PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849942

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849942

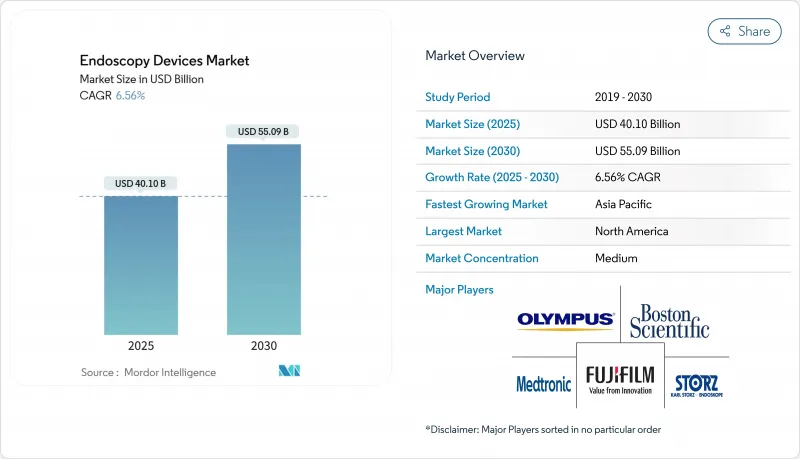

Endoscopy Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The endoscopy devices market stands at USD 40.10 billion in 2025 and is forecast to reach roughly USD 55.09 billion by 2030, reflecting a compound annual growth rate (CAGR) close to 6.56%.

Rising acceptance of minimally invasive surgery continues to reshape hospital capital budgets, drawing investment toward visualization towers and advanced imaging modules that shorten patient recovery times while freeing operating-room slots for high-margin procedures. At the same time, infection-control mandates are redirecting procurement toward disposable or partly disposable scopes, a shift that not only reduces reprocessing labor but also limits reimbursement penalties linked to hospital-acquired infections. Growth in Asia-Pacific is outpacing global averages as expanding insurance coverage collides with a shortage of trained endoscopists, prompting buyers in that region to favor intuitive, software-guided platforms that compress learning curves. Established North American providers remain anchor customers, yet their quick adoption of single-use duodenoscopes is pressuring manufacturers to balance premium pricing with volume-driven cost efficiencies.

Global Endoscopy Devices Market Trends and Insights

Widespread Shift Toward Minimally Invasive Procedures Across Surgical Specialties

Across specialties, clinicians are reshaping care pathways around minimally invasive interventions. Endoluminal robotics-allowing navigation through natural orifices-illustrates how product roadmaps are converging on the same value proposition: lower patient trauma, shorter admissions, and quicker recoveries. A second-order implication is that hospitals now tie capital-budget requests for imaging suites and OR renovations to claims of throughput gains driven by these technologies; therefore, endoscopy vendors must increasingly compete on measurable workflow efficiencies rather than image quality alone.

Continuous Innovation in Endoscopy Visualization Enhancing Clinical Outcomes

High-definition optics, 3D imagery, and software-enhanced contrast platforms have improved early-lesion detection. Olympus's EVIS EXERA III, for example, leverages Narrow Band Imaging (NBI) and Dual Focus to lift adenoma detection rates during colonoscopy. The strategic corollary for providers is the emerging ability to selectively biopsy smaller tissue volumes, which not only accelerates pathology turnaround but also reduces consumable costs at scale. That optimization, in turn, allows outpatient facilities to maintain competitive reimbursement rates while still meeting quality benchmarks.

Global Shortage of Trained Endoscopists and Support Staff

Expanding indications have outpaced the global supply of skilled endoscopists. The American Society for Gastrointestinal Endoscopy stresses that advanced procedures such as ERCP and EUS require prolonged mentorships, deterring rapid credentialing. A pragmatic consequence for suppliers is an emerging market for systems with integrated guidance software, standard-of-care checklists, and artificial-intelligence-assisted navigation. Devices that shorten training timelines improve utilization rates, thereby strengthening the business case for administrators deciding between competing capital requests.

Other drivers and restraints analyzed in the detailed report include:

- Favorable Reimbursement & Public-Health Programs Supporting Preventive Endoscopy

- Rising Global Incidence of Gastrointestinal & Colorectal Cancers Driving Screening Demand

- Persistent Infection-Control Challenges and Heightened Regulatory Scrutiny

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Gastrointestinal endoscopy secured 54.9% market share in 2024, reflecting heavy reliance on colonoscopy and upper-GI diagnostics. Yet laparoscopy is projected to rise at an 8.9% CAGR through 2030, driven by expanded indications such as bariatric revisions and endometriosis treatment. This momentum suggests that multi-disciplinary OR teams may push for modular tower configurations capable of switching between laparoscopic and endoscopic modes, effectively bifurcating procurement strategies into high-volume GI suites versus flexible multi-specialty rooms.

Endoscopic ultrasound (EUS) is also gaining traction, evidenced by rising upper-GI EUS volumes in the United States. Because EUS facilitates both staging and therapeutic interventions like celiac plexus neurolysis, hospitals have started to position the technology as a revenue-enhancing adjunct rather than a diagnostic cost center, subtly shifting budgeting authority from radiology to GI departments.

Reusable scopes still dominate with an 82% share in 2024, but disposables are growing 12.5% annually. Studies comparing disposable-sheath gastroscopes with standard devices demonstrate reprocessing times dropping from roughly 48 minutes to under 10 minutes, effectively tripling possible daily throughput. That throughput improvement is compelling when one considers that most ASCs operate on tight daily schedules; an extra two to three cases per room can materially improve EBITDA margins without extending clinic hours.

The knock-on effect is a heightened focus on waste management and sustainability, as facility managers weigh infection risk mitigation against environmental impact. This dual consideration is likely to influence future purchasing criteria toward recyclable materials and take-back programs, introducing new service-line revenue models for manufacturers.

The Endoscopy Devices Market Report is Segmented by Device Type (Endoscopes [Rigid Endoscopes, and More], Endoscopic Operative Devices [Access Devices, and More], and More), Application (Gastrointestinal, and More), Usability (Reprocessed / Reusable Devices, and More), End-User (Hospitals, Academic Medical Centers, and More) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Olympus

- Boston Scientific

- Medtronic

- FUJIFILM

- Karl Storz

- Stryker

- Johnson & Johnson (Ethicon Endo-Surgery)

- HOYA

- Conmed

- Richard Wolf

- Cook Group

- Smiths Group

- Intuitive Surgical

- Ambu

- Arthrex

- B. Braun

- Ackermann Instrumente

- STERIS

- Interscope Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Incidence of Gastrointestinal & Colorectal Cancers Driving Screening Demand

- 4.2.2 Widespread Shift Toward Minimally Invasive Procedures Across Surgical Specialties

- 4.2.3 Continuous Innovation in Endoscopy Visualization Enhancing Clinical Outcomes

- 4.2.4 Favorable Reimbursement & Public-Health Programs Supporting Preventive Endoscopy

- 4.2.5 Aging Population with Multiple Chronic Conditions Requiring Diagnostic Interventions

- 4.2.6 Expansion of Ambulatory Surgical Centers Boosting Outpatient Endoscopy Volumes

- 4.3 Market Restraints

- 4.3.1 Persistent Infection-Control Challenges and Heightened Regulatory Scrutiny

- 4.3.2 Global Shortage of Trained Endoscopists and Support Staff

- 4.3.3 Lengthy, Stringent Regulatory Approval Processes Slowing Product Launches

- 4.3.4 High Capital & Lifecycle Maintenance Costs of Advanced Endoscopic Systems

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Device Type

- 5.1.1 Endoscopes

- 5.1.1.1 Rigid Endoscopes

- 5.1.1.2 Flexible Endoscopes

- 5.1.1.3 Capsule Endoscopes

- 5.1.1.4 Robotic-assisted Endoscopes

- 5.1.2 Endoscopic Operative Devices

- 5.1.2.1 Irrigation / Suction Systems

- 5.1.2.2 Access Devices

- 5.1.2.3 Wound Protectors

- 5.1.2.4 Insufflation Devices

- 5.1.2.5 Manual Instruments

- 5.1.3 Visualization Equipment

- 5.1.3.1 Endoscopic Cameras

- 5.1.3.2 SD Visualization Systems

- 5.1.3.3 HD / 4K Visualization Systems

- 5.1.1 Endoscopes

- 5.2 By Application

- 5.2.1 Gastrointestinal Endoscopy

- 5.2.2 Laparoscopy

- 5.2.3 Pulmonology / Bronchoscopy

- 5.2.4 ENT / Otolaryngology

- 5.2.5 Urology

- 5.2.6 Gynecology

- 5.2.7 Cardiology

- 5.2.8 Neurology

- 5.2.9 Orthopedics / Arthroscopy

- 5.3 By Usability

- 5.3.1 Reprocessed / Reusable Devices

- 5.3.2 Single-use / Disposable Devices

- 5.3.3 Sterilisation & Reprocessing Services

- 5.4 By End-User

- 5.4.1 Hospitals & Academic Medical Centers

- 5.4.2 Ambulatory Surgical Centers

- 5.4.3 Specialty Clinics

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Olympus Corporation

- 6.3.2 Boston Scientific Corporation

- 6.3.3 Medtronic PLC

- 6.3.4 Fujifilm Holdings Corporation

- 6.3.5 Karl Storz SE & Co. KG

- 6.3.6 Stryker Corporation

- 6.3.7 Johnson & Johnson (Ethicon Endo-Surgery)

- 6.3.8 Hoya Corporation (Pentax Medical)

- 6.3.9 CONMED Corporation

- 6.3.10 Richard Wolf GmbH

- 6.3.11 Cook Group Incorporated

- 6.3.12 Smith & Nephew PLC

- 6.3.13 Intuitive Surgical Inc.

- 6.3.14 Ambu A/S

- 6.3.15 Arthrex Inc.

- 6.3.16 B. Braun Melsungen AG

- 6.3.17 Ackermann Instrumente GmbH

- 6.3.18 Steris PLC

- 6.3.19 Interscope Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment