.2 Johnson Controls International plc

- 6.4.3 GIGA-BYTE Technology Co. Ltd.

- 6.4.4 Vertiv Group Corp.

- 6.4.5 Carrier Global Corporation

- 6.4.6 Rittal GmbH and Co. KG

- 6.4.7 Munters Group AB

- 6.4.8 Stulz GmbH

- 6.4.9 Kstar Science and Technology Co. Ltd.

- 6.4.10 Alfa Laval AB

- 6.4.11 Huawei Technologies Co. Ltd.

- 6.4.12 Hangzhou Envicool Technology Co. Ltd.

- 6.4.13 Shenzhen Yimikang Technology Co. Ltd.

- 6.4.14 Inspur Group Co. Ltd.

- 6.4.15 Lenovo Group Ltd.

- 6.4.16 CoolIT Systems Inc.

- 6.4.17 Asetek A/S

- 6.4.18 Sugon (Dawning Information Industry)

- 6.4.19 Midea Group Co. Ltd. (Clivet Division)

- 6.4.20 Iceotope Technologies Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment