PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849943

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849943

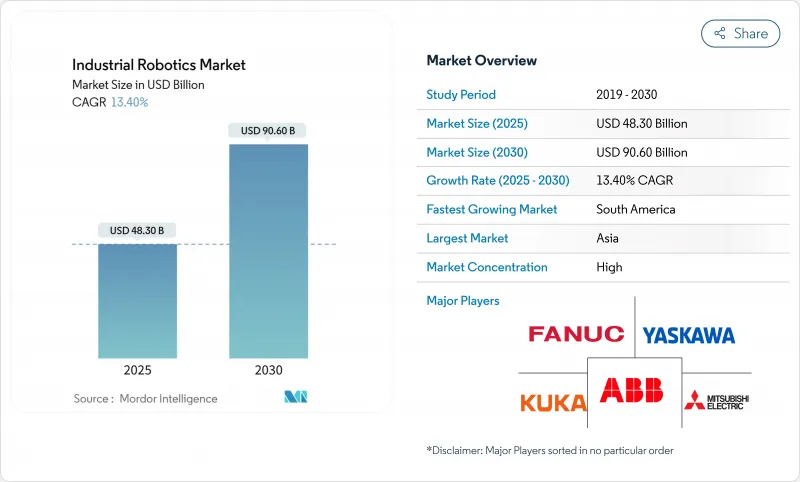

Industrial Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The industrial robotics market stands at USD 48.3 billion in 2025 and is projected to reach USD 90.6 billion by 2030, advancing at a 13.4% CAGR.

Rapid integration of artificial intelligence, mounting labor shortages, and tariff-driven reshoring have moved robots from isolated automation tools to central, adaptive systems that keep production running amid volatile supply chains. Asia's sustained appetite for factory automation, the United States' accelerated expensing incentives, and European sustainability mandates together underpin a demand cycle that remains resilient even during macroeconomic slowdowns. Government incentives such as China's 14th Five-Year Plan and Japan's New Robot Strategy continue to lower investment risk while embedded AI and 5G networks lift overall equipment effectiveness. Competitive intensity is growing as collaborative robot pioneers challenge incumbents, yet scale advantages held by ABB, FANUC, Yaskawa, and KUKA still shape price discipline and service expectations in the industrial robotics market.

Global Industrial Robotics Market Trends and Insights

Rising Labor Costs & Ageing Workforce

Escalating wages and shrinking labor pools push manufacturers to automate tasks that once relied on abundant human labor. Japan's robot density reached 390 units per 10,000 workers in 2024, while Germany's density climbed to 429, underscoring how advanced economies lean on robots to preserve productivity China's climb in manufacturing wages has re-tilted total cost of ownership models, making payback periods for robotic cells shorter than in 2019. Companies also deploy collaborative robots in ergonomically demanding stations to retain experienced workers who can no longer perform repetitive lifting. The demographic squeeze simultaneously drives up turnover and erodes tacit knowledge; robots mitigate that risk by executing standardized workflows that preserve process memory for the next generation of employees.

Rapid Adoption of AI & IIoT-Enabled Smart Factories

Artificial intelligence turns robots into self-optimizing assets that learn from sensor feedback. NVIDIA's Isaac platform allows manufacturers such as Siemens to develop digital twins, cut commissioning time, and reduce unplanned downtime by up to 30%. Machine learning vision now classifies new SKUs without offline programming, enabling same-shift changeovers in e-commerce fulfillment. Edge computing processes high-frequency torque data, predicting bearing wear before catastrophic failure, while private 5G networks push control loops closer to actuators. These capabilities transform the industrial robotics market from simple repeatability toward data-driven adaptability, which is critical for just-in-time, high-mix factories.

High Upfront Cap-ex for SMEs

Turnkey robotic cells still cost between USD 50,000 and USD 500,000, and that range excludes opportunity costs from line downtime during installation. While Robot-as-a-Service converts capital outlays into monthly operating expenses, smaller plants remain wary of multi-year subscription liabilities. Financial constraints are tighter in emerging markets where commercial credit spreads exceed double digits, and public subsidy schemes focus on large exporters rather than local job shops. Without scale to amortize engineering effort across multiple sites, many SMEs delay automation, slowing overall penetration of the industrial robotics market despite compelling productivity gains.

Other drivers and restraints analyzed in the detailed report include:

- Government Cap-ex Subsidies for Automation

- Tariff-Driven Reshoring Fuels US Automation Spend

- Scarcity of Robot-Integration Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Articulated systems retained 67% share of the industrial robotics market in 2024 as six-axis flexibility supports welding, painting, and sealant application in automotive plants that run near-continuous shifts. Extensive installed bases guarantee spare-parts availability, protecting uptime commitments for OEMs. Meanwhile, collaborative robots held 10.5% share but are riding a 14.0% CAGR, driven by safety-rated force sensors that allow operators to work shoulder-to-shoulder without cages. Integrators now mount cobots on autonomous mobile platforms, creating re-deployable workcells that address labor gaps on multiple lines.

Growth momentum continues as lightweight arms automate tasks below 15 kg that previously relied on manual dexterity. Food processors use hygienic stainless-steel cobots to package ready-to-eat meals, while electronics assemblers teach robots new pick points via hand-guiding within minutes. SCARA and delta robots still dominate high-speed pick-and-place operations, yet their unit growth trails cobots because they lack built-in safety functions. Over the forecast period, AI-powered programming lowers barriers for non-experts, ensuring collaborative platforms remain the vanguard of volume expansion in the industrial robotics market.

Robots rated 16-225 kg captured 42% of the industrial robotics market size in 2024, underpinning automotive under-body welding, engine block handling, and palletizing in beverage plants. Manufacturers appreciate the balance between reach, inertia control, and cost per kilogram of payload. Conversely, the <=15 kg class will post a 15.2% CAGR through 2030 because shrinking component geometries in smartphones and medical devices necessitate micron-level precision at higher cycle rates. Vacuum grippers paired with advanced vision enable these smaller robots to handle flexible materials once thought impossible in automated systems.

Heavy-duty robots above 226 kg remain critical for aerospace fuselage riveting and large casting finishing where no alternative automation exists. However, their growth is modest because investment outlays are higher and demand cycles correlate with long-lead capital goods orders. As force-torque sensors and high-strength composites reduce manipulator weight, tasks once assigned to mid-payload units migrate downward, expanding addressable opportunities for the light segment without cannibalizing core volumes of established categories.

The Industrial Robotics Market is Segmented by Type of Robot (Articulated Robots, Linear Robots, SCARA Robots, Collaborative Robots and More), Payload Capacity (<=15 Kg, 16-225 Kg and More), by Application (Material Handling & Packaging and More), by End-User Industry (Automotive, Electrical & Electronics and More) and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD) for all the Above Segments.

Geography Analysis

Asia held 70% revenue share of the industrial robotics market in 2024, underpinned by China's 276,288 installations that equaled 51% of the global total hai-production. Subsidies, domestic component ecosystems, and rising wage levels combine to maintain the momentum. Japan leverages deep supplier networks and Industry 4.0 roadmaps, sustaining a robot density of 390 units per 10,000 workers. South Korea tops density charts above 1,000 units, reflecting aggressive smart-factory roll-outs championed by chaebol conglomerates.

South America represents the fastest-growing bloc with an 11.5% CAGR forecast as Brazilian meat processors and vehicle assemblers introduce robots to rein in labor cost volatility and improve export compliance. Mexico's proximity to US consumer markets attracts EV component makers that capitalize on reshoring incentives. Argentina adopts agricultural packing robots to elevate throughput and reduce post-harvest losses, establishing proof points for other segments within the industrial robotics market.

North America and Europe are mature yet far from saturated. The United States deploys 295 robots per 10,000 workers, placing it tenth globally, but reshoring legislation and Section 179 incentives stimulate sustained double-digit unit growth. Germany's 429-unit density rides on automotive clusters and Mittelstand exporters, while EU carbon-neutrality targets open niches for energy-efficient robot models. Middle East and African manufacturers remain early adopters, focusing on petrochemical packaging lines and increasingly on solar-panel fabrication, indicating long-term upside for the industrial robotics market once logistics infrastructure matures.

- ABB Ltd.

- FANUC Corporation

- Yaskawa Electric Corp.

- KUKA AG

- Mitsubishi Electric Corp.

- Kawasaki Heavy Industries (Robotics)

- DENSO Corporation

- Omron / Adept Technologies

- Panasonic Corp.

- Epson Robots

- Staubli Robotics

- Comau S.p.A.

- Yamaha Robotics

- Universal Robots (Teradyne)

- Nachi-Fujikoshi Corp.

- Techman Robot Inc.

- Siasun Robot & Automation

- Doosan Robotics

- Seiko-Epson

- Hanwha Robotics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising labor costs & ageing workforce

- 4.2.2 Rapid adoption of AI & IIoT-enabled smart factories

- 4.2.3 Government cap-ex subsidies for automation (China, Korea, Germany)

- 4.2.4 Tariff-driven reshoring fuels US automation spend

- 4.2.5 ESG push for energy-efficient, low-carbon robots

- 4.2.6 Robot-as-a-Service boosted by accelerated depreciation rules

- 4.3 Market Restraints

- 4.3.1 High upfront cap-ex for SMEs

- 4.3.2 Scarcity of robot-integration talent

- 4.3.3 Cyber-security liabilities in connected production cells

- 4.3.4 Rare-earth servo-motor supply volatility

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE & GROWTH FORECASTS

- 5.1 By Robot Type

- 5.1.1 Articulated Robots

- 5.1.2 SCARA Robots

- 5.1.3 Cartesian/Gantry Robots

- 5.1.4 Parallel/Delta Robots

- 5.1.5 Cylindrical Robots

- 5.1.6 Collaborative Robots (Cobots)

- 5.2 By Payload Capacity

- 5.2.1 <=15 kg

- 5.2.2 16-225 kg

- 5.2.3 226-500 kg

- 5.2.4 >500 kg

- 5.3 By Application

- 5.3.1 Material Handling & Packaging

- 5.3.2 Welding & Soldering

- 5.3.3 Assembly & Dispensing

- 5.3.4 Machine Tending & CNC

- 5.3.5 Painting & Coating

- 5.3.6 Quality Inspection

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Electrical & Electronics

- 5.4.3 Food & Beverage

- 5.4.4 Machinery & Metal

- 5.4.5 Pharmaceuticals & Healthcare

- 5.4.6 Construction Materials

- 5.4.7 Others (Rubber, Optics)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.4 Asia

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 FANUC Corporation

- 6.4.3 Yaskawa Electric Corp.

- 6.4.4 KUKA AG

- 6.4.5 Mitsubishi Electric Corp.

- 6.4.6 Kawasaki Heavy Industries (Robotics)

- 6.4.7 DENSO Corporation

- 6.4.8 Omron / Adept Technologies

- 6.4.9 Panasonic Corp.

- 6.4.10 Epson Robots

- 6.4.11 Staubli Robotics

- 6.4.12 Comau S.p.A.

- 6.4.13 Yamaha Robotics

- 6.4.14 Universal Robots (Teradyne)

- 6.4.15 Nachi-Fujikoshi Corp.

- 6.4.16 Techman Robot Inc.

- 6.4.17 Siasun Robot & Automation

- 6.4.18 Doosan Robotics

- 6.4.19 Seiko-Epson

- 6.4.20 Hanwha Robotics

7 MARKET OPPORTUNITIES & FUTURE OUTLOOK

- 7.1 White-space & Unmet-need Assessment