PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849958

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849958

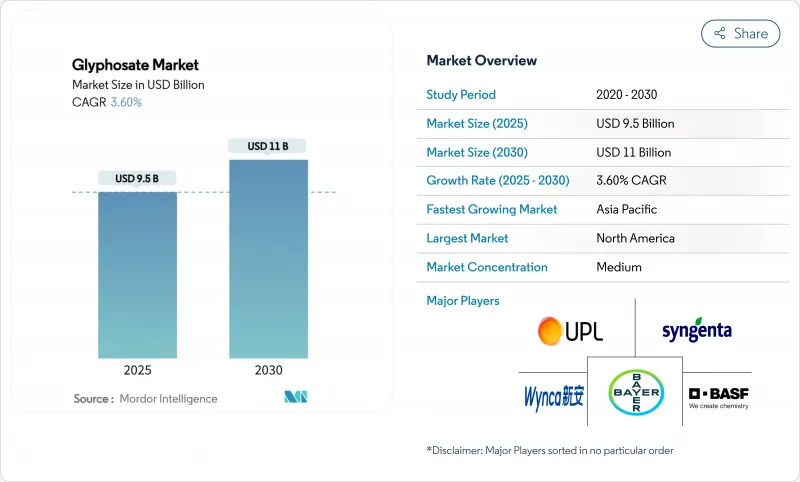

Glyphosate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global glyphosate market stands at USD 9.5 billion in 2025 and is forecast to reach USD 11 billion by 2030, advancing at a 3.6% CAGR.

Stable demand reflects glyphosate's entrenched role in conservation tillage, large-scale row-crop systems, and carbon-credit-linked no-till programs. North America's early adoption of herbicide-tolerant crops underpins consistent usage, while Asia-Pacific's rapid mechanization and rise in biotech acreage accelerate volume growth. Supply fundamentals remain tight because Chinese plants that supply more than 80% of global exports are curbing output to meet environmental rules, and Bayer has warned of a possible production exit amid litigation costs. Price visibility has improved as capacity consolidation limits extreme volatility, giving growers clearer cost forecasts and supporting steady adoption despite regulatory headwinds. Competitive dynamics also shape the glyphosate market: Chinese technical-grade producers control more than 80% of global export volume, while Bayer remains the most visible branded formulator.

Global Glyphosate Market Trends and Insights

Commercialization of GM Herbicide-Tolerant Crops

China's 2024 approval of glyphosate-tolerant seed traits opened more than 1 million mu to biotech varieties, echoing long-running adoption in the United States and Brazil. New stacked technologies, such as Bayer's Vyconic soybeans, tolerant to five herbicides, including glyphosate, promise broader weed-control windows. Continuous trait upgrades ensure herbicide programs remain effective, anchoring long-term glyphosate demand across large acreage crops.

Rising Demand for Effective Weed Control Solutions

Farmers face 530 confirmed herbicide-resistant weed biotypes worldwide, increasing the urgency for reliable broad-spectrum options. Glyphosate's mode of action, application flexibility, and compatibility with precision spraying platforms make it integral to integrated weed management. In many African markets, generic formulations have improved affordability, driving uptake among smallholders who previously relied on manual weeding.

Regulatory Restrictions

The European Union renewed glyphosate for 10 years in 2023 but gave member states leeway to impose stricter limits. Germany moved from an outright ban to restricted use in 2024, and legal challenges continue. Similar uncertainties have surfaced in New Zealand, where proposals to raise residue limits prompted 3,100 public submissions. Fragmented rules complicate stewardship, raise compliance costs, and may shift demand toward countries with clearer approval frameworks.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Agricultural Land and Intensified Farming

- Integration of Glyphosate-Tolerant Traits in Gene-Edited Crops

- Shift Toward Organic and Bio-Herbicides

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Grains and cereals generated 43.5% of the glyphosate market in 2024, reflecting heavy use in corn and wheat conservation systems worldwide. Continued double-cropping in Brazil and expanded sorghum acreage in China anchor demand. The pulses and oilseeds segment is forecast to post a 5.6% CAGR through 2030 as South American soybean hectares and Indian mustard cultivation rise.

Technology advances such as variable-rate sprayers optimize doses, yet total treated hectares keep volumes steady. Cotton and sugarcane remain important in tropical zones where manual weeding costs are high. Although horticultural producers apply more restrictive regimes, dripline injection, and shielded sprayers maintain a baseline of usage in orchards and vineyards.

The Glyphosate Market is Segmented by Crop Type (Grains and Cereals, Commercial Crops, and More), by GMO Adoption (GM Crops and Non-GM Crops), and by Geography (Asia-Pacific, North America, South America, Europe, Middle East, and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 34% share of the glyphosate market in 2024 stems from extensive no-till soy and corn systems, where over 80% of growers depend on herbicides for burndown and in-crop applications. Canada mirrors these practices across prairie wheat and canola, while Mexico's transition to mechanized maize farming introduces steady incremental demand. Litigation remains the main destabilizer, with pending cases threatening domestic supply if Bayer exits. State-level liability shields enacted in Georgia and other jurisdictions aim to safeguard continued manufacture.

Asia-Pacific is projected to deliver the fastest regional growth at a 5.86% CAGR by 2030. China's pesticide volumes have stabilized at around 240,000-250,000 tons, yet glyphosate remains a top-10 active ingredient. India's agrochemical value chain is scaling, and generic glyphosate volumes rise as farmers adopt low-cost weed control. Indonesia, Vietnam, and Thailand show growing adoption of pre-plant burndown to support double-cropping. Australia's broadacre cereal farms maintain mature but steady demand, reinforced by precision guidance systems that fine-tune application.

South America ranks second in overall consumption, anchored by Brazil's 322.3 million-ton grain harvest in 2025, which drives high herbicide intensity. No-till covers more than 35 million hectares, making glyphosate indispensable for grass weed control before planting. Argentina's currency challenges add price sensitivity but do not diminish acreage reliance. New regional tech hubs, such as Syngenta's USD 65 million facility in Paulinia, focus on tropical-climate formulations that preserve efficacy under high humidity, supporting long-term growth.

- Bayer AG

- Zhejiang Xinan (Wynca)

- Syngenta AG

- BASF SE

- UPL Ltd

- Corteva, Inc.

- FMC Corporation

- Nufarm Ltd

- Zhejiang Jiangshan Agrochemical (Jiangshan Chemical Co.)

- Jiangsu Yangnong Chemical (Sinochem Holdings)

- Albaugh LLC (Albaugh Group)

- Bharat Rasayan

- Jiangsu Good-Harvest (Good Harvest Weien Co.)

- King Quenson Industry (King Quenson Group)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Commercialization of GM herbicide-tolerant crops

- 4.2.2 Rising demand for effective weed control solutions

- 4.2.3 Expansion of agricultural land and intensified farming

- 4.2.4 Integration of glyphosate-tolerant traits in gene-edited crops

- 4.2.5 Regenerative no-till carbon-credit programmes boost usage

- 4.2.6 Capacity consolidation stabilises long-term prices

- 4.3 Market Restraints

- 4.3.1 Regulatory restrictions

- 4.3.2 Shift toward organic and bio-herbicides

- 4.3.3 Litigation-driven exit risk of branded suppliers

- 4.3.4 Accelerating weed resistance in major crop belts

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Crop Type

- 5.1.1 Grains and Cereals

- 5.1.2 Pulses and Oilseeds

- 5.1.3 Fruits and Vegetables

- 5.1.4 Commercial Crops

- 5.1.5 Other Crops

- 5.2 By GMO Adoption

- 5.2.1 GM Crops

- 5.2.2 Non-GM Crops

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 South America

- 5.3.2.1 Brazil

- 5.3.2.2 Argentina

- 5.3.2.3 Rest of South America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 Italy

- 5.3.3.4 Spain

- 5.3.3.5 United Kingdom

- 5.3.3.6 Russia

- 5.3.3.7 Rest of Europe

- 5.3.4 Asia-Pacific

- 5.3.4.1 China

- 5.3.4.2 India

- 5.3.4.3 Japan

- 5.3.4.4 Australia

- 5.3.4.5 Rest of Asia-Pacific

- 5.3.5 Middle East

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 UAE

- 5.3.5.3 Turkey

- 5.3.5.4 Rest of Middle East

- 5.3.6 Africa

- 5.3.6.1 South Africa

- 5.3.6.2 Rest of Africa

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Bayer AG

- 6.4.2 Zhejiang Xinan (Wynca)

- 6.4.3 Syngenta AG

- 6.4.4 BASF SE

- 6.4.5 UPL Ltd

- 6.4.6 Corteva, Inc.

- 6.4.7 FMC Corporation

- 6.4.8 Nufarm Ltd

- 6.4.9 Zhejiang Jiangshan Agrochemical (Jiangshan Chemical Co.)

- 6.4.10 Jiangsu Yangnong Chemical (Sinochem Holdings)

- 6.4.11 Albaugh LLC (Albaugh Group)

- 6.4.12 Bharat Rasayan

- 6.4.13 Jiangsu Good-Harvest (Good Harvest Weien Co.)

- 6.4.14 King Quenson Industry (King Quenson Group)

7 Market Opportunities and Future Outlook