PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849945

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849945

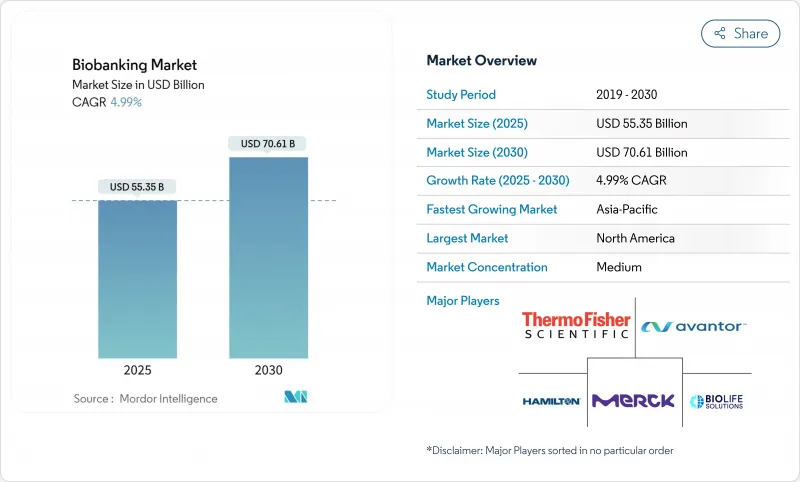

Biobanking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Biobanking Market size is estimated at USD 55.35 billion in 2025, and is expected to reach USD 70.61 billion by 2030, at a CAGR of 4.99% during the forecast period (2025-2030).

Expansion reflects the move from building sample repositories to supporting precision-medicine pipelines that merge stem-cell therapies, proteomics, and multi-omics workflows. Clearer regulations, such as the FDA's January 2025 draft guidance on donor eligibility, are reducing clinical uncertainty and accelerating adoption in hospital and pharmaceutical settings. Demand is further lifted by hospital uptake of cord-blood services, public and private funding for pandemic preparedness, and the rise of AI-based quality analytics. Competitive intensity is moderate, with large suppliers acquiring niche innovators to offer integrated cold-chain, automation, and analytic platforms.

Global Biobanking Market Trends and Insights

Innovations in Regenerative Medicine

Breakthroughs such as Cedars-Sinai's cardiosphere-derived cells for Duchenne muscular dystrophy show how a single cell type can serve multiple therapeutic paths. Gene-edited progenitor cells for ALS require biobanks to guarantee both cellular integrity and genomic stability. ARPA-H's EMBODY program demands infrastructure that is able to support complex immune-cell reprogramming. Research on microgravity-grown stem cells suggests that orbital production techniques will soon influence ground-based processing. Collectively, these shifts push the biobanking market toward facilities that resemble small-scale manufacturing plants rather than passive warehouses.

Growing Incidences of Chronic Diseases

The UCLA team showed that linking biobank genetics to electronic health records predicts patient responses to standard drugs. In China, cord-blood transplants for Thalassemia Major climbed from 30,000 to nearly 40,000 cases in 2024, demonstrating clinical reliance on banked materials. Tianjin's 19-year-old autologous cord-blood success underscores the long-term utility of well-preserved samples. Haplocord protocols that combine cord blood with haploidentical donors maximise sample use, raising demand on existing repositories. As chronic conditions proliferate, the biobanking market is shifting from research-centric to therapy-centric operations.

Complex & Evolving Regulatory Regimes

The EU's Regulation 2024/1938 on substances of human origin will demand major workflow upgrades by 2027. Florida's 2025 stem-cell statute permits non-FDA-approved therapies if stored in FDA-registered facilities, creating cross-state compliance puzzles. China's planned relaxation of genetic-resource controls offers growth but brings interim uncertainty. Such divergent rules force biobanks to fund parallel quality systems, adding cost while lengthening approval timelines. Well-capitalised operators gain an advantage, potentially tilting the biobanking market toward larger, multinational institutions.

Other drivers and restraints analyzed in the detailed report include:

- Advances in Drug Discovery & Development

- Government & NGO Funding Inflows

- High Total Ownership Cost of Cryogenic Infrastructure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cryogenic storage systems generated the most significant portion of 48.58% in the biobanking market size for equipment in 2024. End users are migrating towards freezers that achieve tighter temperature uniformity and lower energy draw, sustaining a robust 7.96% CAGR. Vendors such as Haier Biomedical introduced wide-neck models with dual-coolant redundancy and touchscreen diagnostics. Alarm and monitoring platforms represent the quickest-moving subsegment because regulators now expect continuous data logging. The arrival of SPT Labtech's pneumatic arktic XC system reduces manual handling, raising throughput without compromising traceability.

Storage accessories are also evolving. Densely stacked racking and laser-etched barcodes help academic centres squeeze capacity from existing footprints. Mechanical ultra-low freezers offering +-5 °C uniformity are gaining favor as facilities attempt to lower nitrogen usage. Collectively, these shifts point to an equipment landscape where hardware, software and analytics converge, elevating entry requirements for new suppliers and reshaping competition inside the biobanking market.

The Biobanking Market Report is Segmented by Equipment (Cryogenic Storage Systems [Refrigerators, Freezers, Ice Machines], Alarm and Monitoring Systems, Media & Consumables), Application (Regenerative Medicine, Drug Discovery, and More), Ownership Type (Public/Government, Academic/Non-profit and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 36.31% of global revenue in 2024, anchored by FDA guidelines that provide a clear compliance path and by multi-billion-dollar capital commitments from major suppliers. Thermo Fisher is investing USD 2 billion to reinforce domestic cold-chain and analytical production. ATCC's USD 87 million BARDA contract underscores federal support for pandemic-ready repositories.Continued precision-medicine roll-outs in Canada and heightened clinical-trial activity in Mexico sustain regional sample demand, bolstering revenues for the biobanking market.

Europe's harmonised regulatory approach under Regulation 2024/1938 is stimulating cross-border projects such as the EUR 45 (USD 52) million Genome of Europe initiative. The UK Biobank's 200,000-genome release cements its status as a flagship data resource. Germany's federated network processes thousands of requests against 900,000 stored biospecimens, setting a benchmark for operational transparency. Southern European countries leverage EU funding to upgrade freezer capacity and digital-consent tools, broadening sample accessibility across the broader biobanking market.

Asia-Pacific is advancing at a 10.03% CAGR, the fastest worldwide. China plans to relax genetic-resource export rules, encouraging multinational R&D partnerships. National cord-blood treatments escalated to nearly 40,000 cases in 2024, proving clinical readiness for banked therapies. Japan remains a leader in allogeneic cord-blood transplants, and SK pharmteco's USD 260 million Korean facility will expand GMP-grade storage capacity. Australia and South Korea strengthen regional momentum through strong ethics frameworks and translational-research programmes, collectively propelling the biobanking market.

- Thermo Fisher Scientific

- Beckton Dickinson

- Merck

- BioLife Solutions

- Hamilton Company

- Avantor Inc. (VWR)

- Tecan Group

- Stem Cell Technologies

- CENTOGENE N.V.

- Bio-Techne Corp.

- Azenta

- Cryoport Inc.

- QIAGEN

- BioIVT

- Chart Industries

- Coriell Institute for Medical Research

- UK Biobank

- China Cord Blood Corp.

- Biovault

- Precision Cellular Storage

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Innovations in Regenerative Medicine

- 4.2.2 Growing Incidences of Chronic Diseases

- 4.2.3 Advances in Drug Discovery & Development

- 4.2.4 Government & NGO Funding Inflows

- 4.2.5 AI-Driven Sample-Quality Analytics Adoption

- 4.2.6 Decentralized Blockchain-Enabled Consent Networks

- 4.3 Market Restraints

- 4.3.1 Complex & Evolving Regulatory Regimes

- 4.3.2 High Total Ownership Cost of Cryogenic Infrastructure

- 4.3.3 Litigation Over Donor Privacy & Data Ownership

- 4.3.4 Liquid-Nitrogen Price Volatility

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Cryogenic Storage Systems

- 5.1.1.1 Refrigerators

- 5.1.1.2 Freezers

- 5.1.1.3 Ice Machines

- 5.1.2 Alarm & Monitoring Systems

- 5.1.3 Media & Consumables

- 5.1.1 Cryogenic Storage Systems

- 5.2 By Application

- 5.2.1 Regenerative Medicine

- 5.2.2 Drug Discovery

- 5.2.3 Disease & Epidemiology Research

- 5.2.4 Life-Science & Genomic Research

- 5.3 By Ownership Type

- 5.3.1 Public/Government

- 5.3.2 Academic/Non-profit

- 5.3.3 Private & Commercial

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Thermo Fisher Scientific Inc.

- 6.3.2 Becton, Dickinson & Company

- 6.3.3 Merck KGaA

- 6.3.4 BioLife Solutions Inc.

- 6.3.5 Hamilton Company

- 6.3.6 Avantor Inc. (VWR)

- 6.3.7 Tecan Group Ltd.

- 6.3.8 STEMCELL Technologies

- 6.3.9 CENTOGENE N.V.

- 6.3.10 Bio-Techne Corp.

- 6.3.11 Azenta Life Sciences

- 6.3.12 Cryoport Inc.

- 6.3.13 QIAGEN N.V.

- 6.3.14 BioIVT

- 6.3.15 Chart Industries

- 6.3.16 Coriell Institute for Medical Research

- 6.3.17 UK Biobank

- 6.3.18 China Cord Blood Corp.

- 6.3.19 Biovault Family

- 6.3.20 Precision Cellular Storage

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment